Strategic Portfolio Management Market Size, Trends and Insights By Component (Software, Portfolio Planning Software, Resource Management Software, Project Management Software, Analytics and Reporting Software, Services, Professional Services, Managed Services), By Deployment Mode (Cloud-based, On-premise, Hybrid), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Application (Project Portfolio Management (PPM), Product Portfolio Management, IT Portfolio Management, Resource Management, Financial Portfolio Management, Other Applications), By End-User Industry (Information Technology, Banking and Financial Services, Healthcare, Manufacturing, Retail, Telecommunications, Government and Public Sector, Other Industries), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Planview, Inc.

- Clarity (Broadcom Inc.)

- ServiceNow Inc.

- Anaplan Inc.

- Others

Reports Description

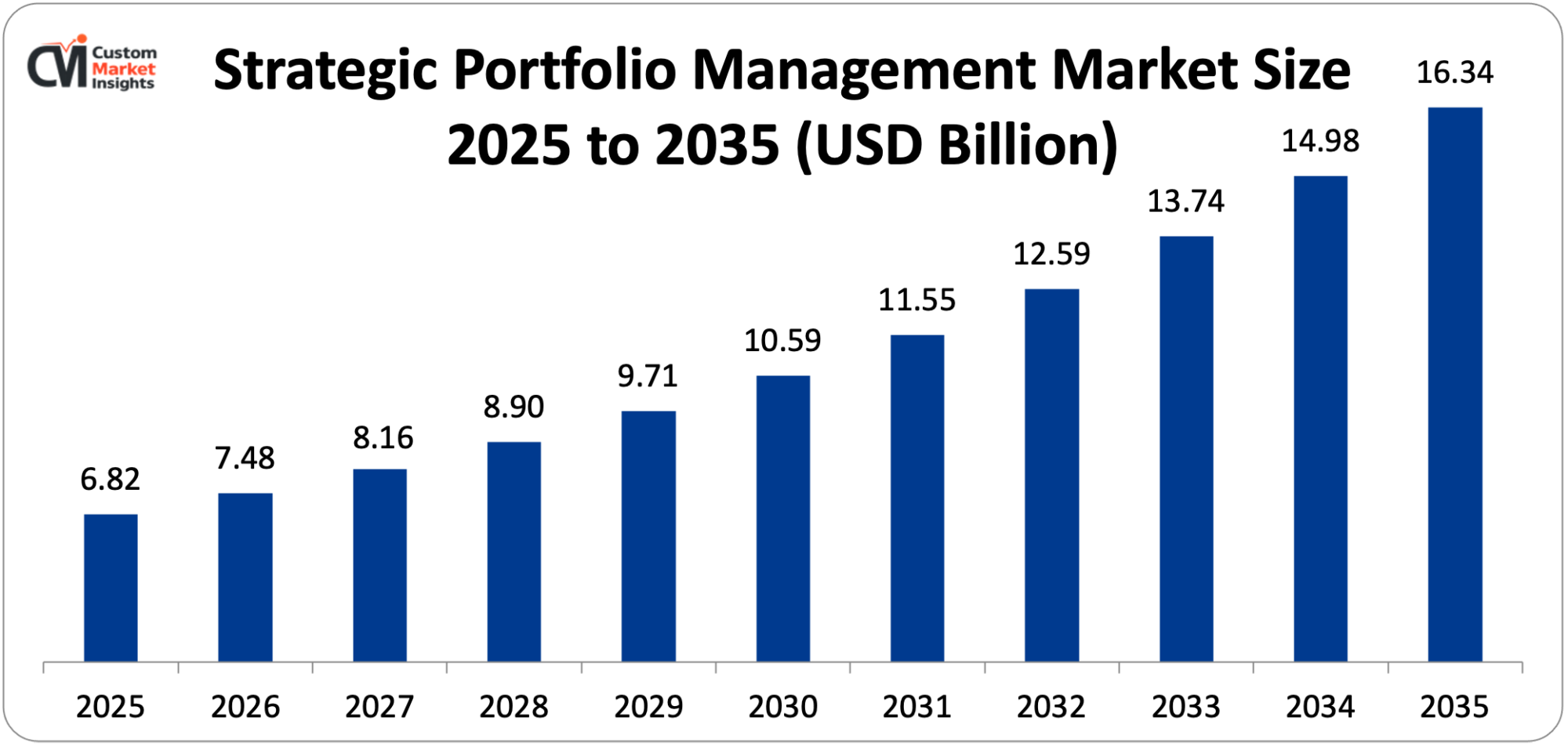

The global strategic portfolio management market size is estimated to be USD 6.82 billion in 2025, and growing by USD 7.48 billion in 2026 to an approximate of USD 16.34 billion in 2035 with CAGR of 9.7% between 2026 and 2035. Market growth is fuelled by the rising demand of strategic alignment of projects and business to achieve objectives, the multi-project complexity, the widespread adoption of agile and hybrid approaches, the promotion of AI and analytics use in portfolio optimization, and the increasing pace of digital transformation efforts in various industries.

Market Highlight

- North America had the largest strategic portfolio management market share of 42% in 2025.

- Asia pacific will have the highest CAGR of 12.3% between 2026 and 2035.

- By component, the software segment had an almost 68% market share in 2025.

- By deployment mode, the cloud-based segment is increasing at the highest CAGR of 10.8% between the years 2026 and 2035.

- By end-user industry, information technology segment had the highest share in the market of 26% in 2025, where the banking and financial services segment is projected to grow by 11.4% during the projected period between 2026 and 2035.

- By size of organization, the large enterprises attracted 69% market share in 2025.

- Companies that implement SPM solutions claim that the success rates of projects go up by 28% and the usage of resources by 35%.

Significant Growth Factors

The Strategic Portfolio Management Market Trends present significant growth opportunities due to several factors:

