Viral Vaccine Cell Culture Media Market Size, Trends and Insights By Cell Culture Type (Suspension Cell Culture, Adherent Cell Culture), By Cell Culture Media (Animal Component Free Media, Protein Free Media, Serum Free Media), By Scale of Operation (Commercial, Clinical), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Thermo Fisher Scientific

- Merck KGaA

- Lonza Group

- Corning Incorporated

- Others

Reports Description

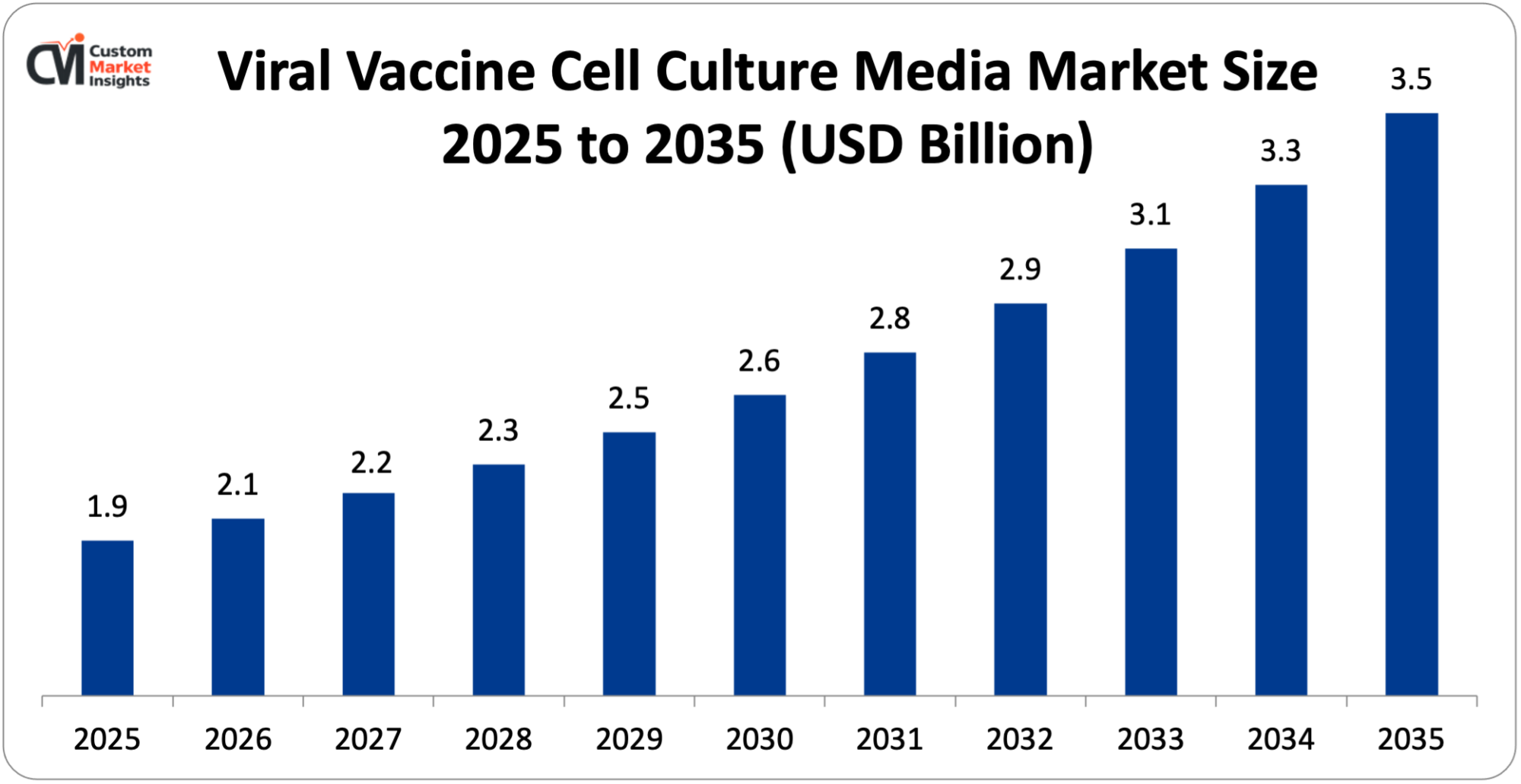

The market size of the global viral vaccine cell culture media will be estimated at USD 1.9 billion in 2025 and is expected to grow to between USD 2.1 billion in 2026 and about USD 3.5 billion by 2035 with a current CAGR of 6.2% during the period of 2026 to 2035.

