Stand-alone Cloud Storage Market Size, Trends and Insights By Deployment Model (Public Cloud Storage, Private Cloud Storage, Hybrid Cloud Storage, Multi-Cloud Storage), By Component (Storage Infrastructure, Software/Management Solutions, Services, Professional Services, Managed Services), By Storage Type (Object Storage, File Storage, Block Storage, Archival/Cold Storage), By Application (Data Backup & Recovery, File Storage & Sharing, Archiving & Compliance, Big Data & Analytics, Content Delivery & Media Workloads), By End-User Industry (BFSI (Banking, Financial Services, and Insurance), IT & Telecom, Healthcare & Life Sciences, Retail & E-commerce, Government & Public Sector, Media & Entertainment, Manufacturing, Education & Research, Other End-User Industries), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Others

Reports Description

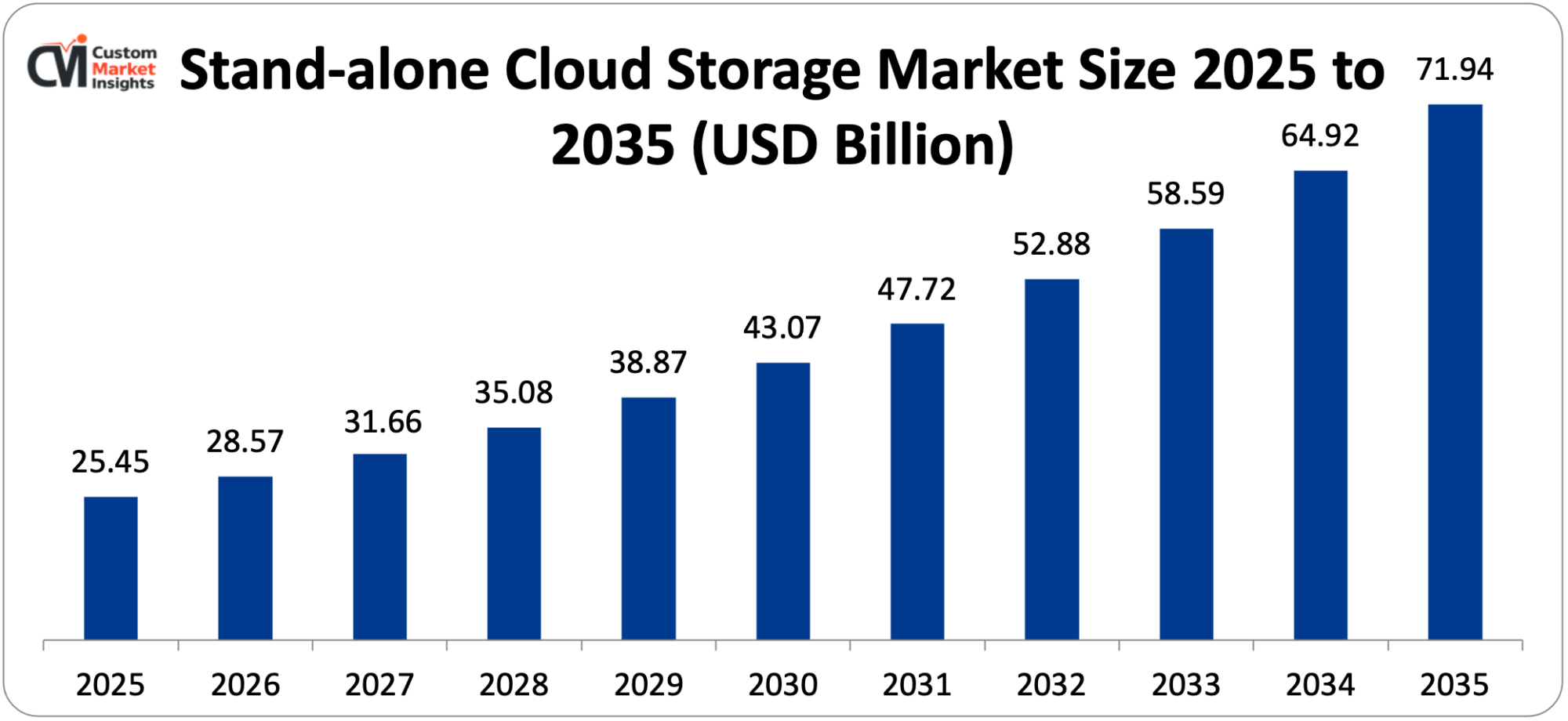

The market size of global stand-alone cloud storage is estimated to be USD 25.45 billion in the year 2025 and is forecasted to grow by USD 28.57 billion in the year 2026 to the projected USD 71.94 billion in the year 2035 with the CAGR of 12.24% between the years 2026 and 2035. The growing amount of generated data, the growth in the use of remote work and digital transformation, the growing need to scale to a more cost-effective storage solution and the growing applications of IoT and big data analytics stimulate the growth of the market.

Market Highlight

- Then, in 2025, the stand-alone market of cloud storage was dominated by North America, which held 45% of the market share.

- Asia Pacific is the region that is projected to grow with the highest CAGR of 13.8% in 2026-2035.

- By model of deployment, the segment of the public cloud storage had obtained approximately 48% of the market share by 2025.

- The hybrid cloud storage segment has the highest CAGR by deployment model of 14.2% during 2026-2035.

- By application, the data backup and recovery segment is expected to grow with the highest market share of 38% in 2025, and the big data and analytics segment is projected to grow 15.1% in the next years, from 2026 to 2035.

- By industry of end-users, the BFSI segment took 26% of the market share in 2025.

