Ride Hailing Services Market Size, Trends and Insights By Offering (e-Hailing, Car Sharing, Car Rental), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Uber Technologies Inc.

- Via Transportation Inc.

- Wheely

- Gett

- Others

Reports Description

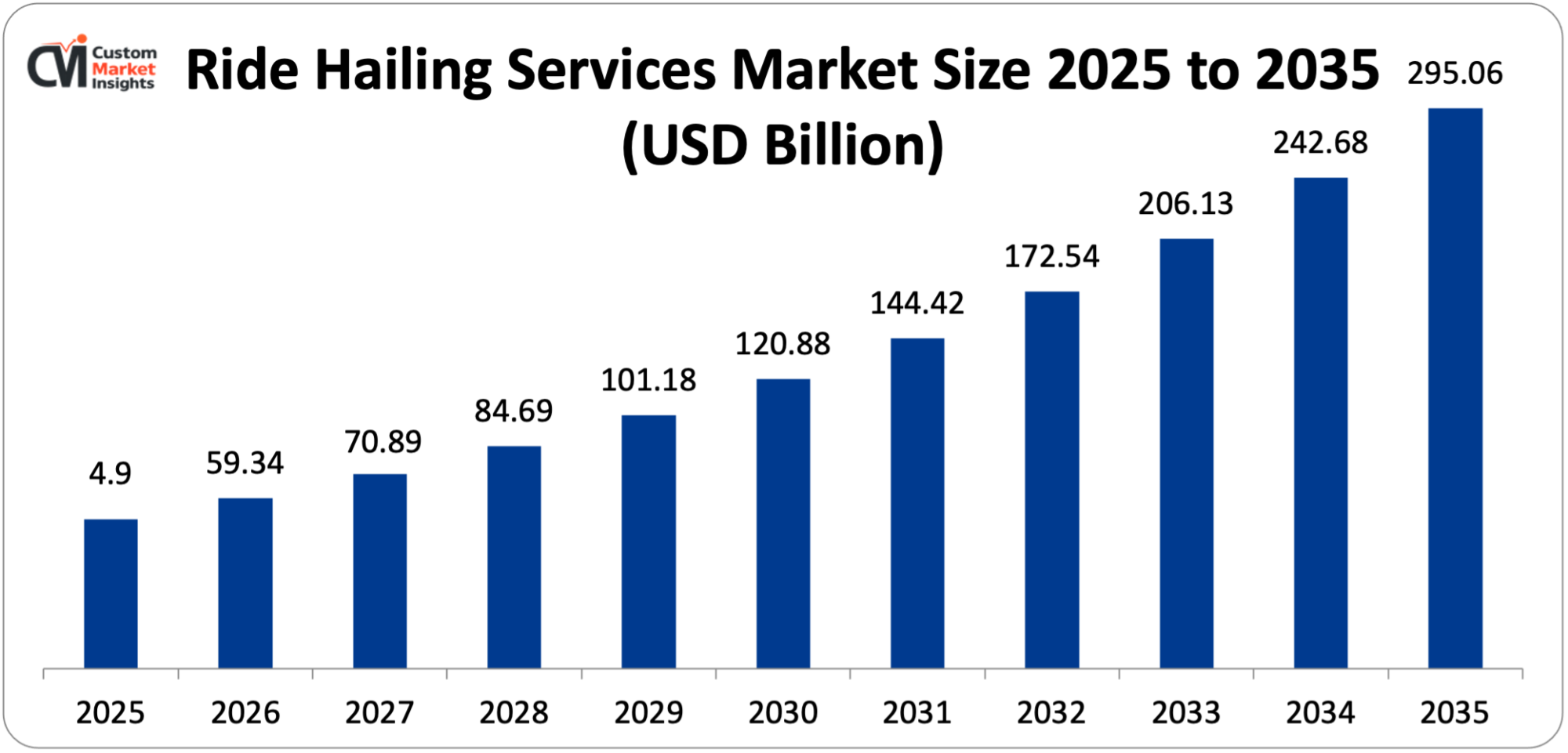

As per the ride hailing services market analysis conducted by the CMI research team, the ride hailing services market is expected to record a CAGR of 19.47% from 2026 to 2035. In 2026, the market size was USD 59.34 Billion. By 2035, the valuation is anticipated to reach USD 295.06 Billion. The market is expanding owing to the ongoing trend of autonomous cars. Also, lenders and banks have reduced their interest rates for making it simpler to finance the buying of automobiles. Deployment of self-driven vehicles is helping the businesses in innovating their services by raising the safety and comfort quotient of the passengers.

