Large And Small Scale Bioprocessing Market Size, Trends and Insights By Scale (Small Scale (Less Than 50,000 Liter), Industrial Scale (Over 50,000 Liter)), By Product (Bioreactors/Fermenters, Filtration Assemblies, Cell Culture Products, Bags & Containers, Bioreactors Accessories, Others), By Workflow (Upstream Processing, Downstream Processing, Fermentation), By Application (Biopharmaceuticals, Environmental Aids, Specialty Industrial Chemicals), By Use Type (Multi-Use, Single-Use), By Mode (In-house, Outsourced), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Corning Inc.

- Sartorius AG

- Lonza

- Merck KGaA

- Others

Reports Description

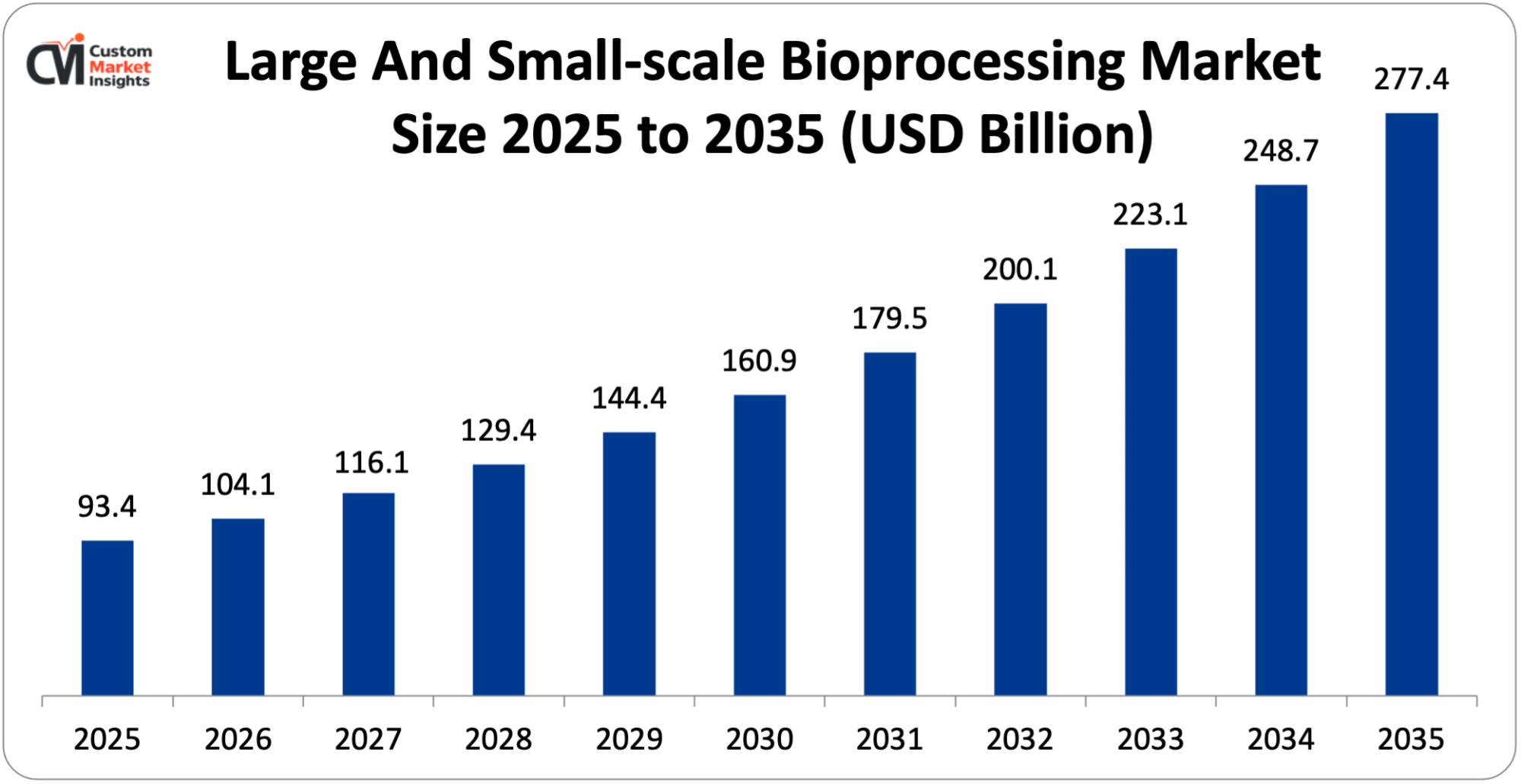

The market size of global large and Small Scale bioprocessing will be estimated at USD 93.4 billion in 2025 and is expected to grow between USD 104.1 billion in 2026 and about USD 277.4 billion by 2035 with a current CAGR of 11.5% during the period of 2026 to 2035.

The main factor stimulating the growth of the large and Small Scale bioprocessing market is the very large and fast-growing market for biopharmaceuticals that includes monoclonal antibodies, vaccines, biosimilars, and cell and gene therapies; all these require top-notch bioprocessing from very early development to commercial production.

The constant expansion of R&D in biotechnology and pharmaceuticals is driving the use of Small Scale bioprocessing systems more quickly for the purpose of process development, pilot studies, and clinical trials manufacturing; at the same time, large-scale bioprocessing is also getting popular for the purpose of supporting mass production and global supply.

