Thermoplastic Polyurethane TPU Market Size, Trends and Insights By Type (Polyester TPU, Polyether TPU, Polycaprolactone TPU, Other Types), By Processing Method (Injection Molding, Extrusion, Blow Molding, Other Processing Methods, Calendering, Compression Molding), By Application (Footwear, Automotive, Medical Devices, Electronics, Construction, Industrial Machinery, Other Applications), By End-Use Industry (Consumer Goods, Industrial Machinery, Construction, Healthcare, Other End-Use Industries), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | Asia Pacific |

Major Players

- BASF SE

- The Lubrizol Corporation

- Covestro AG

- Huntsman International LLC

- Others

Reports Description

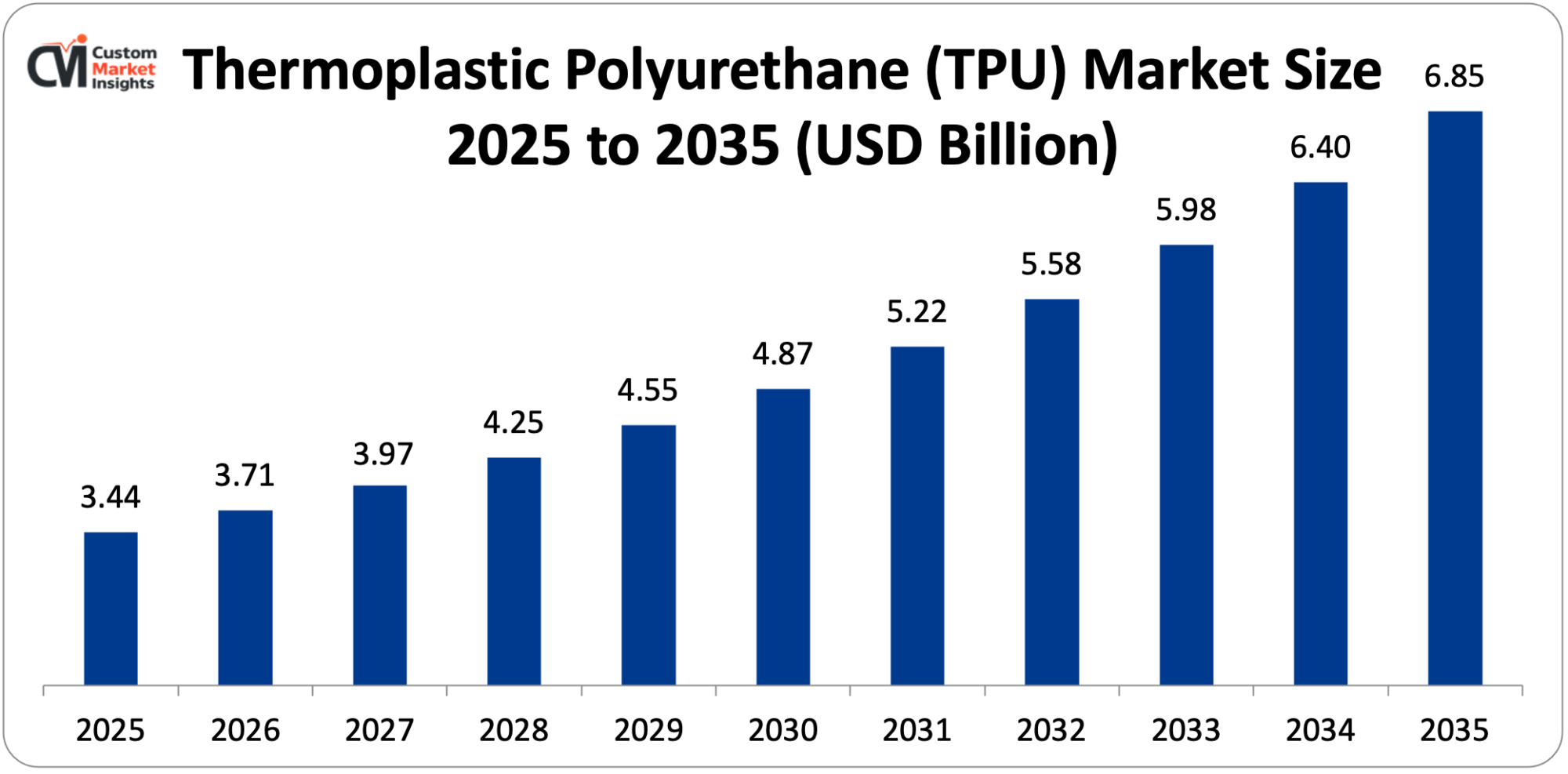

It is estimated that the global market size of thermoplastic polyurethane will amount to USD 3.44 billion in 2025 and it is expected to grow at a CAGR of 7.2% to reach USD 3.71 billion in 2026 and USD 6.85 billion by 2035. The growth of the market is propelled by the growing demands of lightweight materials in the automotive sector, the rising use of lightweight materials in footwear production, the growing use of lightweight materials in medical device production where biocompatibility is required, and the increased use of lightweight materials in 3D printing and advanced manufacturing.

Market Highlight

- Thermoplastic polyurethane in Asia Pacific dominated the market with a 56% market share in 2025.

- North America is projected to grow at a high CAGR of 6.4% in 2026-2035.

- By type, the polyester segment was able to grab 40% of the market share in 2025.

- By type, polycaprolactone segment is increasing with the highest CAGR of 8.2% between 2026 and 2035.

- By segments, the footwear segment would have the largest market share of 30% in 2025 and the automotive segment will grow at a CAGR of 8.0% within the projected period of 2026 to 2035.

- By processing segment, Injection molding segment took 42% of the market share in 2025 whereas the extrusion segment took 44% of the volume.

