Automotive Adhesives and Sealants Market Size, Trends and Insights By Product Type (Epoxy, Polyurethane, Acrylic, Silicone, Other Types), By Technology (Water-based, Solvent-based, Hot Melt, Reactive), By Application (Body-in-White, Powertrain, Paint Shop, Assembly, Other Applications), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), By Propulsion Type (Internal Combustion Engine Vehicles, Electric Vehicles, Hybrid Vehicles), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | Europe |

Major Players

- Henkel AG & Co. KGaA

- 3M Company

- Sika AG

- H.B. Fuller Company

- Others

Reports Description

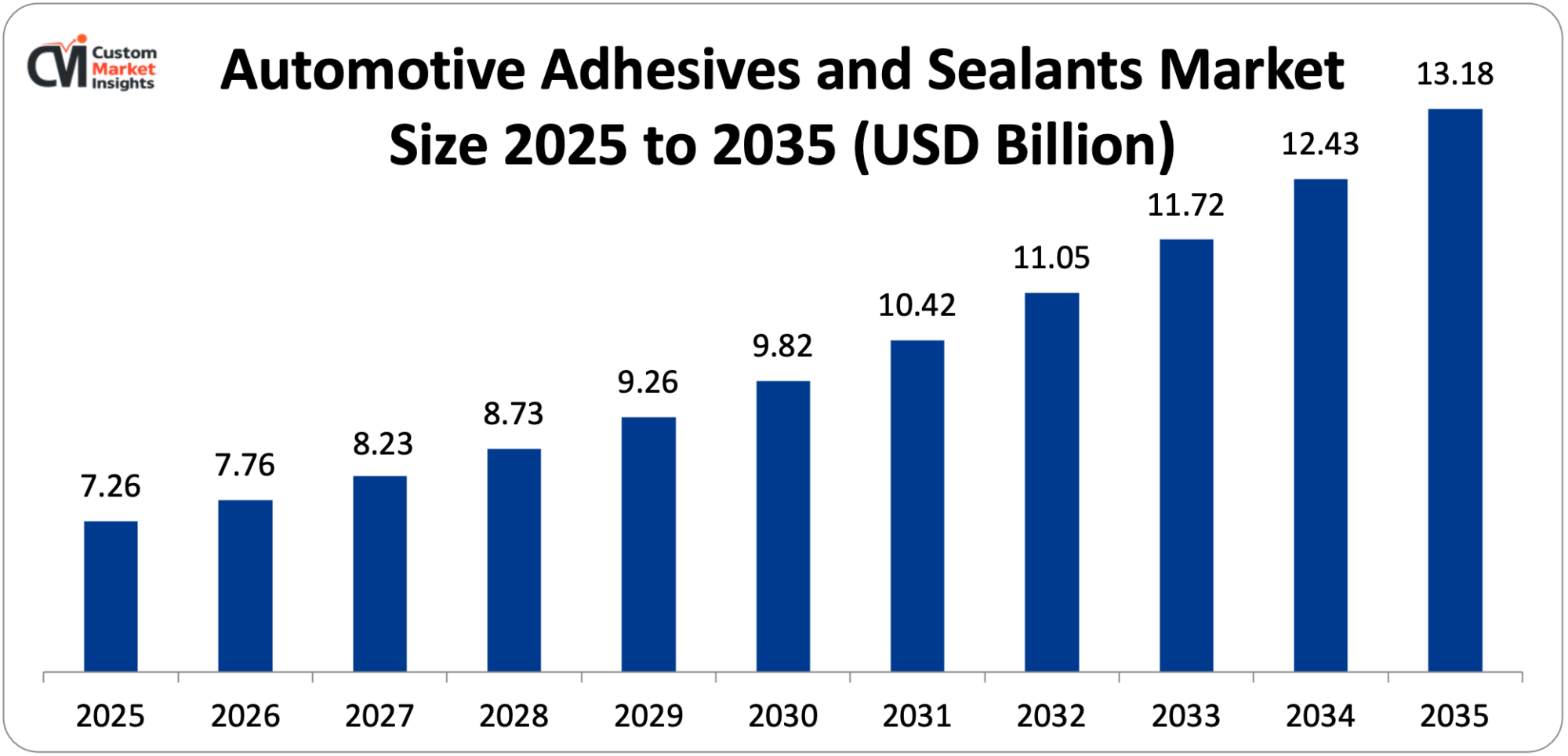

The size of the global market of automotive adhesives and sealants is estimated at USD 7.76 billion in 2026, and it is also projected to grow to about USD 13.18 billion in 2035 with a CAGR of 6.9% between 2026 and 2035.

The market is growing due to the increasing demand for lightweight vehicles to enhance fuel efficiency, the increasing production of electric vehicles necessitating the use of highly bonded solutions, the increased use of composite and aluminum technology in the manufacture of vehicles, the strict emission regulations that have created a need for lightweight vehicles, and the development of new adhesive technology that allows structural bonding to be utilized.