The major factor facilitating the movement is the upgrading of vaccine technologies, which encompasses the new platforms like viral vectors and the betterment of cell line engineering, thus creating a demand for the best media formulations that would yield the highest viral output and be the most efficient. Besides that, the growth of the market has been augmented by the quickening of the innovation and acceptance of the new media solutions that are very much in demand due to the increased funding for research and development coming from the private pharmaceutical companies as well as the public funding agencies.

Market Highlight

- North America had a market share of 36% and was the market leader in the Viral Vaccine Cell Culture Media market in 2025.

- It is projected to have the highest growth rate across Asia Pacific in the years 2026-2035.

- By cell culture type, the adherent cell culture segment dominates the market with over 50% revenue share in 2025.

- By cell culture media, the serum free media held the largest market share of 37.8% in 2025.

Significant Growth Factors

The viral vaccine cell culture media market trends present significant growth opportunities due to several factors:

- Rising Global Vaccine Production Capacity: The viral vaccine cell culture media market is largely influenced by factors such as the increasing global vaccine production capacity. Pharmaceutical companies along with governments are not only developing their manufacturing capabilities so that they can meet the routine vaccination needs but also making production facilities for pandemic readiness. The demand for cell culture media that support virus has risen to a large extent due to the construction of new vaccine production plants, the enlargement of existing ones, and the establishment of more regional manufacturing hubs, especially in Asia-Pacific, Latin America, and certain areas of the Middle East and Africa, that are backed by large-scale investments. Additionally, with the companies increasing their production and changing over to cell culture vaccine platforms because of the advantages like consistency, safety, and flexibility over the egg-based method, the consumption of specialized, serum-free, and chemically defined media grows exponentially. Therefore, this production capacity increase is not only allowing the vaccine output to be more than doubled but also insisting on the use of reliable media that comply with GMP standards for the growth of cells to be strong, for the rate of the virus to be high and for the regulatory compliance, thus indirectly helping the viral vaccine cell culture media market for continuous and stable growth. For instance, in January 2024, Serum Institute of India Pvt. Ltd. (SII), the largest vaccine manufacturer in the world, became part of a network of vaccine makers in the Global South through CEPI, which is a growing coalition of public and private organizations developed to prevent and control epidemics. SII’s participation in the CEPI manufacturing network will not only give a big push to vaccine production in Global South regions but also enable the world to be better equipped to fulfill the 100 Days Mission. This mission aims to produce new vaccines against identified or novel infectious diseases within three months of the pandemic threat being recognized. Hence, CEPI is putting up $30 million for the next steps towards SII’s already established capacity for quick response to infectious disease outbreaks to build up its already existing capability of quickly supplying investigational vaccines during epidemics and pandemics. This would allow CEPI-supported vaccine developers to transfer their technology to SII, starting quick production and equal distribution of low-cost vaccines to the affected communities within a few days or a week following an outbreak.

- Higher Outsourcing to CMOs/CDMOs: The growing tendency towards outsourcing to contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) is one of the leading factors behind the rise in the viral vaccines cell culture media market. Vaccine manufacturers are continuously counting on the support of the outside partners in order to get their whole development timeline up to speed and become competent in the production of large volumes. Very often, pharmaceutical and biotech companies make the decision of outsourcing the production of viral vaccines to the CMOs/CDMOs because they want to take advantage of the companies’ infrastructure, expertise in regulatory matters, and validation of cell culture processes which is already done thus saving them from the need to invest heavily in their own production facilities. This phenomenon not only brings about a demand that is greater but also a demand that is steadier for the GMP-grade, standardized, and high-performance cell culture media. CMOs and CDMOs operate large multi-client production sites and large-scale production requires inputs that are both dependable and reproducible. Moreover, the long-term supply agreements between media producers and CMOs/CDMOs are also a significant factor behind the market growth as such partners always take into account the concerns of several vaccine programs like secure sourcing, batch consistency, and regulatory compliance not only one at a time but simultaneously.

