Cell Culture Media Storage Containers Market Size, Trends and Insights By Product (Storage Bags, Storage Bins & Drums, Storage Bottles, Others), By Application (Biopharmaceutical Production, Tissue Engineering and Regenerative Medicine, Diagnostics), By End-use (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, CROs & CMOs), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Saint Gobain

- Merck KGaA

- Sartorius AG

- VWR International LLC.

- Others

Reports Description

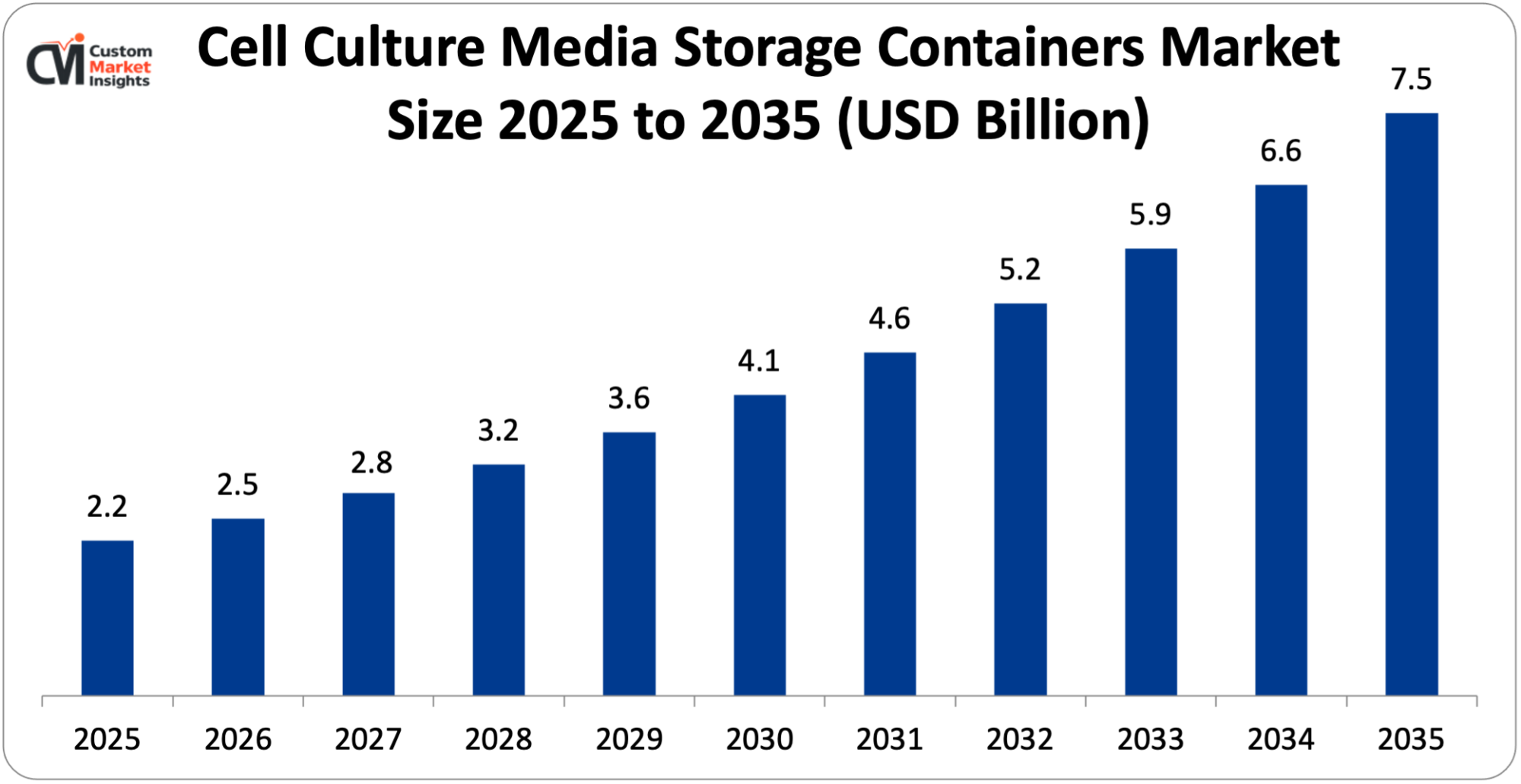

The market size of the global cell culture media storage containers will be estimated at USD 2.2 billion in 2025 and is expected to grow to between USD 2.5 billion in 2026 and about USD 7.5 billion by 2035 with a current CAGR of 12.8% during the period of 2026 to 2035.

