Electrolyzer Market Size, Trends and Insights By Product (Alkaline Electrolyzer, PEM Electrolyzer, Solid Oxide Electrolyzer), By Capacity (Less than 500 kW, 500 kW to 2 MW, Above 2 MW), By Application (Power Generation, Transportation, Industry Energy, Industry Feedstock, Building Heat & Power, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Report Snapshot

| Study Period: | 2023-2032 |

| Fastest Growing Market: | Asia-Pacific |

| Largest Market: | Europe |

Major Players

- Nel ASA

- Hydrogenics Corporation

- ITM Power PLC

- McPhy Energy S.A.

- Siemens AG

- Proton OnSite

- Others

Reports Description

As per the current market research conducted by CMI Team, the global Electrolyzer Market is expected to record a CAGR of 26.2% from 2023 to 2032. In 2022, the market size is projected to reach a valuation of USD 3.5 billion. By 2032, the valuation is anticipated to reach USD 12.3 billion.

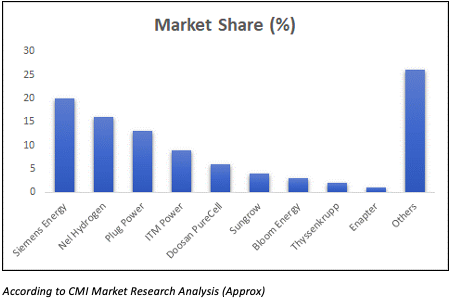

Top 10 Electrolyzer Manufacturing Companies in 2021

The electrolyzer market refers to the industry involved in the production, distribution, and deployment of electrolyzers, which are devices used to split water into hydrogen and oxygen through electrolysis. The market is characterized by a growing emphasis on renewable energy, driven by the need for decarbonization and the transition to a sustainable energy landscape.

Key trends include increasing government support, technological advancements, expanding applications across sectors, collaborations among industry players, and international initiatives promoting the adoption of electrolyzers for the production of clean hydrogen as an alternative energy source.

Additionally, the market is witnessing a trend towards cost reduction and improved efficiency of electrolyzer systems, as well as a focus on scalability and the development of modular and decentralized solutions to meet diverse energy demands.

Electrolyzer Market – Significant Growth Factors

The Electrolyzer Market presents significant growth opportunities due to several factors:

- Green hydrogen adoption: The demand for green hydrogen, produced using renewable energy sources, is increasing to reduce carbon emissions in various sectors. Electrolyzers are crucial for green hydrogen production, driving the market growth.

- Market expansion in emerging economies: Emerging economies recognize the potential of electrolyzers and green hydrogen for sustainable development, creating growth opportunities as they invest in renewable energy infrastructure.

- Technological advancements: Ongoing research improves electrolyzer systems, enhancing efficiency, durability, and scalability while reducing costs. These advancements attract investments and fuel market expansion.

- Integration with renewable energy systems: Electrolyzers can be integrated with solar and wind power plants, storing and converting excess renewable energy into hydrogen, providing a solution for intermittent power supply and grid balancing.

- Government support: Governments globally implement policies, regulations, and incentives to promote electrolyzer adoption. They develop hydrogen infrastructure, support research and development, fostering a favorable market environment.

- Manufacturing and supply chain development: Increasing electrolyzer demand creates opportunities for manufacturing capabilities and efficient supply chains, benefiting electrolyzer production companies.

- Development of electrolyzer manufacturing and supply chain: The growing demand for electrolyzers creates opportunities for the development of manufacturing capabilities and the establishment of an efficient supply chain. Companies involved in electrolyzer production and component manufacturing can benefit from this growing market.

Electrolyzer Market – Mergers and Acquisitions

The Electrolyzer Market has seen several mergers and acquisitions in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability. Some notable examples of mergers and acquisitions in the Electrolyzer Market include:

- Plug Power and Ballard Power Systems: In June 2018, Plug Power, a leading provider of hydrogen fuel cell solutions, acquired American fuel cell manufacturer Ballard Power Systems’ subsidiary, Protonex. The acquisition aimed to strengthen Plug Power’s capabilities in the development of advanced proton exchange membrane (PEM) electrolyzers.