What are the Major Advances Changing the Viral Vaccine Cell Culture Media Market Today

- Wider Adoption of Serum-Free and Chemically Defined Media Formulations: The viral vaccines cell culture media market has been going through a major transformation influenced by various technological and process innovations aimed at increasing efficiency, quality, and scalability in production. One significant alteration is represented by the serum-free and chemically-defined media, the latter having gained broad acceptance within the industry. Such purified formulations, as opposed to traditional serum-containing media, offer exact, stable nutrient profiles practically eliminating the variation between different batches, removing the risks related to animal-derived components, and making the entire regulatory approval process more manageable. The use of single-use biomanufacturing technologies, considered to be the future of the industry, is also a result of this phase and they are already incorporating new media designs that completely eliminate all contamination risks, consequently requiring lower cleaning validation and faster turnaround times in the high-volume vaccine manufacturing that operates at that level.

- High-yield Viral Production Platforms: The reported impact of high-yield viral production platforms on the viral vaccine cell culture media market is indeed a significant one as they are the main driving force behind the demand for the more specialized media formulations that are performance-optimized. The modern vaccine manufacturing process has become highly dependent on various methods, such as engineered cell lines, advanced production platforms, etc., which are aimed at maximizing viral replication, productivity, and process efficiency. All these high-yield capabilities will not be fully realized unless the manufacturer has the appropriate cell culture media that is precisely tailored to the metabolic and growth requirements of the specific host cells, thus enabling faster cell proliferation, higher virus titers, and improved process consistency. Vaccine producers are trying to do the opposite; that is, reduce the cost of goods while still meeting large-scale and time-sensitive demand, especially during outbreaks or pandemic preparedness initiatives. In this context, the adoption of high-yield platforms has increased the demand for advanced, serum-free, and chemically defined media. This connection between the productivity of the virus and the performance of the media is still very strong and continues to drive innovation, premium product adoption, and sustained growth in the viral vaccine cell culture media market.

Category Wise Insights

By Cell Culture Type

Why Adherent Cell Culture Lead the Market?

The adherent cell culture segment dominates the market with over 50% revenue share in 2025. The main factor of the growth is that it still plays a vital role in the production of major viral vaccines and the gradual improvement of the media that are specifically designed for the adherent systems. It is a fact that a lot of conventional and new viral vaccines are still being produced with the help of cell lines that are known to adhere, for instance, Vero, MDCK, and primary cells, which need media that promote the attachment and growth of cells on surfaces or microcarriers. As the manufacturers increase the production capacity in order to satisfy the global immunization needs and the pandemic preparedness goals, the demand for special media that are optimized for adherence and that enhance cell density, viral yields, and process robustness has increased.

The suspension cell culture segment is expected to grow at the highest CAGR over the projected period. The market section for the media used for viral vaccine cell culture in suspension cell culture has experienced a strong surge in revenues, primarily due to the vaccine manufacturers’ gradual shift to suspension-based production platforms for the sake of manufacturing efficiency and satisfying the ever-growing global demand. The cells in the suspension system grow in liquid media without any restrictions thus it is more scalable and it is consequently the more suitable option for large volume bioreactors as compared to the adherent systems. This very nature of suspension cultures leads to the production of a higher quantity of vaccines and reduced cost of goods since the same amount of material can be used to produce more vaccines. With the continuous improvement of bioprocessing technologies, the trend of using suspension-optimized cell lines (like HEK293, CHO variants that are adapted for suspension) is catching on with more and more vaccine manufacturers and CDMOs, and hence, the need for specialized suspension culture media that can support the vigorous growth of cells and viral production in the bioreactors is increasing.

By Cell Culture Media

Why Serum Free Media Dominates the Viral Vaccine Cell Culture Media Market?