Market Highlight

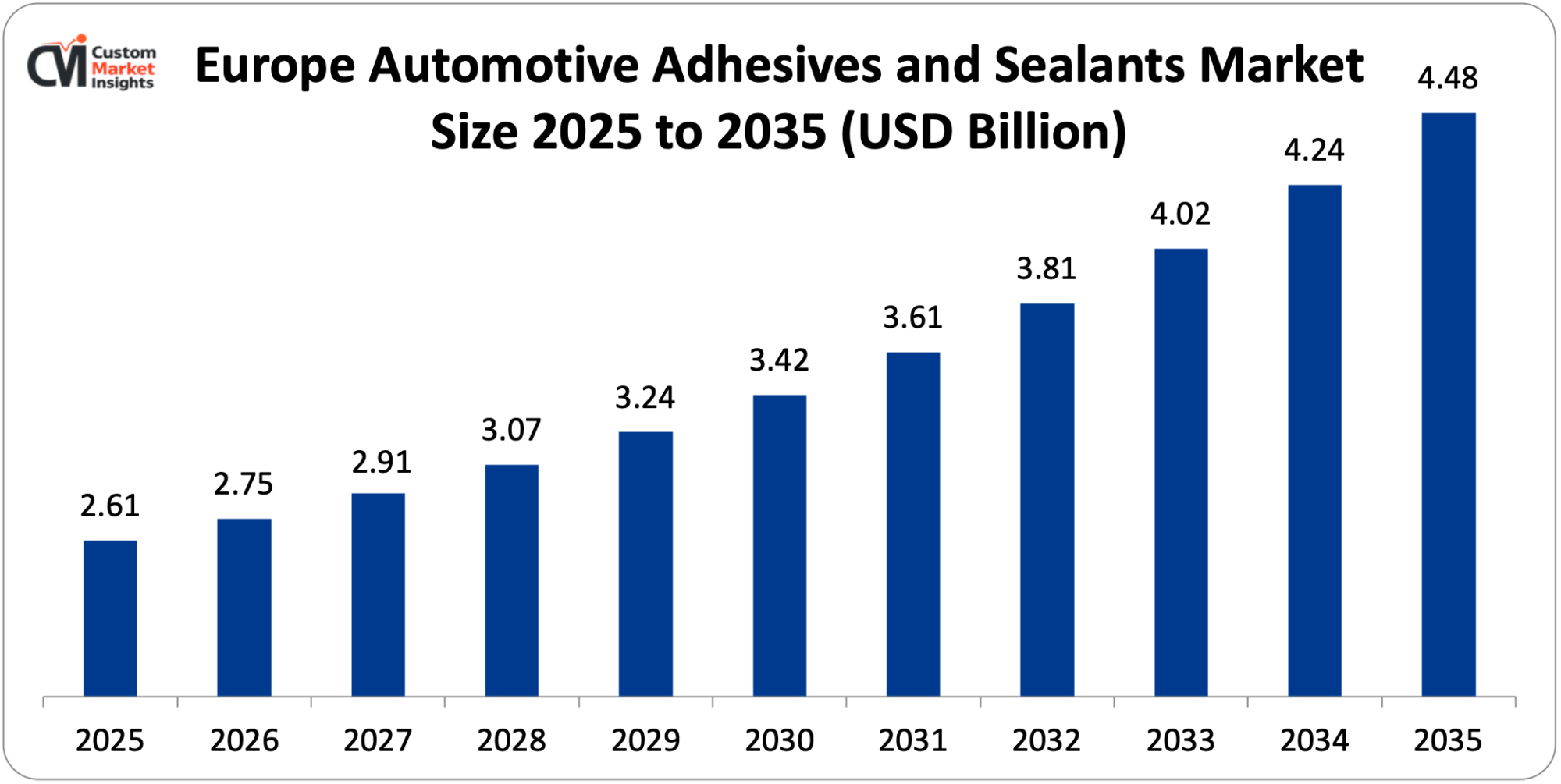

- Europe held the motor vehicle adhesive and sealants market with a 36% market share in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 8.2% between 2026 and 2035.

- By product type, the polyurethane segment had taken a market share of 38% in 2025.

- By technology, the reactive segment is increasing at the highest CAGR of 7.8% between 2026 and 2035.

- By application, the body-in-white segment will play the largest market share of 34% in 2025, whereas the powertrain segment will grow by a CAGR of 7.4% during the period between 2026 and 2035.

- By the type of vehicle, passenger cars had 68% market share in 2025.

- The benefits of adhesive bonding on vehicles include the following: adhesive bonding reduces vehicle weight by 15-25% of what would be required in traditional mechanical fastening.

Significant Growth Factors

The Automotive Adhesives and Sealants Market Trends present significant growth opportunities due to several factors:

- Lightweighting Imperative and Fuel Efficiency Regulations: The main trend in the automotive adhesives and sealants market is the growing regulatory demand on the world to lower vehicle emissions and fuel consumption and to see automakers abandoning mechanical systems of fastening in favor of advanced adhesive bonding technology allowing the utilization of lightweight materials without compromising structural integrity. By 2026, the requirements of corporate average fuel economy (CAFE) standards in the United States are that U.S. passenger vehicles should reach 49 miles per gallon through establishing stringent European regulations that force producers to comply with the standard of 95 grams of CO2 per kilometer, penalty is EUR 95 per gram per vehicle. Around 75% of the fuel consumption in internal combustion engine vehicles is directly proportional to vehicle weight and that each 10% decrease in vehicle weight would enhance fuel efficiency by 6-8%, and as a result of this lightweighting is the most cost effective way of meeting regulatory needs. The 15-20 kilograms of adhesives and sealants in the average vehicle replace about 100-150 kilograms of mechanical fasteners and spot welds and other supporting reinforcement structures, which is 80-130 kilograms per vehicle or 0.4-0.7 liters per 100 kilometers or one-fourth or one-third of the vehicle’s fuel economy. Recent automotive joining adhesives support a multi-material joining approach that incorporates steel, aluminum, composites, and plastics into one structure, and various materials need to use different joining technologies. The International Aluminum Institute predicts that since, on average, North American vehicles used in 2012 weighed 151 kilograms of aluminum and the figure grew to 198 in 2024, the average will rise further to 250 by 2030. In 2015, the Ford F-150 switched to aluminum body construction and reached a 320-kilogram weight cut, with much of that cut being made possible by structural adhesives. It has been found through automotive engineering studies that adhesively bonded joints distribute the stresses on larger areas as compared to point loads created by welds or fasteners, significantly enhancing fatigue performance (by 30-40%), and allowing thinner gauge material to be used without loss of strength.

