Cell Freezing Media Market Size, Trends and Insights By Product (DMSO, Glycerol, Others), By Type (Slow Freezing, Vitrification), By Cell Culture Type (2D Cell Culture, Suspension Cell Culture, 3D Cell Culture, Others), By Application (Stem Cells, Cancer Cell Lines, Reproductive Cells, Bioproduction Cell Lines, Primary Cells, Others), By End Use (Pharmaceuticals and Biotechnology Companies, Academic and Research Institutes, Biobanks, IVF Clinics, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Vitrolife AB

- Bio-Life Solutions Inc.

- HiMedia Laboratories

- Thermo Fisher Scientific Inc.

- Others

Reports Description

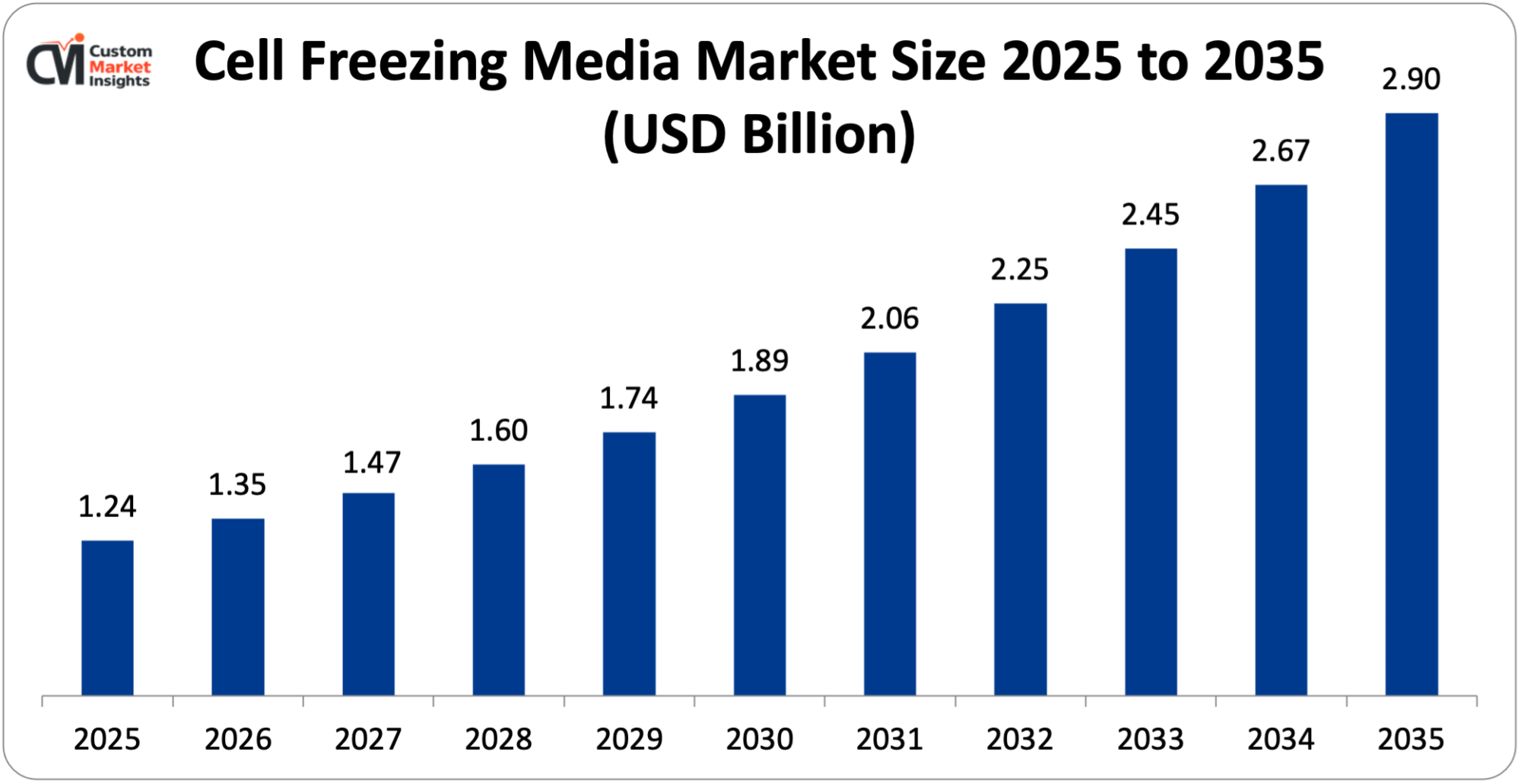

The market size of the global cell freezing media will be estimated at USD 1.24 billion in 2025 and is expected to grow between USD 1.35 billion in 2026 and about USD 2.90 billion by 2035 with a current CAGR of 8.9% during the period of 2026 to 2035.

The cell freezing media market is witnessing constant growth that is mainly supported by the quick development of cell- and gene-based therapies, regenerative medicine, and stem cell research, all of which need good cryopreservation to keep the cells alive and functional during the long storage periods.

Market Highlight

- North America had a market share of 38% and was the market leader in the Cell Freezing Media market in 2025.