- Nel ASA and Nikola Corporation: In February 2020, Nel ASA, a global electrolyzer company, announced a partnership with Nikola Corporation, an American electric vehicle manufacturer. The partnership focused on developing hydrogen fueling stations integrated with Nel’s electrolyzer technology to support Nikola’s fuel cell electric truck deployments.

- Siemens Energy and Siemens Gamesa: In April 2020, Siemens Energy, a global energy technology company, acquired a majority stake in Siemens Gamesa Renewable Energy, a leading wind turbine manufacturer. The acquisition aimed to integrate Siemens Gamesa’s wind turbines with Siemens Energy’s electrolyzers to provide integrated renewable energy solutions.

- McPhy Energy and Chart Industries: In January 2021, McPhy Energy, a French electrolyzer manufacturer, entered into a strategic partnership with Chart Industries, a leading cryogenic equipment manufacturer. The partnership aimed to develop and commercialize integrated hydrogen solutions, including McPhy Energy’s electrolyzers and Chart Industries’ hydrogen storage and distribution equipment.

- Plug Power and Groupe Renault: In March 2021, Plug Power announced a partnership with Groupe Renault, a global automotive manufacturer. The partnership focused on developing hydrogen-powered light commercial vehicles and establishing a network of hydrogen refueling stations, utilizing Plug Power’s electrolyzer technology.

- ITM Power and Linde: In April 2021, ITM Power, a UK-based electrolyzer manufacturer, signed a collaboration agreement with Linde, a global industrial gas company. The collaboration aimed to develop large-scale electrolyzer projects, leveraging ITM Power’s expertise in PEM electrolysis and Linde’s engineering and project execution capabilities.

These mergers and acquisitions have helped companies expand their product offerings, improve their market presence, and capitalize on growth opportunities in the Electrolyzer Market. The trend is expected to continue as companies seek to gain a competitive edge in the market.

COMPARATIVE ANALYSIS OF THE RELATED MARKET

| Electrolyzer Market | Hydrogen Storage Market | Green Hydrogen Market |

| CAGR 26.2% (Approx) | CAGR 9.2% (Approx) | CAGR 55% (Approx) |

| USD 12.3 billion by 2032 | USD 1180 Million by 2030 | USD 90 Billion by 2030 |

Electrolyzer Market – Significant Threats

The Electrolyzer Market faces several significant threats that could impact its growth and profitability in the future. Some of these threats include:

- High capital costs: The initial investment required for electrolyzer installations can be substantial, posing a challenge to widespread adoption. The high capital costs of electrolyzer systems can deter potential buyers and slow down market growth, particularly in sectors with budget constraints.

- Lack of hydrogen infrastructure: The electrolyzer market relies on a well-developed hydrogen infrastructure for the storage, distribution, and utilization of hydrogen. The limited availability of hydrogen infrastructure, including refueling stations and transportation networks, hampers the widespread deployment and market penetration of electrolyzers.

- Competition from alternative technologies: Electrolyzers face competition from alternative technologies that also offer hydrogen production or energy storage solutions. Technologies such as natural gas reforming, biomass gasification, and advanced batteries provide alternatives to electrolysis, which can impact the demand and growth potential of electrolyzer systems.

- Regulatory and policy uncertainties: The electrolyzer market is influenced by regulatory frameworks and government policies. Uncertainties surrounding regulations, incentives, and subsidies for renewable energy and hydrogen can create barriers and impact market development. Inconsistent or unfavorable policies can discourage investments and hinder the market growth.