- Electric Vehicle Revolution and Battery Pack Assembly: Market expansion has increased many times over with the boom of explosive electric vehicle production and the use of fundamentally new adhesive applications in EVs with advanced thermal handling, electrical isolation, battery pack sealing and shielding of electromagnetic interference. The International Energy Agency estimates that in the year 2023, electric vehicle sales in the world had reached 14 million vehicles, which constituted 18% of all vehicles sold, and that by 2030, the global sales of electric vehicles were projected to be 40 million vehicles, or 50% of the world sales. Battery pack assembly is the single biggest single adhesive use in electric vehicles with each EV battery pack having 3-5 kilograms of structural adhesive, thermal interface material, and sealant versus 0.5-1 kilogram in similar internal combustion engine vehicles. Battery pack EVs need special adhesives that offer thermal conductivity to transfer heat to cooling systems, electrical resistance against short circuits of voltages over 400-800 volts, structural bonding to hold the battery pack intact in a crash, and hermetic sealing of battery electronics from moisture and contamination. Microscopic air gaps between battery cells and cooling plates are filled with thermal interface materials (TIMs), and the highest thermal conductivity TIMs have a thermal conductivity of 3-5 W/mK (compared to 0.025 W/mK of air) and enhance heat transfer by 100-200x. Research based on battery technology suggests that efficient thermal management can increase battery life by 20-30% and charge the battery 15-25% faster and can make the battery safer by eliminating the spread of thermal runaway. The lack of internal combustion engines removes the conventional powertrain applications of USD 40-60 per vehicle but introduces USD 120-180 per vehicle in new battery pack applications, or a net USD 60-120 per EV.

What are the Major Advances Changing the Automotive Adhesives and Sealants Market Today

- Structural Adhesives Replacing Spot Welding: Invention of high-strength structural adhesives comparable or superior to the mechanical properties of spot welds is a radical technology change, which means automakers can substitute thousands of spot welds with continuous adhesive bonds, enhancing structural rigidity, crash performance, and corrosion resistance. The conventional bodies of vehicles have 3,000-5,000 spot welds, and this forms point loads and stress concentrations, whereas the new adhesive bonding imparts loads uniformly through the full bond line. The modern structural adhesives have lap shear strength of 25-35 Mpa and peel strengths of 30-50 N/cm, which are stronger than the natural spot weld strength. The automotive structural engineering scripture states that the usage of structural adhesives instead of spot welding enhances torsional rigidity by 30-50%, weight reduction by 15-25%, and NVH by 20-30% vibration damping through continuous bonding. Weld-bonding is a combination of resistance spot welding and structural adhesive, where fatigue performance is enhanced by 100-200% as a result of adhesive curing after welding.

- Fast-Cure and Room-Temperature Curing Technologies: The use of fast-cure adhesive systems with full strength in minutes instead of hours responds to the automotive manufacturing requirement of fast production cycles, with the modern assembly lines producing an automobile every 60-90 seconds. Conventional two-part epoxy structural adhesives have cure durations of 2-4 hours at high temperatures, which pose manufacturing bottlenecks. Handling strength in 3-10 minutes and complete cure in 1-4 hours at room temperature, modern fast-cure systems eliminate the thermal cure requirement, which saves on energy use by 60-80%. On exposure, UV-cure adhesives cure within several seconds under ultraviolet light and have rates of production of 30-60 seconds per assembly. Fast-cure adhesives, according to manufacturing efficiency research, save work-in-process inventory amounting to 40-60%, save factory space amounting to 25-35%, and save 50-70% on energy costs. Reactive technology segment has the highest growth rate at 7.8% CAGR because of the benefits of quick cure, high strength, and environmental conformity.

- Electrically and Thermally Conductive Adhesives: The increasing complexity of electrically and thermally conductive adhesive compositions meets the needs of electric vehicles in terms of heat dissipation, electrical grounding and electromagnetic interference shielding. Thermally conductive adhesive materials that have been developed with aluminum oxide, boron nitride, or graphene are 3-10 W/mK versus 0.2-0.4 W/mK of conventional adhesive and enhance the heat transfer by 10-25x. Silver, copper or carbon filled electrically conductive adhesives can be used to produce electrical resistivity of 0.0001-0.01 ohm-cm that allows grounding and shielding applications. Thermal management studies found that a good conductive adhesive allows thermal dissipation to be used 40-60 times longer than the current thermal dissipation, 20-30 times greater power density, and a 40% lower power consumption of cooling. The electromagnetic interference between electronic components is prevented by 40-80 dB with EMI shielding adhesives.

- Sustainable and Bio-Based Adhesive Formulations: Sustainability in the automotive industry through the development of bio-based raw materials and environmentally friendly adhesive formulations which curb the generation of volatile organic compounds fulfills the sustainability obligations of the industry. New bio-based adhesives use renewable feedstock materials such as plant oils and natural adhesive resins that eliminate 20-80% of petroleum content, which minimizes carbon footprint by 15-60%. Research on the life cycle assessment suggests that bio-based automotive adhesives generated less greenhouse gas through the emission of 25-45% fewer greenhouse gases relative to the petroleum counterparts. Formulations of adhesives that use water exclude organic solvents that decrease the VOC emissions by 90-95. The End-of-Life Vehicles Directive of the European Union has a 95% recyclability target of vehicles that necessitates the creation of thermally reversible and mechanically separable adhesives that allow components to be separated and the material to be reused.

Category Wise Insights

By Product Type

Why Polyurethane Dominates the Market?