- It is projected to have the highest growth rate of 10.5% across Asia Pacific in the years 2026-2035.

- By product, the DMSO segment is expected to hold the largest market share in 2025 of over 70%.

- By Type, the slow freezing is expected to dominate the cell freezing media market over the projected period.

- By Cell Culture Type, the suspension cell culture segment dominates the market with 47.5% of the revenue share.

Significant Growth Factors

The Cell Freezing Media Market Trends present significant growth opportunities due to several factors:

- Rise of Cell & Gene Therapies and Regenerative Medicine: Cell and gene therapies along with regenerative medicine are the main reasons for the growth of the cell freezing media market. These modern therapies rely on effective cryopreservation to keep cells alive, stable, and therapeutically effective during production, storage, transport, and clinical use, which is a process that unites the main ingredients of the cell freezing media market, the cell and gene therapies, and regenerative medicine treatments. Products coming from cells like stem cells, CAR-T cells, and other genetically modified cells will only be with us if the freezing solutions are very precise and reliable; otherwise, they would be damaged by ultra-low-temperature storage and freeze-thaw cycles. The Global investment in regenerative medicine has risen and the number of cell and gene therapy clinical trials continues to rise, which eventually leads to a higher demand for high-quality, GMP-compliant, and ready-to-use cell freezing media. In addition, the situation of needing long-term storage of master cell banks, working cell banks, and patient-specific cell samples makes it even harder for the freezing media to keep up with the advanced cell freezing, thus, the market growth won’t likely slow down anytime soon.

- Expansion of Biobanking & Sample Repositories: The major reason for the growth of the market is the establishment of biobanks and sample repositories, which have become a huge factor for the growth of the market, and these places also need dependable cryopreservation solutions to maintain the long-term viability and quality of the biological specimens. Biobanks keep a variety of specimens like stem cells, primary cells, blood parts, tissues, and DNA, and the materials are for the use of clinical research, drug discovery, diagnostics, and personalized medicine. Governments, research entities, and health care providers are investing more and more in giant biobanks to aid in the studies of the health of populations and the initiatives of precision medicine; thus, the demand for good quality and standard cell freezing media is increasing. In addition, the requirement for similar post-thaw cell recovery, the decrease in the risk of contamination, and the compliance with regulatory and quality standards are among the reasons that push biobanks to opt for commercially validated, ready-to-use freezing media, and this, in turn, is speeding up the overall market growth. For instance, in April 2025, Galatea Bio, an AI-centric genomic research and clinical genetic testing pioneer, won $25 million in funding in the process of next-generation genetic analysis, biomarker discovery, and multi-omics disease modeling. Not only is Galatea Bio dealing with precision health at a large scale for everyone, but also the company is enlarging the Biobank of the Americas into the Galatea Global Biobank, which is a groundbreaking initiative to sequence 10 million individuals around the world—especially those of non-European ancestry—to open up new avenues of research in human health.

What are the Major Advances Changing the Cell Freezing Media Market Today

- Shift Toward DMSO-free and low-DMSO Formulations: One of the most important developments in the freezing media for the cell market is the shift away from DMSO and the use of low-DMSO formulations. The major reason for this switch has been the increasing concern over dimethyl sulfoxide (DMSO) cytotoxicity and side effects, particularly in clinical and therapeutic applications. Although DMSO has been consistently rated the best cryoprotectant due to its capability to prevent ice crystal formation, it still has some drawbacks such as patient adverse reactions and significantly reducing the viability of some cell types during the freezing and thawing process. Thus, companies are trying to develop new ‘safe’ alternative formulations to DMSO with the same quality of post-thaw cell viability. These would mean better, improved, and more regulatory and patient-friendly acceptance. This shift is necessary in the cell and gene therapy field where the complete use of DMSO or even its reduced form is not allowed. This leads to the need for downstream processing simplification, fewer washing steps, overall treatment outcome enhancement, and, therefore, the broader acceptance of next-generation freezing media for cells.

- Increased Automation and Scalability Support: The cell freezing media market has been revolutionized by increased automation and scalable support, since the industry is transitioning from small-scale research to large-scale clinical and commercial cell therapy manufacturing. Today’s cell freezing media are being designed for smooth operation all through the automated, closed, and high-throughput systems where manual handling, variability, and contamination are completely eliminated. This breakthrough promotes the automatic integration of different machines such as automated fill-finish lines, controlled-rate freezers, and large-volume biobanking operations. As the demand for patient-specific and off-the-shelf cell therapies increases, scalable freezing media that ensure the same cell viability across different batches and volumes are becoming mandatory for the manufacturers, biobanks, and CDMOs in order to improve their efficiency, regulatory compliance, and cost-effectiveness while still being able to meet the growing production needs.

Category Wise Insights

By Product

Why DMSO Lead the Market?

The DMSO segment is expected to hold the largest market share in 2025 of over 70%. The gold standard established over the years through the use of DMSO in traditional cryopreservation for maintaining intracellular activity of cells is the reason why DMSO is the significant player in cryobiology because of its high dissolution and no-polarity properties. It prevents the formation of ice crystals inside and outside of the cells at freezing temperatures, which is why DMSO is known as the most popular cryoprotectant among all its freezing properties. For example, in October 2024, Nucleus Biologics presented NB-KUL DF: a DMSO-free and chemically defined cryomedia with a promise to change the landscape of cell and gene therapy and thus provide a breakthrough in the area of cryopreservation.

