Pharmaceutical Microbiology QC Testing Market Size, Trends and Insights By Product (Instruments, Reagents & Kits, Accessories, Software), By Test Type (Conventional/Traditional Testing, Rapid Testing), By Technique (Growth-based Testing, Nucleic Acid-based Testing, Cellular Component-based Testing, Viability-based Testing), By Application (Bioburden Testing, Sterility Testing, Environmental Monitoring, Endotoxin Testing, Pyrogen Testing, Mycoplasma Testing, Microbial Identification), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- BD

- Merck KGaA

- bioMérieux SA

- Danaher

- Others

Reports Description

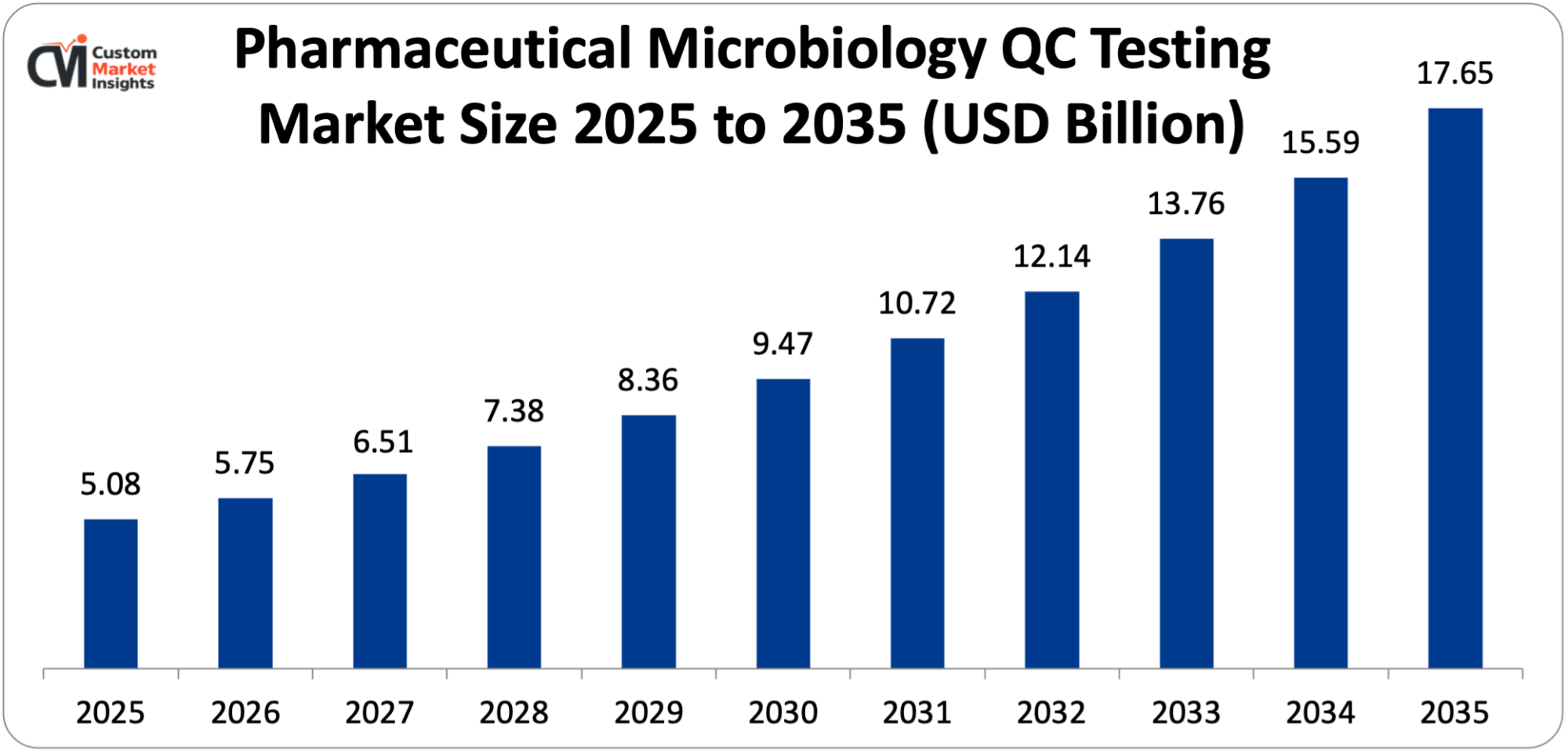

As per the Pharmaceutical Microbiology QC Testing Market analysis conducted by the CMI team, the pharmaceutical microbiology QC testing market is expected to record a CAGR of 13.27% from 2026 to 2035. In 2026, the market size was USD 5.75 Billion. By 2035, the valuation is anticipated to reach USD 17.65 Billion.