Thermoplastic Polyurethane TPU Market Trends – Significant Growth Factors

The Thermoplastic Polyurethane TPU Market Trends present significant growth opportunities due to several factors:

- Automotive Lightweighting and Electric Vehicle Proliferation: The initial force behind the TPU market is the growing focus on vehicle lightweighting to achieve fuel efficiency and reduce emissions, as manufacturers of vehicles worldwide are moving their focus off of traditional materials and to high-performance polymers that can provide them with weight reduction without affecting their durability or safety. Based on global automotive analysis data, the automotive industry is undergoing transformation as never before with the adoption of electric vehicles gaining pace and strict regulation of emissions with strict regulation of lighter vehicle architecture. TPU materials have outstanding strength, flexibility, abrasion resistance, and low density with regard to making it an excellent substitute to heavier metals and hard plastics used in the components of automobiles. It is anticipated that automotive applications will take up about 30% of total TPU consumption in 2024, and that the segment will experience an 8.03% CAGR growth through the year 2030 as original equipment manufacturers actively pursue lightweighting strategies. TPU materials have a key benefit in new energy vehicles, especially battery fluid chemical resistance, flexible routing of complex wires through tight battery compartments and thermal stability to allow under-hood use. Typical automotive TPU uses are interior parts such as instrument panels, door panels, and console parts where soft-touch finishes improve user feel, exterior parts such as paint protection films, bumper parts and flexible trims, functional parts such as cable sheathing protecting wiring harnesses, seals and gasket and battery parts in electric cars like thermal management parts and protective covers. The trend of the world of sustainable transportation is radically changing priorities in material selection, as car OEMs are considering all parts in terms of the possibility of weight reduction. In most applications, TPU allows savings of 30-50% of weight compared to traditional rubber and PVC, and performance is equal or better. This weight saving is directly proportional to the benefits of a longer electric vehicle range, decreased fuel use in internal combustion vehicles, or lower carbon emissions in the entire life cycle of the vehicle, which are in line with more stringent corporate average fuel economy requirements and European emissions laws.

- Growing Footwear Industry and Performance Material Demands: Market expansion has increased significantly because of the adoption of TPU in the global footwear industry in applications as a high-performance requirement with exceptional durability, comfort and aesthetic versatility. The largest application domain was the footwear segment which took 30% of the market share in 2024 of thermoplastic polyurethane. In 2019, over 13.5 billion pairs of shoes were made only in China, which makes the country the leading footwear manufacturing center in the world. The special properties of TPU such as high abrasion resistance for a long life of wear even with heavy use, high elastic recovery to give bouncing properties necessary to athletic performance, high flexibility with the ability to move the foot naturally, light weight to reduce fatigue with prolonged wearing periods, and aesthetic versatility to produce transparent outsoles, complicated geometries, and colorful colors are what have made TPU the material of choice for athletic and performance footwear. TPU technology has been adopted by major footwear brands with notable examples of this adoption being the Infinergy expanded TPU produced by BASF being used in advanced cushioning by major footwear companies to provide excellent energy return which improves athletic performance and the use of E-TPU products by Hotter in September 2021 to show the growing popularity of the material in footwear products in categories such as athletic footwear, casual footwear, and safety footwear. TPU midsoles and outsoles have features of performance that cannot be equaled by traditional EVA foam and rubber and its higher durability as a product with high wear life by a factor of 2-3x in high wear products, uniform cushioning properties over a wide operating range of sub-zero to high temperatures, and customizable hardness also allow designers to design performance-specific characteristics for particular sports and activities. The TPU trend in the circular economy also is promoting further uptake of TPU in mono-material shoe designs such as the Futurecraft Loop program by Adidas that allows the entire shoe to be recycled by making it not only of TPU variants but also by more technically recycling to create take-back programs and completely closed-loop production, which meets the sustainability pledges of large brands. Footwear makers also consider bio-based TPU compounds based on renewable sources, which satisfy the needs of consumers who expect products with no environmental impact, without the performance properties that make TPU an indispensable part of current footwear.

What are the Major Advances Changing the Thermoplastic Polyurethane Market Today?

- Bio-Based and Sustainable TPU Formulations: The creation of bio-based thermoplastic polyurethanes made out of renewable feedstocks A significant technological breakthrough has been made in regard to environmental sustainability issues but does not reduce the performance properties of petroleum-based counterparts. Manufacturers are also launching TPU formulations that use bio-based polyols based on plant oils, bio-based diisocyanates based on renewable carbon sources, and recycled TPU material, allowing the use of a circular economy model. Companies such as BASF, Covestro, and Lubrizol have presented lines of bio-based TPU products that have a 20-70% renewable content that has cut down the carbon footprint and still performs to the high requirements of demanding applications. This trend of sustainable materials has been influenced by the corporate sustainability statements of large brands, the preference of the consumers towards greener materials, regulatory factors such as single-use plastic bans and extended producer responsibility provisions, and the life-cycle assessment systems that measure the environmental effects of product lifecycles. Bio-based TPU preserves key performance characteristics in its mechanical strength that is equivalent to conventional TPU, processing aspects that can be used with existing manufacturing tools, and end-use performance, which can fulfill application requirements without reformulating entire product designs.

- Advanced 3D Printing and Additive Manufacturing Applications: The combination of TPU materials with additive manufacturing technologies has changed the approach to product development and personalized production of goods, making it possible to produce flexible and durable components that could not be produced using standard manufacturing techniques. TPU filaments manufactured to be used in fused deposition modeling (FDM) 3D printing are flexible and elastic enough to be used in the production of wearables and protective cases, gaskets and seals, functional prototypes, and custom-fit wearables. Powder bed fusion and material jetting techniques of industrial additive manufacturing can be used to create complex geometries such as lattice structures of lightweight but strong parts, conformal cooling channels in molds, and individually designed medical devices. The TPU 3D printing market is showing strong growth due to the development of the technology such as increased print speeds that led to a decrease in production times, better formulations that allowed more adhesion and mechanical behavior of layers, and multi-material printing that allowed rigid and flexible materials to be combined on the same part. Its use is found in a wide range of industries, with medical applications in custom orthotics and prosthetic components and in anatomical models used in surgical planning, automotive applications in the creation of functional prototypes, low-volume production parts, and in-house custom trim, consumer products in the creation of personalized phone cases, footwear components and fashion accessories; and industry in replacement parts, tooling and specialized equipment components.