The glycerol segment is expected to grow at the highest CAGR over the projected period. In the market for cell cryopreservation, the formulations based on glycerol are slowly but surely growing their revenue, especially in the areas where blood cells, sperm, yeast, and some microbial as well as primary cell types are involved. Glycerol, since it has been proven effective as a cryoprotectant for long, has been the major formulation for such applications. The revenue growth of cell freezing media containing glycerol is mainly due to its lower toxicity when compared to DMSO, higher acceptance in some clinical and laboratory environments, and strong penetration into blood banks, reproductive medicine, and biobanking applications. Glycerol’s affordability, chemical stability, and suitability for large-volume fluorscien Pre (%) fertilization makes it a perfect candidate for high-throughput and long-term storage sorts, thus keeping its demand in the market alive.non-polarity

By Type

Why Slow Freezing Dominates the Cell Freezing Media Market?

The slow freezing is expected to dominate the cell freezing media market over the projected period. The growth in this segment can be attributed to its broad applicability, reliability, and compatibility with the majority of commercially available freezing media for cells. Stem cells, primary cells, cell lines, blood cells, and immune cells are all extensively used in slow cooling that gradually lowers the temperature to control ice crystal formation, which is the preferred method all over the world in research laboratories, biobanks, hospitals, and biopharma manufacturing facilities. The main factor behind the revenue increase is the technique’s cost-effectiveness, simplicity in standardization, and high post-thaw cell viability proven with a combination of optimized freezing media.

The vitrification segment is expected to grow at the highest rate over the projected period. The main factor behind the growth is the company’s capability of ultra-rapid cooling, which avoids ice crystal formation and results in excellent post-thaw viability of very sensitive cells. This method is being used more and more in reproductive medicine (oocytes and embryos), stem cell preservation, and certain clinical and research applications where the use of conventional slow freezing might deteriorate cell quality.

By Cell Culture Type

Why Suspension Cell Culture Dominate Cell Freezing Media Market?

The suspension cell culture segment dominates the market with 47.5% of the revenue share. The expansion in this segment is attributed to the fact that it is a major player in the bioproduction and research applications market. The suspension culture method is preferred for its ease of scale-up and uniform distribution of nutrients, as well as its compatibility with the automated bioreactor systems which have made it suitable for the large-scale production of vaccines, monoclonal antibodies, and recombinant proteins. The technology’s strength is that it does not depend on surface area for growth, which leads to improved efficiency and cost savings. Meanwhile, the demand from the biopharmaceutical industry, regenerative medicine, and cell-based research is constantly increasing, hence the continued growth of this segment’s market share.

The 3D cell culture segment is growing at the fastest rate during the analysis period. AI models for research purposes are already being used in drug discovery, cancer research, toxicology testing, and regenerative medicine. 3D cell cultures, which are quite a bit more expensive than traditional 2D cultures, are now increasingly accepted in predictive and translational research because they accurately imitate the in vivo tissue architecture and cellular behavior. The transition is being made possible through the necessitating of specialized cell freezing media that can keep the complex 3D structures of spheroids, organoids, and scaffold-based cultures without losing their viability or functionality post-thawing.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 1.35 billion |

| Projected Market Size in 2035 | USD 2.90 billion |

| Market Size in 2025 | USD 1.24 billion |

| CAGR Growth Rate | 8.9% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product, Type, Cell Culture Type, Application, End Use and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Cell Freezing Media Market Size?