The market is regulatory pressures, technological advancements, and an increased focus on product quality and patient safety. Emphasis on quality assurance in the wake of rising demand for microbiology testing in pharmaceuticals is accelerating the pharmaceutical microbiology QC testing.

The manufacturers of drugs are increasingly opting for strict regulatory scrutiny to exercise control over contamination. Microbiology techniques that facilitate an accelerated batch-release timeline without compromising product safety are turning out to be essential as complex biologics like gene and cell therapies gain traction. Also, moving to automation-enabled QC and microbial surveillance in real time is expediting the adoption of the rapid testing platforms that are capable of delivering actionable results in a few hours.

Market Highlights

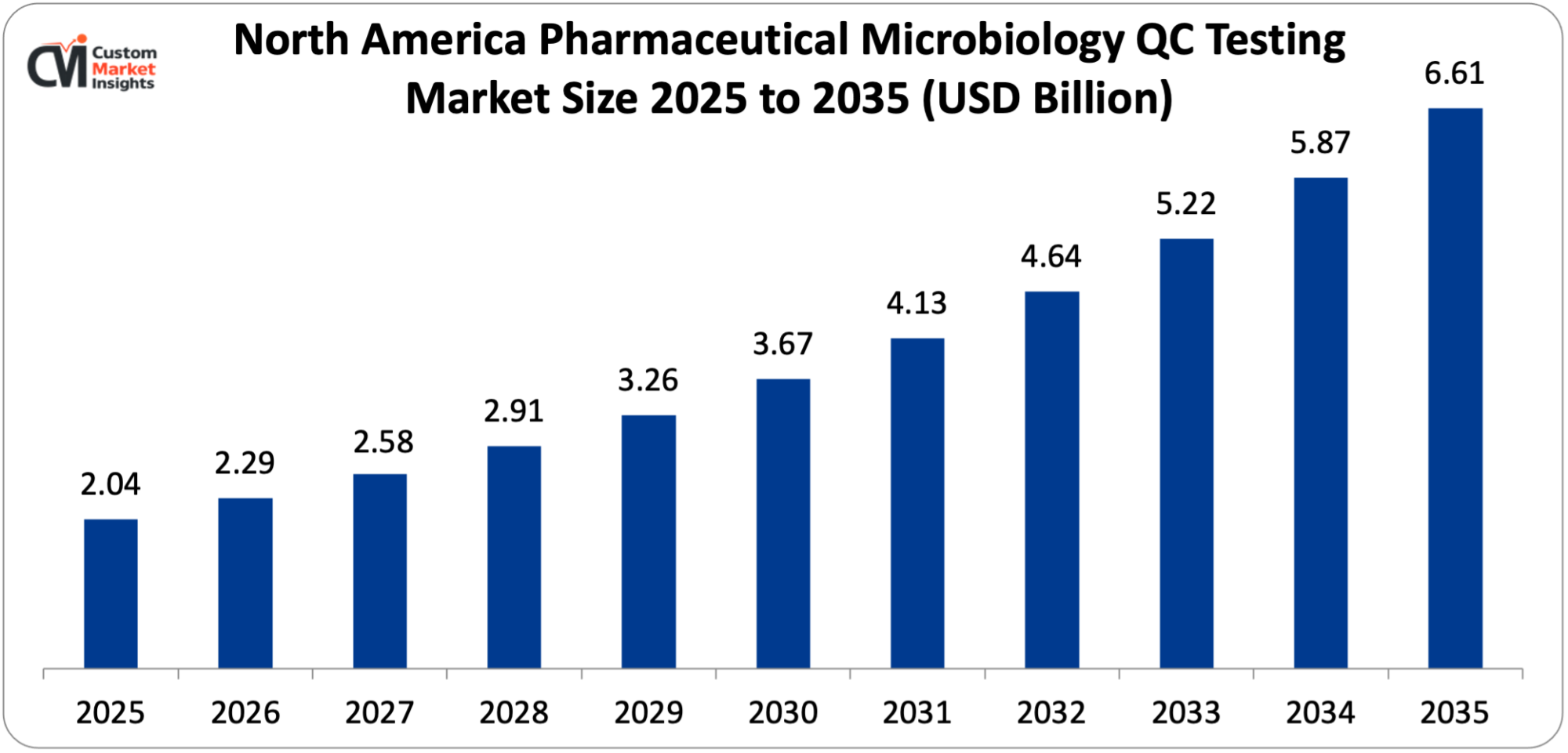

- North America dominated the pharmaceutical microbiology QC testing market in 2025 with 39.12% of the overall share.