- Digital Transformation Acceleration and Multi-Project Complexity: The key road to the strategic portfolio management market is the acceleration of digital transformation efforts in all sectors, and organizations are currently dealing with dozens or hundreds of linked projects, programs, and initiatives that demand complex portfolio orchestration and prioritization functions. With data on the world digital transformation research in 2025, the companies are spending an annual average of USD 1.3 trillion in digital transformation projects and 89% of organizations have embraced digital-first business strategies that need coordinated portfolios in technology, operations, and business transformation projects. Organizational management at any point in time is juggling between 20-100 ongoing strategic initiatives, and big organizations are relatively in the process of managing 200-plus active projects across business units, geographies and functional areas generating an unprecedented complexity in resource allocation, dependency management, and strategic alignment. At just 35% of projects completed on-time and within-budget according to the PMI research, the average success rate of project portfolio is worrying and inadequate portfolio management and strategic alignment are found to be the most critical failure reasons in 68% of the cases.

- Strategic Alignment and Value Maximization Imperative: The market expansion has become tremendously faster because the executive came to understand that portfolio value maximization necessitates strict strategic alignment, prioritization by systematic portfolio, and continuous optimization as opposed to the project-by-project authorization that leads to suboptimal portfolios that are not aligned with the strategic priorities. According to the Harvard Business Review, 85% of executive leadership teams invest less than one hour per month in discussions on strategy implementation and 95% of staff members do not know or are unaware of the strategy of their organization leading to underlying disengagement between strategic intent and operational reality. Strategic portfolio management aligns this gap through the development of formalized structures of assessing proposed initiatives on strategic criteria, portfolios balancing in terms of risk dimensions, types of investment, strategic themes, and resource allocation to the most valuable opportunities, and governance procedures to ensure the portfolio is maintained in line with changes in strategic priorities. Portfolio management research indicates that organizations, which have mature SPM practices, realize 38% higher portfolio returns on portfolio investments than organizations which have ad-hoc portfolio management, and this financial outcome is significant.