Market Highlight

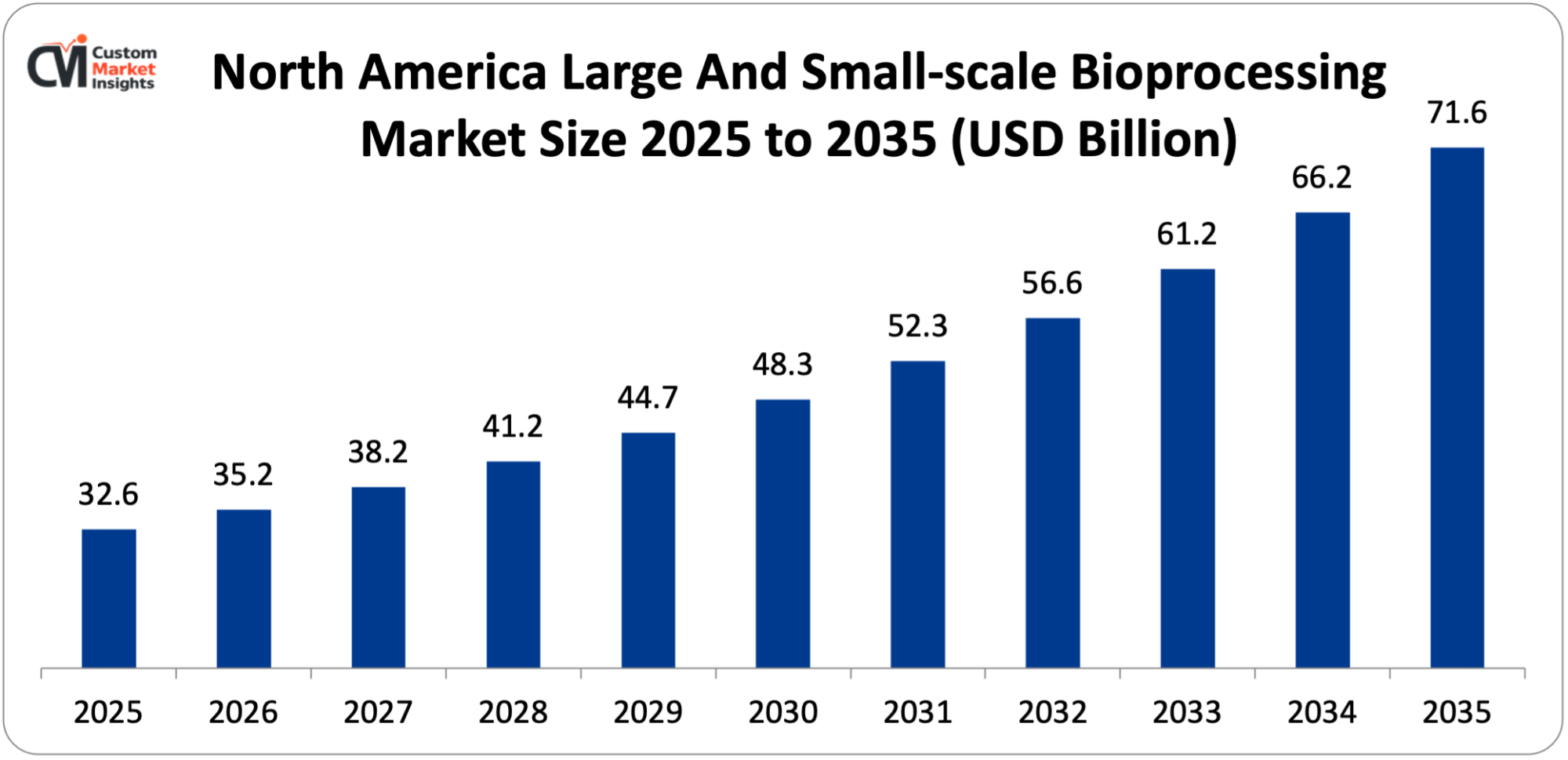

- North America had a market share of 35% and was the market leader in the Large And Small Scale Bioprocessing market in 2025.

- It is projected to have the highest growth rate of 12.5% across Asia Pacific in the years 2026-2035.

- By product, the Bioreactors/Fermenters segment will capture the largest market share over 30% in 2025.

- By Workflow, the downstream processing segment dominates the market with over 45% of the revenue share.

Significant Growth Factors

The Large And Small Scale Bioprocessing Market Trends present significant growth opportunities due to several factors:

- Rising Demand for Biopharmaceuticals: The surging demand for biopharmaceuticals is the primary driving force behind the expansion of the large and Small Scale bioprocessing markets. Bio-based products, such as monoclonal antibodies, vaccines, recombinant proteins and cell and gene therapies, have become unaffordable unless the bioprocessing operations are highly controlled and efficient. A major factor behind the market growth is the global trend of aging populations suffering from chronic diseases, which results in more cases of cancer and autoimmune disorders. Furthermore, the emergence of personalized and targeted therapies has also contributed significantly to the production of biologics, so the demand has widened. The Small Scale bioprocessing systems for research, process development, and clinical stage manufacturing are now being widely adopted as well as the large-scale bioprocessing plants being more and more reliable for commercial production to meet the global need. Biopharmaceutical firms are making heavy bets on bioprocessing technology that is easy to upscale, flexible, and high-tech; that practice, in turn, supports the growth of the large and Small Scale bioprocessing markets very strongly, as continuous regulatory approvals for biologics and the expansion of biopharmaceutical pipelines are the main factors. For instance, according to the Pharmaceutical Research and Manufacturers Association (PhRMA), biopharmaceutical firms in the U.S. spent about $96 billion on R&D in 2023. In 2023, total R&D by biopharmaceutical firms in the U.S. accounted for over 20 percent of total sales.

- Favorable Regulatory Support: Regulatory support is one of the major factors influencing the large and Small Scale bioprocessing market. The authorities are slowly but surely opening the door for the use of new and better biomanufacturing technologies. The main purpose of this initiative is to enhance product quality, safety, and reliability of supply. The U.S. FDA, the European Medicines Agency (EMA), and other agencies are setting modern approaches such as quality-by-design (QbD), process analytical technology (PAT), single-use systems, and continuous bioprocessing as the way forward which not only partners the developments in manufacturing but also cuts their costs greatly for all sized operations. Furthermore, with the helping hands of clear regulatory frameworks and fast-tracked approval routes for biologics, biosimilars, and vaccines, companies can eventually arrive at the market in less time and have more confidence in their decision to set up scalable bioprocessing infrastructure around their pharmaceuticals and biotechnology. Also, government initiatives, funding programs, and tax incentives targeted for strengthening domestic biopharmaceutical manufacturing and supply chain resilience are further backing the bioprocessing capabilities expansion. These combined regulatory and policy environments not only reduce the risk that is associated with compliance but also spur innovation and at the same time help the large and Small Scale bioprocessing market to grow remarkably.

