Cell Therapy Raw Materials Market Size, Trends and Insights By Product (Media, Cell Culture Supplements, Sera, Reagents & Buffers, Antibodies, Others), By End Use (Biopharmaceutical & Pharmaceutical Companies, CROs & CMOs, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Merck KGaA

- Danaher

- Sartorius Stedim Biotech

- Actylis

- Others

Reports Description

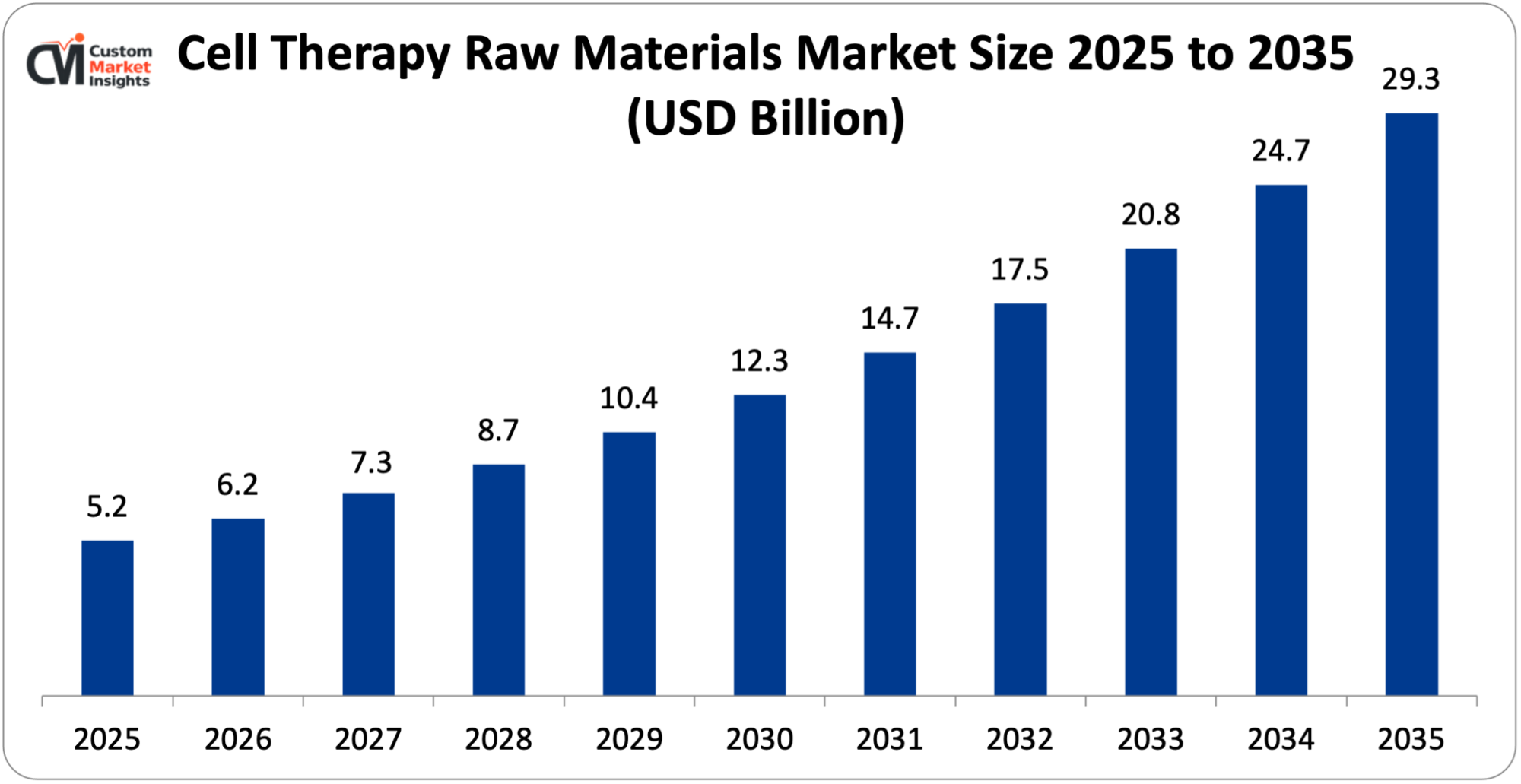

The market size of the global cell therapy raw materials will be estimated at USD 5.2 billion in 2025 and is expected to grow between USD 6.1 billion in 2026 and about USD 29.3 billion by 2035 with a current CAGR of 18.9% during the period of 2026 to 2035.