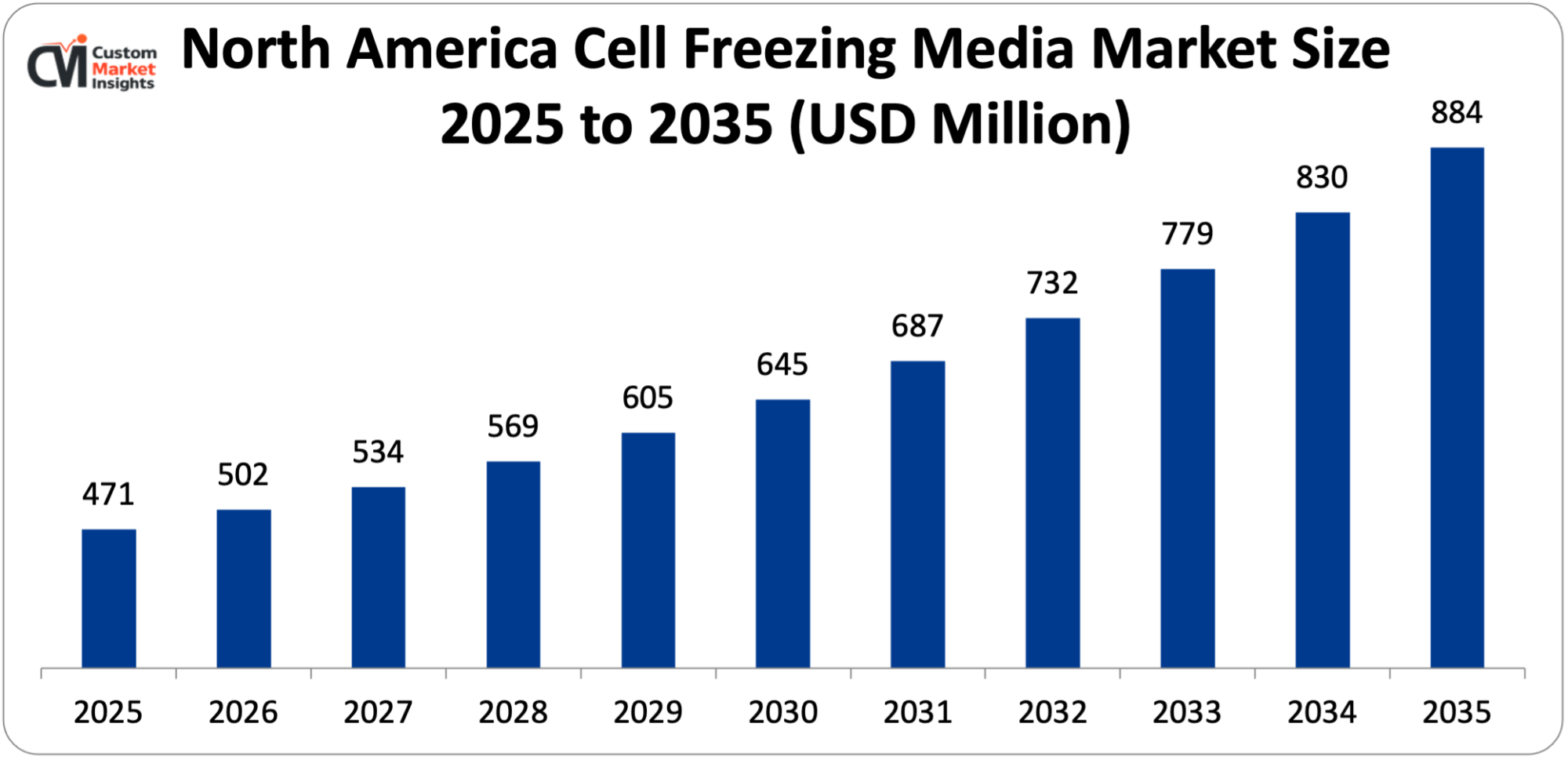

Its market size, in terms of North America Cell Freezing Media, is projected to be USD 471 million in 2025 with a growth of about USD 884 million in 2035 with a CAGR of 6.5% between 2026 and 2035.

Why did North America Dominate the Cell Freezing Media Market in 2025?

In 2025, North America will dominate the global market with an estimated market share of 38%, boosted by its well-established biotech and pharma ecosystem and quick adoption of ultramodern life-science technologies. The area is teeming with cell and gene therapy developers, biobanks, academic research institutes, and contract research and development organizations (CROs/CDMOs), and all these entities are very much dependent on dependable cryopreservation methods for research, clinical trials, and commercial production.

U.S. Cell Freezing Media Market Trends

The US is expected to lead the cell freezing media market over the analysis period owing to the increasing investment in the cell freezing media facility. For instance, in November 2022, Fujifilm made an investment of $188 million for the establishment of a cell culture media production plant in North Carolina, which is aimed at catering to the biopharmaceutical sector’s anticipated increase in demand. The 250,000 square feet of this plant will manufacture both liquid and powder forms of media that help in the cell growth of biologics and advanced therapies. When it becomes operational in 2025, it will be able to manufacture three times more liquid media as compared to the company’s current capacity.

Why is Asia Pacific Experiencing the Fastest Growth in the Cell Freezing Media Market?

It is estimated that the Asia-Pacific region will have the highest growth with a CAGR of 10.5% between the years 2026 and 2035. The expansion of cell freezing media usage seems to have the largest impact on the area which comes from the rapid growth of the key economies’ biotechnology research, pharmaceutical production, and clinical trials. Apart from that, the growth of the regions’ CROs and CDMOs combined with their economical manufacturing and the increasing use of cell and gene therapies for cancer and orphan diseases are other factors driving the revenue growth in the region.

China Cell Freezing Media Market Trends

The Chinese market has an extremely fast-growing market. The rapidly growing biopharmaceutical industry, big investments in regenerative medicine, and the opening of new biobanks are the three factors that mainly contributed to China’s being one of the fastest-growing markets globally. Some government programs, such as “Made in China 2025” and more money for stem cell and gene therapy research, plus the use of GMP-compliant, serum-free, and xeno-free solutions, are the main reasons why China is among the fastest-growing markets. Furthermore, the NMPA regulations are getting stricter, and collaborations in stem cell banking, CAR-T therapy, and precision medicine are proliferating.

Why is Europe is growing at a significant rate in the Cell Freezing Media Market?