Report Scope

| Feature of the Report | Details |

| Market Size in 2023 | USD 4.38 Billion |

| Projected Market Size in 2032 | USD 12.3 Billion |

| Market Size in 2022 | USD 3.5 Billion |

| CAGR Growth Rate | 26.2% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product, Capacity, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Category-Wise Insights

By Product:

- Alkaline Electrolyzer: An alkaline electrolyzer utilizes an alkaline solution, such as potassium hydroxide (KOH), as an electrolyte to split water into hydrogen and oxygen. The market trend for alkaline electrolyzers focuses on improving efficiency, reducing costs, and scaling up large-scale hydrogen production, driven by the increasing demand for sustainable energy solutions.

- PEM Electrolyzer: A PEM electrolyzer employs a proton exchange membrane to separate water into hydrogen and oxygen. Its key features include high efficiency, quick response times, compact size, and versatility for various applications like renewable energy storage and fuel cell systems. The market trend for PEM electrolyzers centers on their adaptability and efficient performance.

- Solid Oxide Electrolyzer: A Solid Oxide Electrolyzer uses a solid oxide material as an electrolyte to split water into hydrogen and oxygen. It offers notable advantages such as high efficiency, durability, and the potential for integration with renewable energy sources. The market trend for solid oxide electrolyzers focuses.

By Capacity

- Less than 500 kW: Electrolyzers with a capacity of less than 500 kW are small-scale systems used for decentralized applications, such as residential or small commercial settings. The trend in this segment is towards compact, modular designs, improved efficiency, and cost reduction to enable wider adoption and integration with renewable energy sources.

- 500 kW to 2 MW: Electrolyzers in the 500 kW to 2 MW capacity range are medium-scale systems suitable for various industrial applications. The trend here is focused on optimizing performance, enhancing operational flexibility, and reducing capital costs to meet the growing demand for hydrogen in sectors like transportation, power generation, and industrial processes.

- Above 2 MW: Electrolyzers with a capacity above 2 MW are large-scale systems designed for industrial applications and hydrogen production at a significant scale. The trend in this segment is towards achieving economies of scale, increasing efficiency, and further cost reductions to facilitate large-scale deployment, particularly for hydrogen-intensive industries and power-to-gas applications.

By Application

- Transportation: In the electrolyzer market, transportation refers to using hydrogen as a clean fuel for vehicles like cars, trucks, buses, and trains. The trend in transportation is the growing acceptance of hydrogen fuel cell vehicles that utilize hydrogen produced by electrolyzers. These vehicles offer emissions-free transportation, helping address the need for reducing carbon emissions in the transportation sector.

- Industry Energy: Industry energy involves using hydrogen generated by electrolyzers as a clean energy source for industrial processes. The trend in industry energy is the shift towards hydrogen-based processes, such as hydrogen combustion or fuel cells, to replace fossil fuels. This transition helps lower greenhouse gas emissions and promotes environmentally sustainable practices in various industries.

- Industry Feedstock: Industry feedstock refers to using hydrogen from electrolyzers as a raw material in industrial applications like chemical production and refineries. The trend in industry feedstock is the adoption of green hydrogen as a renewable and low-carbon alternative to fossil-based feedstocks. This enables the production of eco-friendly chemicals and supports the development of a more sustainable industrial sector.

- Building Heat & Power: Building heat and power involves using hydrogen produced by electrolyzers to provide heating and energy for residential, commercial, and institutional buildings. The trend in building heat and power is integrating hydrogen-based systems, such as fuel cells or hydrogen boilers, to deliver clean and efficient heat and power solutions. This integration contributes to reducing carbon emissions in the building sector and promotes a greener approach to energy usage.

- Others: The “Others” category encompasses additional applications of electrolyzers, including energy storage, grid balancing, and research and development. The trend in this category varies depending on specific applications but generally involves exploring innovative uses of electrolyzers and advancing their technology to meet evolving energy demands. These efforts aim to drive the adoption of clean and sustainable solutions while addressing energy storage needs and supporting research and development initiatives.