What are the Major Advances Changing the Large And Small Scale Bioprocessing Market Today?

- Adoption of Single-Use Bioprocessing Systems: The widespread use of single-use bioprocessing systems is dramatically changing the large and Small Scale bioprocessing market by allowing more flexibility, efficiency, and cost control in manufacturing operations. The use of single-use technologies removes the need for cleaning and sterilization, which are the major drawbacks of traditional systems, thus significantly reducing the time, water and energy consumed and the chances of cross-contamination. All these benefits make single-use technologies particularly appealing for Small Scale bioprocessing, which requires fast and flexible systems for the rapid development of processes, pilot production, and clinical manufacturing. On the other hand, the material and system design innovations have made the single-use solutions adaptable to the large-scale bioprocessing thus allowing the production of biologics at a lower investment and in a more scalable manner. The growing demand for biologics, vaccines, and personalized therapies is pushing the adoption of single-use bioprocessing systems which in turn is changing the manufacturing strategies and boosting the overall market growth.

- Use of Process Analytical Technology (PAT): Real-time monitoring, analysis, and control of the entire process parameters in biomanufacturing through the use of Process Analytical Technology (PAT) are the major factors responsible for the significant advancement of the large and Small Scale bioprocessing market. Besides, the continuous tracking of different variables would be made easier as these factors include pH, temperature, dissolved oxygen, nutrient concentration, and the quality attributes of the product. Thus, repeatability and consistency of the process are significantly improved while batch-to-batch variability is minimized. This situation is particularly beneficial in Small Scale bioprocessing where rapid experimentation, process optimization, and scale-up decisions are all dictated by accurate and timely data. In large-scale bioprocessing, PAT is instrumental in enabling the early detection of deviations that lead to process disruptions, thus allowing the automatic realization of control measures and subsequently, the loss of product to be reduced. PAT has been and will continue to be a big contributor to the overall growth of the bioprocessing market because it perfectly aligns with the quality-by-design (QbD) principles and regulatory agencies’ expectations which help to minimize manufacturing risks, maximize yield and product quality, and hasten the transition from development to commercial production.

- AI and Data-Driven Process Optimization: AI and data-driven process optimization are powerful elements that changed the game in the bioprocessing industry since they are the key trends that will be the primary source of the large and Small Scale bioprocessing market growth by changing the way biomanufacturing processes are designed, monitored, and controlled. Disruptive technologies like AI, ML, and advanced analytics are empowering manufacturers to mine large amounts of process data produced during the different stages of operation, thus being able to detect the best conditions for operating, predicting the result of the process, and discovering errors very early. AI has also taken major roles in Small Scale bioprocessing areas by promoting the development of new processes via modeling. As a result, fewer main experiments are required, thus leading to shorter process development time and better scalability. To the contrary, data-driven methodologies used in large-scale bioprocessing, while supporting real-time decision-making and predictive maintenance, have a positive impact on manufacturing reliability and flexibility thus bringing down operational costs. The application of AI and data-driven solutions not only brings about continuous improvement in the manufacturing process but also keeps the manufacturers ready for the next wave of demand for more complex biopharmaceuticals and personalized therapies.

Category Wise Insights

By Scale

Why Industrial Scale Lead the Market?

In 2025 industrial scale leads the market and shows the same attributes over the projected period. The main factor in this increase is the rising demand for biopharmaceuticals to be produced commercially on a large scale, e.g. monoclonal antibodies, vaccines, biosimilars, and recombinant proteins. The pharmaceutical and biotech industries are substantially augmenting their investments in high-capacity bioreactors, downstream purification systems, and integrated manufacturing facilities as more biologic drugs receive regulatory approval and transfer from clinical development to full commercialization. This transition towards large-volume production is when there is a need to cover the increasing global demand, assure the product supply, and cut the unit manufacturing costs. Furthermore, the large-scale implementation of single-use technologies, continuous bioprocessing, automation, and advanced process control is making the whole production process more efficient, scalable, and yield-friendly which in turn further supports revenue expansion. The government programs aimed at boosting the local biomanufacturing market and the long-term manufacturing contracts for vaccines and biologics are also factors contributing to the growth of the sector.

The small scale segment is expected to grow at the highest CAGR over the projected period. The rise is largely due to the demand for flexible systems in the field of personalized medicine. Furthermore, single-use technologies have been the cause of greater process control and productivity but have not harmed the quality in any way. For example, in October 2024, Univercells Technologies revealed its scale-X nexo fixed-bed bioreactor in Nivelles, Belgium. It mastered Small Scale cell culture workflows, thus reducing development times and costs, and moreover making biopharma applications fully scalable.

By Product

Why Bioreactors/Fermenters Dominates the Large And Small Scale Bioprocessing Market?

The bioreactors/fermenters capture the largest market share of more than 30% in 2025. The growth of the bioreactors/fermenters market is owing to the rising expansion of the product portfolio by the key market players. For instance, in March 2025, Cytiva revealed that the Xcellerex X-platform portfolio is set to be expanded with the introduction of bioreactors of 500-L and 2000-L capacity. The bioreactors are intended to facilitate the entire process from 50 L to 2000 L for the manufacturing of advanced therapeutics of the next generation. The X-platform is a highly adaptable single-use system that was created to enhance efficacy in operations and the amount of production. Besides, the platform will not only cut down costs and lessen risks but also quicken the time needed to advance new therapeutics to the next clinical milestone stage.

The cell culture product is expected to grow at the highest rate over the projected period. The continuous improvements in cell line development, such as the recombinant cell line, are the primary factors behind this. Cell culture application for various purposes in cell and molecular biology, one of the main ones is setting a ground for studying the biological, biochemical, physiological, and metabolic systems of both normal and unhealthy cells. The production of mammalian cell lines for biopharmaceuticals is that major factor propelling the anticipated growth of this segment.