There is a consistent and gradual increase in the cell culture media storage containers market, with the biopharmaceutical and life sciences sectors being the most significant contributors to this trend. The containers, which are represented by terms such as bottles, bags, bins, and drums, are of paramount importance in guaranteeing that cell culture media in the pharmaceutical, biotechnological research, diagnostics, and academic laboratories are stored securely, aseptically, and without contamination.

The need for storage containers that are resistant to chemicals, of high quality and compliant with the regulations has become a worldwide demand due to the increasing acceptance of cell-based experiments and the rising volume of biologics produced by conventional production methods.

Market Highlight

- North America had a market share of 36% and was the market leader in the cell culture media storage containers market in 2025.

- It is projected to have the highest growth rate across Asia Pacific in the years 2026-2035.

- By product, the adherent cell culture segment dominates the market with over 50% revenue share in 2025.

- By application, the serum free media held the largest market share of 37.8% in 2025.

Significant Growth Factors

The cell culture media storage containers market trends present significant growth opportunities due to several factors:

- Increased Life Science and Healthcare R&D Investments: The cell culture media storage containers market is primarily driven by the increase in life science and healthcare R&D investments. These investments are made by different sectors such as governments, pharmaceutical firms, and biotechnologists, who are continuously expanding their funding for drug discovery, biologics, and advanced therapeutic research among others. The growing investments in cell and gene therapy, for instance, have resulted in a huge increase in the volume of cell culture activities globally. Besides, each of these R&D processes necessitates the safe storage of large volumes of cell culture media under sterile and controlled conditions, which in turn leads to the increased demand for high-quality storage containers. The growth of research pipelines along with the expansion of laboratory infrastructure has made it easier for institutions to adopt standardized, single-use, and contamination-resistant media storage solutions to comply with the regulatory requirements and ensure reproducibility. Therefore, the increasing healthcare and life science R&D spending is resulting in greater use of cell culture media storage containers in research institutes, biopharma manufacturing facilities, and academic laboratories.

- Growth in Cell-Based Research & Therapies: The cell culture media storage containers market is primarily driven by factors such as the growth of cell-based research and therapies which is expected to continue during the forecast period. These therapies are among the hottest topics of research in regenerative medicine, stem cell research, immunotherapy, and gene therapy. Such cell culture process is quite intricate to the extent that apart from the usual requisites for the culture media, huge quantities of it have to be carefully handled, stored and preserved to keep the cells viable and consistent. The transition of research from small laboratory studies to large clinical trials and commercial production also leads to a significant rise in the demand for media storage containers that are reliable, sterile and scalable. Furthermore, the number of research institutes and biopharmaceutical companies working on cell-based innovations is on the rise, which, in turn, is the adoption of high-performance storage solutions for quality control and regulatory compliance. Thus, the cell culture media storage containers market is gradually increasing due to constant growth in cell-based research and therapeutic developments.

What are the Major Advances Changing the Cell Culture Media Storage Containers Market Today

- Rise of Single-Use and Disposable Storage Systems: The introduction of single-use and disposable storage systems today is one of the major factors driving the cell culture media storage containers market. On the part of the biopharmaceutical companies and research institutions, a shift from human and animal labor to single-use bags, bottles, and assemblies is seen for the reason of wanting better cleanliness control and faster processing. None of these disposable systems need cleaning, sterilization, and validation in between the batches; thus, they save time and money directly—an important benefit in multi-product facilities and fast-paced R&D environments. Moreover, single-use containers offer the process flexibility and scalability that allow the move from small-scale research to large-scale commercial production to be less difficult. Closed systems compatibility and regulatory norms adherence add further to the sterility assurance thus making them the first choice in sensitive applications such as cell and gene therapy, vaccine production, and regenerative medicine. So, the single-use and disposable storage solutions trend is of great importance and a major reason for the market growth.