- Medical-Grade TPU and Healthcare Applications: With the development of medical-grade TPU compounds that are highly biocompatible, large growth possibilities in the healthcare industry have been created where material safety, flexibility, and durability are of primary concern. Medical grade TPU is tested and certified, such as the ISO 10993 biocompatibility testing that tests cytotoxicity, sensitization, and irritation, the USP Class VI testing of substances in contact with body tissues and fluids, and compliance with the FDA regarding medical device use. Medical grade TPU has found use in healthcare devices such as catheter tubing and parts where flexibility and resistance to kinking are important to the safe insertion and operation of these devices; wound care dressings that need both flexibility and breathability as well as moisture resistance, medical wearables such as continuous glucose monitors, cardiac patches, and drug delivery devices where skin contact (long-term) is needed, surgical instruments with flexible components, and devices that require a permanent connection to the body, such as extracorporeal circuits and implantable components. Medical devices segment is expected to record the best CAGR of the forecast periods in various market analyses due to ageing populations relying on more medical interventions and chronic disease management being changed in favor of wearable and implantable monitoring devices, less invasive procedures that require flexibility and durability, and personalized medicine practices that call on custom medical devices. Manufacturers are in turn increasing the capacity of medical-grade TPU with Avient tripling NEUSoft TPU capacity in Suzhou under ISO 13485 certification to supply neurovascular product-needed protein to Asian health-tech manufacturers and Lubrizol collaborating with polyhose to scale NEUSoft TPU capacity to five times on the Tamil Nadu tubing plant.

- Smart Processing Technologies and Industry 4.0 Integration: The development of processing technology such as adaptive injection molding controls, advanced extrusion systems, and real-time quality monitoring has significantly enhanced the efficiency of TPU production, consistency, and customization. Recent injection molding of TPU systems includes adaptive switchover algorithms that optimizes the time and effort put on changing the fill to pack transitions according to real-time measurements of cavity pressure; multi-component injection molding which allows overmolding of TPU on rigid substrates in a single run; tight temperature control which keeps the processing vigilances lean and narrow, which is a key feature of TPU and quick cycle times which run at a rate 20-30% slower than the old systems. High extrusion technologies make it possible to produce TPU films with thickness uniformity in the range of -3 micrometers, to co-extrude multi-layered TPU films with multiple grades or with other polymers, and high-speed production lines with 500 kg/hour TPU profiles. The integration of Industry 4.0 introduces the temperature, pressure, and flow parameters of real-time process monitoring; predictive maintenance to minimize unexpected downtimes by monitoring equipment degradation before its failure; quality control by machine vision and AI to detect defects; and simulation in digital twins to optimize parameters before the actual production is performed.

Category Wise Insights

By Type

Why Polyester TPU Leads the Market?

The TPU of polyester takes the largest share of around 40% as far as the market share is concerned in 2025. Such dominance is due to the better mechanical properties, chemical resistance, and cost-effectiveness of polyester TPU over other chemistries of TPU. Polyester TPU is a polymer produced by the reaction of diisocyanates with polyester polyols produced by the reaction of adipic acid and diols to form polymer chains of polymer with high tensile strength, high abrasion resistance (twenty to forty times higher than diether variants), better resistance to oil, greases, and solvents of hydrocarbons, high hydrolytic stability in moderate humidity conditions, and low cost due to the use of commodity polyester polyols. All these properties make polyester TPU suitable in applications that demand mechanical integrity, such as footwear outsoles, which are subjected to repeated impact and flexing, automobile hoses that move oils and fuels; industrial belts and conveyor systems; and protective films that resist scratches and abrasion.

The projection of Polyester TPU has a 7.87% CAGR up to 2030 due to automotive lightweighting, the footwear industry, and other industries. The superior injection molding, extrusion, and blow molding of the material make the manufacturing of a wide range of products cost-effective. Manufacturers are still refining polyester TPU recipes with polyester architectures that are more hydrolysis resistant, specialty additives like those enhancing UV stability in outdoor use, and bio-based polyester polyols that have a lower environmental impact.

Polycaprolactone TPU is enjoying the highest growth with a projected CAGR of 8.2% between the years 2026 and 2035 due to its special properties such as exceptionally low-temperature flexibility whereby the compound has the ability to maintain its plasticity even at temperatures below -40°C; high hydrolysis resistance, which is better than polyester TPU; better biocompatibility, which enables it to be used in the production of medical devices; and easy processability characterized by a low melting point. The major uses of polycaprolactone TPU are in medical apparatus, e.g., catheters, tubing, and wound dressings that need to be biocompatible; automotive seals and gaskets that have to be used under extreme temperatures; hydraulic and pneumatic systems, where hydrolysis resistance is of the essence; and specialty markets, e.g., marine equipment and products that must be used at low temperatures.

By Processing Method

Why Injection Molding and Extrusion Dominate Manufacturing?

Injection molding has an estimated market share of 42% of TPU processing in 2025, and extrusion has a volume market share of 44%, and the two processing applications prevail because of their cost-effectiveness, scalability, and adaptability in the application of TPU. Complex geometries Injection modeling offers benefits: This process allows complex geometry designs that could not be made by the extrusion process, high dimensional control to tolerances of less than ±0.1mm, high production throughput with cycle times as short as 60 seconds in many cases, incorporation of inserts and multi-material overmolding and automation to provide lights-out production. Jurisdictions TPU injection molding can be used in footwear (patterns of outliers, outheel counters), automotive (gear shift boots, interior trim), consumer electronics (cases and other protection accessories), and medical (syringe plungers, flexible housings).