By Workflow

Why Downstream Processing Dominate Large And Small Scale Bioprocessing Market?

The downstream processing segment dominates the market with over 45% of the revenue share. The growth of the segment can be linked to the increased sophistication and output of biopharmaceutical manufacturing. The last steps of processing, namely purification, separation, filtration, and formulation, are critical in ensuring the safety, purity, and quality of biotechnological products such as monoclonal antibodies, vaccines, recombinant proteins, and cells as well as gene therapies. The demand for advanced downstream technologies is growing since more biopharmaceuticals are entering the market and their pipelines are being expanded to handle the larger amounts and intricacies of biomolecules.

The fermentation segment is growing at the fastest rate during the analysis period. The expansion is primarily due to the rising acceptance of microbial and cell-based expression systems in clinical and commercial manufacturing. The development of bioreactors, feeding strategies, and process automation is giving to yield, quality, and control, making it possible for the industry to satisfy the tough requirements of regulators. The biopharma industry is adopting a more environmentally friendly and less wasteful production model; hence, the fermentation segment is becoming more and more critical to the whole process, regardless of the size of the operation.

By Use Type

Why Multi-Use holds the largest market share?

The multi-use segment is expected to capture the largest market share over the projected period driven by its continuous adoption in large-volume, long-term biomanufacturing processes. Multi-use (stainless steel or reusable) bioprocessing systems are the most commercially preferred systems for the production of highly demanded biologics (such as monoclonal antibodies, vaccines, and recombinant proteins) where consistent output, process robustness, and long production cycles are vital. The bioprocessing systems have very high durability, are compatible with aggressive cleaning and sterilization protocols, and can accommodate very large batch sizes and thus are cost-effective over extended operational lifecycles even though they come with a higher initial capital investment.

The single-use segment is expected to grow at the highest CAGR over the projected period. The market expansion is mainly because of the rising demand for biomanufacturing solutions that are flexible, economical, and free of contamination. Single-use systems for bioprocessing—like disposable vessels, plastic bags, tubes, and filters—make capital investment much lower by not requiring pricey stainless steel infrastructure, and the processes of cleaning and sterilization will simply be omitted. Thus, they become so advantageous for Small Scale bioprocessing in the case of research and development, clinical trials, and pilot-scale production where rapid changes and scalability are concerned.

By Mode

Why In-house holds the largest market share?

The in-house segment is expected to capture the largest market share over the projected period due to the existing and giant international companies that can handle the entire biopharmaceutical production process in-house. Firms are practicing keeping the confidentiality of their product development processes through their in-house capabilities. Besides, the in-house facilities open up possibilities for tailored solutions connected with better efficiency and even integration with existing systems, thus supporting both large-scale and Small Scale bioprocessing operations.

The outsourced segment is growing rapidly over the analysis period. The first and foremost cause is the spectacular rise in the budget for outsourcing bio-manufacturing. Along with the mentioned factors, technological partnership and cost efficiency offered by contract services are the main driving forces that are expected to create more opportunities for both large and small scale bioprocessing in outsourcing through contract manufacturers.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 104.1 billion |

| Projected Market Size in 2035 | USD 277.4 billion |

| Market Size in 2025 | USD 93.4 billion |

| CAGR Growth Rate | 11.5% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Scale, Product, Workflow, Application, Use Type, Mode and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Large And Small Scale Bioprocessing Market Size?

Its market size, in terms of North America Large And Small Scale Bioprocessing, is projected to be USD 32.6 billion in 2025 with a growth of about USD 71.7 billion in 2035 with a CAGR of 8.2% between 2026 and 2035.

Why did North America Dominate the Large And Small Scale Bioprocessing Market in 2025?

In 2025, North America will dominate the global market with an estimated market share of 35%. The growth is supported by the region’s biopharmaceutical industry, which is already strong and established, the medical care infrastructure that has been developed to the highest standards, and the amount of money that is being put into research and development of biotechnology, which is also high. The presence of so many top-notch pharmaceutical and biotechnology companies, as well as contract development and manufacturing organizations (CDMOs), is creating a constant need for both Small Scale bioprocessing systems used for research, process development, and clinical manufacturing and large-scale bioprocessing facilities set up for commercial production. The rising demand for biologics, biosimilars, vaccines, and cell and gene therapies is also a factor driving the region’s rapid adoption of bioprocessing technologies on a large scale.

U.S. Large And Small Scale Bioprocessing Market Trends

The US market has the most significant share of the worldwide demand high investments in biotechnology research and a well-established healthcare infrastructure are the main drivers of the market. The dominance of chronic diseases that can be treated with biopharmaceuticals and the government’s support also play a role in the market expansion. As an example, during November 2024, Lonza reached the milestone of its first GMP batch at the state-of-the-art mammalian Manufacturing Facility in Portsmouth, USA, thus marking its continuous effort to improve cell and gene therapy production, which in turn stimulates market demand.

Why is Asia Pacific Experiencing the Fastest Growth in the Large And Small Scale Bioprocessing Market?

It is estimated that the Asia-Pacific region will have the highest growth with a CAGR of 12.5% between the years 2026 and 2035. The market is very gradually growing, perhaps by little but nevertheless due to the enlargement of the biopharmaceutical manufacturing capacity, the rise in health care demand, and the increase in investments for the biotechnology infrastructure. The manufacture of biopharmaceuticals in countries such as China, India, South Korea, and Japan is largely due to the factors that include the combination of low manufacturing cost, a large population of patients, and active government policies that not only support the local biomanufacturing industry but also create a drug and vaccine self-sufficient supply. The existence of biotechnology startups and CDMOs are among the demand drivers for Small Scale bioprocessing systems that are being used in various stages, i.e., research, process development, and clinical trials. On the other hand, the big pharmaceutical companies have invested their money in the industrial-scale bioprocessing plants, not only for supporting the commercial production but also for export purposes. They have also realized the benefits of single-use technologies, automation, and advanced downstream processing solutions that have been adopted throughout the region, which has led to increased efficiency and scalability. The combination of positive regulatory changes, an increase in foreign direct investment, and a greater focus on biosimilars and vaccines have contributed to the already vigorous revenue generation of both small and large-scale bioprocessing markets in Asia Pacific even more.

