Environmental Health and Safety Software Market Size, Trends and Insights By Deployment Mode (Cloud-Based, Public Cloud, Private Cloud, On-Premise, Hybrid), By Component (Software, Services, Implementation Services, Training and Support Services, Analytics Services), By Solution Type (Incident Management, Audit and Inspection Management, Risk Assessment, Compliance Management, Training Management, Environmental Data Management, Occupational Health Management, Other Solutions), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End-User Industry (Manufacturing, Oil and Gas, Energy and Utilities, Chemicals and Petrochemicals, Healthcare and Life Sciences, Construction, Transportation and Logistics, Other Industries), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Enablon (Wolters Kluwer)

- Cority Software Inc.

- VelocityEHS

- Sphera Solutions Inc.

- Others

Reports Description

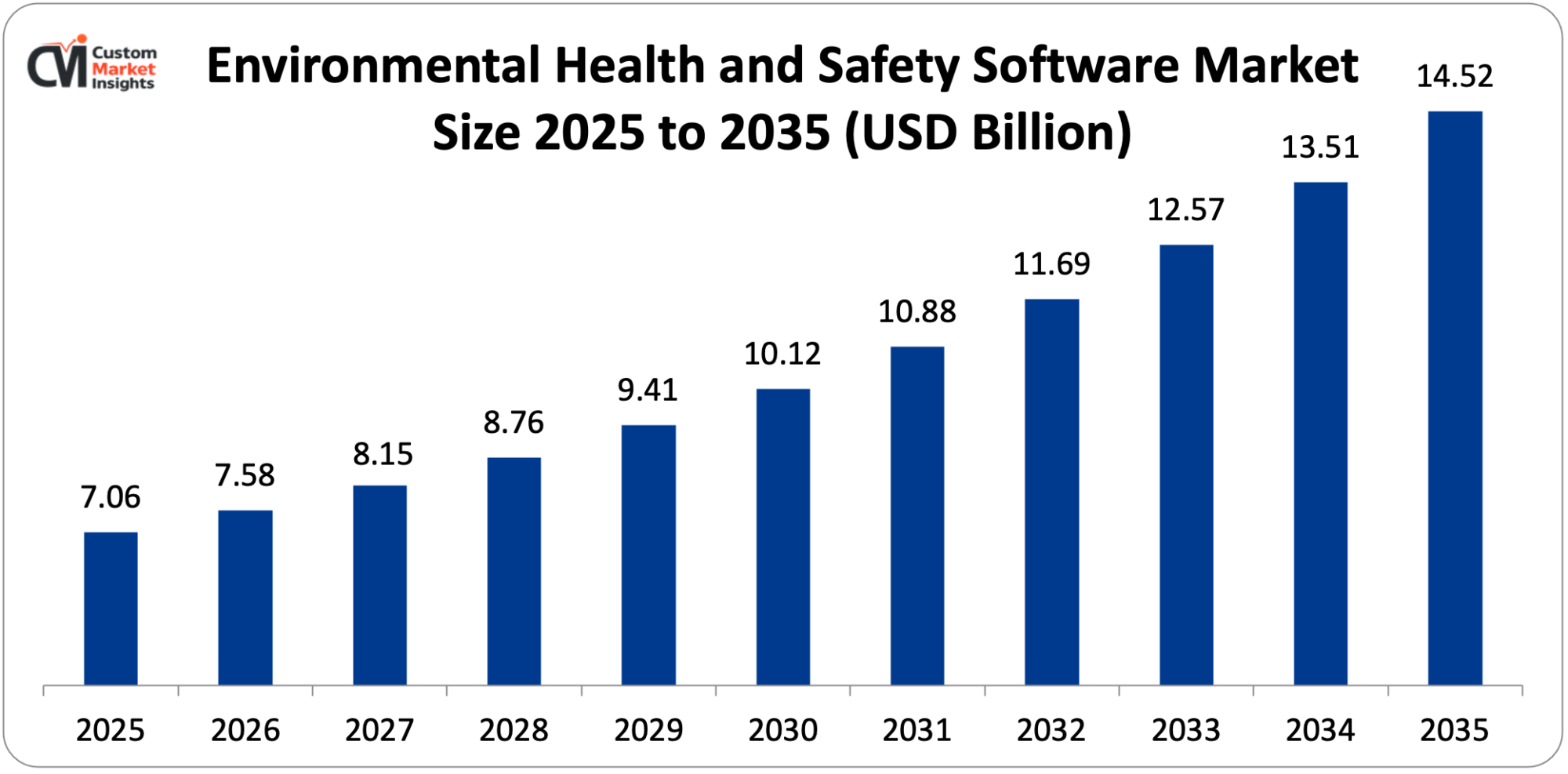

It is estimated that the market size of the global environmental health and safety (EHS) software is USD 7.06 billion in 2025 and that the market size will increase to USD 7.58 billion in 2026, and to approximately USD 14.52 billion in 2035 with an annual CAGR of 7.4% between the years 2026 and 2035. Market expansion is a result of the rising regulatory compliance pressures spanning sectors, the rising focus on occupational health and environmental sustainability, the swift development of enterprise risk management digitalization efforts, the rising use of ESG reporting models, and the technological advancement in artificial intelligence, machine learning, and real-time monitoring capabilities using IoT.

Market Highlight

- North America was a market leader of the EHS software market share of 2025 in 38.6.

- Asia Pacific will increase by 10.1% between 2026 and 2035.

- The segment of deployment mode that had occupied 62% of the market share in 2025 was the cloud-based deployment.

- By mode of deployment, the cloud-based segment will have the highest CAGR of 8.4% in the period between 2026 and 2035.

- End-user, on an industry basis, the manufacturing segment will exist with the largest market share of 28% in 2025, and the healthcare and life sciences segment will have the highest CAGR of 12.3% for the period of time of the projection which is 2026-35.