Stand-alone Cloud Storage Market Trends – Significant Growth Factors

The Stand-alone Cloud Storage Market Trends present significant growth opportunities due to several factors:

- Explosive Data Growth and Digital Transformation: The main force behind the stand-alone cloud storage market is the massive increase in the worldwide volume of data that is being generated, captured, and consumed, which can no longer be afforded by the existing on-premises infrastructure in the storage sector. In 2024, data from the International Data Corporation (IDC) has seen the global datasphere hit 149 zettabytes and is forecasted to hit 181 zettabytes by 2025, a compound annual growth rate of 23% compared to 2020. This growth in exponential data volume is fueled by several drivers such as the growth in the number of IoT devices which is projected to grow to 41.6 billion connected devices by 2025 generating 79.4 zettabytes of data, social media and content creation which also generate large volumes of user-generated content, enterprise digital transformation efforts which also result in structured and unstructured data generation, and artificial intelligence and machine learning applications which all need large training datasets. The amount of data being stored in the world is doubling about every four years and about 90% of the world’s data has been created in the last two years and this indicates the speed at which more data is being created. Individual cloud storage offers scalable services that increase the storage capacity as needed without organizations having to forecast their future storage requirements and also necessitate expensive upgrades to their hardware. The move to cloud storage is one of the most significant whereby it is estimated that currently 60% of all corporate data is cloud stored and it is estimated that by 2025 that 49% of all data will be stored in publicly accessible clouds. This movement is indicative of the better economics of cloud storage over holding on-premises infrastructure, as organizations do not have to spend capital on servers, cooling systems and data center space, nor do they have the burden of operational inefficiencies by having to staff their IT organizations less and more by having automated management and pay-as-you-go pricing models that directly relate costs with usage. The COVID-19 pandemic caused cloud uptake to skyrocket, remote work had immediate storage requirements in terms of accessible data storage that allowed collaboration across distributed locations, video conferencing and content generation put pressure on bandwidth and storage and organizations realized that the business continuity benefits of a cloud-based infrastructure are not subject to local disruptions.

- Cost Reduction and Operational Efficiency Benefits: The compelling total cost of ownership benefits that stand-alone cloud storage offers over traditional infrastructure have sped up market development tremendously. The savings that are realized by organizations when they migrate to cloud platforms are usually 30-50% of the cost of storage that includes hardware capital cost such as servers, storage arrays, and network equipment, data center costs such as building facilities, power usage, and cooling, IT labor requirements through automated management in place of manual administration, and resource sharing as a result of multi-tenancy. Market analysis shows that the market of stand-alone cloud storage is motivated by low capital and operating expenditure (OPEX), and more companies are resorting to the systems to reduce the cost of those that come with traditional on-premise storage options. This is because cloud storage providers can enjoy economies of scale that can never be attained by individual organizations, distributing infrastructure costs across thousands of customers, negotiating good hardware and energy rates, and making better use of utilization through statistical multiplexing where the workload patterns of different users can be used to achieve higher average capacity utilization. Moreover, cloud storage cannot be wasted on provisioning, and traditional on-premises systems usually have 40-60% idle capacity to handle future demands, whilst cloud systems increase capacity step-by-step in line with actual demand. Its operational advantages go beyond direct cost savings to encompass quick deployment of the system which can store data within minutes rather than weeks or months in the case of traditional procurement, the ability to access the system anywhere in the world as long as an individual has access to the internet which can support distributed workforces, and the ability to update operating systems automatically so that they can always have the latest features and security patches. Modern cloud storage services also include new features such as automated tiering which transfers data across performance levels according to access patterns which optimizes cost-performance tradeoffs, data compression which compresses storage footprints by 2-5x as well as built-in backup and disaster recovery which offers data protection without the need to have other systems. Business agility is also enhanced in an organization as cloud storage allows an organization to launch applications quickly, scales dynamically when it is in use, and allows organizations to make experiments without requiring significant initial investments.

What are the Major Advances Changing the Stand-alone Cloud Storage Market Today

- AI-Powered Data Management and Intelligent Automation: Intelligent data management, which can be achieved by the introduction of artificial intelligence and machine learning in cloud storage platforms, is the most radical technological change, producing an optimal way of using the storage capacity, increasing the security of information, and automating the work of the administration system. The AI-enabled storage systems include automated data classification of sensitive information that needs special treatment, intelligent data lifecycle management that relocates data between the storage levels depending on the predicted access patterns, anomaly detection of unusual access patterns that can be the indication of a security breach or system malfunction, and predictive capacity planning that forecasts the future storage demand based on the past trends. Such modern technologies as computer vision can be used to organize and search by content images and process documents, extract metadata, and analyze documents with the help of natural language and deep learning algorithms. They not only compress data with high compression ratios but also improve compression ratios in comparison with older methods. Serverless computing models combined with cloud storage allow event-driven computation in which functions are automatically invoked in response to updates in their cloud storage, without any persistent compute resources, and allow exceptionally efficient data pipelines. The other way AI uses data security is by performing behavioral analytics to identify abnormal access patterns, automated threat response mechanisms to quarantine suspicious activity, and smart encryption key management to provide an appropriate level of protection. The data enrichment features provide a significant value addition as metadata are extracted automatically, relationships between datasets can be identified and insights can be generated using business intelligence tools that are integrated directly with storing systems.

- Hybrid and Multi-Cloud Storage Architectures: The emergence of hybrid and multi-cloud storage solutions has transformed the architecture of the data infrastructure in the organization to allow it the flexibility to distribute workloads between on-premises and multiple cloud environments based on performance factors, compliance factors, and cost factors. Hybrid cloud storage is growing with the highest rate of 14.2% CAGR, with enterprises striking a balance between latency, cost and data sovereignty requirements. The deployment of hybrid architectures by organizations to keep sensitive data on-premises to meet regulatory needs and use cloud as a scale solution is to support performance with hot data on-premises and store cold data in the cloud to meet cost efficiency requirements and ensure business continuity in case the on-premises primary storage fails and the organization uses the cloud as their disaster recovery site. Multi-cloud storage strategies spread data to multiple cloud vendors, prevent vendor lock-in, and negotiate good rates, put workloads in the best place with strengths by the vendor and geographic coverage, and increase resiliency with geographic and vendor diversity. The industry analysis reveals that 85% of business organizations could be using cloud-first approaches by 2025 with a rise in hybrid and multi-cloud architectures because of scalability and flexibility. Nevertheless, companies absorb 51% of storage expenses in API calls and egress traffic, which triggers multi-cloud placement to circumvent expenses. The modern storage gateways are designed to blend on-premises systems with the cloud repositories and offer a unified namespace which hides the complexity of the storage location, intelligent caching which makes the often-used data local to the way it performs, and automated synchronization which makes the environments to be consistent.