Electrolyzer Market – Regional Analysis

The Electrolyzer Market is segmented into various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Here is a brief overview of each region:

- North America: North America is a region made up of countries such as the United States and Canada. There is a considerable emphasis in this region on clean energy programmes, significant investments in hydrogen infrastructure, and supportive government policies pushing the use of electrolyzer technology to advance decarbonization efforts. These factors all contribute to North America’s growing need for electrolyzers.

- Europe: Europe, in the context of the electrolyzer market, refers to the region encompassing countries in Europe. The trend in Europe’s electrolyzer market is towards significant growth driven by increasing investments in renewable energy, favorable government policies, and the push for decarbonization. Europe aims to become a global leader in electrolyzer technology and green hydrogen production.

- Asia-Pacific: Asia-Pacific, comprising countries in East Asia, South Asia, and Oceania, is a region witnessing significant growth in the electrolyzer market. The region’s trend is driven by increasing government initiatives, investments in renewable energy infrastructure, and the rising demand for green hydrogen to support clean energy transitions and achieve carbon reduction goals.

- LAMEA: LAMEA is a geographical region that includes countries from Latin America, the Middle East, and Africa. The utilisation of electrolyzers for hydrogen production is increasing in the LAMEA electrolyzer market. The increased need for clean energy, government programmes encouraging renewable technologies, and the region’s plentiful renewable energy resources are driving this trend.

Competitive Landscape – Electrolyzer Market

The Electrolyzer Market is highly competitive, with a large number of manufacturers and retailers operating globally. Some of the key players in the market include:

- Nel ASA

- Hydrogenics Corporation

- ITM Power PLC

- McPhy Energy S.A.

- Siemens AG

- Proton OnSite

- Giner ELX

- Areva H2Gen

- Tianjin Mainland Hydrogen Equipment Co., Ltd.

- Enapter AG

- Others

These companies operate in the market through various strategies such as product innovation, mergers and acquisitions, and partnerships. For example, in 2021, Siemens Energy launched a new generation of high efficiency electrolyzers, expanding their product offerings. Similarly, in 2020, ITM Power secured significant contracts for the deployment of its electrolyzer systems, showcasing its market growth. These developments highlight the industry’s progress and the commitment of key players to advancing electrolyzer technology.

Several new players have entered the Electrolyzer Market by adopting innovation and development strategies to establish their presence. These include companies such as ITM Power, Nel ASA, and McPhy Energy, which have invested in advanced electrolyzer technologies, expanded their product portfolios, and focused on improving efficiency and scalability.

However, significant manufacturers such as Siemens AG, Plug Power Inc., and Ballard Power Systems now dominate the industry. Because of their considerable expertise, powerful distribution networks, strong customer relationships, and ongoing investment in research and development, these established enterprises have a significant market share. They maintain their dominance by offering a wide range of electrolyzer solutions and providing comprehensive after-sales support and service, positioning themselves as trusted leaders in the market.

The Electrolyzer Market is segmented as follows:

By Product

- Alkaline Electrolyzer

- PEM Electrolyzer

- Solid Oxide Electrolyzer

By Capacity

- Less than 500 kW

- 500 kW to 2 MW

- Above 2 MW

By Application

- Power Generation

- Transportation

- Industry Energy

- Industry Feedstock

- Building Heat & Power

- Others

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Electrolyzer Market, (2024 – 2033) (USD Billion)

- 2.2 Global Electrolyzer Market : snapshot

- Chapter 3. Global Electrolyzer Market – Industry Analysis

- 3.1 Electrolyzer Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Green hydrogen adoption

- 3.2.2 Market expansion in emerging economies

- 3.2.3 Technological advancements

- 3.2.4 Integration with renewable energy systems

- 3.2.5 Government support

- 3.2.6 Manufacturing and supply chain development

- 3.2.7 Development of electrolyzer manufacturing and supply chain.