The cell therapy raw materials market is mainly propelled by the swift expansion of cell-based treatments in cancer therapy, regenerative medicine, and immunotherapy. The rising clinical trials and the validation of new therapies like CAR-T cells, stem cell treatments, and gene-modified cell treatments are considerably increasing the consumption of top-notch raw materials like culture media, sera, cytokines, growth factors, reagents, and GMP-grade consumables, thus, supporting the market.

Market Highlight

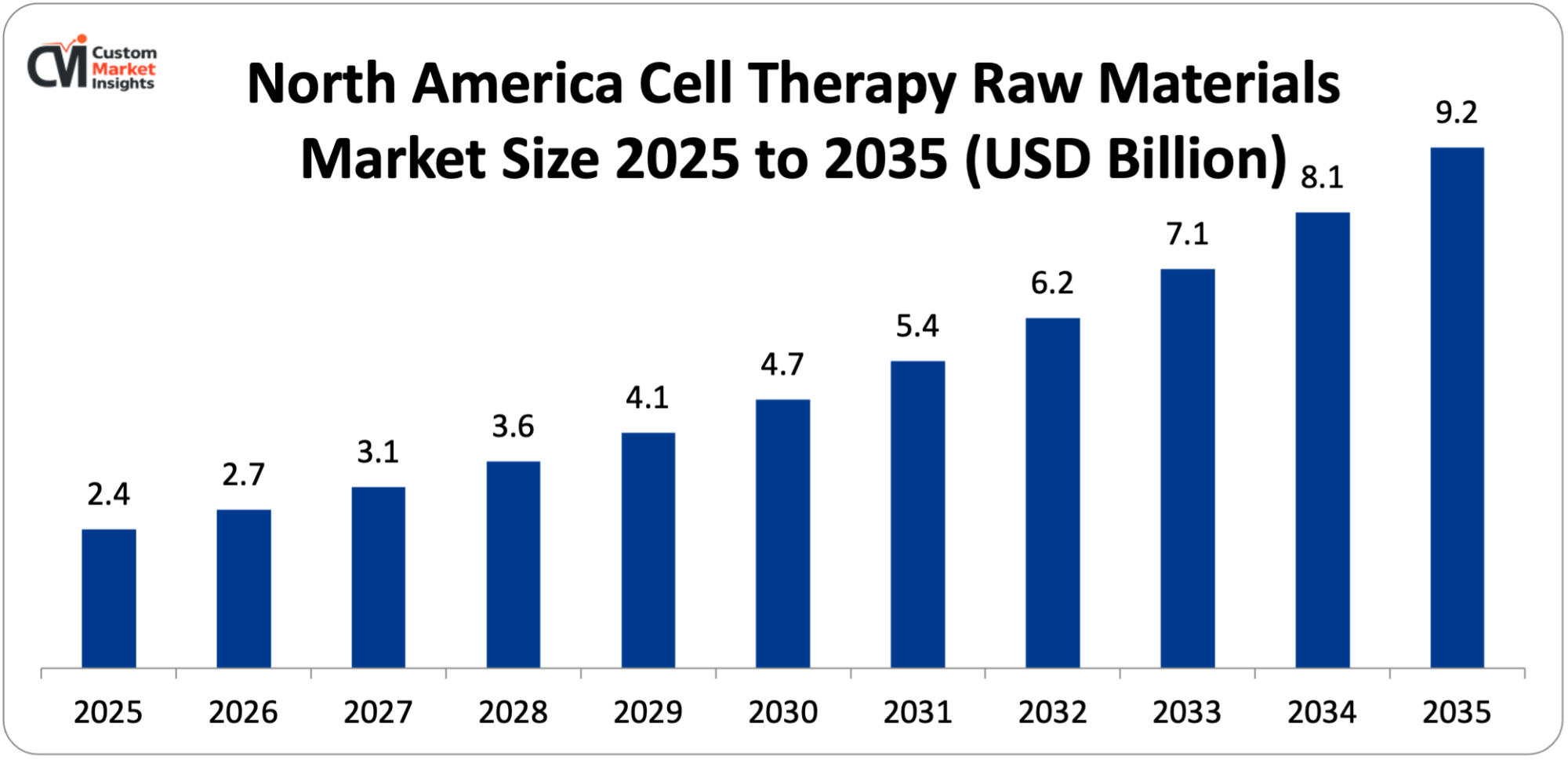

- North America had a market share of 47% market leader in the cell therapy raw materials market in 2025.

- It is projected to have the highest growth rate of 19.5% across Asia Pacific in the year 2026-2035.

- By product, the cell culture supplements segment is expected to hold the largest market share in 2025 of 24.8%.

- By end use, the biopharmaceutical & pharmaceutical companies held the largest market share of 54% in 2025.