- The Asia Pacific is expected to witness the fastest CAGR of 14.33% in the pharmaceutical microbiology QC testing market during the forecast period.

- By product, the reagents & kits segment dominated the pharmaceutical microbiology QC testing market with 47% of the overall share.

- By product, the software segment is expected to witness the fastest CAGR of 12.34% in the pharmaceutical microbiology QC testing market during the forecast period.

- By test type, the conventional/traditional testing segment dominated the pharmaceutical microbiology QC testing market with 46.32% of the overall share.

- By test type, the rapid testing segment is expected to witness the fastest CAGR of 10.34% in the pharmaceutical microbiology QC testing market during the forecast period.

- By technique, the growth-based testing segment dominated the pharmaceutical microbiology QC testing market with 56.32% of the overall share.

- By technique, the nucleic acid-based testing segment is expected to witness the fastest CAGR of 11.34% in the pharmaceutical microbiology QC testing market during the forecast period.

- By application, the bioburden testing segment dominated the pharmaceutical microbiology QC testing market with 66.32% of the overall share.

- By application, the mycoplasma testing segment is expected to witness the fastest CAGR of 9.34% in the pharmaceutical microbiology QC testing market during the forecast period

Significant Growth Factors

The Pharmaceutical Microbiology QC Testing Market Trends signify the following:

- Increased Demand for Quicker Turnaround Times: In traditional microbiology, quality testing is bound to take numerous days, which, in turn, does increase the price of maintenance of inventory along with delaying the release of batches. Rapid microbiology testing (RMT) facilitates decision-making in the manufacturing processes in real-time by giving results in less time. These time savings do end up impacting the profitability in high-throughput manufacturing settings, thereby rendering speed necessary. Quicker testing also supports just-in-time manufacturing and lean production models. The pharmaceutical companies, in order to raise operational efficiency and smoothen workflows, are increasingly adopting RMT.

- Rising Sterile Drug and Biologics Production: Increased production of biosimilars, biologics, and sterile injectables coupled with the requirement of appropriate microbial control (considering their sensitivity to contamination) is keeping the cash registers ringing for the pharmaceutical microbiology QC testing market. It is known that biologics (as opposed to small-molecule medications) are generally produced using living organisms, which, in turn, does raise the probability of contamination at every single stage. RMT techniques provide real-time insights and rapid biological detection, which prove to be necessary in such high-risk settings. As such, adoption of RMT is poised to be in sync with expansion of production of biopharmaceuticals.

- Integration of AI: AI does analyse sizable quantities of environmental monitoring (EM) data for detecting trends such as shifts in microbial growth patterns or particulate levels. AI-driven systems do identify weaker signals, thereby letting preventive action happen against contamination in the clean rooms. Integration of AI with IoT devices allows for monitoring of manufacturing parameters in real-time, thereby improving sanitary standards on the whole. AI-powered deep learning (such as Convolutional Neural Networks) and computer vision models do automate bacterial colonies’ counting on the plates. This does reduce time-consuming, manual, and error-prone activities, thereby achieving over 95% precision. AI accelerates the process of identifying microorganisms, thereby giving results in hours or even minutes rather than days. For instance – Ai-assisted image analysis is capable of detecting contamination in the sterile injectables in less than 4 hours.

What are the Major Advancements Changing the Pharmaceutical Microbiology QC Testing Market Today?

- Rising Adoption of Biologic and Personalized Therapies: There is a burgeoning requirement of real-time and precise microbiological monitoring, which, in turn, is driven by a worldwide shift toward biologics, personalized medications, and gene and cell therapies. Such treatments require stringent sterility guidelines and tend to have shorter shelf lives. It is important to have rapid microbiology testing for facilitating faster product release with quality control. RMT is all set to establish itself as one of the common tools in workflows pertaining to biological manufacturing. Moreover, small-batch production is required on a frequent basis for personalized therapies.

- Supportive Industry Guidelines and Regulatory Push: The regulatory organizations worldwide are into progressive promotion of rapid testing techniques for improving quality assurance rules such as USP. 1223 Ph. Eu. 5 point 1.6. Use of RMT is encouraged by the U.S. FDA’s process analytical technology (PAT) framework. Trade associations like the Parenteral Drug Association (PDA) are also promoting rapid techniques. The early adopters are at a lesser risk owing to regulatory support, which does improve industry compliance. It proves to be beneficial for vendors providing internationally recognized and verified solutions.