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porters Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product

- 3.7.2 Market attractiveness analysis By Capacity

- 3.7.3 Market attractiveness analysis By Application

- Chapter 4. Global Electrolyzer Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Electrolyzer Market: company market share, 2022

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Electrolyzer Market – Product Analysis

- 5.1 Global Electrolyzer Market overview: By Product

- 5.1.1 Global Electrolyzer Market share, By Product, 2022 and – 2033

- 5.2 Alkaline Electrolyzer

- 5.2.1 Global Electrolyzer Market by Alkaline Electrolyzer, 2024 – 2033 (USD Billion)

- 5.3 PEM Electrolyzer

- 5.3.1 Global Electrolyzer Market by PEM Electrolyzer, 2024 – 2033 (USD Billion)

- 5.4 Solid Oxide Electrolyzer

- 5.4.1 Global Electrolyzer Market by Solid Oxide Electrolyzer , 2024 – 2033 (USD Billion)

- 5.1 Global Electrolyzer Market overview: By Product

- Chapter 6. Global Electrolyzer Market – Capacity Analysis

- 6.1 Global Electrolyzer Market overview: By Capacity

- 6.1.1 Global Electrolyzer Market share, By Capacity, 2022 and – 2033

- 6.2 Less than 500 kW

- 6.2.1 Global Electrolyzer Market by Less than 500 kW, 2024 – 2033 (USD Billion)

- 6.3 500 kW to 2 MW

- 6.3.1 Global Electrolyzer Market by 500 kW to 2 MW, 2024 – 2033 (USD Billion)

- 6.4 Above 2 MW

- 6.4.1 Global Electrolyzer Market by Above 2 MW , 2024 – 2033 (USD Billion)

- 6.1 Global Electrolyzer Market overview: By Capacity

- Chapter 7. Global Electrolyzer Market – Application Analysis

- 7.1 Global Electrolyzer Market overview: By Application

- 7.1.1 Global Electrolyzer Market share, By Application, 2022 and – 2033

- 7.2 Power Generation

- 7.2.1 Global Electrolyzer Market by Power Generation, 2024 – 2033 (USD Billion)

- 7.3 Transportation

- 7.3.1 Global Electrolyzer Market by Transportation, 2024 – 2033 (USD Billion)

- 7.4 Industry Energy

- 7.4.1 Global Electrolyzer Market by Industry Energy, 2024 – 2033 (USD Billion)

- 7.5 Industry Feedstock

- 7.5.1 Global Electrolyzer Market by Industry Feedstock, 2024 – 2033 (USD Billion)

- 7.6 Building Heat & Power

- 7.6.1 Global Electrolyzer Market by Building Heat & Power, 2024 – 2033 (USD Billion)

- 7.7 Others

- 7.7.1 Global Electrolyzer Market by Others, 2024 – 2033 (USD Billion)

- 7.1 Global Electrolyzer Market overview: By Application

- Chapter 8. Electrolyzer Market – Regional Analysis

- 8.1 Global Electrolyzer Market Regional Overview

- 8.2 Global Electrolyzer Market Share, by Region, 2022 & – 2033 (USD Billion)

- 8.3. North America

- 8.3.1 North America Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.3.1.1 North America Electrolyzer Market, by Country, 2024 – 2033 (USD Billion)

- 8.3.1 North America Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.4 North America Electrolyzer Market, by Product, 2024 – 2033

- 8.4.1 North America Electrolyzer Market, by Product, 2024 – 2033 (USD Billion)

- 8.5 North America Electrolyzer Market, by Capacity, 2024 – 2033

- 8.5.1 North America Electrolyzer Market, by Capacity, 2024 – 2033 (USD Billion)

- 8.6 North America Electrolyzer Market, by Application, 2024 – 2033

- 8.6.1 North America Electrolyzer Market, by Application, 2024 – 2033 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.7.1.1 Europe Electrolyzer Market, by Country, 2024 – 2033 (USD Billion)

- 8.7.1 Europe Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.8 Europe Electrolyzer Market, by Product, 2024 – 2033

- 8.8.1 Europe Electrolyzer Market, by Product, 2024 – 2033 (USD Billion)