Market Highlights

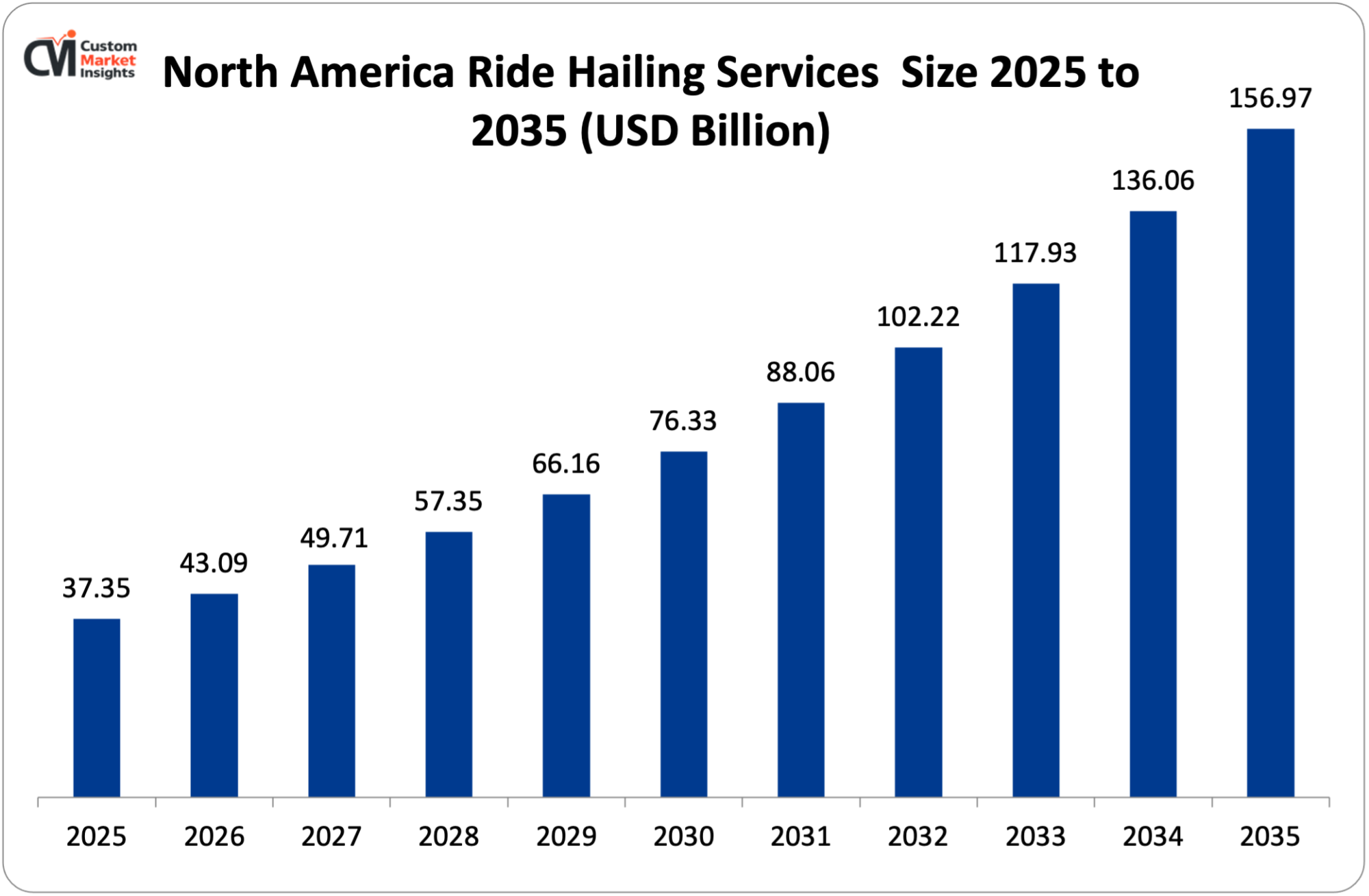

- North America dominated the ride hailing services market in 2025 with 36.32% of the overall share.

- The Asia Pacific is expected to witness the fastest CAGR of 20.23% in the ride hailing services market during the forecast period.

- By offering, the e-hailing segment dominated the ride hailing services market with 73.43% of the overall share.