Category Wise Insights

By Product

- Why are Reagents & Kits Dominating the Pharmaceutical Microbiology QC Testing Market?

Reagents & kits imply consumables that need continual replenishment for sterility tests, routine testing, and bioburden analysis, which helps in creation of consistent revenue stream. Also, there is robust demand for more accurate and quicker detection methods (such as ATP bioluminescence, automated PCR, etc.), which need application-specific kits for fast QC results. The ready-to-use, certified, and validated reagents & kits do help the pharmaceutical companies in adhering to strict GMP standards while curtailing the potential for human error and manual labor. Increased investments in health infrastructure followed by rising emphasis on quality control for avoiding expensive product recalls are drawing the adoption of such products further.

By Test Type

- Why is Traditional/Conventional Testing Dominating the Pharmaceutical Microbiology QC Testing Market?

Traditional/conventional microbiology QC testing dominates the pharmaceutical microbiology QC testing market due to its well-established status as one of the regulatory gold standards for compliance and safety. Regulatory bodies do depend heavily on culture-based, conventional, and competitive methods in order to validate product safety, thereby rendering them one of the default choices for compliance. However, advanced, quicker rapid microbiology testing (RMT) instruments need significant capital expenditure.

By Technique

- Why is Growth-based Testing Dominating the Pharmaceutical Microbiology QC Testing Market?

Growth-based technologies (such as bioluminescence and automated imaging) do detect microorganisms within a few hours rather than days, thereby facilitating faster batch release and curtailing the inventory hold times. Growing regulatory emphasis on mandates pertaining to product safety implies stern control over contamination. The growth-based systems do provide reliable, compliant, and automated results in line with microbiological principles that are well-established, thereby averting pricey recalls. The quicker detection of contaminants does minimize the risk of litigation pertaining to products.

By Application

- Why is Bioburden Testing Dominating the Pharmaceutical Microbiology QC Testing Market?

Regulatory bodies need raw materials’ rigorous testing, in-process samples, and ultimately the products needed for maintaining high class standards and ascertaining patient safety. Rising awareness regarding the higher monetary impact of the product recalls – which average USD 10 Million, does drive the manufacturers to go for stringent bioburden monitoring. The increased demand for sterile pharmaceuticals, biologics, and medical devices that are susceptible to contamination does raise the necessity of testing on a frequent basis.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 5.75 Billion |

| Projected Market Size in 2035 | USD 17.65 Billion |

| Market Size in 2025 | USD 5.08 Billion |

| CAGR Growth Rate | 13.27% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product, Test Type, Technique, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is North America’s Pharmaceutical Microbiology QC Testing Market Size?

North America’s pharmaceutical microbiology QC testing market was worth USD 2.04 Billion in 2025 and is expected to reach USD 6.61 Billion by 2035 at a CAGR of 12.47% between 2025 and 2035.

Why did North America Dominate the Pharmaceutical Microbiology QC Testing Market in 2025?

North America’s pharmaceutical microbiology QC testing market is driven by a robust manufacturing base, strict regulations, and the push of the U.S. FDA toward validated rapid microbiology methods and sterility assurance. The U.S. pharmaceutical microbiology QC testing market holds the largest market share in North America, which is basically driven by continual innovation in microbiological and analytical technologies. Also, the region does hold a properly established production base for biologics, vaccines, and pharmaceuticals, wherein it asks for high class, rigorous testing protocols.

What is the Size of the U.S. Pharmaceutical Microbiology QC Testing Market?

The market size of the U.S. pharmaceutical microbiology QC testing was USD 1.67 Billion in 2025 and is expected to reach USD 5.06 Billion in 2035, witnessing a CAGR of 11.68% between 2026 and 2035.

U.S. Pharmaceutical Microbiology QC Testing Market Trends

The U.S. is witnessing a strong shift away from slow culture-based methods toward rapid microbiological methods (RMM), which do make provisions for quicker results for the sterile product testing. As such, production efficiency gets enhanced. The pharmaceutical companies are also increasingly outsourcing QC to the contract organizations for reducing in-house costs and speeding up the time-to-market. Also, the U.S. FDA’s proactive stance on process analytical technology (PAT) and quality by design (QbD) does encourage adopting real-time, automated monitoring solutions.