- Cold Chain and Cryogenic Storage Enhancements: Cold chain and cryogenic storage are gradually evolving and thus becoming the main factors in the market for cell culture media storage containers’ transformation, as the latest version of biologics, such as cell and gene therapies, along with cellular, etc., are all claiming for that strict temperature control and long-term stability. Today’s storage containers, which are made from high-performance polymers and multilayer reinforced constructions, are able to tolerate very low temperatures without engaging in any actions that would spoil the quality of the product through cracking, leaching, or sterilizing. Due to these innovations, the media can be stored in refrigeration, frozen and cryogenic conditions, thus maintaining the chemical integrity and the cell culture media quality throughout the long storage and transport periods. In addition, sealing technologies and connections with automated cold chain logistics have been improved which positively contributes to the reduction of temperature fluctuations and contamination risks. Enhanced cold chain and cryogenic storage solutions are the ones that not only make the wide biopharmaceutical pipelines and the global distribution of sensitive biological materials more feasible but also are the ones that directly influence and encourage the innovations in the cell culture media storage containers market.

Category Wise Insights

By Product

Why Storage Bags Lead the Market?

The storage bags segment dominates the market with over 40% revenue share in 2025. The growth in the segment has mainly been attributed to its strong connection with modern bioprocessing and laboratory workflows. More and more, storage bags are being selected instead of rigid containers due to their advantageous characteristics like being light in weight, flexible, and coming in different sizes that match both small research and large biopharmaceutical production. Their use with single-use and disposable systems ensures that the risk of contamination is greatly reduced and at the same time, cleaning, sterilization and validation are no longer required, which impacts positively on the cost and time of production.

The storage bottles segment is expected to grow at the highest CAGR over the projected period. The pharmaceuticals and research sectors have embraced storage bottles for their practical benefits and as a result, the bottles have gained a continuous demand. The rugged bottles, made of heavy-duty and chemically resistant materials, can hold and contain various substances for research, diagnostics, and biopharmaceuticals without any leak or contamination during the whole process. Their non-compressible shape makes them ideal for applications needing accurate volume measurement, easy accessibility, and stable stacking or shelving. This situation is especially true for quality control labs and high-throughput environments where such factors are very critical. Furthermore, bottles, unlike flexible bags, can sometimes be more appropriate for the media in small or medium volumes that require frequent access without the risk of contaminating the container.

By Application

Why Biopharmaceutical Production Dominates the Cell Culture Media Storage Containers Market?

The biopharmaceutical production held the largest market share of more than 50% in 2025. The requirement for containers meant for cell culture media storage is going up and the biopharmaceutical industry, which is the major factor behind the market’s high revenue growth, is the primary reason for the increase. The global cell culture process for biopharmaceuticals will be one large-scale, brand-new process, and biologics, vaccines, and advanced therapeutic products are driving the market. The whole biological production and storage of culture media will be necessary at all stages of production in sterile and reliable ways. Thus, the industry is moving into high- volume production as it faces the patient population increase demanding more and quality products and on the regulatory authority’s side—their consistency and quality controls are high, thus, the great demand for high-performance storage containers—bags, bottles, and special combinations. Such containers have the potential for much higher sterility, much better control over contamination, and much more compatibility with automated and single-use bioprocessing workflows—such features are not only critical for the product but for the operation’s efficiency too.