- By offering, the car rental segment is expected to witness the fastest CAGR of 21.34% in the ride hailing services market during the forecast period.

Significant Growth Factors

The Ride Hailing Services Market Trends signify the following:

- Increased Traffic Congestion due to Rise in Urban Population: The megacities such as Manila and Jakarta are witnessing traffic during peak hours, which renders impractical the use of private cars. This, in turn, has resulted in consumers opting for ride hailing services. AI-based dispatch is also being incorporated. It helps in predicting the demand clusters. The public agencies are looking upon integrated MaaS (Mobility-as-a-Service) ecosystems as a relief from congestion. Lyft has achieved sub-one-minute ETA precision in San Francisco using live traffic as well as historical feeds. As such, the interconnectivity of limited parking and urban extension is paving the way for expansion during the forecast period.

- Growing Penetration of Smartphones coupled with Incorporation of AI: Adoption of handsets is witnessing exponentiation in Indonesia, India, and Brazil. As such, novel demographics are being unleashed for app-based booking. Voice-enabled interfaces instilling inclusivity. For instance – AI assistant from Grab is working toward empowering elderly and visually impaired users to effortlessly book the on-demand rides in an independent manner. Wider 4G coverage in the semi-urban regions is improving reliability on pick-up, thereby narrowing the service gap between frigid and busy districts.

AI does analyze historical data, local events, weather, and trends in real-time with the objective of forecasting when and where demand for rides will witness exponentiation. This, in turn, lets drivers obtain guidance regarding high-demand zones, thereby curtailing idle time and reducing passenger wait times by 30% or higher. Algorithms also go beyond simple proximity for considering multiple factors like direction of route, suitability of driver, and historical performance. Real-time, AI-powered traffic analysis does help the drivers in averting congestion, selecting the quickest routes, and reducing consumption of fuel. Also, manual dispatch can be successfully replaced by automated, instant algorithms that do assign the best amongst the available drivers.

What are the Major Advancements Changing the Ride Hailing Services Market Today?

- Electrification (Fleet-wide) Mandates: California’s Clean Miles Standard does mandate usage of electric vehicles by 2030. As such, regions such as Paris, British Columbia, and Seoul are pursuing initiatives along similar lines. Supply side push from Uber with BYD is likely to introduce 100,000 EVs in LATAM and Europe. They would be equipped with an OpenAI-powered driver assistant steering partners toward the reasonable charging hubs. Also, New York City has marked a noteworthy milestone regarding its sustainability journey by recording sizable zero-emission rides, thereby underscoring its commitment to having clean transportation, especially after Gravity Mobility installed the chargers, which delivered 2,400 mi/h recently. Such milestones are illustrating the way OEM alliances, regulations, and infrastructure align for shrinking tailpipe emissions without disturbing the trip volume.

- Subscription-based Multimodal Super-Apps: The super-app model from Grab does convert the single-service users to multi-product customers who are lifting the value of the ride-hailing services market for life. The company is helping in the cultivation of strong customer loyalty across various sectors by spinning together digital payments and insurance services pertaining to them. The private-public MaaS pilots in The Netherlands and Vienna are propagating ride hailing services with shared bikes and transit under the gambit of unified billing.

Category Wise Insights

By Offering

- e-Hailing: The e-Hailing segment dominated the ride hailing services market in 2025 and the scenario is expected to persist during the forecast period. This is credited to smart wearables and smartphones being speedily adopted, along with increased usage of the Internet. Also, app-based travel is gaining popularity, which is majorly driven by the rising affordability of Internet services and smartphones.

- Car Sharing: Car sharing does offer a cost-effective alternative to having a vehicle of one’s own, thereby drawing the cost-conscious consumers who later use the apps for ride hailing. Integration of car sharing into various rail hailing apps does provide the users with several transport choices within a single platform, thereby making shared mobility the epicenter of their tour.

- Car Rental: The car rental segment is expected to witness the fastest CAGR in the ride hailing services market during the forecast period. This is due to the convenience provided by the segment. Cars could be booked through various taxi apps. Plus, numerous conventional car operators across the globe are adding to the growth of the car rental sector.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 59.34 Billion |

| Projected Market Size in 2035 | USD 295.06 Billion |

| Market Size in 2025 | USD 49.67 Billion |

| CAGR Growth Rate | 19.47% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Offering and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is North America’s Ride Hailing Services Market Size?