What are the Major Advances Changing the Strategic Portfolio Management Market Today

- AI-Powered Portfolio Optimization and Predictive Analytics: The most revolutionary technological innovation is the addition of artificial intelligence and machine learning functionalities to strategic portfolio management systems, allowing the automation of portfolio optimization, prediction of project success, smart resource allocation, and risk identification in advance that can radically enhance portfolio performance and quality of decisions. Contemporary AI-driven SPM systems include predictive analytics to predict the likelihood of project success, schedule performance and budget variance on the basis of early indicators and historical trends, portfolio optimization programs to decide optimal project combinations maximising strategic value with resource and budget constraints, intelligent resources allocation programs that recommend resource allocations based on skills, availability, project priority and development objectives and natural language processing that recognises the arising risks and issues by reviewing project documentation, schedule performances and status reports. Implementation studies have found that AI-based improvement in portfolio management systems create a higher rate of predictability in project success (40-55), allow portfolio value improvement (18-25) by providing more accurate prioritization and resource allocation, and cut portfolio management overhead (30-40) through automation of routine analysis and reporting processes. Machine learning algorithms are used to examine thousands of past projects and find a pattern of success and failure that are used in future portfolio to offer early indications of a troubled project that needs attention or cancelation. Predictive resource modeling is the process of forecasting the resource requirements in the future using project pipeline and planned initiatives and finding the gaps or excesses in capacity a number of months beforehand to make proactive decisions to hire, train or reassign resources. Portfolio management is the best application field of machine learning according to AI technology research because of the richness of data and decision making processes based on patterns and high value added by minor increments of performance. State-of-the-art platforms may provide recommendation engines to provide portfolio actions (such as project cancellations, priority adjustment, resource reallocation, or scope adjustment) as a result of overall analysis of portfolio health, strategic alignment and resource utilization. The capabilities of natural language generation automatically generate executive portfolio summaries, project health reports, and strategic alignment analysis, which has the effect of decreasing the manual reporting load and enhancing the quality and consistency of the insight. The scenario simulation engines use AI to quickly assess thousands of possible portfolio combinations, finding strong strategies that do well in multiple futures as opposed to optimizing future as predicted.

- Integrated Agile and Hybrid Portfolio Management: The launch of portfolio management features that enable agile, waterfall, and hybrid approaches on the same platforms take into consideration the fact that current portfolios have a variety of types of projects that should be managed using different methods, yet they all need to be managed and coordinated. The conventional portfolio management tools presupposed the waterfall approach to project management with comprehensive initial planning, fixed scope, and milestone-based governance, whereas the agile approach that takes over software development and is increasingly used in other areas demands completely different portfolio management strategies with adaptive planning, iterative delivery, and prioritization driven by value. Agile adoption research has found 71% of organisations employing agile methods in at least some projects, with 37% saying most work is being done using agile or hybrid processes which makes it necessary to have portfolio management that supports both agile teams and traditional projects in integrated systems. The current state of SPM platforms has agile portfolio management features such as epic and feature-level portfolio planning, capacity-based resource planning with velocity and throughput metrics, incremental funding models that release capital in stages with delivered value, and continuous portfolio optimization with changing priorities with the changing business conditions and capabilities delivered. Formalized portfolio management models used by agile organizations, such as SAFe (Scaled Agile Framework), LeSS (Large-Scale Scrum) and Disciplined Agile, have been formalized on scaled agile frameworks, with the major SPM vendors adopting the approaches as part of platforms in the form of portfolio Kanban boards which visualize initiatives in flow through stages between ideation and delivery, the approach to lean budgeting, which uses value streams but not project-based budgeting, and participatory budgeting, which provides agile teams with a role in portfolio planning. Cloud based deployment segment is growing at the highest rate of 10.8% CAGR because of the benefits of cloud platforms in supporting distributed agile teams, offering real-time collaboration benefits, and supporting constant platform evolution that delivers new capabilities without disruptive releases. The hybrid types of portfolio management acknowledge the fact that portfolios mixes of projects of various types: complex transformation programs that need traditional governance, agile product development projects that should take advantage of iterative approaches, more common operational projects that demand simplified management, and innovation experiment projects that demand a venture capital-like stage-gate funding. Top platforms embrace this diversity with configurable project processes, centralized resources management of all types of work, and consolidated portfolio perspectives that offer visibility of the executive despite underlying project management strategy.