Why is Asia Pacific Experiencing the Fastest Growth in the Pharmaceutical Microbiology QC Testing Market?

The Asia Pacific’s pharmaceutical microbiology QC testing market is driven by enhanced pharmaceutical production capabilities, rising regulatory alignment with the GMP standards at the global level, and supportive initiatives by the governments. The increased occurrence of CMOs (contract manufacturing organizations) and emphasis on reduction of product release timelines are further driving a shift in the direction of RMT solutions driven by automation.

China’s Pharmaceutical Microbiology QC Testing Market Trends

China is witnessing an exponential expansion of biopharmaceutical production and pharmaceutical manufacturing capacities on the domestic front. Government-backed programs are also driving the market, which are, in turn, encouraging biomanufacturing and pharmaceutical innovation, along with the rising utilization of viability-based detection platforms and molecular assays.

Where does Europe stand with respect to Pharmaceutical Microbiology QC Testing Market?

The market for pharmaceutical microbiology QC testing in Europe is witnessing steadiness, driven by a robust regulatory framework and growing focus on prevention of contamination and assurance of sterility. The European Medicines Agency (EMA) and the other regulatory bodies are encouraging implementation of various validated rapid methods under the Good Manufacturing Practice (GMP) guidelines, thereby driving wider adoption across sterile and biopharmaceutical product facilities.

U.K. Pharmaceutical Microbiology QC Testing Market Trends

RMMs are witnessing higher growth. Labs, in order to combat the inefficiencies of manual labor, are increasingly into the adoption of automated culture analysis and robotic systems, which are capable of improving output by close to 30%. Increased production of advanced medicinal products (ATMPs) and biologics calls for specific, improved testing capacities for ascertaining quality and safety. Techniques like nucleic acid-based testing are witnessing an increased demand for the contaminants in comparison with conventional culture methods.

Where is the Middle East & Africa regarding Adoption of Pharmaceutical Microbiology QC Testing?

The UAE and Saudi Arabia are leading regarding the adoption of advanced, automated molecular diagnostics, microbial identification systems, ad RMM platforms for supporting their expanding biotech and pharmaceutical sectors. The laboratories are also integrating Laboratory Information Management Systems (LIS) for improving data traceability, integrity, and compliance with stern regulatory oversight. Saudi Arabia’s Vision 2030 implies investing in novel production facilities incorporating automated microbiology labs.

Brazil Pharmaceutical Microbiology QC Testing Market Trends

The laboratories are into the implementation of AI-powered algorithms and robotic systems for tasks such as environmental monitoring and colony counting, thereby raising throughput by around 30%. Stern quality control regulations (cGMP) for raw materials and water are driving the demand for high-precision, validated microbiology testing, particularly in expanding vaccine and biologics sectors. The mid-tier pharmaceutical companies are outsourcing to the contract testing labs equipped with technology for fast-turnaround, specialized testing.

Top Players in the Pharmaceutical Microbiology QC Testing Market and Their Offerings

- Thermo Fisher Scientific Inc.

- BD

- Merck KGaA

- bioMérieux SA

- Danaher

- Sartorius AG

- Rapid Micro Biosystems Inc.

- Charles River Laboratories

- HiMedia Laboratories

- Hardy Diagnostics

- Others

Key Developments

Pharmaceutical microbiology QC testing market has experienced considerable changes in the last few years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In November 2025, bNovate and BWT launched the AQU Sense MB system to facilitate real-time microbial monitoring in the pharmaceutical water systems, thereby facilitating speedy detection in close to 20 minutes and extending support to accelerated workflows of contamination control in pharma manufacturing.

- In October 2025, Nelson Labs did introduce the RapidCert biological indicator sterility testing service, whereby it can facilitate product-release decisions in close to 48 hours in comparison with conventional multi-day methods.

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast growing pharmaceutical microbiology QC testing market.

The Pharmaceutical Microbiology QC Testing Market is segmented as follows:

By Product

- Instruments

- Reagents & Kits

- Accessories

- Software

By Test Type

- Conventional/Traditional Testing

- Rapid Testing

By Technique

- Growth-based Testing

- Nucleic Acid-based Testing

- Cellular Component-based Testing

- Viability-based Testing

By Application

- Bioburden Testing

- Sterility Testing

- Environmental Monitoring

- Endotoxin Testing

- Pyrogen Testing

- Mycoplasma Testing

- Microbial Identification

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Pharmaceutical Microbiology QC Testing Market, (2026 – 2035) (USD Billion)