North America’s ride hailing services market was worth USD 37.35 Billion in 2025 and is expected to reach USD 156.97 Billion by 2035 at a CAGR of 15.37% between 2025 and 2035.

Why did North America Dominate the Ride Hailing Services Market in 2025?

North America dominated the ride hailing services market in 2025 due to the presence of major players such as Lyft and Uber who cater to the demand for convenient transportation. Also, the switch to cashless travel coupled with the rising number of individuals using ride hailing services for airport trips, daily commutes, and business travel, is strengthening the ride hailing services market in North America. Uber alone clocks close to 14 million individual trips every single day in the U.S.

What is the Size of the U.S. Ride Hailing Services Market?

The market size of the U.S. ride hailing services was USD 32.64 Billion in 2025 and is expected to reach USD 147.65 Billion in 2035, witnessing a CAGR of 9.12% between 2026 and 2035.

U.S. Ride Hailing Services Market Trends

Traffic congestion is increasing the demand for flexible, on-demand transport, thereby helping the users in switching to shared services from private cars. visible investments and development of EVs are poised to increase efficiency and reduce cost of transport in the long run. the ride hailing services are also integrating with public transport, thereby making way for multimodal trip planning.

Why is Asia Pacific Experiencing the Fastest Growth in the Ride Hailing Services Market?

The Asia Pacific is expected to witness the fastest CAGR for ride hailing services during the forecast period. This is credited to the increased population of cities like Mumbai, Bengaluru, Delhi, Tokyo, and Shanghai, which is pushing the requirement of such services. The market players are also being supported by regional/provincial governments regarding the expansion of ride hailing services.

China’s Ride Hailing Services Market Trends

The major players such as Meituan, DiDi Chuxing, and AutoNavi (Alibaba) are providing integrated services. The platforms are also adding bike-sharing within their apps for smooth user journeys. The EVs are expanding, and autonomous taxi services are amongst the major areas of growth, wherein they are promising efficiency.

Where does Europe stand with respect to Ride Hailing Services Market?

The growth of the ride hailing services market in Europe is associated with higher rates of urbanization in cities such as Berlin, Paris, and London, with limited options for public transport and dense populations. Deeper penetration of smartphones (~90%), matured digital infrastructure, and regulations being in place are contributing to the growth further.

Germany Ride Hailing Services Market Trends

App-based booking, varied digital payments, and real-time booking are according popularity to ride hailing services in Germany. Local (Free Now) and global (Uber) players do compete with regards to promotions, thereby enhancing quality of service. The fleets are also shifting to electric vehicles to meet norms related to emission, with robust growth in the battery-electric vehicles.

Where is the Middle East & Africa regarding Incorporation of Ride Hailing Services Market?

The ride hailing services market is driven by higher Internet/mobile usage, rising urbanization, and preference for convenience. The key hubs are inclusive of Riyadh, Dubai, Abu Dhabi, and Cairo owing to higher population density and rising tourism. The region is also one of the early adopters of advanced tech, which include 100% driverless robotaxis operating from Abu Dhabi. The governments are also into creation of frameworks such as TGA regulations in Saudi Arabia for ensuring safety, boosting consumers’ trust, and formalizing the sector.

Brazil Ride Hailing Services Market Trends

The ride hailing services market in Brazil is witnessing a major overhaul due to the penetration of smartphones, fierce competition between players such as Uber and 99, and convenience. The trends also indicate the dominance of e-hailing, speedy growth of two-wheelers (motocabs) for navigating traffic, rising adoption of electric vehicles (such as BYD), and emphasis on female/safety riders through specialized features.

Top Players in the Ride Hailing Services Market and Their Offerings

- Uber Technologies Inc.

- Via Transportation Inc.

- Wheely

- Gett

- Addison Lee Limited

- BlaBlaCar

- Ola Electric Mobility Pvt. Ltd.

- Rapido Transportation

- Others

Key Developments

Ride hailing services market has experienced considerable changes in the last few years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In December 2025, Lyft and Uber partnered with Baidu (China) with the objective of launching driverless taxi trials in London in the year 2026. This would be a unique instance wherein Chinese and U.S. autonomous vehicle players would be competing on a direct basis.

- In November 2025, Uber announced its plan to enter into a partnership with Starship Technologies to launch autonomous robot deliveries in the U.K., beginning with Sheffield and Leeds in December. The company is looking forward to the expansion of service all over Europe in 2026 and the U.S. in 2027 as a part of its wider push to automate delivery operations.