TPU products that are injection-molded are expected to increase by 7.95% CAGR until 2030 due to the improvement in the molding technology. Contemporary injection molding equipment of TPU uses low clamp force to save on energy, electronic control of the process to optimize each shot based on the measured variables, hot runner systems to eliminate runners and minimize material waste, and multi-cavity tooling to produce a number of parts at a time.

Extrusion has the highest volume percentage of 44% of 2024 volume forming continuous profiles, films, sheets, and tubes vital in the application of TPU. The benefits of extrusion are that it allows continuous production, which is suitable when production requires high volumes; it is suitable when the cross-sections of the product are usually circular, such as films and tubes; tooling is cheaper than injection molding, and recycled TPU can be used without compromising the current initiatives of the e-circular economy. Extruded TPU products are automotive paint protection films, medical packaging, and textile laminates, window seal profiles, edge trim, and decoration, medical catheter tubing, industrial hoses, and pneumatic lines; and thermoforming sheets as secondary products.

By Application

Why Footwear Dominates TPU Applications?

The footwear application is the biggest segment, which will occupy 30% of the total market share by 2025. This is the leadership that shows the combination of TPU properties that best meet the modern footwear performance needs in the categories of athletic, casual, safety, and fashion. TPU has been used to create innovation in the shoe business such as transparent outsoles that show design features and energy-returning midsoles that enhance athletic behavior, durable and lightweight construction that reduces fatigue, and abrasion resistant materials that prolong the life of the product. The TPU uptake in the footwear industry is witnessed in giant brand campaigns with BASF Infinergy E-TPU in performance footwear with excellent cushioning, Hotter with the use of E-TPU to prove usage in comfort footwear, and circular design programs such as Futurecraft Loop with TPU mono-materials that are fully recyclable.

Footwear TPU demand is steadily growing as a preventative measure because of consumer spending on athletic and performance footwear, an increase in health and fitness awareness, which is growing due to the demand of athletic shoes, a fashion movement towards visible technology and transparent components and sustainability efforts that promote the use of recyclable mono-material designs. The shoe industry is at a level of over 20 billion pairs in a year of global production, with the trend of TPU expansion because the companies acknowledge its benefits in terms of performance and sustainability.

The automotive use is growing at the highest rate with the CAGR expected to be 8.0% between the years 2026 and 2035, owing to the spread of electric vehicles and the need to lightweight. TPU uses in the automotive industry are in the interior, such as soft-touch panels on instrument panels, door panels, and console panels, cable and wire handling, such as wire harness protective sheathing, the exterior, such as paint protection film and bumper flexible components and decorative trim, and functional parts, such as thermal management hoses, seals and gasket applications, and battery pack protection. Automobile industry developments include the growth of the automotive industry due to stricter fuel economy and emission regulations that require a reduction in the weight of vehicles, electric vehicle design that opens new markets of application, the thriving of autonomous vehicle interiors with a focus on luxury and comfort, and sustainability efforts to minimize the use of PVC in the automobile industry.

By End-Use Industry

Why Consumer Goods and Industrial Machinery Lead Adoption?

The largest segment of the end-use of the industry is consumer goods, which have a large market share owing to various applications of TPU in products that are bought directly by consumers like footwear, which is the biggest category, phone case accessories and smartwatch bands, which are electronic devices, sporting goods with their protective gears, equipment parts, and fashion accessories with their aesthetic flexibility. Manufacturers of consumer goods appreciate TPU to differentiate their brands by making unique product features, the durability of the product decreasing warranty claims and returns, design flexibility so as to make innovative forms of products and the sustainability feature that is attractive to consumers who consider the environment.

Applications in industry machinery are large end-use markets that use TPU in challenging applications such as conveyor belts and power transmission components, hydraulic and pneumatic seals that require long-life operation, industrial hoses that transport abrasive and protective covers over cables and equipment. Industrial users are concerned with TPU because of its long service life that minimizes the replacement rate and the overall cost of ownership, resistance to chemicals to allow work in harsh environments, temperature performance that allows flexibility in operating over a broad operating range, and properties that can be customized to meet the needs of particular applications.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 3.71 billion |

| Projected Market Size in 2035 | USD 6.85 billion |

| Market Size in 2025 | USD 3.44 billion |

| CAGR Growth Rate | 7.2% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Type, Processing Method, Application, End-Use Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Thermoplastic Polyurethane TPU Market – Regional Analysis

How Big is the Asia Pacific Market Size?