The serum free media held the largest market share of 37.8% in 2025. The expansion can be traced to a multitude of reasons that are very convincing and are associated with safety, regulatory trends, and production efficiency. The serum-free processes do away with the use of animal-derived materials including fetal bovine serum (FBS), which in the past brought along risks of contamination, variability in quality from one batch to another, and regulatory issues in the production of vaccines. The use of animal-component-free media has been largely influenced by the regulatory bodies’ demand for vaccine manufacturing processes that are safer and more reproducible; thus, the serum-free choices have become more and more favored in both clinical and commercial production. Consequently, the serum-free media have captured a great part of the market for the viral vaccine cell culture media and are projected to experience steady growth since the manufacturers will constantly be moving away from the media with serum in order to comply with the quality and regulatory standards.

The animal component free media segment is expected to grow at the highest rate over the projected period. The current vaccine manufacturing process that accepts and supports high prices meets different necessary requirements and that is why it is so popular among the manufacturers. It is becoming the most favored option for the production of large-scale viral vaccines as the safety and regulatory compliance issues are getting more and more attention at the manufacturers’ end, and that is the reason for the use of animal-derived material-free formulations—it helps to bring about the complete elimination of serum, hydrolysates, and proteins the use of formulations has become the most preferred choice for the production of large-scale viral vaccines. The use of animal component-free media not only prevents the introduction of adventitious agents and contamination by pathogens but also improves the overall product safety and regulatory approval processes. The trend toward the use of cleaner and chemically defined media results not only in better consistency from one batch to another but also in overall reliability of the process which is of utmost importance for human vaccines that are to meet very high-quality standards.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 2.1 billion |

| Projected Market Size in 2035 | USD 3.5 billion |

| Market Size in 2025 | USD 1.9 billion |

| CAGR Growth Rate | 6.2% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Cell Culture Type, Cell Culture Media, Scale of Operation and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Viral Vaccine Cell Culture Media Market Size?