- Real-Time Portfolio Intelligence and Continuous Planning: The availability of real-time portfolio dashboard and constant planning has already revolutionized periodic review cycles based on fixed-point reports to data-based, dynamic decision support that allow rapid response to the changing environment and new opportunities. The traditional portfolio management used quarterly or monthly cycles where portfolio review was conducted on a point in time basis that became stale quite fast thereby causing a lag between the portfolio reality and the level of management awareness hindering the timely decision making. Current SPM platforms include real-time data integration between with project management systems, financial systems, resource management platforms, and collaboration tools, which offer continuously updated portfolio views, automated KPI calculation updating portfolio health metrics as underlying data changes, predictive trending showing trajectories towards red/yellow/green thresholds before current conditions decline, and configurable dashboards to use by executives, portfolio managers and project teams. Real time management research has shown that organizations with dynamic portfolio intelligence platforms react to portfolio issues 50-60 times quicker than those with periodic reporting systems, and minor issues are not turned into large issues that take costly intervention or termination of projects. Constant planning methods substitute the yearly portfolio planning with the rolling wave planning to support the process of continuous portfolio optimization as strategic priorities change, new opportunities are introduced, and the reality of delivery becomes apparent. The possibility of what-if analysis of scenarios in the modern platform would enable portfolio managers to model the effect of possible modifications such as resource reallocation amidst projects, prioritization acceleration, or new strategic demands fast. Different interactive portfolio visualization such as bubble charts that display projects in terms of strategic value vs. cost or risk, heatmaps that show resource constraints and allocation gaps, and portfolio timelines that indicate initiative sequencing and interdependence can offer user-friendly interfaces that assist in collaborative decisions regarding a portfolio in leadership forums. Mobile applications then allow executives to track the health of their portfolios and authorize the portfolio decisions anywhere and decrease the time taken to make decisions and eliminate the delays due to scheduling issues in order to take senior executives through the review process.

Category Wise Insights

By Component

Why Software Dominates the Market?

The largest segment is that of software, which occupies about 68% of the entire market share in 2025. It is a sign of complexity in the technological infrastructure needed to execute enterprise portfolio management, where platforms are central repositories of all the portfolio data, approval processes and governance are managed by automated workflow engines, and portfolio metrics are calculated with advanced analytics and produce insights, and the integration structure is linked to enterprise systems such as ERP, financial management, project management, and collaboration tools. The industry surveys show that 91% of the leaders in the portfolio management believe that specific SPM software is either necessary or highly important in the management of a complex portfolio, with the average enterprise deployment running 50-500 parallel initiatives and involving 200-2000 users including portfolio managers, project managers, resource managers, executives, and team members. Strategic portfolio management software have several modules that are deeply integrated such as strategic planning and objective setting, demand management and intake processes, portfolio optimization and scenario planning, project and program management, resource capacity planning and allocation, financial management and budget tracking, and reporting and analytics dashboards. These are complex requirements that are met by these platforms such as multi-dimensional portfolio views to support the perspectives of various stakeholders, configurable work flows to support organizational governance processes, and advanced calculation engines to compute weighted scoring, optimization algorithms and portfolio performance metrics.

The service division, which is a 32% market share, is growing at 8.9% CAGR as organizations need implementation support, portfolio maturity evaluation services, and governance design and managed services to continue optimizing portfolios. Professional services assist business to determine the level of maturity in portfolio management and opportunity to improve, put together governance frameworks such as stage gates, approval authorities and decision criteria, install and configure platforms with business structures and business processes, and build the portfolio management skills through training and coaching. Managed services allow firms to outsource portfolio management office (PMO) functions or certain functions such as portfolio reporting, resource management, or financial tracking to external vendors, which is especially useful when there is no experience in managing portfolios in an organization or when there is limited resources available to the organization. The PMO benchmark research indicates that organizations that invest in professional services in the course of implementing SPM realize their time-to-value is 40 times quicker and their user adoption rates are 35 times higher than organizations that make a self-implementation effort without the input of a professional service.

By Deployment Mode

Why Cloud-Based Solutions Are Growing Fastest?

Cloud-based deployment is the highest growing segment with predicted CAGR of 10.8% between 2026 and 2035, due to lower total cost of ownership because it eliminates server infrastructure and maintenance expenses, faster deployment with deployment times of weeks instead of months, automatic updates which provide new features and capabilities without interruption and better accessibility which provides distributed teams and remote work models. Cloud strategic portfolio management solutions have automated elastic scalability that supports the increasing number of users and data, are available globally with multiple data centers that provides high-performance despite geographical differences and are continuously innovative with vendors who make additions to the system every month or quarter, and have usage-based pricing models that match costs to actual consumption. The research on cloud computing indicates that organizations that deploy cloud computing platforms with portfolio management save 35-50% of the IT infrastructure expenses than the on-premise counterparts and deploy it 65 times faster and 55 times lower maintenance overhead.