Significant Growth Factors

The Environmental Health and Safety Software Market Trends present significant growth opportunities due to several factors:

- Stringent Regulatory Compliance and Escalating Safety Standards Globally: The prevailing global regulatory environment on environmental protection, occupational health, and workplace safety is the main factor that has led to the emergence of the EHS software market where organizations are in need of an all-encompassing digital platform to ensure they are compliant with the various regulations in different jurisdictions. According to the U.S. Occupational Safety and Health Administration data on this subject throughout 2024, the number of safety inspections in the workplace has risen by 22% since the past year, which means that the regulatory environment puts pressure on organizations to implement strong compliance management systems. According to the U.S. Environmental Protection Agency, the level of violation of the environment increased by 18% in 2023, which forced businesses to invest in new EHS platforms to reduce the risks of their operations and face significant fines that may reach millions of dollars in case of non-compliance. The regulatory requirements of organisations in North America (OSHA standards), Europe (REACH regulations), and emerging environmental laws in Asia-Pacific demand that organisations maintain 100% traceability of data and evidence, apply uniform auditing activities across various sites and generate formal documents able to meet government inspection and third-party certifications. The EHS software systems will allow real-time compliance monitoring and automatically notify the organizations about the changes in the regulations used in their operations, create audit-ready reports that will prove compliance with the local and international standards and risks and handling of chemicals and hazardous materials and provide documentation of the complete chain of custody and well-documented incident records that will meet the regulations’ requirements of reporting and disclosure.

- Rapid ESG Integration and Mandatory Sustainability Reporting Requirements: The shift of Environmental, social, and governance standards to not optional reporting standards is increasing the adoption of EHS software so much as organizations need all-encompassing systems to capture, examine and report sustainability information to investors, regulators and other interested parties. According to a sustainability reporting analysis performed in 2025, more than three-quarters of compliance executives currently consider digital EHS technology as the sole scalable model in order to deal with the thousands of inspections, certifications, and audit trails that must be conducted in the course of work across multiple sites in enterprise organizations. Investors with USD 130 trillion in assets under management now demand detailed disclosure of the ESG information before making an allocation decision, imposing the highest pressure on the corporations to show environmental stewardship, social responsibility and governance excellence using quantifiable metrics and transparent reporting. The Global Reporting Initiative, Sustainability Accounting Standards Board, and Task Force on Climate-related Financial Disclosures are examples of ESG disclosure frameworks, and each of them stipulates various requirements that organizations need to fulfill at once, which means that it requires integrated software platforms that would consolidate data coming from various sources into standard reporting formats. Contemporary EHS software applications can be used as both compliance management applications and ESG reporting engines to allow organizations to monitor greenhouse gas emissions (S1, S2, and S3), water use, and discharge of wastewater with real-time measurements of IoT sensors, waste generation and recycling rates with detailed material movement-tracking data of source to end disposition, energy efficiency gains across facilities with consumption analytics based on production output, and safety performance through the incident rates and lost time injuries and near-miss reporting serving as evidence of commitment to the wellbeing of the workforce. Carbon accounting modules have now become a default component of enterprise EHS systems and 57% of companies are integrating their EHS data with corporate sustainability dashboards which executives are now viewing alongside financial data. The integration minimizes labor time in sustainability reporting by more than 48%, as per implementation studies recently and enhances the accuracy and transparency of the data to external stakeholders who perform due diligence reviews of the companies. The use of ESG indicators in the analysis of corporate performance is also becoming a growing priority among investment analysts, with organizations with strong EHS management scoring valuation premiums ranging from 15% to 20% on average of their industry peers with less sustainable practices, establishing strong financial incentives to implement EHS software on a wide basis, rather than as a direct response to regulatory pressures.

What are the Major Advances Changing the Environmental Health and Safety Software Market Today

- Integrated ESG and Sustainability Reporting Modules: The integration of conventional EHS compliance management with the detailed and full-fledged ESG reporting capabilities is a significant leap forward in the functionality of the platform as it allows organizations not only to meet their regulatory compliance requirements but also their voluntary sustainability reporting requirements with the help of integrated data collection and reporting systems. Upgraded EHS websites now have special modules on carbon accounting that do calculations on emissions on all three scopes using internationally accepted approaches to calculations, like the GHG Protocol; water stewardship tracking that tracks consumption and carbon emissions, quality of discharge and watershed effects; circular economy, which measures material reuse and waste diversion rates; and biodiversity impact, which evaluates how its operations affect sensitive ecosystems; social responsibility, which tracks board actions on sustainability programs and has indices; and governance, which documents its practice. These combined functions remove data silos that had to be manually consolidated across different systems in the past thus minimizing sustainability reporting manpower needs by 40-50% and enhancing data consistency and auditability. Companies now develop sustainability reports that comply with various frameworks such as GRI, SASB, TCFD, and CDP via unified data collection initiatives as opposed to having two structures of operation in pursuit of each disclosure policy. The platform integration will allow advanced analytics to match environmental performance to operational performance, which will show the business value of sustainability initiatives in front of strict compliance compulsions, finding a cost saving opportunity in energy efficiency gains, waste reduction programs, and resource optimization initiatives. Executive dashboards are financial and non-financial performance indicators that can be used by the leadership teams to view corporate performance in its entirety and therefore give the basis of strategic decision-making that reflects the expectations of the stakeholders in terms of environmental and social accountability.