- Object Storage and Scalability for AI Workloads: Object storage architectures have been adapted to enhance scalability and enable the cloud storage to process large unstructured data needed by artificial intelligence, machine learning, and big data analytics applications. Object storage can be easily scaled to billions of files and exabytes of storage capacity without imposing any performance constraints, contains rich metadata to support advanced classification and search, and provides parallel throughput necessary to scale large language models in the pattern of distributed access. Object storage is already representing significant shares of cloud deployments, and AI workloads are accelerating such deployments. Single AI training run storage footprint is growing from 30 TB in 2025 and projected 100 TB in 2030 and inference nodes are growing even faster as products add AI features across all applications. Enterprise data volumes are being increased by several folds due to the generative AI workloads and solid-state drive demand in AI training environments is increasing 35% each year as traditional spinning disk technologies are finding it difficult to handle latency requirements. Cloud providers are re-architecturing storage layers to support high-throughput NVM-based clusters and object storage buckets optimized to support parallel access, specifically to the structure of AI/ML workloads. The cost models have shown that data-handling charges are bigger than the model-development costs and vendors are forced to maximize tiering schemes and compression algorithms minimizing the total storage expenses of AI applications.

- Sovereign Cloud and Data Residency Solutions: The development of sovereign cloud structures and increased data residency solutions overcomes the expanding governmental and organizational anxieties regarding data management, confidentiality, and regulatory adherence. Countries are funding domestic clouds to gain control over important data, the Global AI Hub Law of Saudi Arabia permits the creation of so-called data embassies to run foreign workloads under the jurisdiction of the home country, Japan is seeking to fully roll out the so-called Sakura Cloud to run federal workloads by fiscal 2025, and in Asia Pacific, 19% of enterprises are increasing sovereign-cloud spending and 64% of Australian firms are considering localized architectures. These projects develop parallel ecosystems that value residency, latency, and legal autonomy above optimizing costs. Stand-alone cloud storage vendors are reacting by providing region-sensitive deployments so that the data does not leave specified geographic limits, compliance certifications to regional regulatory standards such as GDPR in Europe, HIPAA in healthcare, and financial regulations, and a clear policy of data handling, which records the exact location of data and its treatment. The data sovereignty trend especially affects multinational organizations that conduct their operations across jurisdictions with conflicting data needs, which require complex geo-distributed storage systems that keep data requirements in line and provide business operations.

Category Wise Insights

By Deployment Model

Why Public Cloud Storage Leads the Market?

The greatest segment will be the public cloud storage, comprising about 48% of the total market share in the year 2025. This supremacy gives the public cloud strong benefits such as cost efficiency as a result of sharing infrastructure, whose costs can be divided over many customers, it is very scalable, meaning it can expand virtually to an unlimited size, the maintenance cost is minimal since the hardware is managed by the cloud itself and is accessible anywhere as long as there is an internet connection, and it is global giving it accessibility to data wherever one has an internet connection. Public cloud storage offers the lowest total cost of ownership in the majority of applications and cloud providers can experience economies of scale that are unattainable by single organizations through optimized data center usage, bulk purchasing of hardware and efficient usage of the available resources across a wide range of customer workloads. Major big data storage providers such as AWS S3, Microsoft Azure Blob storage, and Google Cloud storage provide highly durable storage (11 nines durability) at prices a typical 60-80% lower than the similar amount of on-premises capacity when all of the costs are considered. Pay as you go pricing model removes waste through overproviding, organizations only pay to be consumed and thus expand or contract capacity based on business needs without any long-term commitments or penalties.

The advantage of public cloud storage is that it is constantly innovative, and vendors add new features such as intelligent tiering of data that automatically moves to a different storage class to optimize the cost-performance tradeoff, lifecycle policies that automatically retain and delete data based on compliance requirements, and built-in analytics that can provide insights on stored data without the need to run separate processing systems. The distributed applications and multinational organisations are supported by the global infrastructure offered by the major cloud platforms that allows geographic redundancy and low-latency access globally, based on the strategically located data centres in continents.

Hybrid cloud storage is the fastest growing with a projected CAGR of 14.2% between 2026 and 2035 due to the demand by organizations to achieve the optimum balance between the advantages of using a public cloud and the ability to control the environment on-premises. Hybrid architectures support sensitive data retention on-premises that complies with and secures the data demands and utilizes the cloud as a cost-effective capacity on-demand, burst capacity during peak use when no provisioned permanent on-premises infrastructure is needed, and disaster recovery where the cloud is used as a geographically diverse backup location. Enterprises are compromising between latency, cost, and data sovereignty requirements, according to analysis, by deploying hybrids. The new hybrid solutions are offering single management across all environments and data mobility to workload up and down the cloud and cloud-premises to ensure that their security policies are consistent in view of the data damage no matter where the data is.

By Application

Why Data Backup & Recovery Dominates Applications?

The highest application segment is the data backup and recovery that is expected to occupy nearly 38% of overall market share in 2025. This leadership embodies the extreme significance of data protection, where organizations acknowledge that the loss of data due to failures of hardware, cyberattacks, human errors or other natural disasters are existential threats that must not be allowed to occur and that they have to provide support systems that are highly effective. Cloud storage is the best backup target because it has the following features: an off-site storage location that is geographically separated from the primary data and scalability allowing it to serve backup retention needs and cost-effectiveness since cold storage levels can be used to store all data in the long run. The recent popularity of ransomware attacks has greatly amplified the significance of a backup, and organizations are adopting immutable backup systems, in which data cannot be altered or erased once it is written, which offers a way to recover in a situation where production systems have been compromised. The market research indicates that the data backup and recovery market is a leader in terms of necessity because of the critical and repetitive necessity of the companies to protect against the loss of data, natural calamities, human mistakes, and cybercrimes.

The latest cloud backup software has enhanced features such as incremental forever backups which only transfer changed data to minimize bandwidth needs, automatic scheduled backup system that will provide consistency in protection without the need to involve any human being and instant recovery which will restore the data in a short time thus minimizing the downtime. The 3-2-1 backup policy (three copies of data, 2 different types of media and 1 off-site) is being adopted more and more often, with cloud serving as the off-site data component, which offers safeguards in case of localized disasters of primary data centers. The industry and regulation-based backup retention requirements differ, with healthcare organizations having records dating back decades, financial institutions having records of transactions to meet regulation requirements and legal discovery requirements demanding long-term retention, all of which push into the adoption of cloud backup.