On-premise deployments, even though increasingly being less popular, are still important to those organizations with high data security considerations in regulated sectors such as defense, intelligence, and in some financial sectors, that have high customization demands necessitating deep platform changes incompatible in multi-tenant cloud platforms, and integration needs with on-premise systems such as mainframe applications and specialized databases. Nevertheless, more and more popular are hybrid deployment models that blend on-premise portfolio repositories with cloud-based collaboration and mobility access with both control and flexibility. By using these hybrid solutions, sensitive project and financial data can be kept in an organizational infrastructure, but user interfaces, analytics, and integration with cloud-based project management and collaboration tools are offered based on cloud capabilities.

By Organization Size

Why Large Enterprises Lead Adoption?

The largest segment is large enterprises, which will control about 69% of the market in 2025. This is the type of leadership that is more indicative of the size and complexity of large organizations where portfolios may have hundreds of concurrent initiatives, thousands of resources to allocate, and budgets of hundreds of millions or billions of dollars annually may require a high level of management skills. Big businesses usually have many business units, geographies, and functional areas, and to manage these there are problems of portfolio management such as complex organizational structures with both matrix reporting relationships and variety of methodologies with differing units, which may use waterfall, agile, or hybrid development methodologies and incompatible priorities that need executive governance making sure that resource and capital allocation aligns with corporate strategy. Enterprise portfolio studies suggest that fortune 500 organizations operate average portfolios of 180 ongoing major projects of greater than USD 500 million yearly, and manage resource reserves of 2,000-10,000 people of permanent employees, contractors and third-party service providers.

Small and medium enterprises are growing faster at 10.5% CAGR as access to advanced portfolio management tools democratizes, an increase in the complexity of projects is impacting even smaller organizations, and targeting the SME segment is triggering product innovation and pricing models that serve smaller budgets. Contemporary platforms have tiered pricing such that powerful features become available at lower costs to smaller organizations, simpler interfaces to lessen learning curves with teams that do not have specific PMO personnel, and pre-built templates to jumpstart implementation with common industries and cases. Small business technology surveys show SMEs operating 10-50 simultaneous projects are finding it increasingly important to formally manage their portfolio and 58% of those surveyed intend to invest in portfolio management software in 2025-2026. Cloud deployment removes the need to have IT infrastructure installed, automated governance processes to replace the few administrative staff, and predefined templates based on best practices to offer proven frameworks with no costly consulting projects.

By End-User Industry

Why Information Technology Dominates SPM Adoption?

The biggest segment is information technology applications, which will account to about 26% of the entire market share in 2025. Such leadership demonstrates the IT industry, and its initial embrace of portfolio management, more complicated portfolios of application development, infrastructure, security and digital transformation projects, and advanced knowledge of project management strategies that build receptive space to advanced SPM capabilities. IT organizations have a variety of portfolios which include application development and improvement projects that provide new capabilities and features, infrastructure modernization projects (migrating to the cloud and consolidating datacenters) and cybersecurity projects that protect organizational assets and assure compliance, digital transformation projects that remake business models and customer experiences, and operational projects that maintain and support existing technology estates. Gartner research suggests that typical large enterprise IT organisation operates 150-300 ongoing technology projects with yearly budgets of USD 100-500 million and they put up significant portfolio administration pressure necessitating advanced platforms that orchestrate these interdependent undertakings.

Banking and financial services are the most rapidly growing sector whose anticipated CAGR is 11.4% between 2026 and 2035 due to the intricate nature of the regulatory environment that demands significant investments in compliance and risk management projects, digital banking transformation initiatives redefining customer experiences and competitive positioning, cyber security requirements designed to guard sensitive financial information and avert fraud, and the merger and acquisition activity necessitating technology and business integration programs. Financial institutions deal with especially complicated portfolios where they strike a balance between the required compliance project which is mandatory and the strategic development and improvements business and thus they need sophisticated prioritization frameworks and governance procedures that will guarantee sufficient investment on mandatory items and hence pursue the strategic opportunities. The current SPM systems allow financial services companies to classify initiatives by regulatory/mandatory and discretionary/strategic risk-weight portfolios that provide the right balance between risk-taking innovation and less risky operational effectiveness, model business value of various benefits such as revenue growth, cost reduction, risk mitigation, and compliance, and monitor capital expenditures and operational expenses budgets to support financial reporting and regulatory filings.