- IoT Sensor Integration and Real-Time Environmental Monitoring: With the growth of Internet of Things sensor networks that are linked directly to EHS software platforms, environmental monitoring has been transformed by offering an alternative to periodic manual measurements by using continuous automated data collection to provide real-time information on operational conditions and environmental effects. Modern EHS implementations are now also integrated with various sensor types such as air quality sensors that measure the levels of particulate matter, volatile organic compounds and chemical concentrations in specific areas at the facility borders, water quality sensors that monitor pH, dissolved oxygen, conductivity and the level of contaminants in streams of discharge, personal exposure sensors that workers wear in hazardous workplaces that are used to monitor personal exposure levels and ensure compliance with regulatory limits on allowable levels of exposure to specific substances. The IoT integration will make the EHS management not a periodical sampling regime but a continuous monitoring, which notifies excursions in real-time, but not hours and days after, when manual sample results show up and allow responding to problems immediately before regulatory limits become surpassed or employee exposures become dangerous. Organizations that use EHS monitoring with IoT have indicated a 32% decrease in incidences of environmental breaches because real-time notifications allow taking immediate corrective measures like shutting down processes, adjusting ventilation, or containing mechanisms that ensure that minor deviations do not turn into reportable releases. Predictive algorithms process real-time sensor data streams to predict the types of excursions to take place in advance, using the trending pattern, weather conditions, and operational schedules to implement proactive measures that prevent the problem instead of responding to it after it takes place. This blend of constant monitoring and automated documentation results in the generation of full audit trails that illustrate regulatory compliance without requiring the conversion of data manually which meets the requirements of the inspector to show regulative control of environmental parameters during reporting periods.

- Advanced Incident Management with Root Cause Analysis Automation: Next-generation EHS solutions have evolved incident management beyond simple reporting and tracking to encompass advanced investigation processes, automated root cause analysis software, and verification systems for corrective actions and facilitate unending safety performance improvements. Incident management modules are now based on structured methods of investigation built into software processes like 5-Why analysis, fishbone diagrams, and change analysis, which help investigators follow systematic root cause identification, automated witness statement collection via mobile applications that record observations immediately after the incidents and preserve details with automatic timestamp validation and photo metadata verification to ensure integrity in the event of litigation, or regulatory investigations, assigning responsibilities, due dates and verification requirements which prevent incomplete implementation and trend analysis state common root causes across multiple incidents to prioritize systemic improvements with the most impact potential. Machine learning algorithms process historical incident data to propose possible root causes on the basis of patterns observed in previous similar incidents, quickening the investigation process but enhancing the quality of analysis. Natural language processing classifies incident narratives provided by the workers automatically into standardized taxonomies to allow statistical analysis of incident types, causes and factors contributing to the incidents across organizational units and across time. The capabilities of behavioral safety monitoring monitor near-miss reports and unsafe observations to determine emerging risk patterns prior to causing actual injuries or environmental releases so that, in advance, interventions might be made. Companies that deploy sophisticated incident control systems indicate a 25-35% lessening in the recurrence of incidents because their systematic root cause examination and confirmed implementation of corrective actions tackle the root causes of systems issues and yield quantifiable safety performance gains leading to lower workers’ compensation expenses, regulatory fines, and production losses due to safety related shutdowns.

Category Wise Insights

By Deployment Mode

Why Cloud-Based Deployment Leads the Market?

In 2025, the largest market share will be the cloud based deployment at approximately 62%. This supremacy can be explained by the fact that the cloud platforms offer better benefits such as avoidance of capital infrastructure investment as well as IT maintenance overhead, automatic software upgrades, which will ensure that latest feature and regulatory content is provided, and scalability that will accommodate expansion of organization and still allow EHS processes to operate in dozens of countries with local customizations being made. In an industry analysis performed on adoption in 2025, more than three-quarters (72%) of EHS managers believe that more software spending will be incurred within the coming 24 months due to cloud migration programs and automation needs. Cloud-based EHS solutions remove the barriers to adoption of enterprise software that existed in the past and only large organizations with significant IT resources would deploy it, and allow mid-sized organizations to utilize advanced compliance management services at low-cost subscriptions.

The hybrid deployment model is realizing the fastest growth with a forecasted CAGR of 8.7% from 2026 to 2035 because of the need of organizations to balance the benefits of cloud computing with certain demands of on-premise data retention caused by regulatory boundaries or Internet connectivity concerns in distant locations. Hybrid architectures allow organizations to store sensitive data in private infrastructure coupled with the ability to use cloud services to collaborate, access data on mobile devices, and perform analytics, which is more flexible than either the pure cloud or on-premises model.

By End-User Industry

Why Manufacturing Dominates EHS Software Applications?

The largest market share of 28% in 2025 will be the manufacturing industry applications. This leadership embodies the entire EHS needs of manufacturing operations whereby organizations have to deal with a complex assemblage of chemical exposures, equipment hazards, ergonomics, environmental emissions, and product safety issues that extend across the entire supply chain beginning with the sourcing of raw materials and ending with the distribution of finished products. Manufacturing activities produce various EHS information sources, such as workplace injury and illness records keeping mandated by OSHA and other similar international organizations, chemical inventory tracking and Safety Data Sheet distributions of hundreds or thousands of substances used in manufacturing processes, environmental permit tracking of air emissions, wastewater discharge, and hazardous waste generation; equipment inspection and maintenance schedules of equipment, and contractor management programs that contain safety requirements of service providers working in manufacturing facilities.

The largest growth is seen in the applications in healthcare and life sciences which are set to see a CAGR of 12.3% between 2026 and 2035 due to the importance of integrating patient safety within the overall occupational health programs, high levels of compliance in the manufacturing of pharmaceuticals, and a more intense focus on cybersecurity issues due to ransomware attacks in which information security rose to the board’s risk category. Specialized EHS capabilities that healthcare organizations are in need of would be infection control monitoring and outbreak investigation, patient safety event tracking and analysis of medication errors and procedural complications, ergonomic assessment that covers musculoskeletal injuries caused by patient handling and repetitive clinical tasks, hazardous drug handling protocols that protect healthcare workers against exposure to chemotherapy agents and other toxic medications, and medical waste management to ensure that the infectious materials and sharps are properly disposed of. The overlap of patient safety and worker safety fields in the interdisciplinary EHS platforms allows the development of superior analytics, which can detect systemic problems impacting both groups: the relationship between workforce numbers and patient adverse events and worker injuries.

By Organization Size

Why Large Enterprises Dominate EHS Software Adoption?