- 8.9 Europe Electrolyzer Market, by Capacity, 2024 – 2033

- 8.9.1 Europe Electrolyzer Market, by Capacity, 2024 – 2033 (USD Billion)

- 8.10 Europe Electrolyzer Market, by Application, 2024 – 2033

- 8.10.1 Europe Electrolyzer Market, by Application, 2024 – 2033 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.11.1.1 Asia Pacific Electrolyzer Market, by Country, 2024 – 2033 (USD Billion)

- 8.11.1 Asia Pacific Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.12 Asia Pacific Electrolyzer Market, by Product, 2024 – 2033

- 8.12.1 Asia Pacific Electrolyzer Market, by Product, 2024 – 2033 (USD Billion)

- 8.13 Asia Pacific Electrolyzer Market, by Capacity, 2024 – 2033

- 8.13.1 Asia Pacific Electrolyzer Market, by Capacity, 2024 – 2033 (USD Billion)

- 8.14 Asia Pacific Electrolyzer Market, by Application, 2024 – 2033

- 8.14.1 Asia Pacific Electrolyzer Market, by Application, 2024 – 2033 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.15.1.1 Latin America Electrolyzer Market, by Country, 2024 – 2033 (USD Billion)

- 8.15.1 Latin America Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.16 Latin America Electrolyzer Market, by Product, 2024 – 2033

- 8.16.1 Latin America Electrolyzer Market, by Product, 2024 – 2033 (USD Billion)

- 8.17 Latin America Electrolyzer Market, by Capacity, 2024 – 2033

- 8.17.1 Latin America Electrolyzer Market, by Capacity, 2024 – 2033 (USD Billion)

- 8.18 Latin America Electrolyzer Market, by Application, 2024 – 2033

- 8.18.1 Latin America Electrolyzer Market, by Application, 2024 – 2033 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Electrolyzer Market, by Country, 2024 – 2033 (USD Billion)

- 8.19.1 The Middle-East and Africa Electrolyzer Market, 2024 – 2033 (USD Billion)

- 8.20 The Middle-East and Africa Electrolyzer Market, by Product, 2024 – 2033

- 8.20.1 The Middle-East and Africa Electrolyzer Market, by Product, 2024 – 2033 (USD Billion)

- 8.21 The Middle-East and Africa Electrolyzer Market, by Capacity, 2024 – 2033

- 8.21.1 The Middle-East and Africa Electrolyzer Market, by Capacity, 2024 – 2033 (USD Billion)

- 8.22 The Middle-East and Africa Electrolyzer Market, by Application, 2024 – 2033

- 8.22.1 The Middle-East and Africa Electrolyzer Market, by Application, 2024 – 2033 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 Nel ASA

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 Hydrogenics Corporation

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 ITM Power PLC

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 McPhy Energy S.A.

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 Siemens AG

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 Proton OnSite

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Giner ELX

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 Areva H2Gen

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 Tianjin Mainland Hydrogen Equipment Co. Ltd.

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 Enapter AG

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 Others.

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.1 Nel ASA

List Of Figures

Figures No 1 to 28

List Of Tables

Tables No 1 to 77

Report Methodology

In order to get the most precise estimates and forecasts possible, Custom Market Insights applies a detailed and adaptive research methodology centered on reducing deviations. For segregating and assessing quantitative aspects of the market, the company uses a combination of top-down and bottom-up approaches. Furthermore, data triangulation, which examines the market from three different aspects, is a recurring theme in all of our research reports. The following are critical components of the methodology used in all of our studies:

Preliminary Data Mining

On a broad scale, raw market information is retrieved and compiled. Data is constantly screened to make sure that only substantiated and verified sources are taken into account. Furthermore, data is mined from a plethora of reports in our archive and also a number of reputed & reliable paid databases. To gain a detailed understanding of the business, it is necessary to know the entire product life cycle and to facilitate this, we gather data from different suppliers, distributors, and buyers.