China Large And Small Scale Bioprocessing Market Trends

The Chinese market has an extremely fast-growing market. The advancement of the biopharmaceutical industry and government backing play pivotal roles in the growth. Low competitive lifecycle costs paired with good compatibility with high-volume productions are also the reasons that favor the adoption of such systems.

Why is Europe is growing at a significant rate in the Large And Small Scale Bioprocessing Market?

The European market is large and established. A stable and well-defined regulatory framework as well as substantial R&D investments underpin the expansion of the regional market. As an illustration, Cytiva (which is under Danaher) declared in June 2025 that it would allocate a sum of USD 1.6 billion for the period up to 2028 to improve the bioprocessing manufacturing capacity in regions of North America, Europe, and Asia thereby reinforcing its regional strategy.

UK Large And Small Scale Bioprocessing Market Trends

In 2025, the UK’s large and Small Scale bioprocessing industry took a considerable market share, mainly due to government support for biotechnology research and a good regulatory environment. Furthermore, the partnerships between universities and industry are the main source of new bioprocessing techniques.

Why is the Middle East & Africa Region is growing rapidly in the Large And Small Scale Bioprocessing?

In the Middle East and Africa area, the bioprocessing industry for both large and small scales is at the beginning, but with a strong will, it is going to build its bioprocessing ecosystem. The majority of the actions being taken are in the areas of basic research, pilot production, and biologics that benefit public health, which include vaccines and insulin. Also, Africa is slowly heading towards self-reliance in bioproduction with the help of international organizations. The region is characterized by Small Scale bioprocessing due to its lack of proper infrastructure, but there is a great desire to step up to commercial-scale capabilities within the next ten years.

UAE Large And Small Scale Bioprocessing Market Trends

The rise in the sector is a result of active government measures to create an indigenous biopharmaceutical manufacturing base and cut down on imports. National policies concentrating on healthcare localization, life science, and advanced manufacturing have opened the door for investments in bioprocessing infrastructure which is made up of systems for research, pilot production, and clinical manufacturing plus Small Scale and large-scale facilities for the production of commercial biologics and vaccines.

Top Players in the Large And Small Scale Bioprocessing Market and Their Offerings

- CESCO BIOENGINEERING CO. LTD

- ExcellGene SA

- Hoffmann-La Roche Ltd

- Corning Inc.

- Sartorius AG

- Lonza

- Merck KGaA

- Bio-Process Group

- BPC Instruments AB

- Eppendorf AG

- Getinge AB

- PBS Biotech Inc.

- Bio-Synthesis Inc.

- Meissner Filtration Products Inc.

- Entegris

- KUHNER AG

- Saint-Gobain

- Thermo Fisher Scientific Inc.

- Repligen Corporation

- Avantor Inc

- CerCell A/S

- Univercells Technologies

- Distek Inc.

- Danaher (Cytiva)

- Others

Key Developments

Large And Small Scale Bioprocessing Market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolio using strategic approaches.

- In February 2025: Thermo Fisher Scientific announced plans to acquire Solventum’s Purification & Filtration business for USD 4.1 billion, enhancing its global bioproduction capabilities. (Source: https://ir.thermofisher.com/investors/news-events/news/news-details/2025/Thermo-Fisher-Scientific-to-Acquire-Solventums-Purification-and-Filtration-Business/default.aspx)

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast growing Large And Small Scale Bioprocessing Market.

The Large And Small Scale Bioprocessing Market is segmented as follows:

By Scale

- Small Scale (Less Than 50,000 Liter)

- Industrial Scale (Over 50,000 Liter)

By Product

- Bioreactors/Fermenters

- Filtration Assemblies

- Cell Culture Products

- Bags & Containers

- Bioreactors Accessories

- Others

By Workflow

- Upstream Processing

- Downstream Processing

- Fermentation

By Application

- Biopharmaceutical

- Environmental Aids

- Specialty Industrial Chemicals

By Use Type

- Multi-Use

- Single-Use

By Mode

- In-house

- Outsourced

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Large And Small Scale Bioprocessing Market, (2026 – 2035) (USD Billion)

- 2.2 Global Large And Small Scale Bioprocessing Market: snapshot

- Chapter 3. Global Large And Small Scale Bioprocessing Market – Industry Analysis

- 3.1 Large And Small Scale Bioprocessing Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Rising Demand for Biopharmaceuticals

- 3.2.2 Favorable Regulatory Support

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Scale

- 3.7.2 Market attractiveness analysis By Product

- 3.7.3 Market attractiveness analysis By Workflow

- 3.7.4 Market attractiveness analysis By Application

- 3.7.5 Market attractiveness analysis By Use Type

- 3.7.6 Market attractiveness analysis By Mode

- Chapter 4. Global Large And Small Scale Bioprocessing Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Large And Small Scale Bioprocessing Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Large And Small Scale Bioprocessing Market – Scale Analysis

- 5.1 Global Large And Small Scale Bioprocessing Market overview: By Scale

- 5.1.1 Global Large And Small Scale Bioprocessing Market share, By Scale, 2025 and 2035

- 5.2 Small Scale (Less Than 50,000 Liters)

- 5.2.1 Global Large And Small Scale Bioprocessing Market by Small Scale (Less Than 50,000 Liter), 2026 – 2035 (USD Billion)

- 5.3 Industrial Scale (Over 50,000 Liters)

- 5.3.1 Global Large And Small Scale Bioprocessing Market by Industrial Scale (Over 50,000 Liter), 2026 – 2035 (USD Billion)

- 5.1 Global Large And Small Scale Bioprocessing Market overview: By Scale

- Chapter 6. Global Large And Small Scale Bioprocessing Market – Product Analysis