Large enterprises are the largest category that will occupy approximately 68% of the market share in 2025. This advantage is based on the increased regulatory pressure, the complexity of operations, and exposure to risks that large organizations are exposed to compared to smaller firms, which makes the extensive use of EHS software applications business justifications. Multinational corporations usually employ several plants that are located in many geographical jurisdictions, and they need centralized solutions to ensure their safety rates are the same, and all the compliance data should be gathered in corporate reporting. MNCs are especially challenged by the EHS management issues such as alignment of safety programs with facilities in dozens of countries with different regulatory environments, different languages, and cultural practices regarding occupational safety, consolidation of incident reporting data among thousands of employees operating in different working environments, supply chain management with supplier qualification and auditing requirements, and corporate sustainability reporting to investors and other stakeholders which requires confirmed data regarding all the international activities. The advanced EHS features available to large organizations such as enterprise-wide dashboards to provide executive insight into the safety performance by business unit, advanced analytics to identify leading indicators of potential issues before they happen, integration with enterprise resource planning and human capital management systems to share information about organizational structures and workforce demographics, and multi-language is also needed to support consistent safety programs in local languages that suit the workforce in individual facilities. Large organizations have economies of scale that justify the high costs of software since the costs are spread out across thousands of users and many facilities, and compliance rewards and risk mitigation due to better EHS management do not require software payments to recoup the costs in the normal 12-18 month payback periods.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 7.58 billion |

| Projected Market Size in 2035 | USD 14.52 billion |

| Market Size in 2025 | USD 7.06 billion |

| CAGR Growth Rate | 7.4% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Deployment Mode, Component, Solution Type, Organization Size, End-User Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Market Size?

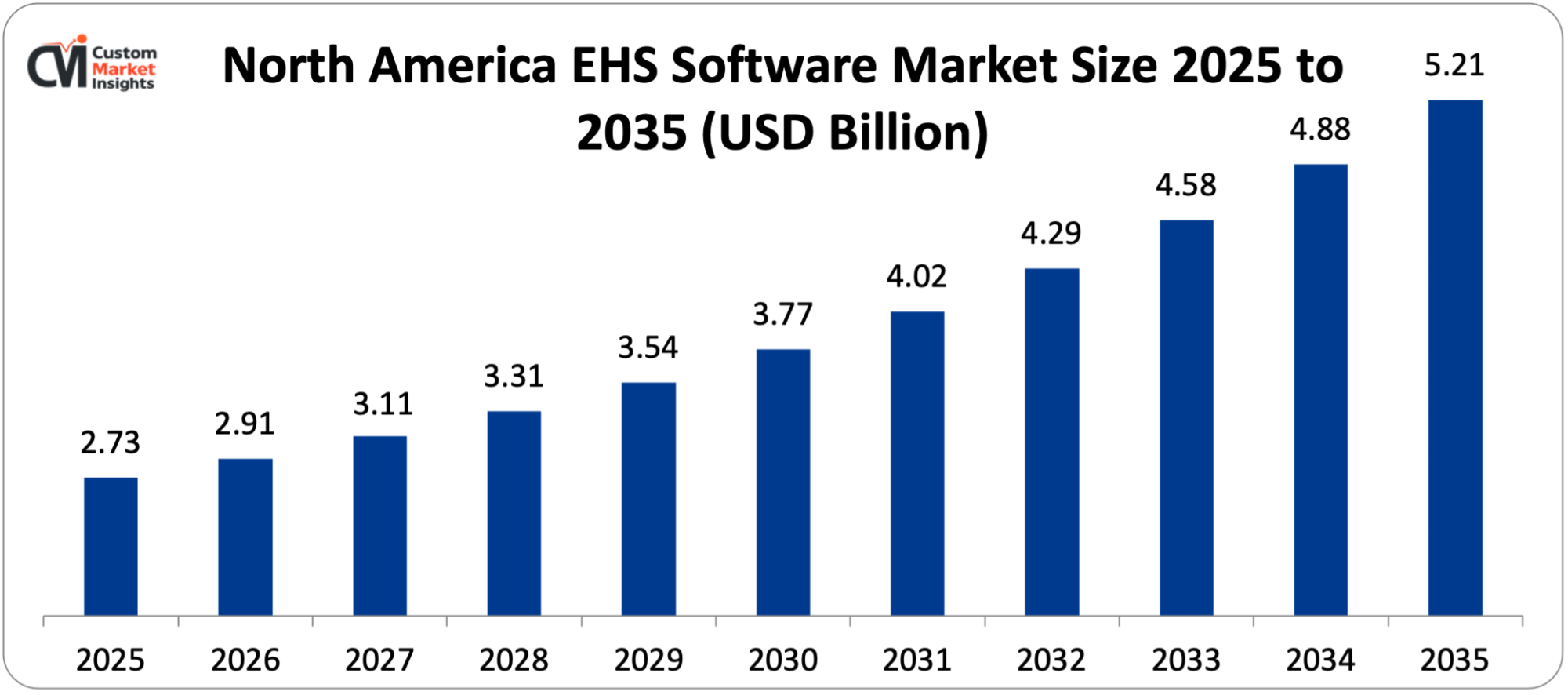

The North America EHS software market size is estimated at USD 2.73 billion in 2025 and is projected to reach approximately USD 5.21 billion by 2035, with a 5.8% CAGR from 2026 to 2035.

Why did North America Dominate the Market in 2025?

With several factors shaping this such as the established culture of regulatory compliance of decades of OSHA enforcement and environmental protection regulations, high age participation of EHS software vendors and implementation partners offering comprehensive ecosystem support, early adoption of high-technology technologies including artificial intelligence and predictive analytics in the safety management process, developed corporate safety culture in major industries that results in complex software requirements, and large investments in workplace safety programs in the U.S. With the Department of Labor raising investments up by 15% each year, North America can be playing a key role in the world with a projected market share of approximately 38.6%. The area has the most sophisticated EHS software market in the world, with the presence of many vendors and high competition that spurs the unending innovation and competitive pricing that are favourable to the enterprise buyers. US organizations are the pioneers of EHS technology adoption that has over 75% penetration in large enterprises and in the mid-market segments that experience rapid penetration as cloud solutions lower barriers to implementation.