The tissue engineering and regenerative medicine segment is expected to grow at the highest rate over the projected period. The market is boosted by the growing adoption of tissue engineering in patient treatment, like the implantation of organs, and the increasing awareness of personalized medicine. Furthermore, the population is getting more informed about regenerative medicines and cell & gene therapy, where the tissue or organ is developed in the lab conditions safely with the help of cell culture techniques. Hence, there will be a need for storage containers to prevent contamination, which in turn will fuel the growth of the cell culture media storage containers industry.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 2.5 billion |

| Projected Market Size in 2035 | USD 7.5 billion |

| Market Size in 2025 | USD 2.2 billion |

| CAGR Growth Rate | 12.8% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product, Application, End-use and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Cell Culture Media Storage Containers Market Size?

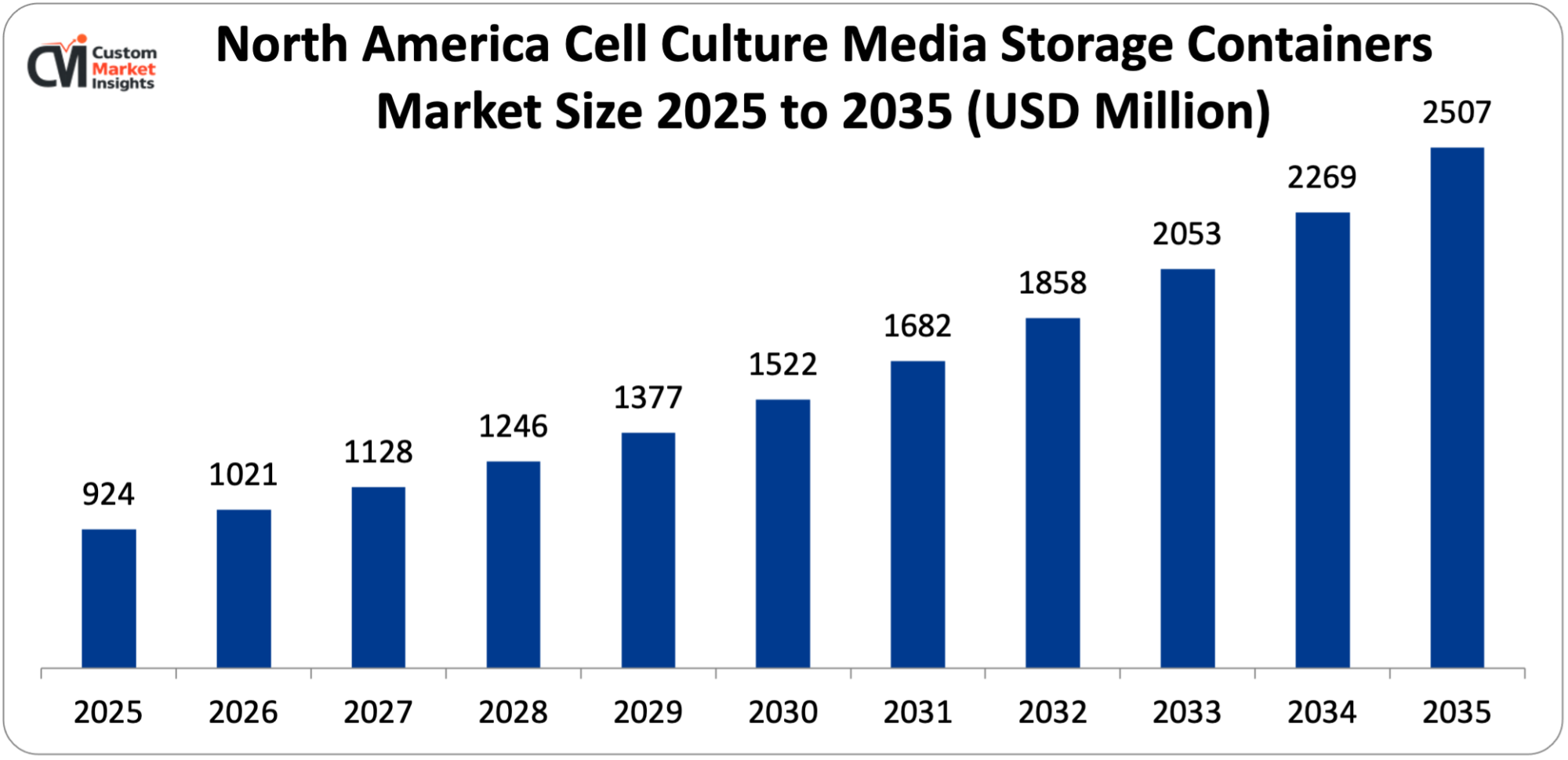

Its market size, in terms of North America Cell Culture Media Storage Containers, is projected to be USD 924 million in 2025 with a growth of about USD 2507 million in 2035 with a CAGR of 10.5% between 2026 and 2035.

Why did North America Dominate the Cell Culture Media Storage Containers Market in 2025?

In 2025, North America will dominate the global market with an estimated market share of 42%. Advanced healthcare and research infrastructure, which is very much present, strongly supports the widespread adoption of cell culture techs across various sectors, namely, pharmaceutical production companies, biotechnological firms, educational institutions, and contract research organizations. Furthermore, the North American market of biopharmaceuticals, which is very strong — consisting of vaccines, monoclonal antibodies, and cell and gene therapy — requires more and more sterile cell culture media and reliable storage solutions, thus indirectly increasing the demand for containers.

U.S. Cell Culture Media Storage Containers Market Trends

The US is expected to lead the cell culture media storage containers market over the analysis period. The US life science ecosystem is strong and highly supported, with a large share of the funding for research and development activities coming from pharmaceutical companies, biotech firms, and universities involved in cell culture, bioproducts, and advanced therapies. The ongoing R&D activity attracts the use of sterile and reliable storage systems that prevent stopping the media and cell cultures via complicated procedures.

Why is Asia Pacific Experiencing the Fastest Growth in the Cell Culture Media Storage Containers Market?