The fastest growing market is big data and analytics with a predicted CAGR of 15.1% between 2026 and 2035, since organizations are expected to gain value by utilizing massive datasets through advanced analytics. Cloud storage offers underpinning to data lakes consolidating both structured and unstructured data across multiple sources, enabling economical storage of past data to compare the trends, and linking to cloud-based analytics services that handle data where it is, it is not transferred. The proliferation of AI and machine learning applications needs enormous training datasets that are stored conveniently, and workloads of generative AI increase the storage needs by multiples of magnitudes. Organizations can use cloud-based analytics platforms to extract insights by processing data that would be economically unfeasible to process on-premises, thus democratising the process of advanced analytics to organisations without special infrastructure.

By End-User Industry

Why BFSI Leads Cloud Storage Adoption?

The Biggest end-user segment is Banking, Financial Services, and Insurance (BFSI), which will occupy about 26% of the market share in 2025. This pre-eminence is an indication of the huge data needs of financial institutions, such as the transaction histories, which need long storage, customer data, which need secure storage, and regulatory data, which are subject to compliance. The transaction processing systems, trading platforms, risk management applications, and channel interactions with customers generate petabytes of financial institution data every year. Financial services regulatory environment requires large volumes of data to be stored and in many cases, the requirements mandate 5-7 years to store transaction records and there are no limits on the storage of some compliance data, which has created very high storage costs in expensive data storage facilities, which can be met with a cost-effective cloud platform. BFSI organizations emphasize security and compliance, which leads to the usage of the private and hybrid cloud models that offer more control but also the advantages of cloud economics. Large financial institutions have advanced data management policies that use a cloud-based disaster recovery approach to keep business running, a storage facility to support retention requirements at very low costs, and analytics tools to process transaction data to detect fraud patterns and customer behavior. IT and telecom industry is an industry that has a huge market share owing to the service providers handling vast amounts of data through network management, customer usage logs, and online services. Telcos have created enormous datasets of logs on network equipment, call detail records and customer usage profiles, and aggregate these datasets in clouds to do network analytics and capacity planning. Healthcare & life sciences is a soaring growth sector due to the use of electronic health records, storage of medical imaging needs and genomics research that is generating huge data volumes. Individual genomic sequences produce gigabytes, and with large-scale genomics projects, petabytes are produced that need cost-effective long-term storage that can be offered by cloud providers.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 28.57 billion |

| Projected Market Size in 2035 | USD 71.94 billion |

| Market Size in 2025 | USD 25.45 billion |

| CAGR Growth Rate | 12.24% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Deployment Model, Component, Storage Type, Application, End-User Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Stand-alone Cloud Storage Market – Regional Analysis

How Big is the North America Market Size?

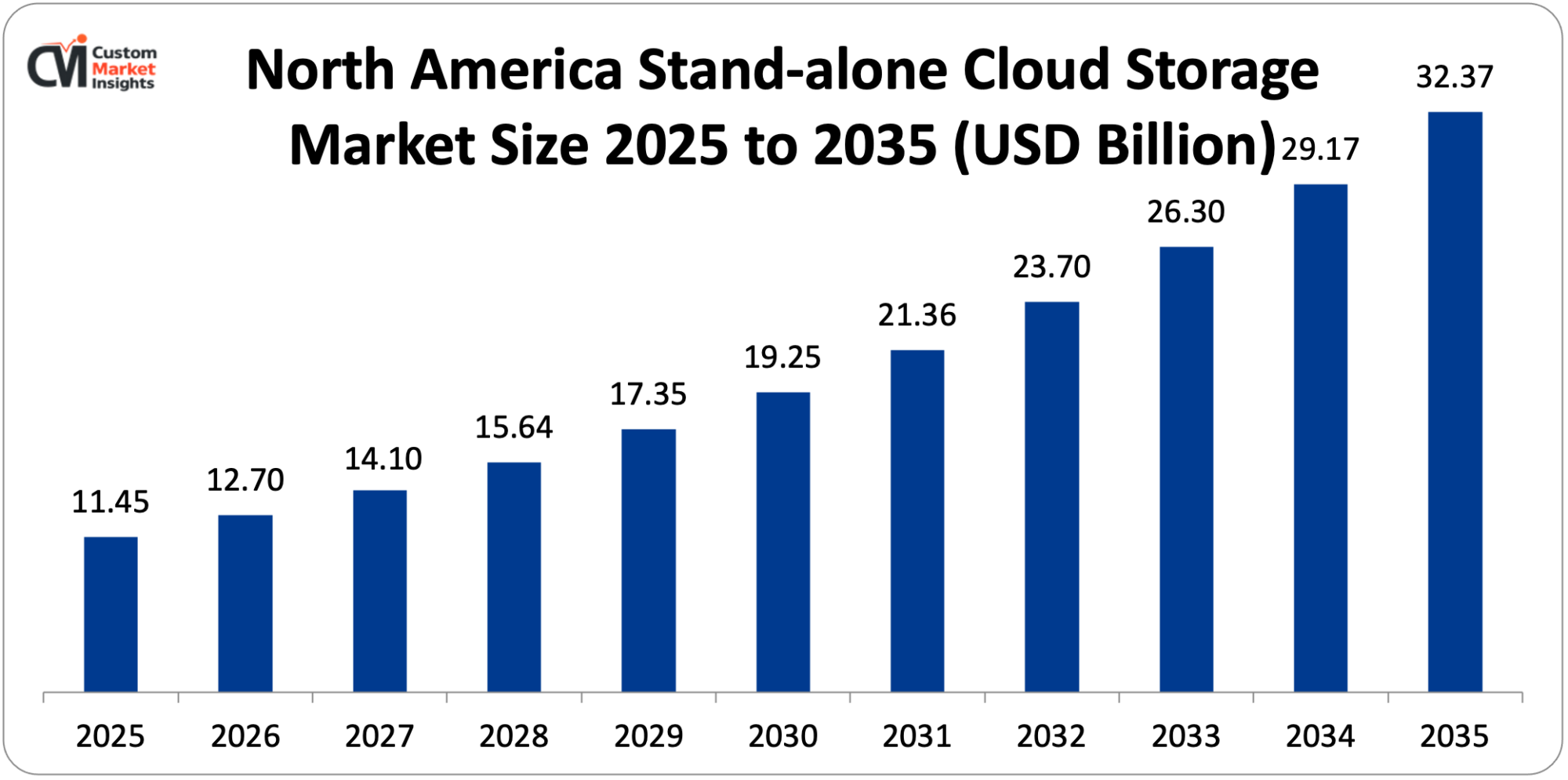

The North America stand-alone cloud storage market size is estimated at USD 11.45 billion in 2025 and is projected to reach approximately USD 32.37 billion by 2035, with a 12.1% CAGR from 2026 to 2035.