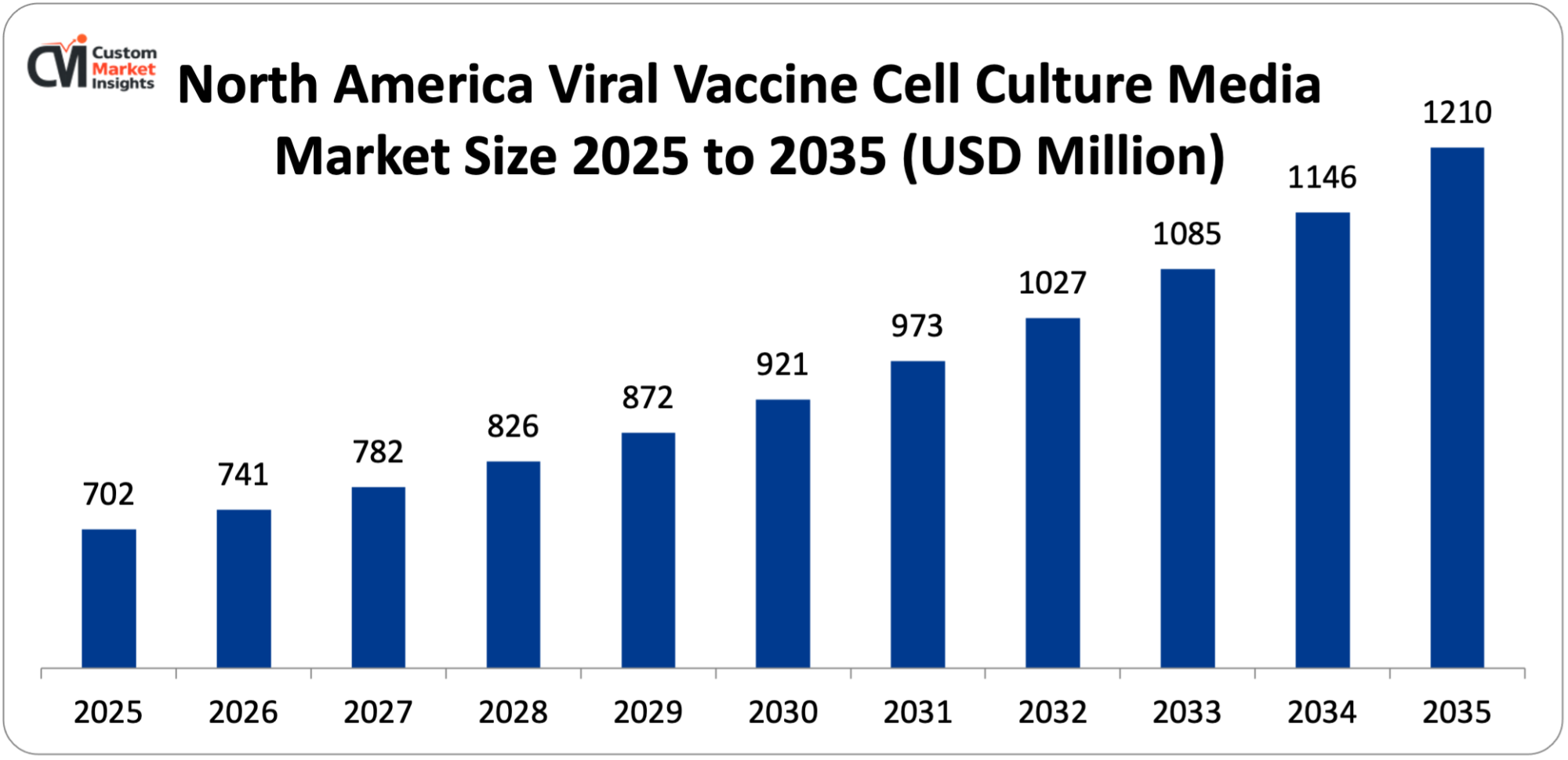

Its market size, in terms of North America Viral Vaccine Cell Culture Media, is projected to be USD 702 million in 2025 with a growth of about USD 1210 million in 2035 with a CAGR of 5.6% between 2026 and 2035.

Why did North America Dominate the Viral Vaccine Cell Culture Media Market in 2025?

In 2025, North America will dominate the global market with an estimated market share of 36%. The growth of the region can be attributed to a combination of factors, the strong biopharmaceutical manufacturing base, advanced research ecosystem and continued investment in vaccines. Besides, the presence of major vaccine manufacturers, biotechnology companies, and leading CMOs/CDMOs in the United States and Canada ensures a continuous demand for high-quality, GMP-grade cell culture media that are used in viral vaccine production. Moreover, the governments are still providing funding and establishing public-private partnerships that are mainly directed towards pandemic preparedness, biodefense, and immunization programs which in turn support large-scale vaccine production and indirectly boost media consumption.

U.S. Viral Vaccine Cell Culture Media Market Trends

The US is expected to lead the viral vaccine cell culture media market over the analysis period. The U.S. market is characterized by the fast acceptance of cost-effective technologies such as serum-free and animal component–free media, single-use bioprocessing systems, and high-yield viral production platforms which result in increased spending on premium media products. The winning regulatory environment that stresses quality, consistency, and safety has also been a major factor to manufacturers sticking to media formulations that are standardized and validated. It is together that they have all contributed to the steady increase of revenues in the U.S. market for viral vaccine cell culture media.

Why is Asia Pacific Experiencing the Fastest Growth in the Viral Vaccine Cell Culture Media Market?

The Asia Pacific region is expected to grow at the highest CAGR during the projected period. The increase in the region’s vaccine supply is mainly due to the growing capacity for vaccine production, investments in healthcare, and the increasing face of the region’s quality in vaccine supply which self-sufficiency. Nations like China, India, Japan and South Korea are pouring money into vaccine manufacturing and improving drug production facilities to be able to supply their vast domestic and export vaccination needs as well. All these developments mean the use of cell culture media in the making of viral vaccines has gone up by a significant amount.

China Viral Vaccine Cell Culture Media Market Trends

The Chinese market has an extremely fast-growing market. The rapid spread of vaccine production domestically and the continuous governmental support for self-reliant biopharmaceuticals have triggered growth. To cover the immunization needs of the entire country, to be ready for pandemics, and to sell vaccines, China has heavily invested in vaccine production and R&D. All this directly boosts the demand for top-quality cell culture media that are used in viral propagation because of the huge volume exports, vaccine quality, and so forth.