By Application

Why Project Portfolio Management Leads Market Applications?

Project portfolio management (PPM) software is the broadest application in strategic portfolio management, integrating entire lifecycle demand intake to project delivery to benefit delivery, which is used by 88% of those who use SPM platforms based on industry surveys. PPM offers end to end portfolio management such as demand management, idea intake processes that capture proposed initiatives across organization, portfolio prioritization that uses strategic criteria to evaluate and rank opportunities, project optimization to see highest-value combinations of projects in face of resource and budget constraints, project execution management to track approved initiatives to delivery, and benefit realization to see whether completed projects are actually achieving projected business value. Based on research by PMI, project portfolio management lowers the cost of portfolio by 15-20% through improved prioritization of work which eliminates low-value work, and the strategic alignment is more strategic-corresponding 65% of the project work is directly linked to the strategic goals as opposed to 40% without project portfolio management.

IT portfolio management is a specialized form that is concerned with technology portfolios, and that includes special requirements such as the application lifecycle management, technology rationalization, and technical architecture governance. Product portfolio management has applications in the products company dealing with product lines and features portfolios instead of project portfolios, and has product road mapping, market analysis and product lifecycle management features. Resource management applications have a specific emphasis on resource planning, resource scheduling, and optimization of resource utilization and are commonly initially implemented before full-fledged SPM.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 7.48 billion |

| Projected Market Size in 2035 | USD 16.34 billion |

| Market Size in 2025 | USD 6.82 billion |

| CAGR Growth Rate | 9.7% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Component, Deployment Mode, Organization Size, Application, End-User Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Market Size?

The North America strategic portfolio management market size is estimated at USD 2.86 billion in 2025 and is projected to reach approximately USD 6.41 billion by 2035, with a 9.4% CAGR from 2026 to 2035.

Why Did North America Dominate the Market in 2025?

The biggest player in the world is North America, which controls slightly more than 42% market share in 2025, due to the mature project management and PMI and the other professional bodies that set up best practices and standards, the concentration of Fortune 500 companies and Fortune 1000 companies that have complex strategic portfolios to manage, the technological leadership in the sector with the major IT companies based in region driving platform innovation, and the heavy investment in digital transformation and technology modernization building large project portfolios. The area is well-established in PMO operations with mature portfolio management offices that are found in large enterprises, well-established vendor ecosystem with dominant SPM platform providers located in North America, with advanced analytics and AI solutions with technology innovation concentrated in Silicon Valley and other technology centers, and with a culture of continuous improvement that triggers the implementation of new management processes and technology. The US controlled the market with dominating share because the world was the biggest economy with the highest corporate expenditure on strategic planning, technological innovation leader with large software vendors and early adopters companies, and with fully-grown project management profession that had more than 600,000 PMP-certified professionals as source of talent to manage large-scale portfolio.

U.S. Market Trends

The US market reflects massive share of the world demand due to massive implementation of digital transformation programs by major fortune 500 companies averaging USD 300-800 million per year in strategic projects, concentration of the technology industry in Silicon Valley, Seattle, Austin and other technology hubs developing demand in advanced projects in portfolio management, financial services digitalization with banks and insurance companies managing massive technology and regulation portfolio, and in healthcare transformation with hospitals and health systems implementing electronic health records, telehealth, and value-based care programs requiring coordinated project portfolios. U.S. enterprise surveys indicate that 82% of the companies with more than USD 1 billion in revenues have adopted or intend to adopt complex strategic portfolio management solutions by 2026, because of the complexity of digital transformation and growing interest in portfolio performance at the board level. The market can be described as having high platform adoption maturity where companies are implementing advanced features such as AI-based analytics, real-time portfolio dashboards, and integrated resource management, but increasing momentum towards agile portfolio management is making platforms evolve and vendors compete.

Why is Asia Pacific Growing at the Fastest Rate?