Why did North America Dominate the Market in 2025?

The biggest player across the world is North America with about 45% market share in the year 2025 due to early adoption of the cloud, with the region being the pioneer of the public cloud services and advanced digital infrastructure such as the high speed internet that facilitates access to cloud services, the existence of large cloud providers such as AWS, Microsoft Azure and Google Cloud headquartered in the region and complex enterprise IT strategies embracing cloud-first strategies. The United States, specifically, is the leader in terms of the highest concentration of cloud storage adoption within industries, significant technology sector leading innovations, and generally good regulatory environment towards cloud computing in the establishment of data protection norms. The most cloud-mature organizations in the North America region are also observed as those having multi-cloud strategies and multi-level data management frameworks, as well as those that integrate cloud storage with wider digital transformation efforts.

What is the Size of the U.S. Market?

The size of the U.S. market in stand-alone cloud storage is estimated at USD 9.87 billion in 2025 and will reach a difference of approximately USD 27.94 million in 2035 with a CAGR of 12.3% between 2026 and 2035.

U.S. Market Trends

The US market constitutes the highest proportion of the global demand based on technology leadership where Silicon Valley and other technology centers have led in the advancement of cloud technologies, wide penetration of cloud applications in all industries, significant venture capital investment in cloud storage startups, and regulatory standards such as cloud security certifications which build trust. Federal agencies are required by the government of the U.S. to focus on solutions provided by the clouds, which has increased the adoption of this technology in the public sector. American businesses are on the front line of cloud storage innovation with new features being added regularly, competitive pricing to drive market growth, and ecosystem building to enable integrated solutions to bring together storage and compute, analytics, and AI services.

Why is Asia Pacific Experiencing Fastest Growth?

It is forecasted that Asia-Pacific will record the highest growth with a 13.8% CAGR between 2026 and 2035. Rapid expansion indicates acceleration of digital transformation by region, increased internet connectivity to previously underserved populations, increased adoption of digital services by the middle class, and government-led efforts to encourage cloud adoption and development of the digital economy. The large investment of USD 46 billion in cloud spending by China in 2025 shows the size of the market, whereas the high pace of digitalization and the growing technological industry in India motivate its adoption. Mobile-first internet connectivity has the benefit of serving populations without an IT legacy infrastructure in place, allowing cloud services to be delivered in the region.

China Market Trends

The market in China is growing at a very high rate due to government incentives towards cloud computing and the data center, local cloud computing providers like Alibaba Cloud and Tencent Cloud are already attaining global scale, the manufacturing industry is going digital and thus needs to store industrial IoT data, and the consumer internet services are increasing and producing huge amounts of user data. The need for data sovereignty in China promotes the use of cloud computing in China and the laws have required that data be localized to provide a business opportunity to the Chinese cloud service provider and a challenge to the international providers that will have to navigate the regulatory environment.

Why is Europe Balancing Innovation with Regulation?

The European market is massive and is indicative of a mature digital economy, stringent data protection laws such as the GDPR that establish global best practices, a focus on data sovereignty that leads to the creation of European cloud providers, and mature enterprise IT policy. Europe upholds a huge market share of Germany, the UK, and France as prime markets. The focus on compliance and desired data residency is a concern of European organizations, which motivates the use of hybrid clouds with control and the utilization of the benefits of public cloud economics. The regulatory climate of the region presents certain challenges that need compliance investment and prospects for providers of GDPR-compliant solutions.

Germany Market Trends

The market penetration in Germany is high because of the highly developed manufacturing industry with initiatives under Industry 4.0 that create industrial data, the high privacy culture that leads to the adoption of secure clouds, and the focus on data sovereignty that supports European and local cloud providers. German companies are showing reserved yet increasing use of cloud technology with hybrid models being favored where control over sensitive information is required and the remaining workloads are done using the public cloud.

Why is the Middle East & Africa Region Developing Cloud Infrastructure?

The LAMEA region exhibits an emerging development of the markets with an increasing adoption due to the digital transformation initiatives in the Gulf countries, increasing internet penetration in the region, and government investments in smart city development that create data that need to be stored. The market share is relatively small at present, but due to the digital infrastructure advancement and the rise of awareness of cloud advantages, the market is expanding rather slowly. The countries of the Middle East are moving into local cloud infrastructure, and the UAE and Saudi Arabia are setting up regional data centers which are attracting international cloud providers.

Top Players in the Market and Their Offerings

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud Infrastructure

- Alibaba Cloud

- Tencent Cloud

- Dell Technologies (EMC)

- Dropbox Inc.

- Box Inc.

- Others

Market News- Key Developments

The market has undergone significant developments as industry participants seek to expand capabilities and enhance product portfolios.

- In January 2025: Synchronoss Technologies launched a next-generation Personal Cloud Platform at CES 2025, offering enhanced backup capabilities, AI-powered tools, improved security features, and user-friendly interfaces for managing photos, videos, and files, demonstrating continued innovation in consumer cloud storage. (Source: Synchronoss Technologies)

- In September 2025, TCC Concept Limited launched MyFlopy.com, a new cloud-based data storage application designed for both individual and business users in the Indian market, expanding cloud storage accessibility in rapidly growing Asian markets. (Source: TCC Concept Limited)

These strategic activities have allowed companies to strengthen market positions, expand geographic presence, enhance product offerings, and capitalize on growth opportunities within the expanding market.