Polyurethane is the biggest segment with around 38% of the total market share in 2025. Such dominance is due to the fact that polyurethane adhesives offer a unique formula of flexibility, strength, and versatility that make them ideal in automotive applications that need impact resistance and the ability or capability to withstand thermal cycling. Elongation at break: According to automotive materials research, polyurethane adhesives have a 200-600% range of elongation at break, versus 2-10% with epoxies, allowing them to be used flexibly to allow thermal expansion and vibration without losing the bond. Polyurethane adhesives deal with varied surfaces such as painted metals, aluminum, plastics, and glass with little preparation on the surface. The automotive testing data have shown that polyurethane windshield adhesives provide 30% roof crush strength during rollover crashes and thus have a structural contribution in addition to glass retention. Contemporary polyurethane systems have employed systems that contain no primer to minimize processing stages, chemistries that cure rapidly to drive away strength in 30-60 minutes, and versions that are optimized to meet various modulus levels. Epoxy adhesive, with 28% of the market share, offers maximum strength and resistance against high temperature in structural bonding construction with a lap shear strength of more than 35 MPa.

By Technology

Why Reactive Technology Is Growing Fastest?

Reactive technology is the most rapidly developing category that is projected to experience a CAGR of 7.8% between the years 2026 and 2035 due to environmental rules restricting VOC emissions, manufacturing efficiency necessities, and performance benefits. In reactive adhesives, crosslinked polymers of high molecular weight are formed by chemical reactions triggered by moisture, heat or UV light as an alternative to a drying process that would leach away lower molecular weight oligomers. The moisture-cure systems offer unrestricted working time preceding practice and foreseeable treatment following dispensing. In paint bake ovens, heat-cure reactive systems cure the paint 35-50% less energy is used and the cycle time shortened by 20-30 minutes compared to paint bake ovens. The UV-cure adhesives cure in 5-30 minutes as opposed to hours with conventional adhesives. The reactive part enjoys regulatory tailwinds as stricter regulations of solvent-based alternatives are imposed, which are essentially requiring a shift to solvent-based alternatives. Environmental compliance research has shown that reactive adhesive technologies can decrease VOC emissions by 85-95% and also have better performance such as faster cure and stronger.

By Application

Why Body-in-White Dominates Applications?

The biggest share is the body-in-white, which is having a market share of about 34% in 2025, as adhesives are the core principle in the contemporary car body designs. Body-in-white structural adhesives allow continuous bonding of roof rails, door frames and floor pan joints and distribute loads evenly, and they enhance torsional rigidity up to 30-50% higher than with spot welding only. Structural adhesive on body-in-white assembly on the average vehicle ranges between 30-60 meters. Multi-material joining Adhesives Body-in-white adhesive applications allow the bonding of aluminum to steel or composites to metal, hem flange bonding seals folded joints in the prevention of corrosion, and crash structure reinforcement in the absorption of impact energy. The Audi a8 space frame made of aluminum employs more than 50 meters of structural bonding of aluminum parts with aluminum glue. The crash testing research indicates that adhesively bonded structures have better energy absorption because of the controlled progressive failure mode. The powertrain applications are the fastest-growing segment with a CAGR of 7.4% because engine downsizing and the use of electric vehicle powertrains require thermal management and electrical insulation.

By Vehicle Type

Why Passenger Cars Lead Consumption?

The largest segment of passenger cars is estimated to take most of the market share at about 68% in 2025 with the volumes of production to be more than 55 million vehicles in a year and with increased volume of adhesive in each car due to the regulations of fuel economy and lightweighting. The adhesives and sealants in passenger vehicles are 15-25 kilograms as opposed to light commercial vehicles, which are 10-18 kilograms. Premium passenger cars have 25-35kg by means of wide usage of low-weight materials, enhanced acoustic treatment, and complex thermal controls. Applications of passenger cars cover body structure with 30-60 meters of structural bonding, windshield bonding with 4-6 meters per car, interior and exterior assembly, and acoustic cover applying 3-8 kilograms of damping materials. In current passenger vehicles the level of noise in the interior is 35-45 decibels inside the vehicle at a highway speed which is possible due to the use of vibration-damping adhesives. Acoustic treatment of electric vehicles in particular focuses on the use of 20-40% more acoustic material since there is no engine noise, and this allows other types of sounds to be heard more effectively.

By Propulsion Type

Why Electric Vehicles Drive Growth?

Increasing disproportionately with adhesive content per EV by a factor of 40-60 due to battery pack assembly and thermal management, EVs with 15% of current market share are the source of disproportionate market growth. Every electric vehicle has 3-5 kilograms of battery pack adhesives such as structural adhesives to bond modules to pack structure, thermal interface materials of thermal conductivity of 3-5 W/mK, and sealants to withstand IP67 of ingress protection. Thermal management adhesives of windings and semiconductors are needed in electric motors and power electronics. Large car manufacturers declared USD 1 trillion+ in EV investments by 2030 with 50+ million every year by 2030. Based on EV market forecasts, the rate of increase in the production of electric vehicles will be 35% CAGR to 2030 against 2-3% CAGR of ICE vehicles. Viable cars with internal combustion engines still secure 72% market share, although their share is slowly declining due to the rising electrification pace.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 7.76 billion |

| Projected Market Size in 2035 | USD 13.18 billion |

| Market Size in 2025 | USD 7.26 billion |

| CAGR Growth Rate | 6.9% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product Type, Technology, Application, Vehicle Type, Propulsion Type and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the Europe Market Size?

The Europe automotive adhesives and sealants market size is estimated at USD 2.61 billion in 2025 and is projected to reach approximately USD 4.48 billion by 2035, with a 6.6% CAGR from 2026 to 2035.

Why Did Europe Dominate the Market in 2025?