The Asia Pacific region is the fastest growing with a projected CAGR of 12.3% in 2026-35, due to the high rate of economic growth that is creating corporate sectors with growing bases of project management, growing rate of digital transformation that is causing governments and enterprises to invest heavily in technology modernisation, and growth of the manufacturing sector that forces the need to continue developing products and improving their operations that requires management of portfolio, and the ongoing adoption of the professional project management practices as organizations mature. The research on technology in the Asian Pacific revealed that expenditure on enterprise software increased by 15.2% CAGR in the 2020-2024, which is significantly greater than global rates, and the portfolio management is a high-growth niche in the overall enterprise application market.

China Market Trends

The biggest and fastest-growing Asia Pacific market is China, which is dominated by huge technology sector with leading companies such as Alibaba, Tencent, Huawei operating enormous development portfolios, government-driven digitalization efforts in the public sector and state-owned enterprises, transformation of manufacturing sector towards advanced manufacturing and Industry 4.0 which requires coordinated technology investment, and Belt and Road infrastructure projects which require management of huge construction and development programs. Chinese companies are quickly embracing western ideas of project management as well as coming up with localized strategies that are based on the Chinese business culture and organization systems. The surveys on Chinese enterprise technology show that the large companies enhanced the use of portfolio management software by 185% in 2021-2024 due to competitive pressure, the need to digitalise and also as a result of project management practices approaching professionalisation. The local vendors are building SPM platforms that support China-specific needs such as integration with Chinese enterprise systems, support of Chinese project management standards, and execution in Chinese cloud environments to meet the needs of data sovereignty.

Why is Europe Experiencing Steady Growth?

The European market is large, with developed project management processes and high PMO cultures, more digital transformation projects within the public and private markets, regulatory complexity necessitating the synchronization of compliance project portfolios, and an increasing focus on agile and hybrid approaches specifically in technology industries. Europe has a large market share internationally and has strong professional project management associations such as APM, IPMA and country-specific associations, detailed data privacy laws such as GDPR that affect platform needs and a diverse linguistic and cultural environment that needs local platforms and services. The European enterprise surveys show that 74% of large European firms have formal PMOs or portfolio management functions that are similar in level of maturity as those found in North America but with varying governance styles that mirror European business cultures.

Germany Market Trends

The market presence of Germany is large because of the well-developed manufacturing industry such as automotive, industrial equipment, and chemicals, which need product portfolio management, a strong history of engineering project management with well-developed planning and control processes, Industry 4.0, which demands factories to become digital and invest in smart manufacturing, and large enterprise segment where companies listed on the DAX manage complex strategic portfolios. German enterprises focus on thorough planning, strict control, and extensive recording in the management of the portfolios, which makes them move toward adopting the platforms with advanced planning tools and audit trail functionalities. German business research shows that manufacturing firms with developed portfolio management would spend 22% less time to market new products and 18% higher on project ROI due to enhanced prioritization and allocation of resources.

Why is the LAMEA Region Experiencing Growth?

The LAMEA region is experiencing an increasing market development due to the growth in economic development resulting in larger corporate sectors handling strategic initiatives, the adoption of digital transformation with governments and undertakings updating their technology infrastructure, infrastructure development projects in Middle East and Africa and increasing project management professionalization with the rising numbers of PMP certification and the creation of PMO. Countries in the Middle Eastern region such as UAE and Saudi Arabia are undertaking Vision 2030 and such other economic transformation initiatives with huge portfolios of infrastructure, technology and business development projects and which demand advanced portfolio management. The emerging competitive pressure in Latin American companies leads to digital transformation and operational improvement portfolio, and the resource constraint means that portfolio optimization is especially useful. The regional development research indicates LAMEA enterprise software expenditure will advance at 13.5% CAGR up to 2030, and portfolio management will be a high potential segment based on the organizational maturity.

Top Players in the Market and Their Offerings

- Planview Inc.

- Clarity (Broadcom Inc.)

- ServiceNow Inc.

- Anaplan Inc.

- Atlassian Corporation

- Microsoft Corporation (Project Online)

- Oracle Corporation (Primavera)

- Planisware

- Workfront (Adobe Inc.)

- Changepoint (Daptiv)

- Celoxis

- Sciforma

- Others

Key Developments

The market has undergone significant developments as industry participants seek to expand capabilities and enhance product portfolios.