The Stand-alone Cloud Storage Market is segmented as follows:

By Deployment Model

- Public Cloud Storage

- Private Cloud Storage

- Hybrid Cloud Storage

- Multi-Cloud Storage

By Component

- Storage Infrastructure

- Software/Management Solutions

- Services

- Professional Services

- Managed Services

By Storage Type

- Object Storage

- File Storage

- Block Storage

- Archival/Cold Storage

By Application

- Data Backup & Recovery

- File Storage & Sharing

- Archiving & Compliance

- Big Data & Analytics

- Content Delivery & Media Workloads

By End-User Industry

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Public Sector

- Media & Entertainment

- Manufacturing

- Education & Research

- Other End-User Industries

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Stand-alone Cloud Storage Market, (2026 – 2035) (USD Billion)

- 2.2 Global Stand-alone Cloud Storage Market: snapshot

- Chapter 3. Global Stand-alone Cloud Storage Market – Industry Analysis

- 3.1 Stand-alone Cloud Storage Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Explosive Data Growth and Digital Transformation

- 3.2.2 Cost Reduction and Operational Efficiency Benefits

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Deployment Model

- 3.7.2 Market attractiveness analysis By Component

- 3.7.3 Market attractiveness analysis By Storage Type

- 3.7.4 Market attractiveness analysis By Application

- 3.7.5 Market attractiveness analysis By End-User Industry

- Chapter 4. Global Stand-alone Cloud Storage Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Stand-alone Cloud Storage Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Stand-alone Cloud Storage Market – Deployment Model Analysis

- 5.1 Global Stand-alone Cloud Storage Market overview: By Deployment Model

- 5.1.1 Global Stand-alone Cloud Storage Market share, By Deployment Model, 2025 and 2035

- 5.2 Public Cloud Storage

- 5.2.1 Global Stand-alone Cloud Storage Market by Public Cloud Storage, 2026 – 2035 (USD Billion)

- 5.3 Private Cloud Storage

- 5.3.1 Global Stand-alone Cloud Storage Market by Private Cloud Storage, 2026 – 2035 (USD Billion)

- 5.4 Hybrid Cloud Storage

- 5.4.1 Global Stand-alone Cloud Storage Market by Hybrid Cloud Storage, 2026 – 2035 (USD Billion)

- 5.5 Multi-Cloud Storage

- 5.5.1 Global Stand-alone Cloud Storage Market by Multi-Cloud Storage, 2026 – 2035 (USD Billion)

- 5.1 Global Stand-alone Cloud Storage Market overview: By Deployment Model

- Chapter 6. Global Stand-alone Cloud Storage Market – Component Analysis

- 6.1 Global Stand-alone Cloud Storage Market overview: By Component

- 6.1.1 Global Stand-alone Cloud Storage Market share, By Component, 2025 and 2035

- 6.2 Storage Infrastructure

- 6.2.1 Global Stand-alone Cloud Storage Market by Storage Infrastructure, 2026 – 2035 (USD Billion)

- 6.3 Software/Management Solutions

- 6.3.1 Global Stand-alone Cloud Storage Market by Software/Management Solutions, 2026 – 2035 (USD Billion)

- 6.4 Services

- 6.4.1 Global Stand-alone Cloud Storage Market by Services, 2026 – 2035 (USD Billion)

- 6.5 Professional Services

- 6.5.1 Global Stand-alone Cloud Storage Market by Professional Services, 2026 – 2035 (USD Billion)

- 6.6 Managed Services

- 6.6.1 Global Stand-alone Cloud Storage Market by Managed Services, 2026 – 2035 (USD Billion)

- 6.1 Global Stand-alone Cloud Storage Market overview: By Component

- Chapter 7. Global Stand-alone Cloud Storage Market – Storage Type Analysis

- 7.1 Global Stand-alone Cloud Storage Market overview: By Storage Type

- 7.1.1 Global Stand-alone Cloud Storage Market share, By Storage Type, 2025 and 2035

- 7.2 Object Storage

- 7.2.1 Global Stand-alone Cloud Storage Market by Object Storage, 2026 – 2035 (USD Billion)

- 7.3 File Storage

- 7.3.1 Global Stand-alone Cloud Storage Market by File Storage, 2026 – 2035 (USD Billion)

- 7.4 Block Storage

- 7.4.1 Global Stand-alone Cloud Storage Market by Block Storage, 2026 – 2035 (USD Billion)

- 7.5 Archival/Cold Storage

- 7.5.1 Global Stand-alone Cloud Storage Market by Archival/Cold Storage, 2026 – 2035 (USD Billion)

- 7.1 Global Stand-alone Cloud Storage Market overview: By Storage Type

- Chapter 8. Global Stand-alone Cloud Storage Market – Application Analysis

- 8.1 Global Stand-alone Cloud Storage Market overview: By Application

- 8.1.1 Global Stand-alone Cloud Storage Market share, By Application, 2025 and 2035

- 8.2 Data Backup & Recovery

- 8.2.1 Global Stand-alone Cloud Storage Market by Data Backup & Recovery, 2026 – 2035 (USD Billion)

- 8.3 File Storage & Sharing

- 8.3.1 Global Stand-alone Cloud Storage Market by File Storage & Sharing, 2026 – 2035 (USD Billion)

- 8.4 Archiving & Compliance

- 8.4.1 Global Stand-alone Cloud Storage Market by Archiving & Compliance, 2026 – 2035 (USD Billion)

- 8.5 Big Data & Analytics

- 8.5.1 Global Stand-alone Cloud Storage Market by Big Data & Analytics, 2026 – 2035 (USD Billion)

- 8.6 Content Delivery & Media Workloads

- 8.6.1 Global Stand-alone Cloud Storage Market by Content Delivery & Media Workloads, 2026 – 2035 (USD Billion)

- 8.1 Global Stand-alone Cloud Storage Market overview: By Application

- Chapter 9. Global Stand-alone Cloud Storage Market – End-User Industry Analysis

- 9.1 Global Stand-alone Cloud Storage Market overview: By End-User Industry

- 9.1.1 Global Stand-alone Cloud Storage Market share, By End-User Industry, 2025 and 2035

- 9.2 BFSI (Banking, Financial Services, and Insurance)

- 9.2.1 Global Stand-alone Cloud Storage Market by BFSI (Banking, Financial Services, and Insurance), 2026 – 2035 (USD Billion)

- 9.3 IT & Telecom

- 9.3.1 Global Stand-alone Cloud Storage Market by IT & Telecom, 2026 – 2035 (USD Billion)

- 9.4 Healthcare & Life Sciences

- 9.4.1 Global Stand-alone Cloud Storage Market by Healthcare & Life Sciences, 2026 – 2035 (USD Billion)