Significant Growth Factors

The cell therapy raw materials market trends present significant growth opportunities due to several factors:

- Rapid Increase in Clinical Trials and Commercial Approvals for Cell Therapies: The cell therapy raw materials market is primarily driven by the rapid increase in clinical trials and commercial approvals for cell therapies, which require high-quality raw materials in large volumes throughout the entire process of cell therapy development, from early research to late-stage commercialization. As more therapies such as CAR-T, stem cell–based treatments, and gene-modified cell therapies progress through clinical pipelines and receive regulatory approval, manufacturers must secure consistent supplies of cell culture media, sera, growth factors, cytokines, enzymes, vectors, and GMP-grade consumables. The commercial approvals further amplify the demand since the approved therapies shift from small-batch clinical production to scaled, repeatable manufacturing, which drastically increases the consumption of raw materials. The regulatory agencies also require the materials used in the approved therapies to meet strict quality, traceability, and GMP compliance, which in turn pushes developers to use premium, certified raw materials. Therefore, the increasing number of clinical trials and market-authorized cell therapies directly imply that there will be continued and rising demand for specialized raw materials, which is a strong factor driving the growth of the cell therapy raw materials market. For instance, Neurotech Pharmaceuticals created a landmark in the year 2025 by getting the FDA stamp of approval for Encelto (revakinagene taroretcel-lwey), which is the first-ever therapy for idiopathic macular telangiectasia type 2 (MacTel) approved so far. Encelto is a cell therapy implant that uses allogeneic, encapsulated cells to release ciliary neurotrophic factor (CNTF) continuously and directly into the vitreous cavity of the eye. The decision to approve was based on the results of two phase 3 trials where a significant reduction in the area of ellipsoid zone loss—a marker for the dying of photoreceptor cells—was reported as 56.4% (P <.0001) and 29.2% (P = .021) for the two trials, respectively.

- Rising Prevalence of Target Diseases Such as Cancer, Autoimmune and Rare Genetic Disorders: The growing number of cases of diseases like cancer, autoimmune disorders, and rare genetic conditions are among the main reasons for the increase of the cell therapy raw materials market. The rising incidence of cancer and the increasing number of people with autoimmune diseases have made it necessary to find advanced and permanent ways to treat these conditions, which are usually done through the development of cell-based treatments like CAR-T therapies, stem cell therapies, and immune cell therapies. Moreover, rare genetic disorders that are usually not treated with traditional drugs are being treated through gene-modified and regenerative cell therapies. As a result of research activity and clinical programs for these diseases, the demand for raw materials such as cell culture media, growth factors, cytokines, viral vectors, enzymes, and GMP-grade reagents that are used for cell isolation, expansion, modification, and preservation is growing. Furthermore, because of the chronic and death-causing nature of these diseases, the biopharmaceutical companies and research institutions are investing continuously which in turn leads to the production of raw materials in larger quantities and more usage of them. Thus, the increasing disease burden is directly responsible for the never-ending demand for high-quality, compliant raw materials, and this in turn is elevating the overall market growth. For instance, according to the Sjögren’s Foundation, Inc., the global autoimmune diseases’ incidence rate has been increasing yearly by 19.1%, whereas rheumatology diseases like Sjögren’s and lupus have been increasing by 7.1% per year.

What are the Major Advances Changing the Cell Therapy Raw Materials Market Today

- Advanced Cell Culture Technologies: Cell culture technologies have advanced significantly and become the main driver of the cell therapy raw materials market transformation by making cell production more efficient, and scalable, and clinically relevant. Conventional 2D culture systems are finally being phased out by 3D cell culture platforms, automated bioreactors, and closed-system expansion technologies. These high-tech systems produce very specific raw materials that consist of culture media, growth factors, cytokines, microcarriers, and matrix components that can support larger cell populations and longer durations of cultivation. Moreover, the automation and closed-system teaching processes lead to reduced contamination risk and batch variability. Each of the aforementioned factors increases the need for consistent, GMP-grade, and chemically defined raw materials that are suitable for these platforms. The biopharmaceutical companies’ pathway from the clinical to the commercial level of scaling up cell therapy production sees the use of advanced cell culture technologies rising constantly and that is the primary reason for the continuous increase in the demand for high-performance raw materials.

- Innovation in Defined and GMP-Grade Media & Reagents: The innovation of defined and GMP-grade media and reagents is the principal factor which is influencing the cell therapy raw materials market core by overcoming the issues of consistency, safety, and regulatory compliance directly. The whole industry for media has been dramatically changing in favor of chemically defined, xeno-free, and animal-component-free formulations over the traditional method serum-based and animal-origin media being used which cuts down significantly on batch-to-batch variations as well as the dangers of contamination. GMP-grade reagents, consisting of growth factors, cytokines, enzymes, and supplements, are created with enhanced traceability, documentation, and quality controls to fulfill the rigorous regulatory standards for clinical and commercial cell therapy manufacturing. The innovations enable better quality control and hence batch-related requirements become less stringent making it particularly applicable for the late-stage and commercialized therapies areas. The global upscaling of cell therapies continues to create the need for standardized, high-purity, and compliant media and reagents that are contributing to the quicker acceptance of premium raw materials, thus, fostering an overall market growth.