Why is Europe is growing at a significant rate in the Viral Vaccine Cell Culture Media Market?

The European market is large and established. The pharma manufacturing strength, the presence of modern research facilities, and the public funding for vaccine development contribute to the revenue growth of the area. The European nations accommodate multiple top vaccine manufacturers, biotechnology companies, and CDMOs that mainly depend on the cell culture–based production method for the manufacture of viral vaccines, thus creating a regular need for quality, GMP-compliant, and culture media.

UK Viral Vaccine Cell Culture Media Market Trends

In 2025, the UK Viral Vaccine Cell Culture Media industry took a considerable market share. The United Kingdom is the place where pioneering academic research institutions, biotech companies, and vaccine producers that are working with cell culture technology for viral vaccine R&D and manufacturing are located, and this has been the reason for the constant need of quality culture media.

Why is the Middle East & Africa Region is growing rapidly in the Viral Vaccine Cell Culture Media?

The viral vaccine cell culture media market in the Middle East & Africa (MEA) is slowly but surely gaining ground, all due to the healthcare investments, local vaccine manufacturing modes and infectious disease readiness awareness among the public. The biopharmaceutical and vaccine production facilities in the Middle East are getting more and more support as part of improved healthcare and wide-ranging self-sufficiency strategies, which in turn is creating a need for cell culture–based viral vaccine manufacturing inputs and specialized media in particular. In Africa, international health organizations, global vaccine alliances and public-private partnerships are coming together to strengthen the regional capacity for vaccine production and filling, thereby indirectly enhancing the demand for GMP-grade cell culture media.

UAE Viral Vaccine Cell Culture Media Market Trends

UAE is growing rapidly over the projected period. The viral vaccine cell culture media market of the United Arab Emirates is experiencing a continuous rise in revenue, which is backed by the country’s significant investments in cutting-edge healthcare infrastructure and its goal to be a biopharmaceutical hub in the region.

Top Players in the Viral Vaccine Cell Culture Media Market and Their Offerings

- Thermo Fisher Scientific

- Merck KGaA

- Lonza Group

- Corning Incorporated

- BD

- Sartorius AG

- Fujifilm Irvine Scientific

- GE Healthcare

- HiMedia Laboratories

- CellGenix GmbH

- ReproCELL Inc.

- Others

Key Developments

Viral vaccine cell culture media market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In October 2025: At the World Vaccine Congress Europe in Amsterdam, which is set for October 14-16, 2025, the Swedish biotech firm Cellevate presented its latest innovation, the Cellevated VAX nanofiber microcarriers. The new product from the company is a technology that can potentially make the production of cell-based viral vaccines more scalable and less costly by a great extent. (Source: https://www.biopharminternational.com/view/new-cellevate-nanofiber-microcarriers-aim-to-transform-vaccine-manufacturing-processes)

- In April 2025, the merger of Capricorn Scientific GmbH, which is the forerunner in the production of sterile cell culture media and animal-free powders, with florabio AS, a company headed by Dr. Aziz Cayli who is a globally recognized biotechnologist and has been in the field for more than 30 years, has paved the way for a very ingenious partnership. This union will enable the new media formulations, which will set standards in cell culture production areas in terms of both quality and quantity, to be the common fruit harvested by the global biotechnology and pharmaceutical industries. (Source: https://www.capricorn-scientific.com/en/news/2025/04-15_capricorn-scientific-florabio-partnership)

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast-growing Viral Vaccine Cell Culture Media market.