- 6.1 Global Large And Small Scale Bioprocessing Market overview: By Product

- 6.1.1 Global Large And Small Scale Bioprocessing Market share, By Product, 2025 and 2035

- 6.2 Bioreactors/Fermenters

- 6.2.1 Global Large And Small Scale Bioprocessing Market by Bioreactors/Fermenters, 2026 – 2035 (USD Billion)

- 6.3 Filtration Assemblies

- 6.3.1 Global Large And Small Scale Bioprocessing Market by Filtration Assemblies, 2026 – 2035 (USD Billion)

- 6.4 Cell Culture Products

- 6.4.1 Global Large And Small Scale Bioprocessing Market by Cell Culture Products, 2026 – 2035 (USD Billion)

- 6.5 Bags & Containers

- 6.5.1 Global Large And Small Scale Bioprocessing Market by Bags & Containers, 2026 – 2035 (USD Billion)

- 6.6 Bioreactors Accessories

- 6.6.1 Global Large And Small Scale Bioprocessing Market by Bioreactors Accessories, 2026 – 2035 (USD Billion)

- 6.7 Others

- 6.7.1 Global Large And Small Scale Bioprocessing Market by Others, 2026 – 2035 (USD Billion)

- 6.1 Global Large And Small Scale Bioprocessing Market overview: By Product

- Chapter 7. Global Large And Small Scale Bioprocessing Market – Workflow Analysis

- 7.1 Global Large And Small Scale Bioprocessing Market overview: By Workflow

- 7.1.1 Global Large And Small Scale Bioprocessing Market share, By Workflow, 2025 and 2035

- 7.2 Upstream Processing

- 7.2.1 Global Large And Small Scale Bioprocessing Market by Upstream Processing, 2026 – 2035 (USD Billion)

- 7.3 Downstream Processing

- 7.3.1 Global Large And Small Scale Bioprocessing Market by Downstream Processing, 2026 – 2035 (USD Billion)

- 7.4 Fermentation

- 7.4.1 Global Large And Small Scale Bioprocessing Market by Fermentation, 2026 – 2035 (USD Billion)

- 7.1 Global Large And Small Scale Bioprocessing Market overview: By Workflow

- Chapter 8. Global Large And Small Scale Bioprocessing Market – Application Analysis

- 8.1 Global Large And Small Scale Bioprocessing Market overview: By Application

- 8.1.1 Global Large And Small Scale Bioprocessing Market share, By Application, 2025 and 2035

- 8.2 Biopharmaceutical

- 8.2.1 Global Large And Small Scale Bioprocessing Market by Biopharmaceuticals, 2026 – 2035 (USD Billion)

- 8.3 Environmental Aids

- 8.3.1 Global Large And Small Scale Bioprocessing Market by Environmental Aids, 2026 – 2035 (USD Billion)

- 8.4 Specialty Industrial Chemicals

- 8.4.1 Global Large And Small Scale Bioprocessing Market by Specialty Industrial Chemicals, 2026 – 2035 (USD Billion)

- 8.1 Global Large And Small Scale Bioprocessing Market overview: By Application

- Chapter 9. Global Large And Small Scale Bioprocessing Market – Use Type Analysis

- 9.1 Global Large And Small Scale Bioprocessing Market overview: By Use Type

- 9.1.1 Global Large And Small Scale Bioprocessing Market share, By Use Type, 2025 and 2035

- 9.2 Multi-Use

- 9.2.1 Global Large And Small Scale Bioprocessing Market by Multi-Use, 2026 – 2035 (USD Billion)

- 9.3 Single-Use

- 9.3.1 Global Large And Small Scale Bioprocessing Market by Single-Use, 2026 – 2035 (USD Billion)

- 9.1 Global Large And Small Scale Bioprocessing Market overview: By Use Type

- Chapter 10. Global Large And Small Scale Bioprocessing Market – Mode Analysis

- 10.1 Global Large And Small Scale Bioprocessing Market overview: By Mode

- 10.1.1 Global Large And Small Scale Bioprocessing Market share, By Mode, 2025 and 2035

- 10.2 In-house

- 10.2.1 Global Large And Small Scale Bioprocessing Market by In-house, 2026 – 2035 (USD Billion)

- 10.3 Outsourced

- 10.3.1 Global Large And Small Scale Bioprocessing Market by Outsourced, 2026 – 2035 (USD Billion)

- 10.1 Global Large And Small Scale Bioprocessing Market overview: By Mode

- Chapter 11. Large And Small Scale Bioprocessing Market – Regional Analysis

- 11.1 Global Large And Small Scale Bioprocessing Market Regional Overview

- 11.2 Global Large And Small Scale Bioprocessing Market Share, by Region, 2025 & 2035 (USD Billion)

- 11.3. North America

- 11.3.1 North America Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.3.1.1 North America Large And Small Scale Bioprocessing Market, by Country, 2026 – 2035 (USD Billion)

- 11.3.1 North America Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.4 North America Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035

- 11.4.1 North America Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035 (USD Billion)

- 11.5 North America Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035

- 11.5.1 North America Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035 (USD Billion)

- 11.6 North America Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035

- 11.6.1 North America Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035 (USD Billion)

- 11.7 North America Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035

- 11.7.1 North America Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035 (USD Billion)

- 11.8 North America Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035

- 11.8.1 North America Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035 (USD Billion)

- 11.9 North America Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035

- 11.9.1 North America Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035 (USD Billion)

- 11.10. Europe

- 11.10.1 Europe Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.10.1.1 Europe Large And Small Scale Bioprocessing Market, by Country, 2026 – 2035 (USD Billion)

- 11.10.1 Europe Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.11 Europe Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035

- 11.11.1 Europe Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035 (USD Billion)

- 11.12 Europe Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035

- 11.12.1 Europe Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035 (USD Billion)

- 11.13 Europe Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035

- 11.13.1 Europe Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035 (USD Billion)

- 11.14 Europe Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035

- 11.14.1 Europe Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035 (USD Billion)

- 11.15 Europe Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035

- 11.15.1 Europe Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035 (USD Billion)

- 11.16 Europe Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035

- 11.16.1 Europe Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035 (USD Billion)