Europe is the key player in the world and it commands about 36% market share in 2025 because of stringent emission rules with the EU 95 g/km CO₂ limit leading to aggressive lightweighting, advanced automotive engineering that has the German premium automakers being the pioneers in adhesive bonding technology, good environmental regulations that support the use of sustainable formulations, and an adhesive supply chain with major players like Henkel, Sika, and Bostik with headquarters in the area. The European market was dominated by Germany, as the automotive producers had premium products that were produced by Mercedes-Benz, BMW, Audi, and Volkswagen through massive adhesive bonding. European automotive research showed that the EU passenger car average CO₂ emissions declined to 107.4 g/km in 2023, decreasing significantly from 118.5 g/km in 2019 because of lightweighting.

Germany Market Trends

The largest European market is Germany, which is driven by high-quality automotive production through the use of lightweight construction with extensive adhesive bonding, a high engineering culture with a focus on structural optimization, a well-developed network of automotive suppliers, and industry leadership in terms of electric vehicle development, with the Volkswagen Group investing EUR 180 billion in electrification until 2030. Aluminum space frame construction and multi-material body engineering that relies on adhesive bonding were developed by German automakers. As German automotive statistics show, local production of vehicles was 4.1 million in 2023 at high content of premium vehicles with 20-30% more adhesives than mass-market vehicles.

Why is Asia Pacific Growing at the Fastest Rate?

The Asia Pacific region has the highest growth rate with a foreseen CAGR of 8.2% in 2026-35 due to its massive vehicle production, with the region making 60% of the world’s vehicles; the quick adoption of the electric vehicle, especially in China, which makes 60% of the world’s EVs; the rise in the middle class buying newer cars; and growing local content. In 2023, Asia Pacific vehicle manufacturing was 53 million, with a forecast of over 65 million in 2030.

China Market Trends

It has the biggest and fastest-growing market in the world, driven by the largest automotive production in the world (30.2% in 2023 of which 9.5 million are electric vehicles), intense EV adoption with government targets to reach 50% in 2030, and local manufacturers BYD, Geely, and NIO, which have been growing fast. The Chinese manufacturers of EVs were the first to develop structural battery pack designs that needed 4-6 kilograms of structural adhesives per vehicle. The Chinese automotive statistics point out that domestic consumption of adhesives went as high as 320,000 tons in 2023 and that it is expected to go past 500,000 tons by 2030.

India Market Trends

India has a high growth potential as automotive output now stands at 5.9 million vehicles in 2023 and is expected to surpass 10 million vehicles by 2030 and rising middle class acquisition of passenger cars with increased feature content and government-imposed fuel efficiency standards are driving lightweighting. The Indian EV manufacturing is expected to be 2 million by 2030 compared to 100,000 in 2023, and builds a large battery pack adhesive market.

Why is North America Experiencing Steady Growth?

The North American market is under stable growth and is expected to have a CAGR of 6.3% between 2026 and 2035, a mature automotive market with 15.5 million vehicle productions annually, high CAFE standards that will need 49 mpg by 2026, and an increasing number of electric vehicle productions with a regional capacity of 5+ million units per annum by 2030. The US has the largest North American market, with 10.6 million vehicles produced per annum, consisting of trucks and SUVs, which have adhesives of 18-25 kilograms.

What is the Size of the U.S. Market?

The automotive adhesives and sealants market worth of the U.S. is estimated as USD 1.82 billion in the year 2025 and forecasted to be approximately USD 3.05 billion in the year 2035, growing at a rate of 6.2% between the years 2026 and 2035.

U.S. Market Trends

The US market is a huge market with the dominance of trucks and SUVs that are getting 80% of the sales with the use of light trucks having lighter bodies weighing 250-350 kilograms and the use of the electric vehicle which is projected to produce 3+ million units of EV vehicles by 2030 with Ford, GM, and Tesla among the potential investors. In 2023, production of domestic light vehicles is 10.6 million vehicles, and with 7% electric vehicle penetration, this is projected to reach 30% by 2030.

Why is the LAMEA Region Experiencing Growth?

The LAMEA region is experiencing increasing growth of the market due to the car production growth in Brazil, South Africa, and the Middle East countries, the growth in the quality of the vehicles that need more adhesives, and the rise in the aftermarket that needs them. The production in Latin America is aimed at cars of moderate adhesive components at low costs. Regional automotive projections indicate that the growth will be at 5-7 CAGR in production by 2030.

Top Players in the Market and Their Offerings

- Henkel AG & Co. KGaA

- 3M Company

- Sika AG

- H.B. Fuller Company

- Dow Inc.

- Huntsman Corporation

- Arkema S.A. (Bostik)

- PPG Industries Inc.

- Ashland Global Holdings Inc.

- Illinois Tool Works Inc. (ITW)

- LORD Corporation (Parker Hannifin)

- Permabond LLC

- Others

Key Developments

- In March 2025, Henkel launched LOCTITE EA 3479, a new epoxy structural adhesive for EV battery pack assembly that has a thermal conductivity of 5 W/mK, electrical insulation up to 1,000 V, and a rapid cure that reaches full strength in 30 minutes at 80 degrees Celsius.

- In June 2025: Sika announced the expansion of automotive adhesive manufacturing with a new facility in Hungary. The investment of €50 million is for the expansion to support the increasing demand in Europe and a manufacturing capacity of 40,000 tons annually.