The Asia Pacific region is expected to grow at the highest CAGR of 13.5% during the projected period. Some of the leading factors that support the rapid expansion of the biopharmaceutical and biotechnology sector are the existence of unsecured opportunities, industrial growth, and improvement in the health sector’s infrastructure, besides the intervention of the government and manufacturers through the provision of incentives or favorable policies.

China Cell Culture Media Storage Containers Market Trends

The Chinese market has an extremely fast-growing market. The market is filled with domestic players in China. However, with the lowered value of production, global investment in manufacturing in this country is quite heavy.

Why is Europe is growing at a significant rate in the Cell Culture Media Storage Containers Market?

The European market is large and established. The cell culture media storage containers market in Europe is expected to witness a significant upswing due to the government’s enhanced regulatory endorsements for biologics & vaccines aimed at satisfying the ever-increasing demand. Besides, the major companies are already formulating plans for tackling and lessening the impact of potential drawbacks in the region.

UK Cell Culture Media Storage Containers Market Trends

In 2025, the UK cell culture media storage containers industry took a considerable market share. The presence of organizations like Cancer Research UK creates opportunities for the development of new cell culture media by studying the specific needs for growing cells. The research funding in the country helps in the use of cell culture products, thus increasing the demand for media storage containers.

Why is the Middle East & Africa Region is growing rapidly in the Cell Culture Media Storage Containers?

The MEA region has a minimum market share in 2025. The main factor behind the growth is increasing investments in the healthcare infrastructure and biotechnology research in the key MEA countries such as the UAE, South Africa, and Saudi Arabia, where both government and private sectors are not only making the life sciences ecosystems stronger but also backing up the advanced research initiatives.

UAE Cell Culture Media Storage Containers Market Trends

UAE is growing rapidly over the projected period. The UAE aims to be a regional leader in life sciences and research, which is why there is so much money going into healthcare innovation and biopharmaceuticals, resulting in this growth.

Top Players in the Cell Culture Media Storage Containers Market and Their Offerings

- Thermo Fisher Scientific Inc.

- Saint Gobain

- Merck KGaA

- Sartorius AG

- VWR International LLC.