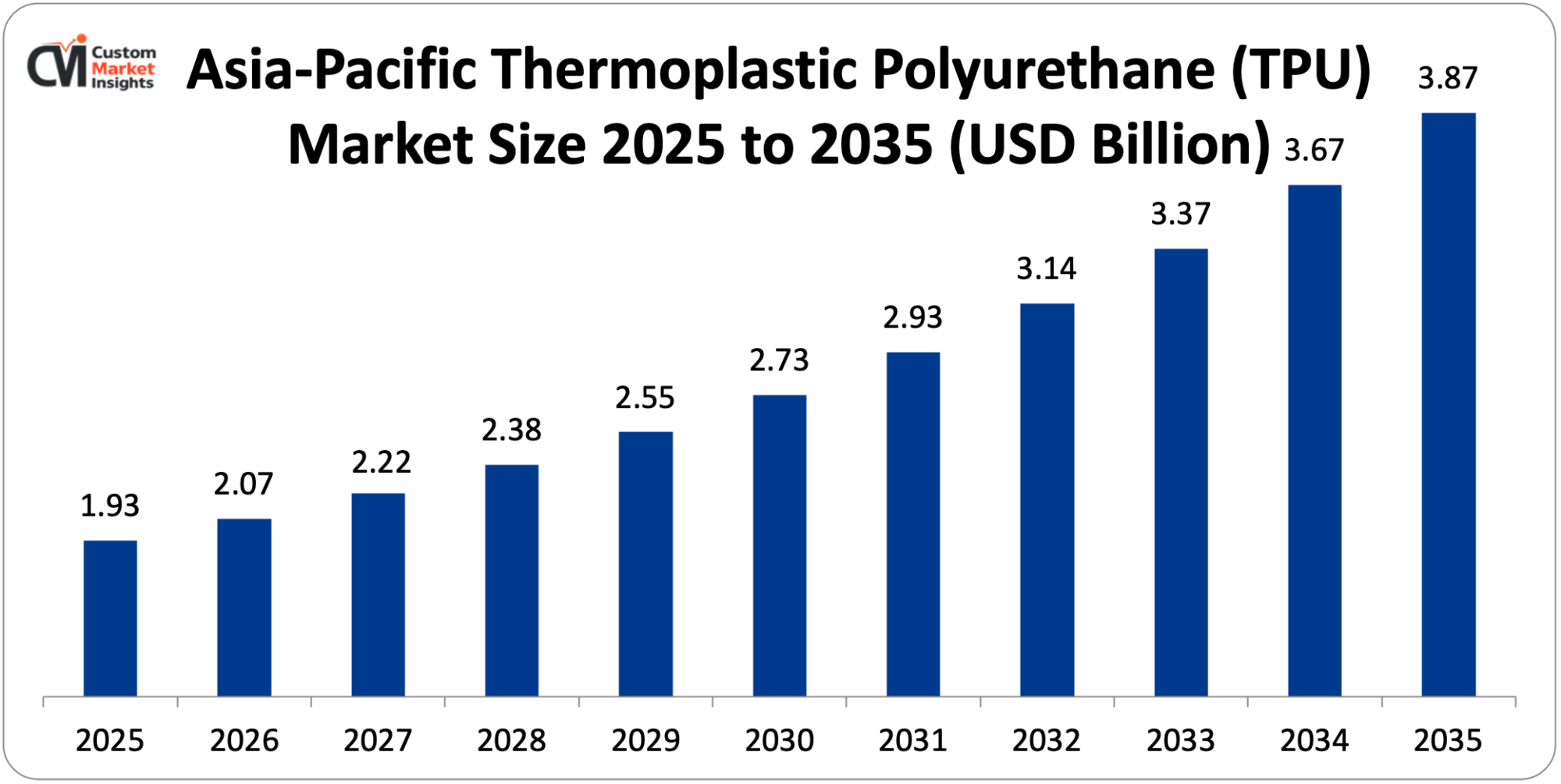

The Asia Pacific thermoplastic polyurethane market size is estimated at USD 1.93 billion in 2025 and is projected to reach approximately USD 3.87 billion by 2035, with a 7.7% CAGR from 2026 to 2035.

Why did Asia Pacific Dominate the Market in 2025?

The most important player in the world is Asia Pacific, with a market share of about 56% in 2025 due to the strong manufacturing capabilities in the region, the fast-rising consumer markets, and massive investment in infrastructure in the automotive, footwear, and construction industries. It took China alone 63% across East Asia in 2024 due to the largest footwear manufacturing capacity (more than 13.5 billion pairs annually), the largest vehicle manufacturing presence (with China being the largest vehicle market globally), the largest electronics manufacturing to global supply chains, and the massive construction industry due to the ongoing urbanization. The leadership in the region is strengthened by built-in supply chains between the production of raw materials and the final goods production, low-cost labor that allows cheap production, increasing numbers of middle classes that boost consumer demand, and government policies that support the growth of the manufacturing sector.

China Market Trends

The largest TPU market in the world is China, which is driven by an extensive manufacturing ecosystem between MDI and polyol production through TPU compounding and end product manufacture, its huge footwear industry with global export dominance, a booming automobile sector becoming dominated by rapid electrification, growing medical device manufacturing capacity, and domestic brands rapidly adopting high-performance material. Recent capacity expansions such as the Zhuhai plant of Covestro to 120,000 tons of yearly capacity by 2033 can be viewed as the size of the infrastructure investment to support the TPU market leadership in China. The TPU market in India is registering good growth due to the fledgling footwear manufacturing industry having major global brands setting up production, the developing automotive industry with augmented local content demands, the booming electronics manufacturing industry under government production incentive schemes, and better infrastructure that allows industrial development.

Why is North America Experiencing Strong Growth?

North America is growing well with a positive CAGR of 6.4% from 2026 to 2035 owing to high adoption of automotive technologies, high demand in the premium footwear market, a high-tech medical device sector, and the use of sustainable materials. At the regional level, the US is leading the pack in terms of automotive innovations, especially in electric cars, high-end and sports footwear; production and development of advanced medical devices; and company sustainability initiatives that have led to the use of bio-based materials.

What is the Size of the U.S. Market?

The market size of the U.S. thermoplastic polyurethane is estimated at USD 708 million in 2025, and USD 1,164 million in 2035 with a high CAGR of 6.4% within the period of 2026 to 2035.

U.S. Market Trends

The US market constitutes a large share of the world market due to the automotive industry’s lightweighting efforts to meet the CAFE standards, the up-end consumer goods market is willing to pay for more costly materials to obtain performance gains, medical device innovation is necessitating high levels of research and development, and sustainability leadership is where corporations make commitments to bio-based TPU use. The growth of the U.S. construction industry, which includes 0.9% growth in December 2024 investment in private construction serves as an example to adopt TPU in building applications.

Why is Europe Focusing on Sustainability and Circular Economy?

The European market is large with developed automotive engineering, high sustainability standards, high footwear and fashion sectors, and a focus on the principles of a circular economy. Europe has a large market share in the world with Germany, the United Kingdom, and France as the largest users. The European efforts that lead to the adoption of TPU are automotive emission regulations that encourage the use of lightweight materials, single use plastic regulations that encourage the use of TPU in place of PVC, circular economy action plans that encourage the use of recyclable materials, and the green buildings that adopt sustainable materials.