- 2.2 Global Pharmaceutical Microbiology QC Testing Market: snapshot

- Chapter 3. Global Pharmaceutical Microbiology QC Testing Market – Industry Analysis

- 3.1 Pharmaceutical Microbiology QC Testing Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Increased Demand for Quicker Turnaround Times

- 3.2.2 Rising Sterile Drug and Biologics Production

- 3.2.3 Integration of AI

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product

- 3.7.2 Market attractiveness analysis By Test Type

- 3.7.3 Market attractiveness analysis By Technique

- 3.7.4 Market attractiveness analysis By Application

- Chapter 4. Global Pharmaceutical Microbiology QC Testing Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Pharmaceutical Microbiology QC Testing Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Pharmaceutical Microbiology QC Testing Market – Product Analysis

- 5.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Product

- 5.1.1 Global Pharmaceutical Microbiology QC Testing Market share, By Product, 2025 and 2035

- 5.2 Instruments

- 5.2.1 Global Pharmaceutical Microbiology QC Testing Market by Instruments, 2026 – 2035 (USD Billion)

- 5.3 Reagents & Kits

- 5.3.1 Global Pharmaceutical Microbiology QC Testing Market by Reagents & Kits, 2026 – 2035 (USD Billion)

- 5.4 Accessories

- 5.4.1 Global Pharmaceutical Microbiology QC Testing Market by Accessories, 2026 – 2035 (USD Billion)

- 5.5 Software

- 5.5.1 Global Pharmaceutical Microbiology QC Testing Market by Software, 2026 – 2035 (USD Billion)

- 5.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Product

- Chapter 6. Global Pharmaceutical Microbiology QC Testing Market – Test Type Analysis

- 6.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Test Type

- 6.1.1 Global Pharmaceutical Microbiology QC Testing Market share, By Test Type, 2025 and 2035

- 6.2 Conventional/Traditional Testing

- 6.2.1 Global Pharmaceutical Microbiology QC Testing Market by Conventional/Traditional Testing, 2026 – 2035 (USD Billion)

- 6.3 Rapid Testing

- 6.3.1 Global Pharmaceutical Microbiology QC Testing Market by Rapid Testing, 2026 – 2035 (USD Billion)

- 6.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Test Type

- Chapter 7. Global Pharmaceutical Microbiology QC Testing Market – Technique Analysis

- 7.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Technique

- 7.1.1 Global Pharmaceutical Microbiology QC Testing Market share, By Technique, 2025 and 2035

- 7.2 Growth-based Testing

- 7.2.1 Global Pharmaceutical Microbiology QC Testing Market by Growth-based Testing, 2026 – 2035 (USD Billion)

- 7.3 Nucleic Acid-based Testing

- 7.3.1 Global Pharmaceutical Microbiology QC Testing Market by Nucleic Acid-based Testing, 2026 – 2035 (USD Billion)

- 7.4 Cellular Component-based Testing

- 7.4.1 Global Pharmaceutical Microbiology QC Testing Market by Cellular Component-based Testing, 2026 – 2035 (USD Billion)

- 7.5 Viability-based Testing

- 7.5.1 Global Pharmaceutical Microbiology QC Testing Market by Viability-based Testing, 2026 – 2035 (USD Billion)

- 7.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Technique

- Chapter 8. Global Pharmaceutical Microbiology QC Testing Market – Application Analysis

- 8.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Application

- 8.1.1 Global Pharmaceutical Microbiology QC Testing Market share, By Application, 2025 and 2035

- 8.2 Bioburden Testing

- 8.2.1 Global Pharmaceutical Microbiology QC Testing Market by Bioburden Testing, 2026 – 2035 (USD Billion)

- 8.3 Sterility Testing

- 8.3.1 Global Pharmaceutical Microbiology QC Testing Market by Sterility Testing, 2026 – 2035 (USD Billion)

- 8.4 Environmental Monitoring

- 8.4.1 Global Pharmaceutical Microbiology QC Testing Market by Environmental Monitoring, 2026 – 2035 (USD Billion)

- 8.5 Endotoxin Testing

- 8.5.1 Global Pharmaceutical Microbiology QC Testing Market by Endotoxin Testing, 2026 – 2035 (USD Billion)

- 8.6 Pyrogen Testing

- 8.6.1 Global Pharmaceutical Microbiology QC Testing Market by Pyrogen Testing, 2026 – 2035 (USD Billion)

- 8.7 Mycoplasma Testing

- 8.7.1 Global Pharmaceutical Microbiology QC Testing Market by Mycoplasma Testing, 2026 – 2035 (USD Billion)