- HiMedia Laboratories

- CYTIVA

- Greiner Bio-One International GmbH

- Corning Incorporated

- DiagnoCine LLC

- HiMedia Laboratories

- Luoyang Fudau Biotech Co. Ltd

- Tarsons Products Limited

- Starlab

- Others

Key Developments

Cell culture media storage containers market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In March 2025: Caron Scientific, Inc., an innovator for advanced environmental testing, incubation, and controlled atmosphere equipment, revealed their latest product, the 7406 Incubator Shaker, at the EU Advanced Therapies conference. The 7406 is the ultimate capacity single chamber Incubator Shaker with the most reduced footprint for cell culture. The vertical system leads to savings in lab and production floor space and the integrated construction ensures complete uniformity of the conditions throughout all levels of the system. (Source: https://caronscientific.com/news/caron-scientific-unveils-new-product-launch-the-7406-incubator-shaker)

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast-growing cell culture media storage containers market.

The Cell Culture Media Storage Containers Market is segmented as follows:

By Product

- Storage Bags

- Storage Bins & Drums

- Storage Bottles

- Others

By Application

- Biopharmaceutical Production

- Tissue Engineering and Regenerative Medicine

- Diagnostics

By End-use

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- CROs & CMOs

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Cell Culture Media Storage Containers Market, (2026 – 2035) (USD Billion)

- 2.2 Global Cell Culture Media Storage Containers Market: snapshot

- Chapter 3. Global Cell Culture Media Storage Containers Market – Industry Analysis

- 3.1 Cell Culture Media Storage Containers Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Increased Life Science and Healthcare R&D Investments

- 3.2.2 Growth in Cell-Based Research & Therapies

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product

- 3.7.2 Market attractiveness analysis By Application

- 3.7.3 Market attractiveness analysis By End-use

- Chapter 4. Global Cell Culture Media Storage Containers Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Cell Culture Media Storage Containers Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Cell Culture Media Storage Containers Market – Product Analysis

- 5.1 Global Cell Culture Media Storage Containers Market overview: By Product

- 5.1.1 Global Cell Culture Media Storage Containers Market share, By Product, 2025 and 2035

- 5.2 Storage Bags

- 5.2.1 Global Cell Culture Media Storage Containers Market by Storage Bags, 2026 – 2035 (USD Billion)

- 5.3 Storage Bins & Drums

- 5.3.1 Global Cell Culture Media Storage Containers Market by Storage Bins & Drums, 2026 – 2035 (USD Billion)

- 5.4 Storage Bottles

- 5.4.1 Global Cell Culture Media Storage Containers Market by Storage Bottles, 2026 – 2035 (USD Billion)

- 5.5 Others

- 5.5.1 Global Cell Culture Media Storage Containers Market by Others, 2026 – 2035 (USD Billion)

- 5.1 Global Cell Culture Media Storage Containers Market overview: By Product

- Chapter 6. Global Cell Culture Media Storage Containers Market – Application Analysis

- 6.1 Global Cell Culture Media Storage Containers Market overview: By Application

- 6.1.1 Global Cell Culture Media Storage Containers Market share, By Application, 2025 and 2035

- 6.2 Biopharmaceutical Production

- 6.2.1 Global Cell Culture Media Storage Containers Market by Biopharmaceutical Production, 2026 – 2035 (USD Billion)

- 6.3 Tissue Engineering and Regenerative Medicine

- 6.3.1 Global Cell Culture Media Storage Containers Market by Tissue Engineering and Regenerative Medicine, 2026 – 2035 (USD Billion)

- 6.4 Diagnostics

- 6.4.1 Global Cell Culture Media Storage Containers Market by Diagnostics, 2026 – 2035 (USD Billion)

- 6.1 Global Cell Culture Media Storage Containers Market overview: By Application

- Chapter 7. Global Cell Culture Media Storage Containers Market – End-use Analysis

- 7.1 Global Cell Culture Media Storage Containers Market overview: By End-use

- 7.1.1 Global Cell Culture Media Storage Containers Market share, By End-use, 2025 and 2035