- In October 2025, Rapido made an entry into the online travel space by entering into partnership with RedBus, Goibibo, and ConfirmTkt, thereby facilitating the users to book hotels, flights, trains, and buses directly through the app. The launch does position Rapido as India’s very first homegrown, one-stop travel platform led by mobility.

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast-growing ride-hailing services market.

The Ride Hailing Services Market is segmented as follows:

By Offering

- e-Hailing

- Car Sharing

- Car Rental

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Ride Hailing Services Market (2026-2035) (USD Billion)

- 2.2 Global Ride Hailing Services Market: snapshot

- Chapter 3. Global Ride Hailing Services Market – Industry Analysis

- 3.1 Ride Hailing Services Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Increased Traffic Congestion due to Rise in Urban Population

- 3.2.2 Growing Penetration of Smartphones coupled with Incorporation of AI

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Offering

- Chapter 4. Global Ride Hailing Services Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Ride Hailing Services Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Ride Hailing Services Market – Offering Analysis

- 5.1 Global Ride Hailing Services Market overview: By Offering

- 5.1.1 Global Ride Hailing Services Market share, By Offering , 2025 and 2035

- 5.2 e-Hailing

- 5.2.1 Global Ride Hailing Services Market by e-Hailing, 2026 – 2035 (USD Billion)

- 5.3 Car Sharing

- 5.3.1 Global Ride Hailing Services Market by Car Sharing, 2026 – 2035 (USD Billion)

- 5.4 Car Rental

- 5.4.1 Global Ride Hailing Services Market by Car Rental, 2026 – 2035 (USD Billion)

- 5.1 Global Ride Hailing Services Market overview: By Offering

- Chapter 6. Ride Hailing Services Market – Regional Analysis

- 6.1 Global Ride Hailing Services Market Regional Overview

- 6.2 Global Ride Hailing Services Market Share, by Region, 2025 & 2035 (USD Billion)

- 6.3. North America

- 6.3.1 North America Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.3.1.1 North America Ride Hailing Services Market, by Country, 2026 – 2035 (USD Billion)

- 6.3.1 North America Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.4 North America Ride Hailing Services Market, by Offering, 2026 – 2035

- 6.4.1 North America Ride Hailing Services Market, by Offering, 2026 – 2035 (USD Billion)

- 6.5. Europe

- 6.5.1 Europe Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.5.1.1 Europe Ride Hailing Services Market, by Country, 2026 – 2035 (USD Billion)

- 6.5.1 Europe Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.6 Europe Ride Hailing Services Market, by Offering, 2026 – 2035

- 6.6.1 Europe Ride Hailing Services Market, by Offering, 2026 – 2035 (USD Billion)

- 6.7. Asia Pacific

- 6.7.1 Asia Pacific Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.7.1.1 Asia Pacific Ride Hailing Services Market, by Country, 2026 – 2035 (USD Billion)

- 6.7.1 Asia Pacific Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.8 Asia Pacific Ride Hailing Services Market, by Offering, 2026 – 2035

- 6.8.1 Asia Pacific Ride Hailing Services Market, by Offering, 2026 – 2035 (USD Billion)

- 6.9. Latin America

- 6.9.1 Latin America Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.9.1.1 Latin America Ride Hailing Services Market, by Country, 2026 – 2035 (USD Billion)

- 6.9.1 Latin America Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.10 Latin America Ride Hailing Services Market, by Offering, 2026 – 2035

- 6.10.1 Latin America Ride Hailing Services Market, by Offering, 2026 – 2035 (USD Billion)

- 6.11. The Middle-East and Africa

- 6.11.1 The Middle-East and Africa Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.11.1.1 The Middle-East and Africa Ride Hailing Services Market, by Country, 2026 – 2035 (USD Billion)

- 6.11.1 The Middle-East and Africa Ride Hailing Services Market, 2026 – 2035 (USD Billion)

- 6.12 The Middle-East and Africa Ride Hailing Services Market, by Offering, 2026 – 2035

- 6.12.1 The Middle-East and Africa Ride Hailing Services Market, by Offering, 2026 – 2035 (USD Billion)

- Chapter 7. Company Profiles

- 7.1 Uber Technologies Inc.

- 7.1.1 Overview

- 7.1.2 Financials

- 7.1.3 Product Portfolio

- 7.1.4 Business Strategy

- 7.1.5 Recent Developments

- 7.2 Via Transportation Inc.