- 8.8 Microbial Identification

- 8.8.1 Global Pharmaceutical Microbiology QC Testing Market by Microbial Identification, 2026 – 2035 (USD Billion)

- 8.1 Global Pharmaceutical Microbiology QC Testing Market overview: By Application

- Chapter 9. Pharmaceutical Microbiology QC Testing Market – Regional Analysis

- 9.1 Global Pharmaceutical Microbiology QC Testing Market Regional Overview

- 9.2 Global Pharmaceutical Microbiology QC Testing Market Share, by Region, 2025 & 2035 (USD Billion)

- 9.3. North America

- 9.3.1 North America Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.3.1.1 North America Pharmaceutical Microbiology QC Testing Market, by Country, 2026 – 2035 (USD Billion)

- 9.3.1 North America Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.4 North America Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035

- 9.4.1 North America Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035 (USD Billion)

- 9.5 North America Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035

- 9.5.1 North America Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035 (USD Billion)

- 9.6 North America Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035

- 9.6.1 North America Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035 (USD Billion)

- 9.7 North America Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035

- 9.7.1 North America Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035 (USD Billion)

- 9.8. Europe

- 9.8.1 Europe Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.8.1.1 Europe Pharmaceutical Microbiology QC Testing Market, by Country, 2026 – 2035 (USD Billion)

- 9.8.1 Europe Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.9 Europe Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035

- 9.9.1 Europe Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035 (USD Billion)

- 9.10 Europe Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035

- 9.10.1 Europe Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035 (USD Billion)

- 9.11 Europe Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035

- 9.11.1 Europe Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035 (USD Billion)

- 9.12 Europe Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035

- 9.12.1 Europe Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035 (USD Billion)

- 9.13. Asia Pacific

- 9.13.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.13.1.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Country, 2026 – 2035 (USD Billion)

- 9.13.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.14 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035

- 9.14.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035 (USD Billion)

- 9.15 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035

- 9.15.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035 (USD Billion)

- 9.16 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035

- 9.16.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035 (USD Billion)

- 9.17 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035

- 9.17.1 Asia Pacific Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035 (USD Billion)

- 9.18. Latin America

- 9.18.1 Latin America Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.18.1.1 Latin America Pharmaceutical Microbiology QC Testing Market, by Country, 2026 – 2035 (USD Billion)

- 9.18.1 Latin America Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.19 Latin America Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035

- 9.19.1 Latin America Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035 (USD Billion)

- 9.20 Latin America Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035

- 9.20.1 Latin America Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035 (USD Billion)

- 9.21 Latin America Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035

- 9.21.1 Latin America Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035 (USD Billion)

- 9.22 Latin America Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035

- 9.22.1 Latin America Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035 (USD Billion)

- 9.23. The Middle-East and Africa

- 9.23.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.23.1.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Country, 2026 – 2035 (USD Billion)

- 9.23.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, 2026 – 2035 (USD Billion)

- 9.24 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035

- 9.24.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Product, 2026 – 2035 (USD Billion)

- 9.25 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035

- 9.25.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Test Type, 2026 – 2035 (USD Billion)

- 9.26 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035

- 9.26.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Technique, 2026 – 2035 (USD Billion)

- 9.27 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035

- 9.27.1 The Middle-East and Africa Pharmaceutical Microbiology QC Testing Market, by Application, 2026 – 2035 (USD Billion)

- Chapter 10. Company Profiles

- 10.1 Thermo Fisher Scientific Inc.

- 10.1.1 Overview

- 10.1.2 Financials

- 10.1.3 Product Portfolio

- 10.1.4 Business Strategy

- 10.1.5 Recent Developments

- 10.2 BD

- 10.2.1 Overview

- 10.2.2 Financials

- 10.2.3 Product Portfolio

- 10.2.4 Business Strategy

- 10.2.5 Recent Developments

- 10.3 Merck KGaA

- 10.3.1 Overview

- 10.3.2 Financials

- 10.3.3 Product Portfolio

- 10.3.4 Business Strategy

- 10.3.5 Recent Developments

- 10.4 bioMérieux SA

- 10.4.1 Overview

- 10.4.2 Financials

- 10.4.3 Product Portfolio

- 10.4.4 Business Strategy

- 10.4.5 Recent Developments

- 10.5 Danaher

- 10.5.1 Overview

- 10.5.2 Financials

- 10.5.3 Product Portfolio

- 10.5.4 Business Strategy

- 10.5.5 Recent Developments

- 10.6 Sartorius AG

- 10.6.1 Overview

- 10.6.2 Financials

- 10.6.3 Product Portfolio

- 10.6.4 Business Strategy

- 10.6.5 Recent Developments

- 10.7 Rapid Micro Biosystems Inc.