Category Wise Insights

By Product

Why Cell Culture Supplements Lead the Market?

The cell culture supplements segment is expected to hold the largest market share in 2025 of 24.8%. The main reason behind the growth is the important contribution of these supplements to drug production since they make cells that are more viable, able to proliferate and function better. The use of growth factors, cytokines, hormones, and serum substitutes as supplements is necessary to get large amounts of cells and to have the results in modern treatments like CAR-T, stem cell, and immune-cell therapies, among others, being predictable. As the production of cell therapy shifts from the lab to clinical and large-scale commercial manufacturing, the requirement for GMP-grade, defined, and xeno-free supplements that comply with the stringent regulatory requirements will escalate. Furthermore, the launch of innovative platform florish the market expansion. For instance, in August 2024, Nucleus Biologics, The Cell Performance Company™, has unveiled a new platform to accelerate the development of custom media formulations and their production. This platform, named QuickStart Media™, is an innovative and revolutionary step in the production of Nucleus Biologics’ comprehensive line of cell culture products and solutions and also showcases Nucleus Biologics’ professionalism and commitment in the field of delivery faster and easier custom cell culture media, buffers, reagents, and services.

The media segment is expected to grow at the highest CAGR over the projected period. One of the major factors behind the development of these specialized media that support the growth and proliferation of therapeutic cells is the talking about cell therapy research and development. Besides, the market for these media is getting bigger also due to the increasing product development focused on stem cell therapies. To give an example, in May 2023, Lonza announced the introduction of TheraPEAK T-VIVO Cell Culture Medium, a chemically defined medium specifically designed to enhance the production of CAR T-cells with more reliability, better process control, and faster regulatory approval.

By End Use

Why Biopharmaceutical & Pharmaceutical Companies Dominates the Cell Therapy Raw Materials Market?

The biopharmaceutical & pharmaceutical companies held the largest market share of 54% in 2025. These companies are increasingly accepting the transformative potential of cell therapies to treat cancer, autoimmune diseases and degenerative conditions, which has brought them to the point of making considerable investments into the research, development and marketing of the respective products. The activities taking place have created an enormous demand for premium quality raw materials needed for cell therapy production. As a case in point, in September 2023, Novo Nordisk A/S made the announcement of a USD 136 million investment that would go into the creation of a cell therapy manufacturing facility at Cellerator, Denmark, which is situated at the Technical University of Denmark (DTU), intended for the production of stem cell therapies for initial clinical trials.

The CROs & CMOs segment is expected to grow at the highest rate over the projected period. The expansion is being propelled by the increasing trend of outsourcing in the cell therapy sector, where pharmaceutical companies are depending more on skilled professionals to get the production done smoothly and efficiently. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) contribute by providing a full range of services from Research and Development to manufacturing, consequently cutting down the operational costs and risks, while giving the companies the option to concentrate on their main activities. The rise of outsourcing has led to an increased need for the base materials like culture media and growth factors that are necessary for the manufacturing of cell therapy products in outsourced facilities. The ongoing investment in the area of cell therapy R&D is expected to further push the need for these base materials, thereby enhancing the role of CMOs and CROs as market developers.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 6.1 billion |

| Projected Market Size in 2035 | USD 29.3 billion |

| Market Size in 2025 | USD 5.2 billion |

| CAGR Growth Rate | 18.9% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product, End Use and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Cell Therapy Raw Materials Market Size?

Its market size, in terms of North America Cell Therapy Raw Materials, is projected to be USD 2.4 billion in 2025 with a growth of about USD 9.2 billion in 2035 with a CAGR of 14.5% between 2026 and 2035.

Why did North America Dominate the Cell Therapy Raw Materials Market in 2025?

In 2025, North America will dominate the global market with an estimated market share of 47%. The regional development can be attributed to the area’s being in the forefront of the cell and gene therapy domain in terms of research, clinical development, and market introduction. Particularly, the U.S. has a heavy presence of biopharmaceutical companies, state-of-the-art research institutions, and contract development and manufacturing organizations (CDMOs), all of which continuously create the need for the high-quality raw materials such as cell culture media, supplements, reagents, vectors, and GMP-grade consumables. The swift ascent of clinical trials and authority approvals for cell therapy—particularly in the areas of cancer and the restoration of tissue—has hastened the movement from mini-laboratory research to large-scale manufacturing, thus, greatly increasing the use of raw materials.