- 11.17. Asia Pacific

- 11.17.1 Asia Pacific Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.17.1.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Country, 2026 – 2035 (USD Billion)

- 11.17.1 Asia Pacific Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.18 Asia Pacific Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035

- 11.18.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035 (USD Billion)

- 11.19 Asia Pacific Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035

- 11.19.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035 (USD Billion)

- 11.20 Asia Pacific Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035

- 11.20.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035 (USD Billion)

- 11.21 Asia Pacific Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035

- 11.21.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035 (USD Billion)

- 11.22 Asia Pacific Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035

- 11.22.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035 (USD Billion)

- 11.23 Asia Pacific Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035

- 11.23.1 Asia Pacific Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035 (USD Billion)

- 11.24. Latin America

- 11.24.1 Latin America Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.24.1.1 Latin America Large And Small Scale Bioprocessing Market, by Country, 2026 – 2035 (USD Billion)

- 11.24.1 Latin America Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.25 Latin America Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035

- 11.25.1 Latin America Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035 (USD Billion)

- 11.26 Latin America Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035

- 11.26.1 Latin America Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035 (USD Billion)

- 11.27 Latin America Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035

- 11.27.1 Latin America Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035 (USD Billion)

- 11.28 Latin America Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035

- 11.28.1 Latin America Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035 (USD Billion)

- 11.29 Latin America Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035

- 11.29.1 Latin America Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035 (USD Billion)

- 11.30 Latin America Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035

- 11.30.1 Latin America Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035 (USD Billion)

- 11.31. The Middle-East and Africa

- 11.31.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.31.1.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Country, 2026 – 2035 (USD Billion)

- 11.31.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, 2026 – 2035 (USD Billion)

- 11.32 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035

- 11.32.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Scale, 2026 – 2035 (USD Billion)

- 11.33 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035

- 11.33.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Product, 2026 – 2035 (USD Billion)

- 11.34 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035

- 11.34.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Workflow, 2026 – 2035 (USD Billion)

- 11.35 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035

- 11.35.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Application, 2026 – 2035 (USD Billion)

- 11.36 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035

- 11.36.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Use Type, 2026 – 2035 (USD Billion)

- 11.37 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035

- 11.37.1 The Middle-East and Africa Large And Small Scale Bioprocessing Market, by Mode, 2026 – 2035 (USD Billion)

- Chapter 12. Company Profiles

- 12.1 CESCO BIOENGINEERING CO. LTD

- 12.1.1 Overview

- 12.1.2 Financials

- 12.1.3 Product Portfolio

- 12.1.4 Business Strategy

- 12.1.5 Recent Developments

- 12.2 ExcellGene SA

- 12.2.1 Overview

- 12.2.2 Financials

- 12.2.3 Product Portfolio

- 12.2.4 Business Strategy

- 12.2.5 Recent Developments

- 12.3 F. Hoffmann-La Roche Ltd

- 12.3.1 Overview

- 12.3.2 Financials

- 12.3.3 Product Portfolio

- 12.3.4 Business Strategy

- 12.3.5 Recent Developments

- 12.4 Corning Inc.

- 12.4.1 Overview

- 12.4.2 Financials

- 12.4.3 Product Portfolio

- 12.4.4 Business Strategy

- 12.4.5 Recent Developments

- 12.5 Sartorius AG

- 12.5.1 Overview

- 12.5.2 Financials

- 12.5.3 Product Portfolio

- 12.5.4 Business Strategy

- 12.5.5 Recent Developments

- 12.6 Lonza

- 12.6.1 Overview

- 12.6.2 Financials

- 12.6.3 Product Portfolio

- 12.6.4 Business Strategy

- 12.6.5 Recent Developments

- 12.7 Merck KGaA

- 12.7.1 Overview

- 12.7.2 Financials

- 12.7.3 Product Portfolio

- 12.7.4 Business Strategy

- 12.7.5 Recent Developments

- 12.8 Bio-Process Group

- 12.8.1 Overview

- 12.8.2 Financials

- 12.8.3 Product Portfolio

- 12.8.4 Business Strategy

- 12.8.5 Recent Developments

- 12.9 BPC Instruments AB

- 12.9.1 Overview

- 12.9.2 Financials

- 12.9.3 Product Portfolio

- 12.9.4 Business Strategy

- 12.9.5 Recent Developments

- 12.10 Eppendorf AG

- 12.10.1 Overview

- 12.10.2 Financials

- 12.10.3 Product Portfolio

- 12.10.4 Business Strategy

- 12.10.5 Recent Developments

- 12.11 Getinge AB

- 12.11.1 Overview

- 12.11.2 Financials

- 12.11.3 Product Portfolio

- 12.11.4 Business Strategy

- 12.11.5 Recent Developments

- 12.12 PBS Biotech Inc.

- 12.12.1 Overview

- 12.12.2 Financials

- 12.12.3 Product Portfolio

- 12.12.4 Business Strategy

- 12.12.5 Recent Developments

- 12.13 Bio-Synthesis Inc.

- 12.13.1 Overview

- 12.13.2 Financials

- 12.13.3 Product Portfolio

- 12.13.4 Business Strategy

- 12.13.5 Recent Developments

- 12.14 Meissner Filtration Products Inc.

- 12.14.1 Overview

- 12.14.2 Financials

- 12.14.3 Product Portfolio

- 12.14.4 Business Strategy

- 12.14.5 Recent Developments

- 12.15 Entegris

- 12.15.1 Overview

- 12.15.2 Financials

- 12.15.3 Product Portfolio

- 12.15.4 Business Strategy

- 12.15.5 Recent Developments

- 12.16 KUHNER AG

- 12.16.1 Overview

- 12.16.2 Financials

- 12.16.3 Product Portfolio

- 12.16.4 Business Strategy

- 12.16.5 Recent Developments

- 12.17 Saint-Gobain

- 12.17.1 Overview

- 12.17.2 Financials

- 12.17.3 Product Portfolio

- 12.17.4 Business Strategy

- 12.17.5 Recent Developments

- 12.18 Thermo Fisher Scientific Inc.