The Viral Vaccine Cell Culture Media Market is segmented as follows:

By Cell Culture Type

- Suspension Cell Culture

- Adherent Cell Culture

By Cell Culture Media

- Animal Component Free Media

- Protein Free Media

- Serum Free Media

By Scale of Operation

- Commercial

- Clinical

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Viral Vaccine Cell Culture Media Market, (2026 – 2035) (USD Billion)

- 2.2 Global Viral Vaccine Cell Culture Media Market: snapshot

- Chapter 3. Global Viral Vaccine Cell Culture Media Market – Industry Analysis

- 3.1 Viral Vaccine Cell Culture Media Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Rising Global Vaccine Production Capacity

- 3.2.2 Higher Outsourcing to CMOs/CDMOs

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Cell Culture Type

- 3.7.2 Market attractiveness analysis By Cell Culture Media

- 3.7.3 Market attractiveness analysis By Scale of Operation

- Chapter 4. Global Viral Vaccine Cell Culture Media Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Viral Vaccine Cell Culture Media Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Viral Vaccine Cell Culture Media Market – Cell Culture Type Analysis

- 5.1 Global Viral Vaccine Cell Culture Media Market overview: By Cell Culture Type

- 5.1.1 Global Viral Vaccine Cell Culture Media Market share, By Cell Culture Type, 2025 and 2035

- 5.2 Suspension Cell Culture

- 5.2.1 Global Viral Vaccine Cell Culture Media Market by Suspension Cell Culture, 2026 – 2035 (USD Billion)

- 5.3 Adherent Cell Culture

- 5.3.1 Global Viral Vaccine Cell Culture Media Market by Adherent Cell Culture, 2026 – 2035 (USD Billion)

- 5.1 Global Viral Vaccine Cell Culture Media Market overview: By Cell Culture Type

- Chapter 6. Global Viral Vaccine Cell Culture Media Market – Cell Culture Media Analysis

- 6.1 Global Viral Vaccine Cell Culture Media Market overview: By Cell Culture Media

- 6.1.1 Global Viral Vaccine Cell Culture Media Market share, By Cell Culture Media, 2025 and 2035

- 6.2 Animal Component Free Media

- 6.2.1 Global Viral Vaccine Cell Culture Media Market by Animal Component Free Media, 2026 – 2035 (USD Billion)

- 6.3 Protein Free Media

- 6.3.1 Global Viral Vaccine Cell Culture Media Market by Protein Free Media, 2026 – 2035 (USD Billion)

- 6.4 Serum Free Media

- 6.4.1 Global Viral Vaccine Cell Culture Media Market by Serum Free Media, 2026 – 2035 (USD Billion)

- 6.1 Global Viral Vaccine Cell Culture Media Market overview: By Cell Culture Media

- Chapter 7. Global Viral Vaccine Cell Culture Media Market – Scale of Operation Analysis

- 7.1 Global Viral Vaccine Cell Culture Media Market overview: By Scale of Operation

- 7.1.1 Global Viral Vaccine Cell Culture Media Market share, By Scale of Operation, 2025 and 2035

- 7.2 Commercial

- 7.2.1 Global Viral Vaccine Cell Culture Media Market by Commercial, 2026 – 2035 (USD Billion)

- 7.3 Clinical

- 7.3.1 Global Viral Vaccine Cell Culture Media Market by Clinical, 2026 – 2035 (USD Billion)

- 7.1 Global Viral Vaccine Cell Culture Media Market overview: By Scale of Operation

- Chapter 8. Viral Vaccine Cell Culture Media Market – Regional Analysis

- 8.1 Global Viral Vaccine Cell Culture Media Market Regional Overview

- 8.2 Global Viral Vaccine Cell Culture Media Market Share, by Region, 2025 & 2035 (USD Billion)

- 8.3. North America

- 8.3.1 North America Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.3.1.1 North America Viral Vaccine Cell Culture Media Market, by Country, 2026 – 2035 (USD Billion)

- 8.3.1 North America Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.4 North America Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035

- 8.4.1 North America Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 8.5 North America Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035

- 8.5.1 North America Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035 (USD Billion)

- 8.6 North America Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035

- 8.6.1 North America Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.7.1.1 Europe Viral Vaccine Cell Culture Media Market, by Country, 2026 – 2035 (USD Billion)

- 8.7.1 Europe Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.8 Europe Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035

- 8.8.1 Europe Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 8.9 Europe Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035

- 8.9.1 Europe Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035 (USD Billion)

- 8.10 Europe Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035

- 8.10.1 Europe Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.11.1.1 Asia Pacific Viral Vaccine Cell Culture Media Market, by Country, 2026 – 2035 (USD Billion)

- 8.11.1 Asia Pacific Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.12 Asia Pacific Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035