U.S. Market Trends

The sheer scale of aggregate demand of workplace safety management across more than 7 million business facilities subject to OSHA regulation, the leadership in EHS software development that features Silicon Valley and Boston technology centers hosting large vendors, the extensive manufacturing base that requires comprehensive chemical safety and process hazards management, oil and gas operations in the Gulf Coast and Rocky Mountain areas that need specialized process safety solutions, and the advanced use of AI have made the United States have the largest EHS software market in the world. The United States corporate sustainability movement has made the EHS software adoption go beyond pure compliance reasons, as investors with trillions of assets at stake are requiring ESG disclosures that exhibit environmental stewardship and social responsibility. As per market analysis, environmental violations have risen by 18% in 2023, which makes businesses invest in advanced EHS platforms that reduce operational risks and prevent significant regulatory fines that could cost up to millions of dollars due to severe violations.

Why is Asia Pacific Experiencing Fastest Growth?

The largest growth has been seen in Asia Pacific with an expected CAGR of 10.1% in 2026-2035, which is a sign of a rapid industrialization that is building new manufacturing facilities that need EHS infrastructure, an increasing number of regulatory frameworks that are becoming more stringent in the major economies, an increasing awareness of workplace safety and environmental protection, and an increasing number of multinational corporations setting up operations in the region with demands that they need to gain global safety standards. China controls the local market through a huge industrial base in chemicals, electronics, automotive and heavy manufacturing to produce vast EHS demands.

China Market Trends

The huge manufacturing industry that manufactures products to be sold in world markets with multicomponent supply networks, the fast integration of smart factory technologies combining EHS monitoring with production automation, the focus of governments on environmental protection with more and more stringent air quality laws and water pollution, safer workplaces after the highly publicized industrial disasters leading to regulatory oversight and publicity, and the significant growth of EHS software software developers in the country and the creation of competitive alternatives to the Western ones make China have high EHS software market prospects. The 14th five-year plan introduced by the government focuses on workplace safety and environmental protection as priorities of the country, so regulatory compliance of the requirements stimulates the implementation of EHS software in Chinese firms. Reports on industrial safety indicate that in 2023, more than 30,000 workplace incidents were recorded in China, which led to government requirements of better safety management systems in high-risk sectors.

Why is Europe Focusing on Comprehensive ESG Integration?

The European market is the most regulated in the world with the widest environmental guidelines, high standards of workplace health and safety, and the mandatory ESG reporting demands of the Corporate Sustainability Reporting Directive, with which it generates high levels of compliance complexity, leading to widespread adoption of advanced EHS software. Europe has significant market share throughout the world with such regulatory frameworks as REACH chemical regulation, which is a regulation that entails significant substance tracking and safety evaluations; EC Environmental Liability Directive which is a regulation that entails the establishment of strict accountability to environmental harms, the Corporate Due Sustainability Directive, which is a regulation that entails monitoring of sustainability in the supply chain; and national regulations on the safety of the workplace in the member states. In the case of sustainability reporting analysis, 77% of compliance executives in the European region consider the use of digital EHS technology to be critical in achieving management of thousands of annual inspections and audit requests in the multi-site operations.

Germany Market Trends

Germany has a great market share due to a well-developed manufacturing industry with the production of automotive, chemical, and industrial equipment, where robust safety management is essential, strict environmental protection thereby making extensive emission monitoring and waste management, Industry 4.0 leadership in integrating the EHS platform and smart manufacturing technology, and a well-developed corporate governance culture with a focus on systematic risk management and sustainability reporting. The German manufacturers focus on management of the process safety which has a thorough hazard analysis and a thorough method of risk assessment strategies incorporated in EHS platforms.

Why is the Middle East & Africa Region Experiencing Growth?

The growing market in the LAMEA region is typified by massive industrial developments in the Gulf Cooperation Council countries that need international safety standards, mining developments in African countries that need workplace hazard management standards, oil and gas developments in the Middle East and North Africa that need the ability to manage process safety, the growth of environmental awareness leading to the development of regulatory frameworks, and economic diversification ventures that introduce new industries that are not focused on the traditional hydrocarbon industries. Both the Vision 2030 of Saudi Arabia and the economic diversification program of the UAE have large-scale infrastructure developments that require comprehensive safety management in the construction process and during the period of operation. The growth of mining activities in South Africa, the Democratic Republic of Congo, and West African states introduces the need for EHS that deal with occupational health risks such as dust concentrations, equipment security, and the effects of mining on the local community.

Top Players in the Market and Their Offerings

- Enablon (Wolters Kluwer)

- Cority Software Inc.

- VelocityEHS

- Sphera Solutions Inc.

- Intelex Technologies

- Gensuite

- EHS Insight

- SAP SE

- Protex AI

- IsoMetrix

- Quentic

- SiteDocs

- Others

Key Developments

The market has undergone significant developments as industry participants seek to expand capabilities and enhance product portfolios.

- In May 2025: Protex AI announced the expansion of its GenAI Copilot platform, achieving 80% incident reduction for major retail clients through advanced predictive analytics and real-time monitoring capabilities, demonstrating the transformative potential of artificial intelligence in workplace safety management.

- In March 2025: Intelex Technologies launched Intelex Essentials, a simplified EHS platform specifically designed for small and medium enterprises with pre-configured workflows, guided implementation, and affordable subscription pricing, making enterprise-grade safety management accessible to organizations previously limited by cost and complexity barriers.

These strategic activities have allowed companies to strengthen market positions, expand product offerings, enhance technological capabilities, and capitalize on growth opportunities within the expanding market.