The European market is large and established. The growth of the market accompanying the European cell and gene therapy industry is mainly due to the implementation of regulations that are supportive, cutting-edge biomedical research infrastructure, and the regional increase in use of cell and gene therapies. Europe has a network of academic research institutions, biopharmaceutical companies, and biobanks that are well-established and therefore, they all need the best and standardized cryopreservation solutions.

UK Cell Freezing Media Market Trends

In 2025, the UK Cell Freezing Media industry took a considerable market share. The UK has established itself as a leader in biomedical sciences through various means, such as having a robust biomedical research foundation, state-of-the-art biobanking, and leading in cell and gene therapies. The government and UK Biobank projects are major funding sources, along with the strict quality regulations imposed by the MHRA, which altogether boost the implementation of GMP-compliant, serum-free, and xeno-free methods. For example, in January 2025, the National Institute for Health and Care Excellence (NICE) gave a green light to the CRISPR-based gene-editing therapy for sickle cell disease called Casgevy, which is a strong indicator of the UK’s progressive approach towards regenerative medicine since the therapy is going to be applied within the NHS.

Why is the Middle East & Africa Region is growing rapidly in the Cell Freezing Media?

In the Middle East and Africa area, the biobanking and biomedical industries of the region are on the way to gaining a new upgrade in terms of the resources allocated to them, and at the same time, $1.5 billion worth of investment has already been poured into this sector of the industry. The Gulf Cooperation Council (GCC) countries are set to be the ones leading the development of the industry once more, as they have already invested heavily in the foundations of the research sector, including the research labs, universities, and diagnostic centers. It is the governments that will continue to support the industry through life-science innovation and precision medicine programs.

UAE Cell Freezing Media Market Trends

UAE is growing rapidly over the projected period. Healthcare modernization, biomedical research, and high-tech lab infrastructure are the main investments contributing significantly to the sector’s growth. The UAE government’s commitment to precision medicine, regenerative therapies, and biobanking methods, coupled with national health strategies and innovation-driven policies, has, in turn, increased the demand for trustworthy cryopreservation solutions.

Top Players in the Cell Freezing Media Market and Their Offerings

- Vitrolife AB

- Bio-Life Solutions Inc.

- HiMedia Laboratories

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Bio-Techne

- PromoCell GmbH

- Capricorn Scientific

- Merck KGaA

- AMSBIO

- ZENOGEN PHARMA CO. LTD.

- Others

Key Developments

Cell Freezing Media Market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In April 2024: Pluristyx, the prominent supplier of cellular therapies related tools, technologies, and services, declared the introduction of its proprietary cryopreservation medium solution, PluriFreeze™. The product is now accessible in a Research Use Only (RUO) formulation, and a Good Manufacturing Practice (GMP) version is being planned. PluriFreeze™ is not just another product but ranks high among the panCELLa™ Platform of Pluristyx, which is primarily intended for iPSC therapeutic development, however, it is quite applicable for other delicate cell types as well. (Source: https://pluristyx.com/pluristyx-launches-plurifreeze-cryopreservation-media-to-accelerate-stem-cell-therapy-development/)

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast growing Cell Freezing Media Market.

The Cell Freezing Media Market is segmented as follows:

By Product

- DMSO

- Glycerol

- Others

By Type

- Slow Freezing

- Vitrification

By Cell Culture Type

- 2D Cell Culture

- Suspension Cell Culture

- 3D Cell Culture

- Others

By Application

- Stem Cells

- Cancer Cell Lines

- Reproductive Cells

- Bioproduction Cell Lines

- Primary Cells

- Others

By End Use

- Pharmaceuticals and Biotechnology Companies

- Academic and Research Institutes

- Biobanks

- IVF Clinics

- Others

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Cell Freezing Media Market, (2026 – 2035) (USD Billion)

- 2.2 Global Cell Freezing Media Market: snapshot

- Chapter 3. Global Cell Freezing Media Market – Industry Analysis

- 3.1 Cell Freezing Media Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Rise of Cell & Gene Therapies and Regenerative Medicine

- 3.2.2 Expansion of Biobanking & Sample Repositories

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product

- 3.7.2 Market attractiveness analysis By Type

- 3.7.3 Market attractiveness analysis By Cell Culture Type

- 3.7.4 Market attractiveness analysis By Application

- 3.7.5 Market attractiveness analysis By End Use

- Chapter 4. Global Cell Freezing Media Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Cell Freezing Media Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Cell Freezing Media Market – Product Analysis

- 5.1 Global Cell Freezing Media Market overview: By Product

- 5.1.1 Global Cell Freezing Media Market share, By Product, 2025 and 2035

- 5.2 DMSO

- 5.2.1 Global Cell Freezing Media Market by DMSO, 2026 – 2035 (USD Billion)

- 5.3 Glycerol

- 5.3.1 Global Cell Freezing Media Market by Glycerol, 2026 – 2035 (USD Billion)

- 5.4 Others

- 5.4.1 Global Cell Freezing Media Market by Others, 2026 – 2035 (USD Billion)