- 7.2.1 Overview

- 7.2.2 Financials

- 7.2.3 Product Portfolio

- 7.2.4 Business Strategy

- 7.2.5 Recent Developments

- 7.3 Wheely

- 7.3.1 Overview

- 7.3.2 Financials

- 7.3.3 Product Portfolio

- 7.3.4 Business Strategy

- 7.3.5 Recent Developments

- 7.4 Gett

- 7.4.1 Overview

- 7.4.2 Financials

- 7.4.3 Product Portfolio

- 7.4.4 Business Strategy

- 7.4.5 Recent Developments

- 7.5 Addison Lee Limited

- 7.5.1 Overview

- 7.5.2 Financials

- 7.5.3 Product Portfolio

- 7.5.4 Business Strategy

- 7.5.5 Recent Developments

- 7.6 BlaBlaCar

- 7.6.1 Overview

- 7.6.2 Financials

- 7.6.3 Product Portfolio

- 7.6.4 Business Strategy

- 7.6.5 Recent Developments

- 7.7 Ola Electric Mobility Pvt. Ltd.

- 7.7.1 Overview

- 7.7.2 Financials

- 7.7.3 Product Portfolio

- 7.7.4 Business Strategy

- 7.7.5 Recent Developments

- 7.8 Rapido Transportation

- 7.8.1 Overview

- 7.8.2 Financials

- 7.8.3 Product Portfolio

- 7.8.4 Business Strategy

- 7.8.5 Recent Developments

- 7.9 Others.

- 7.9.1 Overview

- 7.9.2 Financials

- 7.9.3 Product Portfolio

- 7.9.4 Business Strategy

- 7.9.5 Recent Developments

- 7.1 Uber Technologies Inc.

List Of Figures

Figures No 1 to 15

List Of Tables

Tables No 1 to 27

Prominent Player

- Uber Technologies Inc.

- Via Transportation Inc.

- Wheely

- Gett

- Addison Lee Limited

- BlaBlaCar

- Ola Electric Mobility Pvt. Ltd.

- Rapido Transportation

- Others

FAQs

The key players in the market are Uber Technologies Inc., Via Transportation Inc., Wheely, Gett, Addison Lee Limited, BlaBlaCar, Ola Electric Mobility Pvt. Ltd., Rapido Transportation, and others.

The governments are establishing frameworks in order to license ride-hailing companies as well as drivers, thereby helping them in moving to legal businesses from gray or unregulated zones. Stern regulations like caps on requirements for the specified licenses or vehicles are likely to act as barriers for new entrants, usually favoring larger players or conventional taxi companies. Regulations do dictate background checks and safety precautions related to vehicles, which do increase overheads but improve user safety and service reliability.

Competitive, low-cost pricing is amongst the key drivers to penetration of the ride hailing services market in the urban areas. These low fares do encourage daily use, thereby appealing to consumers to opt for ride hailing services. Also, the players, in order to obtain a higher market share, do engage in price wars and go for heavy subsidies, which do drive speedy adoption.

According to the present analysis and forecast modeling, the ride hailing services market is projected to reach USD 295.06 Billion by the year 2035 due to ease of booking, growing traffic congestion, and more comfort to passengers. Plus, increased initiatives by the government for creating awareness amongst the public regarding increase in air pollution is bound to promulgate the ride hailing services market.

North America is expected to dominate the market with over 40% of the market share. This is credited to the presence of players such as Uber and Lyft. Also, the major institutions investing in the ride-sharing organizations are inclusive of BlackRock, Vanguard, and Capital Research. Also, there are individual investors such as Turqi Alnowaiser, who are driving shares in players such as Uber.

The Asia Pacific is expected to witness the fastest CAGR in this market during the forecast period. This is attributed to the fact that densely populated cities such as Mumbai, Delhi, Jakarta, Beijing are struggling with regards to public transport, which does make ride hailing one of the feasible solutions. Also, deeper smartphones’ penetration makes ride hailing apps accessible to a bigger user base. Regional leaders such as DiDi and Grab do have stronger presence.

The ongoing trend of cost-saving coupled with rising prices of vehicle ownership is the factor basically driving the ride hailing services market. The other factor proliferating the market is growing awareness about environment hazards. Also, start-ups in the ride hailing services are functioning on the dictum that smartphones are poised to foster market growth during the forecast period. Plus, increased commute time due to traffic congestion is the other driver. For example – one takes ~53 minute on an average to commute.