- 10.7.1 Overview

- 10.7.2 Financials

- 10.7.3 Product Portfolio

- 10.7.4 Business Strategy

- 10.7.5 Recent Developments

- 10.8 Charles River Laboratories

- 10.8.1 Overview

- 10.8.2 Financials

- 10.8.3 Product Portfolio

- 10.8.4 Business Strategy

- 10.8.5 Recent Developments

- 10.9 HiMedia Laboratories

- 10.9.1 Overview

- 10.9.2 Financials

- 10.9.3 Product Portfolio

- 10.9.4 Business Strategy

- 10.9.5 Recent Developments

- 10.10 Hardy Diagnostics

- 10.10.1 Overview

- 10.10.2 Financials

- 10.10.3 Product Portfolio

- 10.10.4 Business Strategy

- 10.10.5 Recent Developments

- 10.11 Others.

- 10.11.1 Overview

- 10.11.2 Financials

- 10.11.3 Product Portfolio

- 10.11.4 Business Strategy

- 10.11.5 Recent Developments

- 10.1 Thermo Fisher Scientific Inc.

List Of Figures

Figures No 1 to 35

List Of Tables

Tables No 1 to 102

Prominent Player

- Thermo Fisher Scientific Inc.

- BD

- Merck KGaA

- bioMérieux SA

- Danaher

- Sartorius AG

- Rapid Micro Biosystems Inc.

- Charles River Laboratories

- HiMedia Laboratories

- Hardy Diagnostics

- Others

FAQs

The key players in the market are Thermo Fisher Scientific Inc., BD, Merck KGaA, bioMérieux SA, Danaher, Sartorius AG, Rapid Micro Biosystems Inc., Charles River Laboratories, HiMedia Laboratories, Hardy Diagnostics, Others.

Regulatory focus on reduction of risks of contamination and improvement in speed-to-market ratio has accelerated the adoption of high-throughput, automated, and digital microbiology testing solutions like ATP bioluminescence and PCR. Guidelines such as EU GMP Annex 1 are mandating rigorous environmental monitoring inclusive of continuous cleanroom monitoring and testing of the water systems. The regulations state that sterile products like injectables undergo tough sterility testing with endotoxin monitoring (such as LAL tests) for preventing severe patient reactions.

Advanced instruments such as PCR and the ones used for automating bioluminescence are usually expensive for the smaller labs, thereby resulting in newer technologies witnessing a slower adoption. The higher price of consumables like specialized reagent packs could be around USD 100–200 per panel in comparison with USD 10–20 for conventional culture methods. This, in turn, does make the daily use of rapid, advanced platforms monetarily challenging.

According to the present analysis and forecast modeling, the pharmaceutical microbiology QC testing market is projected to reach USD 17.65 Billion by the year 2035 due to rising demand for more accurate, quicker, and regulatory-compliant microbial testing solutions in biopharmaceutical and pharmaceutical manufacturing.

North America is anticipated to dominate the market during the forecast period. This is owing to strict FDA requirements regarding quality control, which do necessitate tough testing for ensuring safety of product, thereby prompting higher adoption of efficient, advanced, and faster testing solutions. Notable investments in healthcare infrastructure coupled with higher per capita spending on healthcare do support usage of advanced diagnostic tools at the global level. Moreover, rising incidences of infectious and chronic diseases do contribute to an increased demand for the pharmaceutical products and, ultimately, strict quality control testing.

The Asia Pacific is expected to witness the fastest CAGR in this market during the forecast period. This is credited to the region witnessing increased healthcare expenditure, speedy industrialization, and strict regulatory compliance (GMP standards) in India and China. Growing demand for automated testing for ensuring product safety along with large-scale investments in biotech and outsourcing services does fuel this growth further. The government of China is also enforcing Healthy China 2030, which expedites the market.

Speedy technological advancements (NGS, PCR, automation), stern regulatory compliance needs (by EMA, FDA), and growing demand for precise, speedy microbial detection in complicated biologics are the factors basically influencing the expansion of the pharmaceutical microbiology QC testing market. The pharmaceutical companies are also outsourcing QC testing to the contract service providers for speeding up the production, thereby driving the growth of the market. The growing requirement of vaccines as well as treatments, along with the rising focus on subverting microbial contamination, does boost the need for rapid testing.