- 5.1 Global Cell Freezing Media Market overview: By Product

- Chapter 6. Global Cell Freezing Media Market – Type Analysis

- 6.1 Global Cell Freezing Media Market overview: By Type

- 6.1.1 Global Cell Freezing Media Market share, By Type, 2025 and 2035

- 6.2 Slow Freezing

- 6.2.1 Global Cell Freezing Media Market by Slow Freezing, 2026 – 2035 (USD Billion)

- 6.3 Vitrification

- 6.3.1 Global Cell Freezing Media Market by Vitrification, 2026 – 2035 (USD Billion)

- 6.1 Global Cell Freezing Media Market overview: By Type

- Chapter 7. Global Cell Freezing Media Market – Cell Culture Type Analysis

- 7.1 Global Cell Freezing Media Market overview: By Cell Culture Type

- 7.1.1 Global Cell Freezing Media Market share, By Cell Culture Type, 2025 and 2035

- 7.2 2D Cell Culture

- 7.2.1 Global Cell Freezing Media Market by 2D Cell Culture, 2026 – 2035 (USD Billion)

- 7.3 Suspension Cell Culture

- 7.3.1 Global Cell Freezing Media Market by Suspension Cell Culture, 2026 – 2035 (USD Billion)

- 7.4 3D Cell Culture

- 7.4.1 Global Cell Freezing Media Market by 3D Cell Culture, 2026 – 2035 (USD Billion)

- 7.5 Others

- 7.5.1 Global Cell Freezing Media Market by Others, 2026 – 2035 (USD Billion)

- 7.1 Global Cell Freezing Media Market overview: By Cell Culture Type

- Chapter 8. Global Cell Freezing Media Market – Application Analysis

- 8.1 Global Cell Freezing Media Market overview: By Application

- 8.1.1 Global Cell Freezing Media Market share, By Application, 2025 and 2035

- 8.2 Stem Cells

- 8.2.1 Global Cell Freezing Media Market by Stem Cells, 2026 – 2035 (USD Billion)

- 8.3 Cancer Cell Lines

- 8.3.1 Global Cell Freezing Media Market by Cancer Cell Lines, 2026 – 2035 (USD Billion)

- 8.4 Reproductive Cells

- 8.4.1 Global Cell Freezing Media Market by Reproductive Cells, 2026 – 2035 (USD Billion)

- 8.5 Bioproduction Cell Lines

- 8.5.1 Global Cell Freezing Media Market by Bioproduction Cell Lines, 2026 – 2035 (USD Billion)

- 8.6 Primary Cells

- 8.6.1 Global Cell Freezing Media Market by Primary Cells, 2026 – 2035 (USD Billion)

- 8.7 Others

- 8.7.1 Global Cell Freezing Media Market by Others, 2026 – 2035 (USD Billion)

- 8.1 Global Cell Freezing Media Market overview: By Application

- Chapter 9. Global Cell Freezing Media Market – End Use Analysis

- 9.1 Global Cell Freezing Media Market overview: By End Use

- 9.1.1 Global Cell Freezing Media Market share, By End Use, 2025 and 2035

- 9.2 Pharmaceuticals and Biotechnology Companies

- 9.2.1 Global Cell Freezing Media Market by Pharmaceuticals and Biotechnology Companies, 2026 – 2035 (USD Billion)

- 9.3 Academic and Research Institutes

- 9.3.1 Global Cell Freezing Media Market by Academic and Research Institutes, 2026 – 2035 (USD Billion)

- 9.4 Biobanks

- 9.4.1 Global Cell Freezing Media Market by Biobanks, 2026 – 2035 (USD Billion)

- 9.5 IVF Clinics

- 9.5.1 Global Cell Freezing Media Market by IVF Clinics, 2026 – 2035 (USD Billion)

- 9.6 Others

- 9.6.1 Global Cell Freezing Media Market by Others, 2026 – 2035 (USD Billion)

- 9.1 Global Cell Freezing Media Market overview: By End Use

- Chapter 10. Cell Freezing Media Market – Regional Analysis

- 10.1 Global Cell Freezing Media Market Regional Overview

- 10.2 Global Cell Freezing Media Market Share, by Region, 2025 & 2035 (USD Billion)

- 10.3. North America

- 10.3.1 North America Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.3.1.1 North America Cell Freezing Media Market, by Country, 2026 – 2035 (USD Billion)

- 10.3.1 North America Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.4 North America Cell Freezing Media Market, by Product, 2026 – 2035

- 10.4.1 North America Cell Freezing Media Market, by Product, 2026 – 2035 (USD Billion)

- 10.5 North America Cell Freezing Media Market, by Type, 2026 – 2035

- 10.5.1 North America Cell Freezing Media Market, by Type, 2026 – 2035 (USD Billion)

- 10.6 North America Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035

- 10.6.1 North America Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 10.7 North America Cell Freezing Media Market, by Application, 2026 – 2035

- 10.7.1 North America Cell Freezing Media Market, by Application, 2026 – 2035 (USD Billion)

- 10.8 North America Cell Freezing Media Market, by End Use, 2026 – 2035

- 10.8.1 North America Cell Freezing Media Market, by End Use, 2026 – 2035 (USD Billion)

- 10.9. Europe

- 10.9.1 Europe Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.9.1.1 Europe Cell Freezing Media Market, by Country, 2026 – 2035 (USD Billion)