The Automotive Adhesives and Sealants Market is segmented as follows:

By Product Type

- Epoxy

- Polyurethane

- Acrylic

- Silicone

- Other Types

By Technology

- Water-based

- Solvent-based

- Hot Melt

- Reactive

By Application

- Body-in-White

- Powertrain

- Paint Shop

- Assembly

- Other Applications

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Propulsion Type

- Internal Combustion Engine Vehicles

- Electric Vehicles

- Hybrid Vehicles

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Automotive Adhesives and Sealants Market, (2026 – 2035) (USD Billion)

- 2.2 Global Automotive Adhesives and Sealants Market : snapshot

- Chapter 3. Global Automotive Adhesives and Sealants Market – Industry Analysis

- 3.1 Automotive Adhesives and Sealants Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Lightweighting Imperative and Fuel Efficiency Regulations

- 3.2.2 Electric Vehicle Revolution and Battery Pack Assembly

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product Type

- 3.7.2 Market attractiveness analysis By Technology

- 3.7.3 Market attractiveness analysis By Application

- 3.7.4 Market attractiveness analysis By Vehicle Type

- 3.7.5 Market attractiveness analysis By Propulsion Type

- Chapter 4. Global Automotive Adhesives and Sealants Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Automotive Adhesives and Sealants Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Automotive Adhesives and Sealants Market – Product Type Analysis

- 5.1 Global Automotive Adhesives and Sealants Market overview: By Product Type

- 5.1.1 Global Automotive Adhesives and Sealants Market share, By Product Type, 2025 and 2035

- 5.2 Epoxy

- 5.2.1 Global Automotive Adhesives and Sealants Market by Epoxy, 2026 – 2035 (USD Billion)

- 5.3 Polyurethane

- 5.3.1 Global Automotive Adhesives and Sealants Market by Polyurethane, 2026 – 2035 (USD Billion)

- 5.4 Acrylic

- 5.4.1 Global Automotive Adhesives and Sealants Market by Acrylic, 2026 – 2035 (USD Billion)

- 5.5 Silicone

- 5.5.1 Global Automotive Adhesives and Sealants Market by Silicone, 2026 – 2035 (USD Billion)

- 5.6 Other Types

- 5.6.1 Global Automotive Adhesives and Sealants Market by Other Types, 2026 – 2035 (USD Billion)

- 5.1 Global Automotive Adhesives and Sealants Market overview: By Product Type

- Chapter 6. Global Automotive Adhesives and Sealants Market – Technology Analysis

- 6.1 Global Automotive Adhesives and Sealants Market overview: By Technology

- 6.1.1 Global Automotive Adhesives and Sealants Market share, By Technology, 2025 and 2035

- 6.2 Water-based

- 6.2.1 Global Automotive Adhesives and Sealants Market by Water-based, 2026 – 2035 (USD Billion)

- 6.3 Solvent-based

- 6.3.1 Global Automotive Adhesives and Sealants Market by Solvent-based, 2026 – 2035 (USD Billion)

- 6.4 Hot Melt

- 6.4.1 Global Automotive Adhesives and Sealants Market by Hot Melt, 2026 – 2035 (USD Billion)

- 6.5 Reactive

- 6.5.1 Global Automotive Adhesives and Sealants Market by Reactive, 2026 – 2035 (USD Billion)

- 6.1 Global Automotive Adhesives and Sealants Market overview: By Technology

- Chapter 7. Global Automotive Adhesives and Sealants Market – Application Analysis

- 7.1 Global Automotive Adhesives and Sealants Market overview: By Application

- 7.1.1 Global Automotive Adhesives and Sealants Market share, By Application, 2025 and 2035

- 7.2 Body-in-White

- 7.2.1 Global Automotive Adhesives and Sealants Market by Body-in-White, 2026 – 2035 (USD Billion)

- 7.3 Powertrain

- 7.3.1 Global Automotive Adhesives and Sealants Market by Powertrain, 2026 – 2035 (USD Billion)

- 7.4 Paint Shop

- 7.4.1 Global Automotive Adhesives and Sealants Market by Paint Shop, 2026 – 2035 (USD Billion)

- 7.5 Assembly

- 7.5.1 Global Automotive Adhesives and Sealants Market by Assembly, 2026 – 2035 (USD Billion)

- 7.6 Other Applications

- 7.6.1 Global Automotive Adhesives and Sealants Market by Other Applications, 2026 – 2035 (USD Billion)

- 7.1 Global Automotive Adhesives and Sealants Market overview: By Application

- Chapter 8. Global Automotive Adhesives and Sealants Market – Vehicle Type Analysis

- 8.1 Global Automotive Adhesives and Sealants Market overview: By Vehicle Type

- 8.1.1 Global Automotive Adhesives and Sealants Market share, By Vehicle Type, 2025 and 2035

- 8.2 Passenger Cars

- 8.2.1 Global Automotive Adhesives and Sealants Market by Passenger Cars, 2026 – 2035 (USD Billion)

- 8.3 Light Commercial Vehicles

- 8.3.1 Global Automotive Adhesives and Sealants Market by Light Commercial Vehicles, 2026 – 2035 (USD Billion)

- 8.4 Heavy Commercial Vehicles

- 8.4.1 Global Automotive Adhesives and Sealants Market by Heavy Commercial Vehicles, 2026 – 2035 (USD Billion)

- 8.1 Global Automotive Adhesives and Sealants Market overview: By Vehicle Type

- Chapter 9. Global Automotive Adhesives and Sealants Market – Propulsion Type Analysis

- 9.1 Global Automotive Adhesives and Sealants Market overview: By Propulsion Type

- 9.1.1 Global Automotive Adhesives and Sealants Market share, By Propulsion Type, 2025 and 2035

- 9.2 Internal Combustion Engine Vehicles

- 9.2.1 Global Automotive Adhesives and Sealants Market by Internal Combustion Engine Vehicles, 2026 – 2035 (USD Billion)

- 9.3 Electric Vehicles

- 9.3.1 Global Automotive Adhesives and Sealants Market by Electric Vehicles, 2026 – 2035 (USD Billion)