U.S. Cell Therapy Raw Materials Market Trends

The US is expected to lead the cell therapy raw materials market over the analysis period owing to the presence of major players and continuous launch of gene therapies solution. For instance, in April 2025, U.S. Pharmacopeia (USP) has introduced a comprehensive package of reference standards, materials, and other resources to eliminate confusion for AAV-based gene therapy developers and manufacturers. The new tools can assist AAV producers in harmonizing quality assessment and control activities for the entire duration of the production process, starting with raw and starting materials and ending with release and stability tests. The use of standardized analytical methods and suitably qualified materials can make it easier to develop and characterize the product efficiently.

Why is Asia Pacific Experiencing the Fastest Growth in the Cell Therapy Raw Materials Market?

It is estimated that the Asia-Pacific region will have the highest growth with a CAGR of 19.5% between the year 2026 and 2035. The increasing occurrence of chronic and degenerative diseases, which include cancer, cardiovascular and neurological disorders, is one of the major reasons for the rise in demand for cell therapy raw materials. Apart from that, the acceptance of new cell treatments as well as the favorable regulations in countries like China and India have also contributed to the growth in the demand for the raw materials used in the production of these therapies.

China Cell Therapy Raw Materials Market Trends

The Chinese market has an extremely fast-growing market. The country is constantly innovating and investing in healthcare and biotechnology which is the major reason for the demand for advanced treatments such as gene therapies, stem cell applications and cancer immunotherapies to go up. Besides, there are also high-quality raw materials for the production of different culture media, growth factors, and reagents that are in accordance with the demand.

Why is Europe is growing at a significant rate in the Cell Therapy Raw Materials Market?

The European market is large and established. The growth is fueled by the growing cell and gene therapy pipeline in the region, excellent cooperation between academia and industry, and helpful regulations. Germany, the UK, France, and the Nordic countries are investing in regenerative medicine and advanced therapy medicinal products (ATMPs) to ensure that demand for high-quality raw materials such as cell culture media, supplements, reagents, enzymes, and GMP-grade consumables will keep on increasing. Gartner forecasts there will be more clinical trials and the gradual release of cell therapies to the market would cause a push for manufacturers of raw materials to reach European approval with the help of proper documentation, traceable materials, and ever-so compliant GMP standards.

UK Cell Therapy Raw Materials Market Trends

In 2025, the UK cell therapy raw materials industry took a considerable market share. Cell-based therapies have become the prime reason behind the increasing demand for high-quality raw materials in the medical sector. The cell-based therapies are used in treating cancer, autoimmune diseases, genetic disorders, and other ailments. Additionally, the advancements in regenerative medicine and the trend towards personalized medication are at the same time increasing the need for high-quality raw materials like growth factors, cytokines, and cell culture media. The quality of these raw materials is a crucial factor in the development and production of cell therapies, thus they are of utmost importance.

Why is the Middle East & Africa Region is growing rapidly in the Cell Therapy Raw Materials?

The MEA cell therapy raw materials market is positively impacted by the growing need for innovative therapies which in turn is causing the widespread use of cell and gene therapies. Curing of chronic diseases like cancer, autoimmune disease, and rare genetic disorders is some of the treatments offered by these therapies. Plus, the establishment of cell therapy labs by biopharma companies and CDMOs in the region is pushing the requirement for high-quality raw materials like growth factors, cytokines, and culture media even further.

UAE Cell Therapy Raw Materials Market Trends

UAE is growing rapidly over the projected period. The United Arab Emirates aims to position itself as a leader in the field of precision medicine and cell-based therapies in the region through government-led initiatives, medical-free zones, and collaborations with global bio-pharmaceutical firms and academic research facilities. The rising application of cell therapies in oncology and autosomal diseases treatment along with the mainstay of personalized medicine has created a need for premium raw materials like cell culture media, supplements, reagents, enzymes, and GMP-grade consumables.

Top Players in the Cell Therapy Raw Materials Market and Their Offerings

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher

- Sartorius Stedim Biotech

- Actylis

- ACROBiosystems

- STEMCELL Technologies.

- Grifols S.A.

- Charles River Laboratories

- RoosterBio Inc.

- PromoCell GmbH

- AGC Biologics

- Johnson & Johnson

- Promega Corporation

- STEMPEUTICS RESEARCH PVT LTD

- Others

Key Developments

Cell therapy raw materials market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolio using strategic approaches.