The Environmental Health and Safety Software Market is segmented as follows:

By Deployment Mode

- Cloud-Based

- Public Cloud

- Private Cloud

- On-Premise

- Hybrid

By Component

- Software

- Services

- Implementation Services

- Training and Support Services

- Analytics Services

By Solution Type

- Incident Management

- Audit and Inspection Management

- Risk Assessment

- Compliance Management

- Training Management

- Environmental Data Management

- Occupational Health Management

- Other Solutions

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- Manufacturing

- Oil and Gas

- Energy and Utilities

- Chemicals and Petrochemicals

- Healthcare and Life Sciences

- Construction

- Transportation and Logistics

- Other Industries

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Environmental Health and Safety Software Market, (2026 – 2035) (USD Billion)

- 2.2 Global Environmental Health and Safety Software Market: snapshot

- Chapter 3. Global Environmental Health and Safety Software Market – Industry Analysis

- 3.1 Environmental Health and Safety Software Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Stringent Regulatory Compliance and Escalating Safety Standards Globally

- 3.2.2 Rapid ESG Integration and Mandatory Sustainability Reporting Requirements

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Deployment Mode

- 3.7.2 Market attractiveness analysis By Component

- 3.7.3 Market attractiveness analysis By Solution Type

- 3.7.4 Market attractiveness analysis By Organization Size

- 3.7.5 Market attractiveness analysis By End-User Industry

- Chapter 4. Global Environmental Health and Safety Software Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Environmental Health and Safety Software Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Environmental Health and Safety Software Market – Deployment Mode Analysis

- 5.1 Global Environmental Health and Safety Software Market overview: By Deployment Mode

- 5.1.1 Global Environmental Health and Safety Software Market share, By Deployment Mode, 2025 and 2035

- 5.2 Cloud-Based

- 5.2.1 Global Environmental Health and Safety Software Market by Cloud-Based, 2026 – 2035 (USD Billion)

- 5.3 Public Cloud

- 5.3.1 Global Environmental Health and Safety Software Market by Public Cloud, 2026 – 2035 (USD Billion)

- 5.4 Private Cloud

- 5.4.1 Global Environmental Health and Safety Software Market by Private Cloud, 2026 – 2035 (USD Billion)

- 5.5 On-Premise

- 5.5.1 Global Environmental Health and Safety Software Market by On-Premise, 2026 – 2035 (USD Billion)

- 5.6 Hybrid

- 5.6.1 Global Environmental Health and Safety Software Market by Hybrid, 2026 – 2035 (USD Billion)

- 5.1 Global Environmental Health and Safety Software Market overview: By Deployment Mode

- Chapter 6. Global Environmental Health and Safety Software Market – Component Analysis

- 6.1 Global Environmental Health and Safety Software Market overview: By Component

- 6.1.1 Global Environmental Health and Safety Software Market share, By Component, 2025 and 2035

- 6.2 Software

- 6.2.1 Global Environmental Health and Safety Software Market by Software, 2026 – 2035 (USD Billion)

- 6.3 Services

- 6.3.1 Global Environmental Health and Safety Software Market by Services, 2026 – 2035 (USD Billion)

- 6.4 Implementation Services

- 6.4.1 Global Environmental Health and Safety Software Market by Implementation Services, 2026 – 2035 (USD Billion)

- 6.5 Training and Support Services

- 6.5.1 Global Environmental Health and Safety Software Market by Training and Support Services, 2026 – 2035 (USD Billion)

- 6.6 Analytics Services

- 6.6.1 Global Environmental Health and Safety Software Market by Analytics Services, 2026 – 2035 (USD Billion)

- 6.1 Global Environmental Health and Safety Software Market overview: By Component

- Chapter 7. Global Environmental Health and Safety Software Market – Solution Type Analysis

- 7.1 Global Environmental Health and Safety Software Market overview: By Solution Type

- 7.1.1 Global Environmental Health and Safety Software Market share, By Solution Type, 2025 and 2035

- 7.2 Incident Management

- 7.2.1 Global Environmental Health and Safety Software Market by Incident Management, 2026 – 2035 (USD Billion)

- 7.3 Audit and Inspection Management

- 7.3.1 Global Environmental Health and Safety Software Market by Audit and Inspection Management, 2026 – 2035 (USD Billion)

- 7.4 Risk Assessment

- 7.4.1 Global Environmental Health and Safety Software Market by Risk Assessment, 2026 – 2035 (USD Billion)

- 7.5 Compliance Management

- 7.5.1 Global Environmental Health and Safety Software Market by Compliance Management, 2026 – 2035 (USD Billion)

- 7.6 Training Management

- 7.6.1 Global Environmental Health and Safety Software Market by Training Management, 2026 – 2035 (USD Billion)

- 7.7 Environmental Data Management

- 7.7.1 Global Environmental Health and Safety Software Market by Environmental Data Management, 2026 – 2035 (USD Billion)

- 7.8 Occupational Health Management

- 7.8.1 Global Environmental Health and Safety Software Market by Occupational Health Management, 2026 – 2035 (USD Billion)

- 7.9 Other Solutions

- 7.9.1 Global Environmental Health and Safety Software Market by Other Solutions, 2026 – 2035 (USD Billion)

- 7.1 Global Environmental Health and Safety Software Market overview: By Solution Type

- Chapter 8. Global Environmental Health and Safety Software Market – Organization Size Analysis

- 8.1 Global Environmental Health and Safety Software Market overview: By Organization Size

- 8.1.1 Global Environmental Health and Safety Software Market share, By Organization Size, 2025 and 2035

- 8.2 Small and Medium Enterprises (SMEs)

- 8.2.1 Global Environmental Health and Safety Software Market by Small and Medium Enterprises (SMEs), 2026 – 2035 (USD Billion)

- 8.3 Large Enterprises

- 8.3.1 Global Environmental Health and Safety Software Market by Large Enterprises, 2026 – 2035 (USD Billion)

- 8.1 Global Environmental Health and Safety Software Market overview: By Organization Size

- Chapter 9. Global Environmental Health and Safety Software Market – End-User Industry Analysis

- 9.1 Global Environmental Health and Safety Software Market overview: By End-User Industry

- 9.1.1 Global Environmental Health and Safety Software Market share, By End-User Industry, 2025 and 2035

- 9.2 Manufacturing

- 9.2.1 Global Environmental Health and Safety Software Market by Manufacturing, 2026 – 2035 (USD Billion)