Germany Market Trends

Germany has a high market presence, as the country has high leadership in the automotive industry engineering and electric vehicles, high quality manufacturing capabilities, a leading chemical industry with high-end TPU manufacturers BASF and Covestro, and a focus on quality and performance. German carmakers are also the first to utilize TPU in electric vehicle designs, battery thermal control and high-tech interiors.

Why is the Middle East & Africa Region Developing Market Presence?

The LAMEA region is experiencing development of emerging markets with increased adoption being made by the growing footwear production in certain nations, automotive assembly operations rising local content, the building construction sector expanding led by infrastructure building, and industrial capabilities increasing. Although the current market share is rather low against other areas, the development of manufacturing infrastructure and rising consumer markets contribute to a slow increase in TPU markets.

Top Players in the Market and Their Offerings

- BASF SE

- The Lubrizol Corporation

- Covestro AG

- Huntsman International LLC

- Wanhua Chemical Group Co. Ltd.

- Avient Corporation

- Mitsui Chemicals Inc.

- American Polyfilm Inc.

- COIM Group

- Trinseo

- Others

Market News- Key Developments

The market has undergone significant developments as industry participants seek to expand capabilities and enhance product portfolios.

- In February 2025, Covestro AG has planned that it will be constructing its biggest TPU plant in Zhuhai, South China. There will be three phases of the growth of the project. The initial stage is expected to be completed by the end of 2025 with a capacity of 30,000 tons per year. The ultimate stage, which will be in place in 2033, will take the yearly TPU manufacturing capacity to 120,000 tonnes. (Source: Covestro AG)

- In January 2024, BASF opened the thermoplastic polyurethane TPU plant at Zhanjiang Verbund. The plant will increase the production capacity of the company in China to serve the increasing demand of the Asian market in automotive, footwear, and industrial use. (Source: BASF)

These strategic activities have allowed companies to strengthen market positions, expand manufacturing capacity, enhance product offerings, and capitalize on growth opportunities within the expanding market.

The Thermoplastic Polyurethane TPU Market is segmented as follows:

By Type

- Polyester TPU

- Polyether TPU

- Polycaprolactone TPU

- Other Types

By Processing Method

- Injection Molding

- Extrusion

- Blow Molding

- Other Processing Methods

- Calendering

- Compression Molding

By Application

- Footwear

- Automotive

- Medical Devices

- Electronics

- Construction

- Industrial Machinery

- Other Applications

By End-Use Industry

- Consumer Goods

- Industrial Machinery

- Construction

- Healthcare

- Other End-Use Industries

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Thermoplastic Polyurethane TPU Market, (2026 – 2035) (USD Billion)

- 2.2 Global Thermoplastic Polyurethane TPU Market: snapshot

- Chapter 3. Global Thermoplastic Polyurethane TPU Market – Industry Analysis

- 3.1 Thermoplastic Polyurethane TPU Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Automotive Lightweighting and Electric Vehicle Proliferation

- 3.2.2 Growing Footwear Industry and Performance Material Demands

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Type

- 3.7.2 Market attractiveness analysis By Processing Method

- 3.7.3 Market attractiveness analysis By Application

- 3.7.4 Market attractiveness analysis By End-Use Industry

- Chapter 4. Global Thermoplastic Polyurethane TPU Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Thermoplastic Polyurethane TPU Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Thermoplastic Polyurethane TPU Market – Type Analysis

- 5.1 Global Thermoplastic Polyurethane TPU Market overview: By Type

- 5.1.1 Global Thermoplastic Polyurethane TPU Market share, By Type, 2025 and 2035

- 5.2 Polyester TPU

- 5.2.1 Global Thermoplastic Polyurethane TPU Market by Polyester TPU, 2026 – 2035 (USD Billion)

- 5.3 Polyether TPU

- 5.3.1 Global Thermoplastic Polyurethane TPU Market by Polyether TPU, 2026 – 2035 (USD Billion)

- 5.4 Polycaprolactone TPU

- 5.4.1 Global Thermoplastic Polyurethane TPU Market by Polycaprolactone TPU, 2026 – 2035 (USD Billion)

- 5.5 Other Types

- 5.5.1 Global Thermoplastic Polyurethane TPU Market by Other Types, 2026 – 2035 (USD Billion)

- 5.1 Global Thermoplastic Polyurethane TPU Market overview: By Type

- Chapter 6. Global Thermoplastic Polyurethane TPU Market – Processing Method Analysis

- 6.1 Global Thermoplastic Polyurethane TPU Market overview: By Processing Method

- 6.1.1 Global Thermoplastic Polyurethane TPU Market share, By Processing Method, 2025 and 2035

- 6.2 Injection Molding

- 6.2.1 Global Thermoplastic Polyurethane TPU Market by Injection Molding, 2026 – 2035 (USD Billion)

- 6.3 Extrusion

- 6.3.1 Global Thermoplastic Polyurethane TPU Market by Extrusion, 2026 – 2035 (USD Billion)

- 6.4 Blow Molding

- 6.4.1 Global Thermoplastic Polyurethane TPU Market by Blow Molding, 2026 – 2035 (USD Billion)

- 6.5 Other Processing Methods

- 6.5.1 Global Thermoplastic Polyurethane TPU Market by Other Processing Methods, 2026 – 2035 (USD Billion)

- 6.6 Calendering

- 6.6.1 Global Thermoplastic Polyurethane TPU Market by Calendering, 2026 – 2035 (USD Billion)

- 6.7 Compression Molding

- 6.7.1 Global Thermoplastic Polyurethane TPU Market by Compression Molding, 2026 – 2035 (USD Billion)

- 6.1 Global Thermoplastic Polyurethane TPU Market overview: By Processing Method

- Chapter 7. Global Thermoplastic Polyurethane TPU Market – Application Analysis

- 7.1 Global Thermoplastic Polyurethane TPU Market overview: By Application

- 7.1.1 Global Thermoplastic Polyurethane TPU Market share, By Application, 2025 and 2035