- 10.9.1 Europe Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.10 Europe Cell Freezing Media Market, by Product, 2026 – 2035

- 10.10.1 Europe Cell Freezing Media Market, by Product, 2026 – 2035 (USD Billion)

- 10.11 Europe Cell Freezing Media Market, by Type, 2026 – 2035

- 10.11.1 Europe Cell Freezing Media Market, by Type, 2026 – 2035 (USD Billion)

- 10.12 Europe Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035

- 10.12.1 Europe Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 10.13 Europe Cell Freezing Media Market, by Application, 2026 – 2035

- 10.13.1 Europe Cell Freezing Media Market, by Application, 2026 – 2035 (USD Billion)

- 10.14 Europe Cell Freezing Media Market, by End Use, 2026 – 2035

- 10.14.1 Europe Cell Freezing Media Market, by End Use, 2026 – 2035 (USD Billion)

- 10.15. Asia Pacific

- 10.15.1 Asia Pacific Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.15.1.1 Asia Pacific Cell Freezing Media Market, by Country, 2026 – 2035 (USD Billion)

- 10.15.1 Asia Pacific Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.16 Asia Pacific Cell Freezing Media Market, by Product, 2026 – 2035

- 10.16.1 Asia Pacific Cell Freezing Media Market, by Product, 2026 – 2035 (USD Billion)

- 10.17 Asia Pacific Cell Freezing Media Market, by Type, 2026 – 2035

- 10.17.1 Asia Pacific Cell Freezing Media Market, by Type, 2026 – 2035 (USD Billion)

- 10.18 Asia Pacific Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035

- 10.18.1 Asia Pacific Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 10.19 Asia Pacific Cell Freezing Media Market, by Application, 2026 – 2035

- 10.19.1 Asia Pacific Cell Freezing Media Market, by Application, 2026 – 2035 (USD Billion)

- 10.20 Asia Pacific Cell Freezing Media Market, by End Use, 2026 – 2035

- 10.20.1 Asia Pacific Cell Freezing Media Market, by End Use, 2026 – 2035 (USD Billion)

- 10.21. Latin America

- 10.21.1 Latin America Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.21.1.1 Latin America Cell Freezing Media Market, by Country, 2026 – 2035 (USD Billion)

- 10.21.1 Latin America Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.22 Latin America Cell Freezing Media Market, by Product, 2026 – 2035

- 10.22.1 Latin America Cell Freezing Media Market, by Product, 2026 – 2035 (USD Billion)

- 10.23 Latin America Cell Freezing Media Market, by Type, 2026 – 2035

- 10.23.1 Latin America Cell Freezing Media Market, by Type, 2026 – 2035 (USD Billion)

- 10.24 Latin America Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035

- 10.24.1 Latin America Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 10.25 Latin America Cell Freezing Media Market, by Application, 2026 – 2035

- 10.25.1 Latin America Cell Freezing Media Market, by Application, 2026 – 2035 (USD Billion)

- 10.26 Latin America Cell Freezing Media Market, by End Use, 2026 – 2035

- 10.26.1 Latin America Cell Freezing Media Market, by End Use, 2026 – 2035 (USD Billion)

- 10.27. The Middle-East and Africa

- 10.27.1 The Middle-East and Africa Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.27.1.1 The Middle-East and Africa Cell Freezing Media Market, by Country, 2026 – 2035 (USD Billion)

- 10.27.1 The Middle-East and Africa Cell Freezing Media Market, 2026 – 2035 (USD Billion)

- 10.28 The Middle-East and Africa Cell Freezing Media Market, by Product, 2026 – 2035

- 10.28.1 The Middle-East and Africa Cell Freezing Media Market, by Product, 2026 – 2035 (USD Billion)

- 10.29 The Middle-East and Africa Cell Freezing Media Market, by Type, 2026 – 2035

- 10.29.1 The Middle-East and Africa Cell Freezing Media Market, by Type, 2026 – 2035 (USD Billion)

- 10.30 The Middle-East and Africa Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035

- 10.30.1 The Middle-East and Africa Cell Freezing Media Market, by Cell Culture Type, 2026 – 2035 (USD Billion)

- 10.31 The Middle-East and Africa Cell Freezing Media Market, by Application, 2026 – 2035

- 10.31.1 The Middle-East and Africa Cell Freezing Media Market, by Application, 2026 – 2035 (USD Billion)

- 10.32 The Middle-East and Africa Cell Freezing Media Market, by End Use, 2026 – 2035

- 10.32.1 The Middle-East and Africa Cell Freezing Media Market, by End Use, 2026 – 2035 (USD Billion)

- Chapter 11. Company Profiles

- 11.1 Vitrolife AB

- 11.1.1 Overview

- 11.1.2 Financials

- 11.1.3 Product Portfolio

- 11.1.4 Business Strategy

- 11.1.5 Recent Developments

- 11.2 Bio-Life Solutions Inc.