- 9.3 Oil and Gas

- 9.3.1 Global Environmental Health and Safety Software Market by Oil and Gas, 2026 – 2035 (USD Billion)

- 9.4 Energy and Utilities

- 9.4.1 Global Environmental Health and Safety Software Market by Energy and Utilities, 2026 – 2035 (USD Billion)

- 9.5 Chemicals and Petrochemicals

- 9.5.1 Global Environmental Health and Safety Software Market by Chemicals and Petrochemicals, 2026 – 2035 (USD Billion)

- 9.6 Healthcare and Life Sciences

- 9.6.1 Global Environmental Health and Safety Software Market by Healthcare and Life Sciences, 2026 – 2035 (USD Billion)

- 9.7 Construction

- 9.7.1 Global Environmental Health and Safety Software Market by Construction, 2026 – 2035 (USD Billion)

- 9.8 Transportation and Logistics

- 9.8.1 Global Environmental Health and Safety Software Market by Transportation and Logistics, 2026 – 2035 (USD Billion)

- 9.9 Other Industries

- 9.9.1 Global Environmental Health and Safety Software Market by Other Industries, 2026 – 2035 (USD Billion)

- 9.1 Global Environmental Health and Safety Software Market overview: By End-User Industry

- Chapter 10. Environmental Health and Safety Software Market – Regional Analysis

- 10.1 Global Environmental Health and Safety Software Market Regional Overview

- 10.2 Global Environmental Health and Safety Software Market Share, by Region, 2025 & 2035 (USD Billion)

- 10.3. North America

- 10.3.1 North America Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.3.1.1 North America Environmental Health and Safety Software Market, by Country, 2026 – 2035 (USD Billion)

- 10.3.1 North America Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.4 North America Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035

- 10.4.1 North America Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.5 North America Environmental Health and Safety Software Market, by Component, 2026 – 2035

- 10.5.1 North America Environmental Health and Safety Software Market, by Component, 2026 – 2035 (USD Billion)

- 10.6 North America Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035

- 10.6.1 North America Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035 (USD Billion)

- 10.7 North America Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035

- 10.7.1 North America Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.8 North America Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035

- 10.8.1 North America Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.9. Europe

- 10.9.1 Europe Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.9.1.1 Europe Environmental Health and Safety Software Market, by Country, 2026 – 2035 (USD Billion)

- 10.9.1 Europe Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.10 Europe Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035

- 10.10.1 Europe Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.11 Europe Environmental Health and Safety Software Market, by Component, 2026 – 2035

- 10.11.1 Europe Environmental Health and Safety Software Market, by Component, 2026 – 2035 (USD Billion)

- 10.12 Europe Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035

- 10.12.1 Europe Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035 (USD Billion)

- 10.13 Europe Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035

- 10.13.1 Europe Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.14 Europe Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035

- 10.14.1 Europe Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.15. Asia Pacific

- 10.15.1 Asia Pacific Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.15.1.1 Asia Pacific Environmental Health and Safety Software Market, by Country, 2026 – 2035 (USD Billion)

- 10.15.1 Asia Pacific Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.16 Asia Pacific Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035

- 10.16.1 Asia Pacific Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.17 Asia Pacific Environmental Health and Safety Software Market, by Component, 2026 – 2035

- 10.17.1 Asia Pacific Environmental Health and Safety Software Market, by Component, 2026 – 2035 (USD Billion)

- 10.18 Asia Pacific Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035

- 10.18.1 Asia Pacific Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035 (USD Billion)

- 10.19 Asia Pacific Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035

- 10.19.1 Asia Pacific Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.20 Asia Pacific Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035

- 10.20.1 Asia Pacific Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.21. Latin America

- 10.21.1 Latin America Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.21.1.1 Latin America Environmental Health and Safety Software Market, by Country, 2026 – 2035 (USD Billion)

- 10.21.1 Latin America Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.22 Latin America Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035

- 10.22.1 Latin America Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.23 Latin America Environmental Health and Safety Software Market, by Component, 2026 – 2035

- 10.23.1 Latin America Environmental Health and Safety Software Market, by Component, 2026 – 2035 (USD Billion)

- 10.24 Latin America Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035

- 10.24.1 Latin America Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035 (USD Billion)

- 10.25 Latin America Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035

- 10.25.1 Latin America Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.26 Latin America Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035

- 10.26.1 Latin America Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.27. The Middle-East and Africa

- 10.27.1 The Middle-East and Africa Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.27.1.1 The Middle-East and Africa Environmental Health and Safety Software Market, by Country, 2026 – 2035 (USD Billion)

- 10.27.1 The Middle-East and Africa Environmental Health and Safety Software Market, 2026 – 2035 (USD Billion)

- 10.28 The Middle-East and Africa Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035

- 10.28.1 The Middle-East and Africa Environmental Health and Safety Software Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.29 The Middle-East and Africa Environmental Health and Safety Software Market, by Component, 2026 – 2035

- 10.29.1 The Middle-East and Africa Environmental Health and Safety Software Market, by Component, 2026 – 2035 (USD Billion)

- 10.30 The Middle-East and Africa Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035

- 10.30.1 The Middle-East and Africa Environmental Health and Safety Software Market, by Solution Type, 2026 – 2035 (USD Billion)

- 10.31 The Middle-East and Africa Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035

- 10.31.1 The Middle-East and Africa Environmental Health and Safety Software Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.32 The Middle-East and Africa Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035

- 10.32.1 The Middle-East and Africa Environmental Health and Safety Software Market, by End-User Industry, 2026 – 2035 (USD Billion)

- Chapter 11. Company Profiles

- 11.1 Enablon (Wolters Kluwer)

- 11.1.1 Overview

- 11.1.2 Financials

- 11.1.3 Product Portfolio

- 11.1.4 Business Strategy

- 11.1.5 Recent Developments

- 11.2 Cority Software Inc.

- 11.2.1 Overview

- 11.2.2 Financials

- 11.2.3 Product Portfolio

- 11.2.4 Business Strategy

- 11.2.5 Recent Developments

- 11.3 VelocityEHS

- 11.3.1 Overview

- 11.3.2 Financials

- 11.3.3 Product Portfolio

- 11.3.4 Business Strategy

- 11.3.5 Recent Developments

- 11.4 Sphera Solutions Inc.