- 9.4 Hybrid Vehicles

- 9.4.1 Global Automotive Adhesives and Sealants Market by Hybrid Vehicles, 2026 – 2035 (USD Billion)

- 9.1 Global Automotive Adhesives and Sealants Market overview: By Propulsion Type

- Chapter 10. Automotive Adhesives and Sealants Market – Regional Analysis

- 10.1 Global Automotive Adhesives and Sealants Market Regional Overview

- 10.2 Global Automotive Adhesives and Sealants Market Share, by Region, 2025 & 2035 (USD Billion)

- 10.3. North America

- 10.3.1 North America Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.3.1.1 North America Automotive Adhesives and Sealants Market, by Country, 2026 – 2035 (USD Billion)

- 10.3.1 North America Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.4 North America Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035

- 10.4.1 North America Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035 (USD Billion)

- 10.5 North America Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035

- 10.5.1 North America Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035 (USD Billion)

- 10.6 North America Automotive Adhesives and Sealants Market, by Application, 2026 – 2035

- 10.6.1 North America Automotive Adhesives and Sealants Market, by Application, 2026 – 2035 (USD Billion)

- 10.7 North America Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035

- 10.7.1 North America Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035 (USD Billion)

- 10.8 North America Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035

- 10.8.1 North America Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035 (USD Billion)

- 10.9. Europe

- 10.9.1 Europe Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.9.1.1 Europe Automotive Adhesives and Sealants Market, by Country, 2026 – 2035 (USD Billion)

- 10.9.1 Europe Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.10 Europe Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035

- 10.10.1 Europe Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035 (USD Billion)

- 10.11 Europe Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035

- 10.11.1 Europe Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035 (USD Billion)

- 10.12 Europe Automotive Adhesives and Sealants Market, by Application, 2026 – 2035

- 10.12.1 Europe Automotive Adhesives and Sealants Market, by Application, 2026 – 2035 (USD Billion)

- 10.13 Europe Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035

- 10.13.1 Europe Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035 (USD Billion)

- 10.14 Europe Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035

- 10.14.1 Europe Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035 (USD Billion)

- 10.15. Asia Pacific

- 10.15.1 Asia Pacific Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.15.1.1 Asia Pacific Automotive Adhesives and Sealants Market, by Country, 2026 – 2035 (USD Billion)

- 10.15.1 Asia Pacific Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.16 Asia Pacific Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035

- 10.16.1 Asia Pacific Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035 (USD Billion)

- 10.17 Asia Pacific Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035

- 10.17.1 Asia Pacific Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035 (USD Billion)

- 10.18 Asia Pacific Automotive Adhesives and Sealants Market, by Application, 2026 – 2035

- 10.18.1 Asia Pacific Automotive Adhesives and Sealants Market, by Application, 2026 – 2035 (USD Billion)

- 10.19 Asia Pacific Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035

- 10.19.1 Asia Pacific Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035 (USD Billion)

- 10.20 Asia Pacific Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035

- 10.20.1 Asia Pacific Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035 (USD Billion)

- 10.21. Latin America

- 10.21.1 Latin America Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.21.1.1 Latin America Automotive Adhesives and Sealants Market, by Country, 2026 – 2035 (USD Billion)

- 10.21.1 Latin America Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.22 Latin America Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035

- 10.22.1 Latin America Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035 (USD Billion)

- 10.23 Latin America Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035

- 10.23.1 Latin America Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035 (USD Billion)

- 10.24 Latin America Automotive Adhesives and Sealants Market, by Application, 2026 – 2035

- 10.24.1 Latin America Automotive Adhesives and Sealants Market, by Application, 2026 – 2035 (USD Billion)

- 10.25 Latin America Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035

- 10.25.1 Latin America Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035 (USD Billion)

- 10.26 Latin America Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035

- 10.26.1 Latin America Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035 (USD Billion)

- 10.27. The Middle-East and Africa

- 10.27.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.27.1.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Country, 2026 – 2035 (USD Billion)

- 10.27.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, 2026 – 2035 (USD Billion)

- 10.28 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035

- 10.28.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Product Type, 2026 – 2035 (USD Billion)

- 10.29 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035

- 10.29.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Technology, 2026 – 2035 (USD Billion)

- 10.30 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Application, 2026 – 2035

- 10.30.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Application, 2026 – 2035 (USD Billion)

- 10.31 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035

- 10.31.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Vehicle Type, 2026 – 2035 (USD Billion)

- 10.32 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035

- 10.32.1 The Middle-East and Africa Automotive Adhesives and Sealants Market, by Propulsion Type, 2026 – 2035 (USD Billion)

- Chapter 11. Company Profiles

- 11.1 Henkel AG & Co. KGaA

- 11.1.1 Overview

- 11.1.2 Financials

- 11.1.3 Product Portfolio

- 11.1.4 Business Strategy

- 11.1.5 Recent Developments

- 11.2 3M Company

- 11.2.1 Overview

- 11.2.2 Financials

- 11.2.3 Product Portfolio

- 11.2.4 Business Strategy

- 11.2.5 Recent Developments

- 11.3 Sika AG

- 11.3.1 Overview

- 11.3.2 Financials

- 11.3.3 Product Portfolio

- 11.3.4 Business Strategy

- 11.3.5 Recent Developments

- 11.4 H.B. Fuller Company

- 11.4.1 Overview

- 11.4.2 Financials

- 11.4.3 Product Portfolio

- 11.4.4 Business Strategy

- 11.4.5 Recent Developments

- 11.5 Dow Inc.