- 7.2 Academic & Research Institutes

- 7.2.1 Global Cell Culture Media Storage Containers Market by Academic & Research Institutes, 2026 – 2035 (USD Billion)

- 7.3 Pharmaceutical & Biotechnology Companies

- 7.3.1 Global Cell Culture Media Storage Containers Market by Pharmaceutical & Biotechnology Companies, 2026 – 2035 (USD Billion)

- 7.4 CROs & CMOs

- 7.4.1 Global Cell Culture Media Storage Containers Market by CROs & CMOs, 2026 – 2035 (USD Billion)

- 7.1 Global Cell Culture Media Storage Containers Market overview: By End-use

- Chapter 8. Cell Culture Media Storage Containers Market – Regional Analysis

- 8.1 Global Cell Culture Media Storage Containers Market Regional Overview

- 8.2 Global Cell Culture Media Storage Containers Market Share, by Region, 2025 & 2035 (USD Billion)

- 8.3. North America

- 8.3.1 North America Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.3.1.1 North America Cell Culture Media Storage Containers Market, by Country, 2026 – 2035 (USD Billion)

- 8.3.1 North America Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.4 North America Cell Culture Media Storage Containers Market, by Product, 2026 – 2035

- 8.4.1 North America Cell Culture Media Storage Containers Market, by Product, 2026 – 2035 (USD Billion)

- 8.5 North America Cell Culture Media Storage Containers Market, by Application, 2026 – 2035

- 8.5.1 North America Cell Culture Media Storage Containers Market, by Application, 2026 – 2035 (USD Billion)

- 8.6 North America Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035

- 8.6.1 North America Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.7.1.1 Europe Cell Culture Media Storage Containers Market, by Country, 2026 – 2035 (USD Billion)

- 8.7.1 Europe Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.8 Europe Cell Culture Media Storage Containers Market, by Product, 2026 – 2035

- 8.8.1 Europe Cell Culture Media Storage Containers Market, by Product, 2026 – 2035 (USD Billion)

- 8.9 Europe Cell Culture Media Storage Containers Market, by Application, 2026 – 2035

- 8.9.1 Europe Cell Culture Media Storage Containers Market, by Application, 2026 – 2035 (USD Billion)

- 8.10 Europe Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035

- 8.10.1 Europe Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.11.1.1 Asia Pacific Cell Culture Media Storage Containers Market, by Country, 2026 – 2035 (USD Billion)

- 8.11.1 Asia Pacific Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.12 Asia Pacific Cell Culture Media Storage Containers Market, by Product, 2026 – 2035

- 8.12.1 Asia Pacific Cell Culture Media Storage Containers Market, by Product, 2026 – 2035 (USD Billion)

- 8.13 Asia Pacific Cell Culture Media Storage Containers Market, by Application, 2026 – 2035

- 8.13.1 Asia Pacific Cell Culture Media Storage Containers Market, by Application, 2026 – 2035 (USD Billion)

- 8.14 Asia Pacific Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035

- 8.14.1 Asia Pacific Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.15.1.1 Latin America Cell Culture Media Storage Containers Market, by Country, 2026 – 2035 (USD Billion)

- 8.15.1 Latin America Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.16 Latin America Cell Culture Media Storage Containers Market, by Product, 2026 – 2035

- 8.16.1 Latin America Cell Culture Media Storage Containers Market, by Product, 2026 – 2035 (USD Billion)

- 8.17 Latin America Cell Culture Media Storage Containers Market, by Application, 2026 – 2035

- 8.17.1 Latin America Cell Culture Media Storage Containers Market, by Application, 2026 – 2035 (USD Billion)

- 8.18 Latin America Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035

- 8.18.1 Latin America Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Cell Culture Media Storage Containers Market, by Country, 2026 – 2035 (USD Billion)

- 8.19.1 The Middle-East and Africa Cell Culture Media Storage Containers Market, 2026 – 2035 (USD Billion)

- 8.20 The Middle-East and Africa Cell Culture Media Storage Containers Market, by Product, 2026 – 2035