- 9.5 Retail & E-commerce

- 9.5.1 Global Stand-alone Cloud Storage Market by Retail & E-commerce, 2026 – 2035 (USD Billion)

- 9.6 Government & Public Sector

- 9.6.1 Global Stand-alone Cloud Storage Market by Government & Public Sector, 2026 – 2035 (USD Billion)

- 9.7 Media & Entertainment

- 9.7.1 Global Stand-alone Cloud Storage Market by Media & Entertainment, 2026 – 2035 (USD Billion)

- 9.8 Manufacturing

- 9.8.1 Global Stand-alone Cloud Storage Market by Manufacturing, 2026 – 2035 (USD Billion)

- 9.9 Education & Research

- 9.9.1 Global Stand-alone Cloud Storage Market by Education & Research, 2026 – 2035 (USD Billion)

- 9.10 Other End-User Industries

- 9.10.1 Global Stand-alone Cloud Storage Market by Other End-User Industries, 2026 – 2035 (USD Billion)

- 9.1 Global Stand-alone Cloud Storage Market overview: By End-User Industry

- Chapter 10. Stand-alone Cloud Storage Market – Regional Analysis

- 10.1 Global Stand-alone Cloud Storage Market Regional Overview

- 10.2 Global Stand-alone Cloud Storage Market Share, by Region, 2025 & 2035 (USD Billion)

- 10.3. North America

- 10.3.1 North America Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.3.1.1 North America Stand-alone Cloud Storage Market, by Country, 2026 – 2035 (USD Billion)

- 10.3.1 North America Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.4 North America Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035

- 10.4.1 North America Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035 (USD Billion)

- 10.5 North America Stand-alone Cloud Storage Market, by Component, 2026 – 2035

- 10.5.1 North America Stand-alone Cloud Storage Market, by Component, 2026 – 2035 (USD Billion)

- 10.6 North America Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035

- 10.6.1 North America Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035 (USD Billion)

- 10.7 North America Stand-alone Cloud Storage Market, by Application, 2026 – 2035

- 10.7.1 North America Stand-alone Cloud Storage Market, by Application, 2026 – 2035 (USD Billion)

- 10.8 North America Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035

- 10.8.1 North America Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.9. Europe

- 10.9.1 Europe Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.9.1.1 Europe Stand-alone Cloud Storage Market, by Country, 2026 – 2035 (USD Billion)

- 10.9.1 Europe Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.10 Europe Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035

- 10.10.1 Europe Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035 (USD Billion)

- 10.11 Europe Stand-alone Cloud Storage Market, by Component, 2026 – 2035

- 10.11.1 Europe Stand-alone Cloud Storage Market, by Component, 2026 – 2035 (USD Billion)

- 10.12 Europe Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035

- 10.12.1 Europe Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035 (USD Billion)

- 10.13 Europe Stand-alone Cloud Storage Market, by Application, 2026 – 2035

- 10.13.1 Europe Stand-alone Cloud Storage Market, by Application, 2026 – 2035 (USD Billion)

- 10.14 Europe Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035

- 10.14.1 Europe Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.15. Asia Pacific

- 10.15.1 Asia Pacific Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.15.1.1 Asia Pacific Stand-alone Cloud Storage Market, by Country, 2026 – 2035 (USD Billion)

- 10.15.1 Asia Pacific Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.16 Asia Pacific Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035

- 10.16.1 Asia Pacific Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035 (USD Billion)

- 10.17 Asia Pacific Stand-alone Cloud Storage Market, by Component, 2026 – 2035

- 10.17.1 Asia Pacific Stand-alone Cloud Storage Market, by Component, 2026 – 2035 (USD Billion)

- 10.18 Asia Pacific Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035

- 10.18.1 Asia Pacific Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035 (USD Billion)

- 10.19 Asia Pacific Stand-alone Cloud Storage Market, by Application, 2026 – 2035

- 10.19.1 Asia Pacific Stand-alone Cloud Storage Market, by Application, 2026 – 2035 (USD Billion)

- 10.20 Asia Pacific Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035

- 10.20.1 Asia Pacific Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.21. Latin America

- 10.21.1 Latin America Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.21.1.1 Latin America Stand-alone Cloud Storage Market, by Country, 2026 – 2035 (USD Billion)

- 10.21.1 Latin America Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.22 Latin America Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035

- 10.22.1 Latin America Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035 (USD Billion)

- 10.23 Latin America Stand-alone Cloud Storage Market, by Component, 2026 – 2035

- 10.23.1 Latin America Stand-alone Cloud Storage Market, by Component, 2026 – 2035 (USD Billion)

- 10.24 Latin America Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035

- 10.24.1 Latin America Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035 (USD Billion)

- 10.25 Latin America Stand-alone Cloud Storage Market, by Application, 2026 – 2035

- 10.25.1 Latin America Stand-alone Cloud Storage Market, by Application, 2026 – 2035 (USD Billion)

- 10.26 Latin America Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035

- 10.26.1 Latin America Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.27. The Middle-East and Africa

- 10.27.1 The Middle-East and Africa Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.27.1.1 The Middle-East and Africa Stand-alone Cloud Storage Market, by Country, 2026 – 2035 (USD Billion)

- 10.27.1 The Middle-East and Africa Stand-alone Cloud Storage Market, 2026 – 2035 (USD Billion)

- 10.28 The Middle-East and Africa Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035

- 10.28.1 The Middle-East and Africa Stand-alone Cloud Storage Market, by Deployment Model, 2026 – 2035 (USD Billion)

- 10.29 The Middle-East and Africa Stand-alone Cloud Storage Market, by Component, 2026 – 2035

- 10.29.1 The Middle-East and Africa Stand-alone Cloud Storage Market, by Component, 2026 – 2035 (USD Billion)

- 10.30 The Middle-East and Africa Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035

- 10.30.1 The Middle-East and Africa Stand-alone Cloud Storage Market, by Storage Type, 2026 – 2035 (USD Billion)

- 10.31 The Middle-East and Africa Stand-alone Cloud Storage Market, by Application, 2026 – 2035

- 10.31.1 The Middle-East and Africa Stand-alone Cloud Storage Market, by Application, 2026 – 2035 (USD Billion)

- 10.32 The Middle-East and Africa Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035