- 11.4.1 Overview

- 11.4.2 Financials

- 11.4.3 Product Portfolio

- 11.4.4 Business Strategy

- 11.4.5 Recent Developments

- 11.5 Intelex Technologies

- 11.5.1 Overview

- 11.5.2 Financials

- 11.5.3 Product Portfolio

- 11.5.4 Business Strategy

- 11.5.5 Recent Developments

- 11.6 Gensuite

- 11.6.1 Overview

- 11.6.2 Financials

- 11.6.3 Product Portfolio

- 11.6.4 Business Strategy

- 11.6.5 Recent Developments

- 11.7 EHS Insight

- 11.7.1 Overview

- 11.7.2 Financials

- 11.7.3 Product Portfolio

- 11.7.4 Business Strategy

- 11.7.5 Recent Developments

- 11.8 SAP SE

- 11.8.1 Overview

- 11.8.2 Financials

- 11.8.3 Product Portfolio

- 11.8.4 Business Strategy

- 11.8.5 Recent Developments

- 11.9 Protex AI

- 11.9.1 Overview

- 11.9.2 Financials

- 11.9.3 Product Portfolio

- 11.9.4 Business Strategy

- 11.9.5 Recent Developments

- 11.10 IsoMetrix

- 11.10.1 Overview

- 11.10.2 Financials

- 11.10.3 Product Portfolio

- 11.10.4 Business Strategy

- 11.10.5 Recent Developments

- 11.11 Quentic

- 11.11.1 Overview

- 11.11.2 Financials

- 11.11.3 Product Portfolio

- 11.11.4 Business Strategy

- 11.11.5 Recent Developments

- 11.12 SiteDocs

- 11.12.1 Overview

- 11.12.2 Financials

- 11.12.3 Product Portfolio

- 11.12.4 Business Strategy

- 11.12.5 Recent Developments

- 11.13 Others.

- 11.13.1 Overview

- 11.13.2 Financials

- 11.13.3 Product Portfolio

- 11.13.4 Business Strategy

- 11.13.5 Recent Developments

- 11.1 Enablon (Wolters Kluwer)

List Of Figures

Figures No 1 to 48

List Of Tables

Tables No 1 to 127

Prominent Player

- Enablon (Wolters Kluwer)

- Cority Software Inc.

- VelocityEHS

- Sphera Solutions Inc.

- Intelex Technologies

- Gensuite

- EHS Insight

- SAP SE

- Protex AI

- IsoMetrix

- Quentic

- SiteDocs

- Others

FAQs

The Global Environmental Health and Safety Software Market will continue to experience a marvelous expansion in the light of growing compliance regulations whereby the number of workplace safety inspections rises 22% in 2024, mandatory ESG reporting which impacts 77% of large businesses that require locally coordinated sustainability data gathering, artificial intelligence integration which allows 30-40% incidents mitigation by predictive analytics, cloud computing that removes infrastructure obstacles with 62% market share, and IoT sensor applications which reduce environmental breaches by 32% through real-time monitoring.

The region with the highest growth pattern is Asia-Pacific with the projected CAGR of 10.1% in 2026-2035 because of the high-paced industrialization that is developing new production sites, regulatory frameworks that are becoming stricter in China and India, significant Industry 4.0 investments in integrating EHS platforms with intelligent manufacturing, increasing the multinational presence that opens new facilities with a global ranked safety standard, and government initiative that establishes workplace protection and environmental sustainability as a national priority.

The forecast period will ensure that North America retains the largest share of revenue at an estimated 38.6% of the global market in 2025, due to decades of regulatory compliance culture, advanced corporate safety programs that have created advanced software requirements, the large number of EHS vendors developing comprehensive implementation ecosystems, the adoption of AI and predictive analytics technologies early, and the focus on government provided that OSHA inspection will still be emphasized and that the government will have increased funding available to it on the safety issue in the workplace.

The market is currently projected to rise to about USD 14.52 billion by 2035, and with a rate of 7.4% CAGR of growth between 2026 and 2035, the market is well positioned to grow due to mandatory ESG disclosure requirements, artificial intelligence and machine learning development of predictive safety management, proliferation of IoT sensors to monitor the environment in real-time, the development of cloud platforms to reduce barriers to implementation, and the adoption of SMEs as simplified solutions to previously undervalued segments of the market.

The cost of EHS software significantly depends on the deployment model, functions and scope, and the size of the organization as low-end cloud subscriptions cost USD 5,000-15,000/year with small organizations having simple compliance requirements and high-end statements of USD 100,000-500,000/year with large multinational implementations with sophisticated analytics, IoT connectivity, and deep customization. Subscription pricing platforms have made access democratically by transforming capital spending into the operation costs and lowering the barriers to initial adoption that had restricted the adoption to large organizations in addition to making the costs predictable and providing simpler budgeting and better cash management, quickening the penetration of the markets of all organization sizes.

The EHS software market is essentially driven by government regulations that entail compliance requirements necessitating orderly documentation and reporting, the rise in the number of inspections creating pressure on enforcers, the growth in sustainability disclosures requirements on public companies and their suppliers, the imposition of stricter environmental standards that require constant monitoring, and safety enhancement programs that provide funding and incentives to use technology. The regulatory changes like the focus on workplace health and safety by OSHA with 22% increase of inspection, environmental protection enforcement by EPA where violations are tracked, Corporate Sustainability Reporting Directive by EU where organizations are obligated to disclose all their practices and strategies regarding environmental and health impacts all create the continuous need to implement the EHS platform where organizations can ensure that they meet the demands of complex and dynamic regulatory compliance and show systematic ways of addressing environmental and sustainability risks management.

The key players in the market are Enablon (Wolters Kluwer), Cority Software Inc., VelocityEHS, Sphera Solutions Inc., Intelex Technologies, Gensuite, EHS Insight, SAP SE, Protex AI, IsoMetrix, Quentic, SiteDocs, Others.