- In November 2024: QPS Holdings, LLC has made it known that their campus in Springfield, QPS Missouri, has set up a new business unit for Cell Therapy. The milestone of this unit is the establishment of a new center for Leukopak collection and blood product processing. The facility is geared up to cater to the increasing demand for blood products to aid in the cell and gene therapy works exponentially. QPS is a comprehensive service specialized hence that supporting the drug development process from the very beginning idea to the drug commercial launch. The current facility is providing necessary raw materials for the r&d of biopharmaceuticals but it is going to start soon supporting clinical and commercial cell therapy companies and patients as well. On top of that, the new facility will render a local economic boost by giving financial compensation to blood product donors. (Source: https://www.businesswire.com/news/home/20241113328476/en/QPS-Launches-New-Leukopak-and-Cell-Therapy-Products-Facility)

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast-growing cell therapy raw materials market.

The Cell Therapy Raw Materials Market is segmented as follows:

By Product

- Media

- Cell Culture Supplements

- Sera

- Reagents & Buffers

- Antibodies

- Others

By End Use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Others

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Cell Therapy Raw Materials Market, (2026 – 2035) (USD Billion)

- 2.2 Global Cell Therapy Raw Materials Market : snapshot

- Chapter 3. Global Cell Therapy Raw Materials Market – Industry Analysis

- 3.1 Cell Therapy Raw Materials Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Rapid Increase in Clinical Trials and Commercial Approvals for Cell Therapies

- 3.2.2 Rising Prevalence of Target Diseases Such as Cancer

- 3.2.3 Autoimmune and Rare Genetic Disorders

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product

- 3.7.2 Market attractiveness analysis By End Use

- Chapter 4. Global Cell Therapy Raw Materials Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Cell Therapy Raw Materials Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Cell Therapy Raw Materials Market – Product Analysis

- 5.1 Global Cell Therapy Raw Materials Market overview: By Product

- 5.1.1 Global Cell Therapy Raw Materials Market share, By Product, 2025 and 2035

- 5.2 Media

- 5.2.1 Global Cell Therapy Raw Materials Market by Media, 2026 – 2035 (USD Billion)

- 5.3 Cell Culture Supplements

- 5.3.1 Global Cell Therapy Raw Materials Market by Cell Culture Supplements, 2026 – 2035 (USD Billion)

- 5.4 Sera

- 5.4.1 Global Cell Therapy Raw Materials Market by Sera, 2026 – 2035 (USD Billion)

- 5.5 Reagents & Buffers

- 5.5.1 Global Cell Therapy Raw Materials Market by Reagents & Buffers, 2026 – 2035 (USD Billion)

- 5.6 Antibodies

- 5.6.1 Global Cell Therapy Raw Materials Market by Antibodies, 2026 – 2035 (USD Billion)

- 5.7 Others

- 5.7.1 Global Cell Therapy Raw Materials Market by Others, 2026 – 2035 (USD Billion)

- 5.1 Global Cell Therapy Raw Materials Market overview: By Product

- Chapter 6. Global Cell Therapy Raw Materials Market – End Use Analysis

- 6.1 Global Cell Therapy Raw Materials Market overview: By End Use

- 6.1.1 Global Cell Therapy Raw Materials Market share, By End Use, 2025 and 2035

- 6.2 Biopharmaceutical & Pharmaceutical Companies

- 6.2.1 Global Cell Therapy Raw Materials Market by Biopharmaceutical & Pharmaceutical Companies, 2026 – 2035 (USD Billion)

- 6.3 CROs & CMOs

- 6.3.1 Global Cell Therapy Raw Materials Market by CROs & CMOs, 2026 – 2035 (USD Billion)

- 6.4 Others

- 6.4.1 Global Cell Therapy Raw Materials Market by Others, 2026 – 2035 (USD Billion)

- 6.1 Global Cell Therapy Raw Materials Market overview: By End Use

- Chapter 7. Cell Therapy Raw Materials Market – Regional Analysis

- 7.1 Global Cell Therapy Raw Materials Market Regional Overview

- 7.2 Global Cell Therapy Raw Materials Market Share, by Region, 2025 & 2035 (USD Billion)

- 7.3. North America

- 7.3.1 North America Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.3.1.1 North America Cell Therapy Raw Materials Market, by Country, 2026 – 2035 (USD Billion)

- 7.3.1 North America Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.4 North America Cell Therapy Raw Materials Market, by Product, 2026 – 2035

- 7.4.1 North America Cell Therapy Raw Materials Market, by Product, 2026 – 2035 (USD Billion)

- 7.5 North America Cell Therapy Raw Materials Market, by End Use, 2026 – 2035

- 7.5.1 North America Cell Therapy Raw Materials Market, by End Use, 2026 – 2035 (USD Billion)

- 7.6. Europe

- 7.6.1 Europe Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.6.1.1 Europe Cell Therapy Raw Materials Market, by Country, 2026 – 2035 (USD Billion)