Surveys, technological conferences, and trade magazines are used to identify technical issues and trends. Technical data is also gathered from the standpoint of intellectual property, with a focus on freedom of movement and white space. The dynamics of the industry in terms of drivers, restraints, and valuation trends are also gathered. As a result, the content created contains a diverse range of original data, which is then cross-validated and verified with published sources.

Statistical Model

Simulation models are used to generate our business estimates and forecasts. For each study, a one-of-a-kind model is created. Data gathered for market dynamics, the digital landscape, development services, and valuation patterns are fed into the prototype and analyzed concurrently. These factors are compared, and their effect over the projected timeline is quantified using correlation, regression, and statistical modeling. Market forecasting is accomplished through the use of a combination of economic techniques, technical analysis, industry experience, and domain knowledge.

Short-term forecasting is typically done with econometric models, while long-term forecasting is done with technological market models. These are based on a synthesis of the technological environment, legal frameworks, economic outlook, and business regulations. Bottom-up market evaluation is favored, with crucial regional markets reviewed as distinct entities and data integration to acquire worldwide estimates. This is essential for gaining a thorough knowledge of the industry and ensuring that errors are kept to a minimum.

Some of the variables taken into account for forecasting are as follows:

• Industry drivers and constraints, as well as their current and projected impact

• The raw material case, as well as supply-versus-price trends

• Current volume and projected volume growth through 2030

We allocate weights to these variables and use weighted average analysis to determine the estimated market growth rate.

Primary Validation

This is the final step in our report’s estimating and forecasting process. Extensive primary interviews are carried out, both in-person and over the phone, to validate our findings and the assumptions that led to them.

Leading companies from across the supply chain, including suppliers, technology companies, subject matter experts, and buyers, use techniques like interviewing to ensure a comprehensive and non-biased overview of the business. These interviews are conducted all over the world, with the help of local staff and translators, to overcome language barriers.

Primary interviews not only aid with data validation, but also offer additional important insight into the industry, existing business scenario, and future projections, thereby improving the quality of our reports.

All of our estimates and forecasts are validated through extensive research work with key industry participants (KIPs), which typically include:

• Market leaders

• Suppliers of raw materials

• Suppliers of raw materials

• Buyers.

The following are the primary research objectives:

• To ensure the accuracy and acceptability of our data.

• Gaining an understanding of the current market and future projections.

Data Collection Matrix

| Perspective | Primary research | Secondary research |

| Supply-side |

|

|

| Demand-side |

|

|

Market Analysis Matrix

| Qualitative analysis | Quantitative analysis |

|

|

Key players content will come here.

- Nel Hydrogen (Norway)

- Asahi Kasei (Japan)

- Hydrogenics (Canada)

- Shandong Saikesaisi Hydrogen Energy Co., Ltd. (China)

- Teledyne Energy Systems (U.S.)

- Siemens (Germany)

- Kobelco Eco-Solutions (U.S.)

- Green Hydrogen Systems (Denmark)

- Next Hydrogen (Canada)

- H-Tec Systems (Germany)

- Others

FAQs

“North America” region will lead the Global Electrolyzer Market during the forecast period 2023 to 2032.

The key factors driving the Market are Green hydrogen adoption, Market expansion in emerging economies, Technological advancements, Integration with renewable energy systems, Government support, Manufacturing and supply chain development And Development of electrolyzer manufacturing and supply chain.

The key players operating in the Electrolyzer Market are Nel ASA, Hydrogenics Corporation, ITM Power PLC, McPhy Energy S.A., Siemens AG, Proton OnSite, Giner ELX, Areva H2Gen, Tianjin Mainland Hydrogen Equipment Co. Ltd., Enapter AG, Others.

The Global Electrolyzer Market is expanding growth with a CAGR of approximately 26.2% during the forecast period (2023 to 2032).

The Global Electrolyzer Market size was valued at USD 3.5 Billion in 2022 and it is projected to reach around USD 12.3 Billion by 2032.