- 7.2 Footwear

- 7.2.1 Global Thermoplastic Polyurethane TPU Market by Footwear, 2026 – 2035 (USD Billion)

- 7.3 Automotive

- 7.3.1 Global Thermoplastic Polyurethane TPU Market by Automotive, 2026 – 2035 (USD Billion)

- 7.4 Medical Devices

- 7.4.1 Global Thermoplastic Polyurethane TPU Market by Medical Devices, 2026 – 2035 (USD Billion)

- 7.5 Electronics

- 7.5.1 Global Thermoplastic Polyurethane TPU Market by Electronics, 2026 – 2035 (USD Billion)

- 7.6 Construction

- 7.6.1 Global Thermoplastic Polyurethane TPU Market by Construction, 2026 – 2035 (USD Billion)

- 7.7 Industrial Machinery

- 7.7.1 Global Thermoplastic Polyurethane TPU Market by Industrial Machinery, 2026 – 2035 (USD Billion)

- 7.8 Other Applications

- 7.8.1 Global Thermoplastic Polyurethane TPU Market by Other Applications, 2026 – 2035 (USD Billion)

- 7.1 Global Thermoplastic Polyurethane TPU Market overview: By Application

- Chapter 8. Global Thermoplastic Polyurethane TPU Market – End-Use Industry Analysis

- 8.1 Global Thermoplastic Polyurethane TPU Market overview: By End-Use Industry

- 8.1.1 Global Thermoplastic Polyurethane TPU Market share, By End-Use Industry, 2025 and 2035

- 8.2 Consumer Goods

- 8.2.1 Global Thermoplastic Polyurethane TPU Market by Consumer Goods, 2026 – 2035 (USD Billion)

- 8.3 Industrial Machinery

- 8.3.1 Global Thermoplastic Polyurethane TPU Market by Industrial Machinery, 2026 – 2035 (USD Billion)

- 8.4 Construction

- 8.4.1 Global Thermoplastic Polyurethane TPU Market by Construction, 2026 – 2035 (USD Billion)

- 8.5 Healthcare

- 8.5.1 Global Thermoplastic Polyurethane TPU Market by Healthcare, 2026 – 2035 (USD Billion)

- 8.6 Other End-Use Industries

- 8.6.1 Global Thermoplastic Polyurethane TPU Market by Other End-Use Industries, 2026 – 2035 (USD Billion)

- 8.1 Global Thermoplastic Polyurethane TPU Market overview: By End-Use Industry

- Chapter 9. Thermoplastic Polyurethane TPU Market – Regional Analysis

- 9.1 Global Thermoplastic Polyurethane TPU Market Regional Overview

- 9.2 Global Thermoplastic Polyurethane TPU Market Share, by Region, 2025 & 2035 (USD Billion)

- 9.3. North America

- 9.3.1 North America Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.3.1.1 North America Thermoplastic Polyurethane TPU Market, by Country, 2026 – 2035 (USD Billion)

- 9.3.1 North America Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.4 North America Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035

- 9.4.1 North America Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035 (USD Billion)

- 9.5 North America Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035

- 9.5.1 North America Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035 (USD Billion)

- 9.6 North America Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035

- 9.6.1 North America Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035 (USD Billion)

- 9.7 North America Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035

- 9.7.1 North America Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035 (USD Billion)

- 9.8. Europe

- 9.8.1 Europe Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.8.1.1 Europe Thermoplastic Polyurethane TPU Market, by Country, 2026 – 2035 (USD Billion)

- 9.8.1 Europe Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.9 Europe Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035

- 9.9.1 Europe Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035 (USD Billion)

- 9.10 Europe Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035

- 9.10.1 Europe Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035 (USD Billion)

- 9.11 Europe Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035

- 9.11.1 Europe Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035 (USD Billion)

- 9.12 Europe Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035

- 9.12.1 Europe Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035 (USD Billion)

- 9.13. Asia Pacific

- 9.13.1 Asia Pacific Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.13.1.1 Asia Pacific Thermoplastic Polyurethane TPU Market, by Country, 2026 – 2035 (USD Billion)

- 9.13.1 Asia Pacific Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.14 Asia Pacific Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035

- 9.14.1 Asia Pacific Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035 (USD Billion)

- 9.15 Asia Pacific Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035

- 9.15.1 Asia Pacific Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035 (USD Billion)

- 9.16 Asia Pacific Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035

- 9.16.1 Asia Pacific Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035 (USD Billion)

- 9.17 Asia Pacific Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035

- 9.17.1 Asia Pacific Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035 (USD Billion)

- 9.18. Latin America

- 9.18.1 Latin America Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.18.1.1 Latin America Thermoplastic Polyurethane TPU Market, by Country, 2026 – 2035 (USD Billion)

- 9.18.1 Latin America Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.19 Latin America Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035

- 9.19.1 Latin America Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035 (USD Billion)

- 9.20 Latin America Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035

- 9.20.1 Latin America Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035 (USD Billion)

- 9.21 Latin America Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035

- 9.21.1 Latin America Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035 (USD Billion)

- 9.22 Latin America Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035

- 9.22.1 Latin America Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035 (USD Billion)

- 9.23. The Middle-East and Africa

- 9.23.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.23.1.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Country, 2026 – 2035 (USD Billion)

- 9.23.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, 2026 – 2035 (USD Billion)

- 9.24 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035

- 9.24.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Type, 2026 – 2035 (USD Billion)

- 9.25 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035

- 9.25.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Processing Method, 2026 – 2035 (USD Billion)

- 9.26 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035

- 9.26.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by Application, 2026 – 2035 (USD Billion)

- 9.27 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035

- 9.27.1 The Middle-East and Africa Thermoplastic Polyurethane TPU Market, by End-Use Industry, 2026 – 2035 (USD Billion)

- Chapter 10. Company Profiles

- 10.1 BASF SE

- 10.1.1 Overview

- 10.1.2 Financials

- 10.1.3 Product Portfolio

- 10.1.4 Business Strategy

- 10.1.5 Recent Developments

- 10.2 The Lubrizol Corporation

- 10.2.1 Overview

- 10.2.2 Financials

- 10.2.3 Product Portfolio

- 10.2.4 Business Strategy

- 10.2.5 Recent Developments

- 10.3 Covestro AG

- 10.3.1 Overview

- 10.3.2 Financials

- 10.3.3 Product Portfolio

- 10.3.4 Business Strategy

- 10.3.5 Recent Developments

- 10.4 Huntsman International LLC

- 10.4.1 Overview

- 10.4.2 Financials

- 10.4.3 Product Portfolio

- 10.4.4 Business Strategy

- 10.4.5 Recent Developments

- 10.5 Wanhua Chemical Group Co. Ltd.