- 7.6.1 Europe Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.7 Europe Cell Therapy Raw Materials Market, by Product, 2026 – 2035

- 7.7.1 Europe Cell Therapy Raw Materials Market, by Product, 2026 – 2035 (USD Billion)

- 7.8 Europe Cell Therapy Raw Materials Market, by End Use, 2026 – 2035

- 7.8.1 Europe Cell Therapy Raw Materials Market, by End Use, 2026 – 2035 (USD Billion)

- 7.9. Asia Pacific

- 7.9.1 Asia Pacific Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.9.1.1 Asia Pacific Cell Therapy Raw Materials Market, by Country, 2026 – 2035 (USD Billion)

- 7.9.1 Asia Pacific Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.10 Asia Pacific Cell Therapy Raw Materials Market, by Product, 2026 – 2035

- 7.10.1 Asia Pacific Cell Therapy Raw Materials Market, by Product, 2026 – 2035 (USD Billion)

- 7.11 Asia Pacific Cell Therapy Raw Materials Market, by End Use, 2026 – 2035

- 7.11.1 Asia Pacific Cell Therapy Raw Materials Market, by End Use, 2026 – 2035 (USD Billion)

- 7.12. Latin America

- 7.12.1 Latin America Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.12.1.1 Latin America Cell Therapy Raw Materials Market, by Country, 2026 – 2035 (USD Billion)

- 7.12.1 Latin America Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.13 Latin America Cell Therapy Raw Materials Market, by Product, 2026 – 2035

- 7.13.1 Latin America Cell Therapy Raw Materials Market, by Product, 2026 – 2035 (USD Billion)

- 7.14 Latin America Cell Therapy Raw Materials Market, by End Use, 2026 – 2035

- 7.14.1 Latin America Cell Therapy Raw Materials Market, by End Use, 2026 – 2035 (USD Billion)

- 7.15. The Middle-East and Africa

- 7.15.1 The Middle-East and Africa Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.15.1.1 The Middle-East and Africa Cell Therapy Raw Materials Market, by Country, 2026 – 2035 (USD Billion)

- 7.15.1 The Middle-East and Africa Cell Therapy Raw Materials Market, 2026 – 2035 (USD Billion)

- 7.16 The Middle-East and Africa Cell Therapy Raw Materials Market, by Product, 2026 – 2035

- 7.16.1 The Middle-East and Africa Cell Therapy Raw Materials Market, by Product, 2026 – 2035 (USD Billion)

- 7.17 The Middle-East and Africa Cell Therapy Raw Materials Market, by End Use, 2026 – 2035

- 7.17.1 The Middle-East and Africa Cell Therapy Raw Materials Market, by End Use, 2026 – 2035 (USD Billion)

- Chapter 8. Company Profiles

- 8.1 Thermo Fisher Scientific Inc.

- 8.1.1 Overview

- 8.1.2 Financials

- 8.1.3 Product Portfolio

- 8.1.4 Business Strategy

- 8.1.5 Recent Developments

- 8.2 Merck KGaA

- 8.2.1 Overview

- 8.2.2 Financials

- 8.2.3 Product Portfolio

- 8.2.4 Business Strategy

- 8.2.5 Recent Developments

- 8.3 Danaher

- 8.3.1 Overview

- 8.3.2 Financials

- 8.3.3 Product Portfolio

- 8.3.4 Business Strategy

- 8.3.5 Recent Developments

- 8.4 Sartorius Stedim Biotech

- 8.4.1 Overview

- 8.4.2 Financials

- 8.4.3 Product Portfolio

- 8.4.4 Business Strategy

- 8.4.5 Recent Developments

- 8.5 Actylis.

- 8.5.1 Overview

- 8.5.2 Financials

- 8.5.3 Product Portfolio

- 8.5.4 Business Strategy

- 8.5.5 Recent Developments

- 8.6 ACROBiosystems

- 8.6.1 Overview

- 8.6.2 Financials

- 8.6.3 Product Portfolio

- 8.6.4 Business Strategy

- 8.6.5 Recent Developments

- 8.7 STEMCELL Technologies.

- 8.7.1 Overview

- 8.7.2 Financials

- 8.7.3 Product Portfolio

- 8.7.4 Business Strategy

- 8.7.5 Recent Developments

- 8.8 Grifols S.A.

- 8.8.1 Overview

- 8.8.2 Financials

- 8.8.3 Product Portfolio

- 8.8.4 Business Strategy

- 8.8.5 Recent Developments

- 8.9 Charles River Laboratories

- 8.9.1 Overview

- 8.9.2 Financials

- 8.9.3 Product Portfolio

- 8.9.4 Business Strategy

- 8.9.5 Recent Developments

- 8.10 RoosterBio Inc.