- 10.32.1 The Middle-East and Africa Stand-alone Cloud Storage Market, by End-User Industry, 2026 – 2035 (USD Billion)

- Chapter 11. Company Profiles

- 11.1 Amazon Web Services (AWS)

- 11.1.1 Overview

- 11.1.2 Financials

- 11.1.3 Product Portfolio

- 11.1.4 Business Strategy

- 11.1.5 Recent Developments

- 11.2 Microsoft Azure

- 11.2.1 Overview

- 11.2.2 Financials

- 11.2.3 Product Portfolio

- 11.2.4 Business Strategy

- 11.2.5 Recent Developments

- 11.3 Google Cloud Platform (GCP)

- 11.3.1 Overview

- 11.3.2 Financials

- 11.3.3 Product Portfolio

- 11.3.4 Business Strategy

- 11.3.5 Recent Developments

- 11.4 IBM Cloud

- 11.4.1 Overview

- 11.4.2 Financials

- 11.4.3 Product Portfolio

- 11.4.4 Business Strategy

- 11.4.5 Recent Developments

- 11.5 Oracle Cloud Infrastructure

- 11.5.1 Overview

- 11.5.2 Financials

- 11.5.3 Product Portfolio

- 11.5.4 Business Strategy

- 11.5.5 Recent Developments

- 11.6 Alibaba Cloud

- 11.6.1 Overview

- 11.6.2 Financials

- 11.6.3 Product Portfolio

- 11.6.4 Business Strategy

- 11.6.5 Recent Developments

- 11.7 Tencent Cloud

- 11.7.1 Overview

- 11.7.2 Financials

- 11.7.3 Product Portfolio

- 11.7.4 Business Strategy

- 11.7.5 Recent Developments

- 11.8 Dell Technologies (EMC)

- 11.8.1 Overview

- 11.8.2 Financials

- 11.8.3 Product Portfolio

- 11.8.4 Business Strategy

- 11.8.5 Recent Developments

- 11.9 Dropbox Inc.

- 11.9.1 Overview

- 11.9.2 Financials

- 11.9.3 Product Portfolio

- 11.9.4 Business Strategy

- 11.9.5 Recent Developments

- 11.10 Box Inc.

- 11.10.1 Overview

- 11.10.2 Financials

- 11.10.3 Product Portfolio

- 11.10.4 Business Strategy

- 11.10.5 Recent Developments

- 11.11 Others.

- 11.11.1 Overview

- 11.11.2 Financials

- 11.11.3 Product Portfolio

- 11.11.4 Business Strategy

- 11.11.5 Recent Developments

- 11.1 Amazon Web Services (AWS)

List Of Figures

Figures No 1 to 47

List Of Tables

Tables No 1 to 127

Prominent Player

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud Infrastructure

- Alibaba Cloud

- Tencent Cloud

- Dell Technologies (EMC)

- Dropbox Inc.

- Box Inc.

- Others

FAQs

The key players in the market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud Infrastructure, Alibaba Cloud, Tencent Cloud, Dell Technologies (EMC), Dropbox Inc., Box Inc., Others.

Government regulations play a major role, establishing data residency policies and requiring the location of the data to be within certain geographic limits especially in EU under GDPR and in China and other jurisdictions that value data sovereignty, privacy laws such as GDPR that have supplanted the data protection criteria, and breach notification laws such as the HIPAA regulation of medical use enforcement in the US, and in financial regulation such as the requirement of specific data handling, sovereign cloud programs such as those in Saudi Arabia and Japan, and security certifications such as the FedRAMP of U.S. government These rules not only generate compliance needs that drive particular deployment models such as the ones of a private or sovereign cloud, but they also offer market opportunities to vendors whose solutions meet the regulatory needs of a particular region but still allow global functionality.

The cost of cloud storage has also been made more competitive and affordable with the major providers of cloud storage providing storage at USD 0.02-0.10 per GB per month depending on the type of storage and redundancy levels which is considered up to 70-80% cheaper as compared to the on-premises equivalent considering all the factors. Nevertheless, companies need to deal with aggregate costs such as egress charges that are paid to data retrieval companies that use 51% of storage budgets on API calls and egress traffic, API request charges that are paid to companies that store data, and data transfer expenses between providers or regions. A number of factors enhance cost-effectiveness such as intelligent tiering which automatically migrates data to the best storage class, lifecycle policies which deletes and archives data according to retention policy, committed use discounts which offers predictable usage a 2-5x reduction in storage footprint and data compression. The transition to consumption pricing will remove capital spending and overprovisioning waste that will render cloud storage affordable to those organizations that cannot afford to invest in traditional storage infrastructure.

According to the current analysis, the market is expected to reach about USD 71.94 billion by 2035, and the growth is projected to be strong due to the continued data explosion (with a projection of more than 200 zettabytes by 2025), the expanding applications of AI/ML, which is forcing the need of massive storage, the adoption of hybrid and multi-cloud computing, which is balancing the flexibility and control needs, sovereign cloud computing, and is addressing the needs of data residency, to enable the organizations of all scales to utilize cloud storage.

It is projected that North America will continue to hold the largest revenue share, standing at about 45% of the total market share globally because of the early adoption of cloud which pioneered the development of public cloud service providers, large-scale presence of major cloud providers such as AWS, Microsoft Azure, and Google Cloud in the region, advanced digital infrastructure that supports high-speed cloud delivery, advanced enterprise IT strategies being cloud-first, and technological leadership that was continually innovating to drive the development of the market.

Asia-Pacific region is expected to post the highest CAGR of around 13.8% over the forecast period due to the acceleration of digital transformation, the growth of internet connectivity to the underserved populations, the USD 46 billion cloud investment by China in 2025, the fast pace of digitalization and growing technology sector in India, the fact that mobile-first internet connectivity opens the possibility of utilizing the cloud services to the underserved populations and government efforts to encourage cloud usage and the development of the digital economy throughout the region.

Global Stand-alone Cloud Storage Market is estimated to grow at a healthy rate because of the explosive data growth with the world datasphere reaching 181 zettabytes by 2025 representing 23% CAGR in 2020, the proliferation of IoT devices with 41.6 billion connected devices producing 79.4 zettabytes of data, 60% of corporate data are now in the cloud with 49% of that in the public cloud and 2025 by 60-50% of that in.