- 10.5.1 Overview

- 10.5.2 Financials

- 10.5.3 Product Portfolio

- 10.5.4 Business Strategy

- 10.5.5 Recent Developments

- 10.6 Avient Corporation

- 10.6.1 Overview

- 10.6.2 Financials

- 10.6.3 Product Portfolio

- 10.6.4 Business Strategy

- 10.6.5 Recent Developments

- 10.7 Mitsui Chemicals Inc.

- 10.7.1 Overview

- 10.7.2 Financials

- 10.7.3 Product Portfolio

- 10.7.4 Business Strategy

- 10.7.5 Recent Developments

- 10.8 American Polyfilm Inc.

- 10.8.1 Overview

- 10.8.2 Financials

- 10.8.3 Product Portfolio

- 10.8.4 Business Strategy

- 10.8.5 Recent Developments

- 10.9 COIM Group

- 10.9.1 Overview

- 10.9.2 Financials

- 10.9.3 Product Portfolio

- 10.9.4 Business Strategy

- 10.9.5 Recent Developments

- 10.10 Trinseo

- 10.10.1 Overview

- 10.10.2 Financials

- 10.10.3 Product Portfolio

- 10.10.4 Business Strategy

- 10.10.5 Recent Developments

- 10.11 Others.

- 10.11.1 Overview

- 10.11.2 Financials

- 10.11.3 Product Portfolio

- 10.11.4 Business Strategy

- 10.11.5 Recent Developments

- 10.1 BASF SE

List Of Figures

Figures No 1 to 40

List Of Tables

Tables No 1 to 102

Prominent Player

- BASF SE

- The Lubrizol Corporation

- Covestro AG

- Huntsman International LLC

- Wanhua Chemical Group Co. Ltd.

- Avient Corporation

- Mitsui Chemicals Inc.

- American Polyfilm Inc.

- COIM Group

- Trinseo

- Others

FAQs

The key players in the market are BASF SE, The Lubrizol Corporation, Covestro AG, Huntsman International LLC, Wanhua Chemical Group Co. Ltd., Avient Corporation, Mitsui Chemicals Inc., American Polyfilm Inc., COIM Group, Trinseo, Others.

Government regulations have a major impact on the market in the form of automotive emissions regulation such as CAFE in the United States and Euro standards in Europe that require fuel efficiency driving lightweighting, environmental regulation such as single-use plastic regulations that promote the use of TPU as a sustainable alternative to PVC, building policy that requires sustainability-related requirements to support the use of TPU in construction, medical device regulation that requires biocompatibility testing and certification in the use of TPU in healthcare, recycling, and extended producer responsibility rules that encourage the use of recycling as a method of the circular economy, Recyclability benefits over thermoset elastomers and greener environmental profiles over PVC are increasing TPU as the preferred choice of sustainability regulations.

TPU pricing is the consideration of the balance between the performance advantages and the cost limit. TPU is usually priced between USD 3 and 8 per kilogram by grade, formulation, and volume, which is premium compared to the commodity thermoplastics such as PVC or PE but it performs better, which warrants higher prices due to a longer lifespan of the product, increased functionality, fewer warranty claims, and sustainability advantages. Some of the aspects that enhance cost-competitiveness are economies of scale with increasing production volumes, bio-based formulations that may allow the rejection of volatility in petroleum feedstock as raw material, recycling efforts that allow the use of reclaimed material and require less virgin TPU, and optimization of the process which increases manufacturing efficiency and yield rates and minimizes waste.

According to the latest estimation, the market is expected to increase by an average of 7.2% every 2026-2035 to reach about USD 6.85 billion, largely due to the need to electrify and lightweight automotive vehicles, the growth of the footwear industry and the use of performance materials, the imperative to innovate medical devices and the need to adopt a biocompatible material, the use of 3D printing and additive manufacturing, and sustainability efforts that promote the use of bio-based and recyclable material.

Asia Pacific will have the largest revenue share of about 56% of the world market share as it comprises integrated manufacturing ecosystems of raw materials to end products, dominance in footwear manufacturing where China produces more than 13.5 billion pairs of footwear annually, the largest market in the world as the greatest automotive market with rising electric vehicle adoption, large electronics manufacturing that serves the entire world supply chain, and affordable manufacturing ability to be competitive globally.

Asia-Pacific Region has the strongest market share of 56% and high growth rates with a predicted CAGR of 7.7% over the forecast period due to China holding a dominant share of 63% of East Asia and India with its fast growing industrialization with electronic production rising at 13% CAGR between FY17-FY23, rising middle-income populations compelling consumer goods demand, and government policies encouraging the development of the manufacturing industry and infrastructure investment across the automotive, construction, and electronic industries.

The market of Thermoplastic Polyurethane is estimated to show significant growth with the lightweighting in automobiles that is 30% of TPU consumption growing at 8.03% CAGR, the footwear industry demand of 30% of the market share with China making 13.5 billion pairs per year, electric vehicle expansion creating new applications, medical devices growing due to ageing populations and wearable health monitors, 3D printing making customised production possibilities, sustainability efforts supporting the development of bio-based TPU, and the construction sector growth with the rise of bold symbols.