- 11.5.1 Overview

- 11.5.2 Financials

- 11.5.3 Product Portfolio

- 11.5.4 Business Strategy

- 11.5.5 Recent Developments

- 11.6 Huntsman Corporation

- 11.6.1 Overview

- 11.6.2 Financials

- 11.6.3 Product Portfolio

- 11.6.4 Business Strategy

- 11.6.5 Recent Developments

- 11.7 Arkema S.A. (Bostik)

- 11.7.1 Overview

- 11.7.2 Financials

- 11.7.3 Product Portfolio

- 11.7.4 Business Strategy

- 11.7.5 Recent Developments

- 11.8 PPG Industries Inc.

- 11.8.1 Overview

- 11.8.2 Financials

- 11.8.3 Product Portfolio

- 11.8.4 Business Strategy

- 11.8.5 Recent Developments

- 11.9 Ashland Global Holdings Inc.

- 11.9.1 Overview

- 11.9.2 Financials

- 11.9.3 Product Portfolio

- 11.9.4 Business Strategy

- 11.9.5 Recent Developments

- 11.10 Illinois Tool Works Inc. (ITW)

- 11.10.1 Overview

- 11.10.2 Financials

- 11.10.3 Product Portfolio

- 11.10.4 Business Strategy

- 11.10.5 Recent Developments

- 11.11 LORD Corporation (Parker Hannifin)

- 11.11.1 Overview

- 11.11.2 Financials

- 11.11.3 Product Portfolio

- 11.11.4 Business Strategy

- 11.11.5 Recent Developments

- 11.12 Permabond LLC

- 11.12.1 Overview

- 11.12.2 Financials

- 11.12.3 Product Portfolio

- 11.12.4 Business Strategy

- 11.12.5 Recent Developments

- 11.13 Others.

- 11.13.1 Overview

- 11.13.2 Financials

- 11.13.3 Product Portfolio

- 11.13.4 Business Strategy

- 11.13.5 Recent Developments

- 11.1 Henkel AG & Co. KGaA

List Of Figures

Figures No 1 to 40

List Of Tables

Tables No 1 to 127

Prominent Player

- Henkel AG & Co. KGaA

- 3M Company

- Sika AG

- H.B. Fuller Company

- Dow Inc.

- Huntsman Corporation

- Arkema S.A. (Bostik)

- PPG Industries Inc.

- Ashland Global Holdings Inc.

- Illinois Tool Works Inc. (ITW)

- LORD Corporation (Parker Hannifin)

- Permabond LLC

- Others

FAQs

The key players in the market are Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Dow Inc., Huntsman Corporation, Arkema S.A. (Bostik), PPG Industries Inc., Ashland Global Holdings Inc., Illinois Tool Works Inc. (ITW), LORD Corporation (Parker Hannifin), Permabond LLC, Others.

The government regulations influence the market significantly since they establish fuel-economy standards. By 2026, Corporate Average Fuel Economy (CAFE) regulation in the U.S. will require an average fleet of 49m mpg. The EU limit of 95 g/km of CO₂ with a fine of 95 per gram compels manufacturers to produce light cars, and adhesive bonding is a major factor in such cars. The emission regulations limit the manufacture of volatile organic compounds (VOCs), which compel producers to use water-based and reactive adhesives. Regulations on safety ensure structures are not of loose character; adhesives currently offer nearly 30 percent of the roof crush strength. Lastly, there are environmental laws governing the recyclability of vehicles that demand adhesives, which can be separated and recycled together with all the other materials.

Automotive adhesives are variable costs which are product-type-performance based. The adhesives are structural epoxy (USD 8-15/kg), polyurethane windshield (USD 6-12/kg), and specialized battery pack (USD 20-40/kg). Mass-market vehicles cost USD 40-80 per vehicle, premium vehicles cost USD 80-150 per vehicle and electric vehicles cost USD 120-200 per vehicle. There are however reasons behind these costs such as weight savings of USD 240-390 in fuel savings during the lifetime of the vehicle, manufacturing efficiency that will replace 3,000-5,000 spot welds, and structural performance that will result in 30-50% rigidity gains.

According to the current analysis, it is estimated that the market will increase to about USD 13.18 billion by the year 2035 with strong growth in the market due to further lightweighting of vehicles to meet the emission standards; the production of more than 40+ million vehicles a year as electric vehicles, multi-material construction of vehicles will require adhesive joining and structural bonding as an alternative to spot welding using 30-60 meters of adhesive per vehicle and more applications in thermal management and electromagnetic shielding, which will see the market grow by 6.9%.

Europe will have the largest share of revenues, at around 36% of the global market share on the basis of the high emission standards in the EU that require 95 g/km CO2, high-end production of autos by Germans who manufacture high-end structural bonding, technology leadership with the European vehicles as frontrunners in adhesive technology development, and early adoption of electric vehicles with the EU forecasting 30 million zero-emission vehicles by 2030.

The fastest growth is in the Asia-Pacific Region with a forecasted 8.2% CAGR between 2026 and 2035 due to the massive production of vehicles (reaching 53 million), totaling 60% of global production, China with the production of 30.2 million vehicles, including 9.5 million EVs, India with its projections of over 10 million by 2030, and the production of local adhesive manufacturing capacity to meet the local demand.

The Global Automotive Adhesives and Sealants Market is predicted to experience substantial growth due to the lightweighting imperative with every 10% vehicle weight reduction improving fuel efficiency 6-8% and adhesive bonding reducing weight 15-25%; stringent emission regulations with EU requiring 95 g/km CO2 and U.S. CAFE mandating 49 mpg by 2026, electric vehicle revolution with 14 million EV sales in 2023 growing to projected 40 million by 2030 requiring 3-5 kilograms battery pack adhesives per vehicle, aluminum adoption increasing from 151 kg per vehicle in 2012 to 250 kg by 2030 requiring adhesive bonding, and structural bonding improving torsional rigidity 30-50% while reducing weight.