- 12.18.1 Overview

- 12.18.2 Financials

- 12.18.3 Product Portfolio

- 12.18.4 Business Strategy

- 12.18.5 Recent Developments

- 12.19 Repligen Corporation

- 12.19.1 Overview

- 12.19.2 Financials

- 12.19.3 Product Portfolio

- 12.19.4 Business Strategy

- 12.19.5 Recent Developments

- 12.20 Avantor Inc

- 12.20.1 Overview

- 12.20.2 Financials

- 12.20.3 Product Portfolio

- 12.20.4 Business Strategy

- 12.20.5 Recent Developments

- 12.21 CerCell A/S

- 12.21.1 Overview

- 12.21.2 Financials

- 12.21.3 Product Portfolio

- 12.21.4 Business Strategy

- 12.21.5 Recent Developments

- 12.22 Univercells Technologies

- 12.22.1 Overview

- 12.22.2 Financials

- 12.22.3 Product Portfolio

- 12.22.4 Business Strategy

- 12.22.5 Recent Developments

- 12.23 Distek Inc.

- 12.23.1 Overview

- 12.23.2 Financials

- 12.23.3 Product Portfolio

- 12.23.4 Business Strategy

- 12.23.5 Recent Developments

- 12.24 Danaher (Cytiva)

- 12.24.1 Overview

- 12.24.2 Financials

- 12.24.3 Product Portfolio

- 12.24.4 Business Strategy

- 12.24.5 Recent Developments

- 12.25 Others.

- 12.25.1 Overview

- 12.25.2 Financials

- 12.25.3 Product Portfolio

- 12.25.4 Business Strategy

- 12.25.5 Recent Developments

- 12.1 CESCO BIOENGINEERING CO. LTD

List Of Figures

Figures No 1 to 40

List Of Tables

Tables No 1 to 152

Prominent Player

- CESCO BIOENGINEERING CO. LTD

- ExcellGene SA

- Hoffmann-La Roche Ltd

- Corning Inc.

- Sartorius AG

- Lonza

- Merck KGaA

- Bio-Process Group

- BPC Instruments AB

- Eppendorf AG

- Getinge AB

- PBS Biotech Inc.

- Bio-Synthesis Inc.

- Meissner Filtration Products Inc.

- Entegris

- KUHNER AG

- Saint-Gobain

- Thermo Fisher Scientific Inc.

- Repligen Corporation

- Avantor Inc

- CerCell A/S

- Univercells Technologies

- Distek Inc.

- Danaher (Cytiva)

- Others

FAQs

The key players in the market are CESCO BIOENGINEERING CO. LTD, ExcellGene SA, F. Hoffmann-La Roche Ltd, Corning Inc., Sartorius AG, Lonza, Merck KGaA, Bio-Process Group, BPC Instruments AB, Eppendorf AG, Getinge AB, PBS Biotech Inc., Bio-Synthesis Inc., Meissner Filtration Products Inc., Entegris, KUHNER AG, Saint-Gobain, Thermo Fisher Scientific Inc., Repligen Corporation, Avantor Inc., CerCell A/S, Univercells Technologies, Distek Inc., Danaher (Cytiva), and Others.

Government regulations are the primary determinants of the bioprocessing market’s directions, both at the small and large scales, as they influence technology, manufacturing practices, investment decisions, and time-to-market for biopharmaceutical products the most. Among the regulatory authorities, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are those that enforce the strictest quality, safety, traceability, and consistency in the process requirements, which all involve the utilization of advanced bioprocessing technologies at small and large scales. The manufacturers who adopt the Regulation standards like Quality by Design (QbD), Process Analytical Technology (PAT), and data integrity are those who invest in automation, real-time monitoring, and digitalized bioprocessing systems. Moreover, the FDA and EMA’s approval processes, fast-track designations, and their supportive policies for biologics, biosimilars, and vaccines significantly reduce the uncertainties and result in the rapid commercialization which in turn increases the market growth. The government policy and financial support are two of the factors that define the investment in bioprocessing infrastructure in the emerging regions, where the government initiatives, incentivizations, and localization policies directed towards enhancing domestic biomanufacturing are even more investment-stimulating. On the one hand, the government regulations result in compliance and patient safety, but on the other hand, they are the main factor for the bioprocessing market innovation, scalability, and long-term growth both at the large and small scales.

In the case of small-scale operations, the lower initial cost is one of the major driving factors for acceptance, particularly in biotech startups, research institutions, and university laboratories that have limited funds. The entry of low-cost benchtop and pilot-scale bioreactors, along with modular and single-use systems, has significantly shrunk the capital expenses and permitted the organizations to initiate process development with very little financial risk. The cozy pricing invites a trial, speeds up the development, and thus rapidly advances the innovation. On the other hand, machinery or consumables with high prices can lead to cash-strapped regions taking a longer time to accept the technology and thus limit the market penetration despite great demand for R&D.

According to the present analysis and forecast modeling, the market of Large And Small-scale Bioprocessing will witness a significant growth of about USD 277.4 billion in the year 2035 with the growth of biotechnology R&D & personalized medicine, technological advancements, flexible & modular manufacturing models, and favorable regulatory support, with a CAGR of 11.5% between the years 2026 and 2035.

It is projected that North America will hold the largest market share in the Large And Small-scale Bioprocessing market in the forecast period, with a share of about 35% of the global market share, which is attributed to the existence of major players and increasing government support.

The Asia-Pacific Region is expected to have the highest growth rate of about 12.5% in the forecast period. The growing number of biotechnology startups and contract development and manufacturing organizations (CDMOs) is boosting demand for small-scale bioprocessing systems used in research, process development, and clinical trials, while large pharmaceutical companies are investing in industrial-scale bioprocessing facilities to support commercial production and exports.

The market growth is pushed by the technological advancements, like single-use bioreactors, continuous bioprocessing, automation, and digitized monitoring, which enhance process efficiency, lower the risks of contamination, cut operational expenses, and allow quick scaling up.