- 8.20.1 The Middle-East and Africa Cell Culture Media Storage Containers Market, by Product, 2026 – 2035 (USD Billion)

- 8.21 The Middle-East and Africa Cell Culture Media Storage Containers Market, by Application, 2026 – 2035

- 8.21.1 The Middle-East and Africa Cell Culture Media Storage Containers Market, by Application, 2026 – 2035 (USD Billion)

- 8.22 The Middle-East and Africa Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035

- 8.22.1 The Middle-East and Africa Cell Culture Media Storage Containers Market, by End-use, 2026 – 2035 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 Thermo Fisher Scientific Inc.

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 Saint Gobain

- 9.3 Merck KGaA

- 9.4 Sartorius AG

- 9.5 VWR International LLC.

- 9.6 HiMedia Laboratories

- 9.7 CYTIVA

- 9.8 Greiner Bio-One International GmbH

- 9.9 Corning Incorporated

- 9.10 DiagnoCine LLC

- 9.11 HiMedia Laboratories

- 9.12 Luoyang Fudau Biotech Co. Ltd

- 9.13 Tarsons Products Limited

- 9.14 Starlab

- 9.15 Others.

- 9.1 Thermo Fisher Scientific Inc.

List Of Figures

Figures No 1 to 26

List Of Tables

Tables No 1 to 77

Prominent Player

- Thermo Fisher Scientific Inc.

- Saint Gobain

- Merck KGaA

- Sartorius AG

- VWR International LLC.

- HiMedia Laboratories

- CYTIVA

- Greiner Bio-One International GmbH

- Corning Incorporated

- DiagnoCine LLC

- HiMedia Laboratories

- Luoyang Fudau Biotech Co. Ltd

- Tarsons Products Limited

- Starlab

- Others

FAQs

The key players in the market are Thermo Fisher Scientific Inc., Saint Gobain, Merck KGaA, Sartorius AG, VWR International LLC, HiMedia Laboratories, CYTIVA, Greiner Bio-One International GmbH, Corning Incorporated, DiagnoCine LLC, HiMedia Laboratories, Luoyang Fudau Biotech Co. Ltd, Tarsons Products Limited, Starlab, Others.

The market for storage containers for cell culture media has been influenced significantly by government regulations which, among other things, require the pharmaceutical and life science sectors to adhere to stringent safety, sterility, quality, and traceability measures. The authorities like the FDA, EMA, and other health departments worldwide have made it obligatory for the manufacturers to follow Good Manufacturing Practices (GMP) that dictate the characteristics of storage containers to be non-toxic, free of any contamination, and suitable for given bioprocessing workflows.

The price point is a major factor in shaping the market growth and the use of cell culture media storage containers since the purchase decision is heavily linked to the budget, the scale of the business and the importance of the application. Typically, high-quality containers for single-use bioprocessing, cryogenic storage, or GMP-compliant production are pricy because of the latest materials, sterilization technology, and compliance with regulatory standards.

According to the present analysis and forecast modeling, the market of cell culture media storage containers will witness a significant growth of about USD 7.5 billion in the year 2035 with the rising demand for biopharmaceuticals, growth in cell-based research & therapies, and increased life science and healthcare R&D investments with a CAGR of 12.8% between the years 2026 and 2035.

It is projected that North America will hold the largest market share in the cell culture media storage containers market in the forecast period, with a share of about 42% of the global market share, which is attributed to the growing product launch by the key market players and robust life science industry.

The Asia Pacific is expected to grow at the highest CAGR of 13.5% over the forecast period. The regional growth is owing to the growth in cell-based research & therapies and investment in healthcare infrastructure.

The storage container market for cell culture media is experiencing a constant rise which is primarily due to the rapid growth of the biopharmaceutical and life sciences industries. These containers like bottles, bags, bins, and drums are the ones that ensure the safe sterile and contamination-free storage of cell culture media, which is used in the production of drugs, research in biotechnology, diagnostics, and academic labs.