- 8.12.1 Asia Pacific Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 8.13 Asia Pacific Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035

- 8.13.1 Asia Pacific Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035 (USD Billion)

- 8.14 Asia Pacific Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035

- 8.14.1 Asia Pacific Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.15.1.1 Latin America Viral Vaccine Cell Culture Media Market, by Country, 2026 – 2035 (USD Billion)

- 8.15.1 Latin America Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.16 Latin America Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035

- 8.16.1 Latin America Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 8.17 Latin America Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035

- 8.17.1 Latin America Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035 (USD Billion)

- 8.18 Latin America Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035

- 8.18.1 Latin America Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Country, 2026 – 2035 (USD Billion)

- 8.19.1 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, 2026 – 2035 (USD Billion)

- 8.20 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035

- 8.20.1 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 8.21 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035

- 8.21.1 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Cell Culture Media, 2026 – 2035 (USD Billion)

- 8.22 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035

- 8.22.1 The Middle-East and Africa Viral Vaccine Cell Culture Media Market, by Scale of Operation, 2026 – 2035 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 Thermo Fisher Scientific

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 Merck KGaA

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 Lonza Group

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 Corning Incorporated

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 BD

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 Sartorius AG

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Fujifilm Irvine Scientific

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 GE Healthcare

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 HiMedia Laboratories

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 CellGenix GmbH

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 ReproCELL Inc.

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.12 Others.

- 9.12.1 Overview

- 9.12.2 Financials

- 9.12.3 Product Portfolio

- 9.12.4 Business Strategy

- 9.12.5 Recent Developments

- 9.1 Thermo Fisher Scientific

List Of Figures

Figures No 1 to 23

List Of Tables

Tables No 1 to 77

Prominent Player

- Thermo Fisher Scientific

- Merck KGaA

- Lonza Group

- Corning Incorporated

- BD

- Sartorius AG

- Fujifilm Irvine Scientific

- GE Healthcare

- HiMedia Laboratories

- CellGenix GmbH

- ReproCELL Inc.

- Others

FAQs

The key players in the market are Thermo Fisher Scientific, Merck KGaA, Lonza Group, Corning Incorporated, BD, Sartorius AG, Fujifilm Irvine Scientific, GE Healthcare, HiMedia Laboratories, CellGenix GmbH, ReproCELL Inc., Others.

Viral vaccine cell culture media market development is highly influenced by government regulations that have been playing a major part in product design, manufacturing, and the entire vaccine value chain by putting different adoption rates. The United States Food and Drug Administration, the European Medicines Agency, and the World Health Organization are some of the regulatory bodies that require vaccines to meet very high standards regarding safety, quality, and consistency; these same standards also apply to the media used in the viral production process.

The price point is the main factor that affects the market development and acceptance of the viral vaccine cell culture media. It has a direct impact on the manufacturing costs, selection of suppliers, and use of technology in different regions. The advanced media like serum-free, animal component-free, and chemically defined are usually priced high because of the higher R&D costs, strict quality control, and GMP compliance requirements.

According to the present analysis and forecast modeling, the market of viral vaccine cell culture media will witness a significant growth of about USD 3.5 billion in the year 2035 with the rising global vaccine production capacity, shift to serum-free/chemically-defined and single-use processes, and greater outsourcing to CMOs/CDMOs, with a CAGR of 6.2% between the years 2026 and 2035.

It is projected that North America will hold the largest market share in the viral vaccine cell culture media market in the forecast period, with a share of about 36% of the global market share, which is attributed to the growing product launch by the key market players and rising government initiatives.

The Asia Pacific is expected to grow at the highest CAGR over the forecast period. One more element fostering market growth is the surge of new local and global CMOs/CDMOs, together with the implementation of cutting-edge technologies such as serum-free and animal-component-free media and single-use bioreactors.

The development of capable production facilities in various parts of the world backed by supportive government policies and provision of funds for vaccine production and pandemic preparedness has resulted in a surge in demand for GMP-grade culture media which is an indispensable raw material for clinical and commercial vaccine production. The overall market expansion is also facilitated by new regions such as Asia-Pacific where vaccine manufacturing capacity is increasing at an unprecedented rate.