- 8.10.1 Overview

- 8.10.2 Financials

- 8.10.3 Product Portfolio

- 8.10.4 Business Strategy

- 8.10.5 Recent Developments

- 8.11 PromoCell GmbH

- 8.11.1 Overview

- 8.11.2 Financials

- 8.11.3 Product Portfolio

- 8.11.4 Business Strategy

- 8.11.5 Recent Developments

- 8.12 AGC Biologics

- 8.12.1 Overview

- 8.12.2 Financials

- 8.12.3 Product Portfolio

- 8.12.4 Business Strategy

- 8.12.5 Recent Developments

- 8.13 Johnson & Johnson

- 8.13.1 Overview

- 8.13.2 Financials

- 8.13.3 Product Portfolio

- 8.13.4 Business Strategy

- 8.13.5 Recent Developments

- 8.14 Promega Corporation

- 8.14.1 Overview

- 8.14.2 Financials

- 8.14.3 Product Portfolio

- 8.14.4 Business Strategy

- 8.14.5 Recent Developments

- 8.15 STEMPEUTICS RESEARCH PVT LTD

- 8.15.1 Overview

- 8.15.2 Financials

- 8.15.3 Product Portfolio

- 8.15.4 Business Strategy

- 8.15.5 Recent Developments

- 8.16 Others.

- 8.16.1 Overview

- 8.16.2 Financials

- 8.16.3 Product Portfolio

- 8.16.4 Business Strategy

- 8.16.5 Recent Developments

- 8.1 Thermo Fisher Scientific Inc.

List Of Figures

Figures No 1 to 23

List Of Tables

Tables No 1 to 52

Prominent Player

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher

- Sartorius Stedim Biotech

- Actylis

- ACROBiosystems

- STEMCELL Technologies.

- Grifols S.A.

- Charles River Laboratories

- RoosterBio Inc.

- PromoCell GmbH

- AGC Biologics

- Johnson & Johnson

- Promega Corporation

- STEMPEUTICS RESEARCH PVT LTD

- Others

FAQs

The key players in the market are Thermo Fisher Scientific Inc., Merck KGaA, Danaher, Sartorius Stedim Biotech, Actylis, ACROBiosystems, STEMCELL Technologies, Grifols S.A., Charles River Laboratories, RoosterBio Inc., PromoCell GmbH, AGC Biologics, Johnson & Johnson, Promega Corporation, STEMPEUTICS RESEARCH PVT LTD, Others.

Government rules or regulations act as a catalyst for innovation by creating definitive frameworks for the progress of advanced therapy, promoting the standardization of production and global harmonization.

The high cost of raw materials for cell therapy has numerous repercussions that eventually restrict the cell therapy market size and the influx of new patients receiving the latest treatments. The cell therapy production cost is significantly increased due to the use of GMP-grade media, growth factors, cytokines, vectors, and reagents that are costly, and this may render the technology adoption impossible for some, mainly for smaller biotech companies, academic laboratories, and manufacturers in price-controlled regions. High costs lead to a delay in the process from clinical trials to large-scale commercialization and, thus, limit the number of patients who can access the new treatments.

According to the present analysis and forecast modeling, the market of cell therapy raw materials will witness a significant growth of about USD 29.3 billion in the year 2035 with the shift to personalized & regenerative medicine, rising prevalence of target diseases, and technological advances in raw materials and processes, with a CAGR of 18.9% between the years 2026 and 2035.

It is projected that North America will hold the largest market share in the cell therapy raw materials market in the forecast period, with a share of about 47% of the global market share, which is attributed to the existence of major players and rising government initiatives.

The Asia-Pacific Region is expected to have the highest growth rate of about 19.5% in the forecast period. Regional factors such as the large-scale biotechnological development, more healthcare funds allocated, and the switch to cell and gene therapy as the main research area are the major proponents of the growth. The nations of China, Japan, South Korea, India, and Australia are experiencing an upsurge in clinical trials, governmental financial support, and private capital that are primarily directed at the development of regenerative medicine and immunotherapy. As a result, there is an increased demand for the most important raw materials, i.e. cell culture media, supplements, reagents, cytokines, enzymes, and GMP-grade consumables, to a great extent.

The worldwide transition to personalized and precision medicine has made it more urgent than ever to get specialized, reproducible, and patient-specific raw materials, especially for autologous cell therapies, which are the most demanding ones from the materials point of view. The increasing number of cancers, autoimmune diseases, and rare genetic disorders has an additional effect, as it not only leads to higher therapy demand but also to higher consumption of raw materials in the research, clinical, and commercial manufacturing stages across the board.