- 11.2.1 Overview

- 11.2.2 Financials

- 11.2.3 Product Portfolio

- 11.2.4 Business Strategy

- 11.2.5 Recent Developments

- 11.3 HiMedia Laboratories

- 11.3.1 Overview

- 11.3.2 Financials

- 11.3.3 Product Portfolio

- 11.3.4 Business Strategy

- 11.3.5 Recent Developments

- 11.4 Thermo Fisher Scientific Inc.

- 11.4.1 Overview

- 11.4.2 Financials

- 11.4.3 Product Portfolio

- 11.4.4 Business Strategy

- 11.4.5 Recent Developments

- 11.5 Sartorius AG

- 11.5.1 Overview

- 11.5.2 Financials

- 11.5.3 Product Portfolio

- 11.5.4 Business Strategy

- 11.5.5 Recent Developments

- 11.6 Bio-Techne

- 11.6.1 Overview

- 11.6.2 Financials

- 11.6.3 Product Portfolio

- 11.6.4 Business Strategy

- 11.6.5 Recent Developments

- 11.7 PromoCell GmbH

- 11.7.1 Overview

- 11.7.2 Financials

- 11.7.3 Product Portfolio

- 11.7.4 Business Strategy

- 11.7.5 Recent Developments

- 11.8 Capricorn Scientific

- 11.8.1 Overview

- 11.8.2 Financials

- 11.8.3 Product Portfolio

- 11.8.4 Business Strategy

- 11.8.5 Recent Developments

- 11.9 Merck KGaA

- 11.9.1 Overview

- 11.9.2 Financials

- 11.9.3 Product Portfolio

- 11.9.4 Business Strategy

- 11.9.5 Recent Developments

- 11.10 AMSBIO

- 11.10.1 Overview

- 11.10.2 Financials

- 11.10.3 Product Portfolio

- 11.10.4 Business Strategy

- 11.10.5 Recent Developments

- 11.11 ZENOGEN PHARMA CO. LTD.

- 11.11.1 Overview

- 11.11.2 Financials

- 11.11.3 Product Portfolio

- 11.11.4 Business Strategy

- 11.11.5 Recent Developments

- 11.12 Others.

- 11.12.1 Overview

- 11.12.2 Financials

- 11.12.3 Product Portfolio

- 11.12.4 Business Strategy

- 11.12.5 Recent Developments

- 11.1 Vitrolife AB

List Of Figures

Figures No 1 to 40

List Of Tables

Tables No 1 to 127

Prominent Player

- Vitrolife AB

- Bio-Life Solutions Inc.

- HiMedia Laboratories

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Bio-Techne

- PromoCell GmbH

- Capricorn Scientific

- Merck KGaA

- AMSBIO

- ZENOGEN PHARMA CO. LTD.

- Others

FAQs

The key players in the market are Vitrolife AB, Bio-Life Solutions Inc., HiMedia Laboratories, Thermo Fisher Scientific Inc., Sartorius AG, Bio-Techne, PromoCell GmbH, Capricorn Scientific, Merck KGaA, AMSBIO, ZENOGEN PHARMA CO. LTD., Others.

It is regulations that are responsible for the critical and shaping role played by the government in the development of cell freezing media market as they indirectly influence product formulation, manufacturing standards, adoption rates and commercialization pathways. Regulators want cell freezing media—especially those for clinical, biobanking, and cell and gene therapy applications—to have high quality, safety and traceability standards, such as compliance with GMP guidelines, sterility requirements, and detailed documentation. These regulations motivate users to convert their in-house or non-standard freezing media to commercially validated, ready-to-use ones thus boosting the market.

Price is one of the main factors that determines the growth and acceptance of the market for freezing media for cells, making it a primary consideration for buyers from research and clinical as well as commercial users. The expensive GMP-grade and specialty freezing media are very quickly embraced by companies working with biopharmaceuticals, developers of cell and gene therapy, and large biobanks where regulatory adherence, consistency, and performance of post-thaw cells are given priority over price. In these market segments, high pricing not only contributes to revenue growth but also to the opening up of new ideas in making advanced, serum-free and DMSO-reduced formulations.

According to the present analysis and forecast modeling, the market of Cell Freezing Media will witness a significant growth of about USD 2.90 billion in the year 2035 with the rise of cell & gene therapies and regenerative medicine, expansion of biobanking & sample repositories, and regulatory & quality requirements, with a CAGR of 8.9% between the years 2026 and 2035.

It is projected that North America will hold the largest market share in the Cell Freezing Media market in the forecast period, with a share of about 38% of the global market share, which is attributed to the existence of major players and growing product launch.

The Asia-Pacific Region is expected to be the most growth rate of about 10.5% in the forecast period. The area of Asia Pacific is a major high-growth area in the global market as a result of improved healthcare infrastructure, wider academic research networks, and increased awareness of standardized and GMP-compliant cryopreservation practices that are rapidly adopting advanced cell freezing media.

The worldwide proliferation of biobanks and biorepositories for disease research, personalized medicine and population studies is fast-tracking the use of cell freezing solutions that are standardized and ready-to-use. Furthermore, the market is boosted by the adoption of serum-free, chemically defined and DMSO-reduced or DMSO-free formulations that are less toxic and more compliant with the standards of reproducibility and regulation, particularly for clinical and GMP applications.