- In March 2025: Planview announced significant enhancements to its portfolio management platform introducing AI-powered project health prediction and automated portfolio optimization recommendations, enabling organizations to proactively identify at-risk initiatives and optimize portfolio composition for maximum strategic value delivery.

- In February 2025: ServiceNow expanded its Strategic Portfolio Management capabilities with launch of integrated agile portfolio management module supporting SAFe framework implementation, addressing growing demand for platforms supporting both traditional and agile portfolio management within unified platform for hybrid organizations.

These strategic activities have allowed companies to strengthen market positions, expand product offerings, enhance technological capabilities, and capitalize on growth opportunities within the expanding market.

The Strategic Portfolio Management Market is segmented as follows:

By Component

- Software

- Portfolio Planning Software

- Resource Management Software

- Project Management Software

- Analytics and Reporting Software

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-based

- On-premise

- Hybrid

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Project Portfolio Management (PPM)

- Product Portfolio Management

- IT Portfolio Management

- Resource Management

- Financial Portfolio Management

- Other Applications

By End-User Industry

- Information Technology

- Banking and Financial Services

- Healthcare

- Manufacturing

- Retail

- Telecommunications

- Government and Public Sector

- Other Industries

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Strategic Portfolio Management Market, (2026 – 2035) (USD Billion)

- 2.2 Global Strategic Portfolio Management Market : snapshot

- Chapter 3. Global Strategic Portfolio Management Market – Industry Analysis

- 3.1 Strategic Portfolio Management Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Digital Transformation Acceleration and Multi-Project Complexity

- 3.2.2 Strategic Alignment and Value Maximization Imperative

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Component

- 3.7.2 Market attractiveness analysis By Deployment Mode

- 3.7.3 Market attractiveness analysis By Organization Size

- 3.7.4 Market attractiveness analysis By Application

- 3.7.5 Market attractiveness analysis By End-User Industry

- Chapter 4. Global Strategic Portfolio Management Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Strategic Portfolio Management Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Strategic Portfolio Management Market – Component Analysis

- 5.1 Global Strategic Portfolio Management Market overview: By Component

- 5.1.1 Global Strategic Portfolio Management Market share, By Component, 2025 and 2035

- 5.2 Software

- 5.2.1 Global Strategic Portfolio Management Market by Software, 2026 – 2035 (USD Billion)

- 5.3 Portfolio Planning Software

- 5.3.1 Global Strategic Portfolio Management Market by Portfolio Planning Software, 2026 – 2035 (USD Billion)

- 5.4 Resource Management Software

- 5.4.1 Global Strategic Portfolio Management Market by Resource Management Software, 2026 – 2035 (USD Billion)

- 5.5 Project Management Software

- 5.5.1 Global Strategic Portfolio Management Market by Project Management Software, 2026 – 2035 (USD Billion)

- 5.6 Analytics and Reporting Software

- 5.6.1 Global Strategic Portfolio Management Market by Analytics and Reporting Software, 2026 – 2035 (USD Billion)

- 5.7 Services

- 5.7.1 Global Strategic Portfolio Management Market by Services, 2026 – 2035 (USD Billion)

- 5.8 Professional Services

- 5.8.1 Global Strategic Portfolio Management Market by Professional Services, 2026 – 2035 (USD Billion)

- 5.9 Managed Services

- 5.9.1 Global Strategic Portfolio Management Market by Managed Services, 2026 – 2035 (USD Billion)

- 5.1 Global Strategic Portfolio Management Market overview: By Component

- Chapter 6. Global Strategic Portfolio Management Market – Deployment Mode Analysis

- 6.1 Global Strategic Portfolio Management Market overview: By Deployment Mode

- 6.1.1 Global Strategic Portfolio Management Market share, By Deployment Mode, 2025 and 2035

- 6.2 Cloud-based

- 6.2.1 Global Strategic Portfolio Management Market by Cloud-based, 2026 – 2035 (USD Billion)

- 6.3 On-premise

- 6.3.1 Global Strategic Portfolio Management Market by On-premise, 2026 – 2035 (USD Billion)

- 6.4 Hybrid

- 6.4.1 Global Strategic Portfolio Management Market by Hybrid, 2026 – 2035 (USD Billion)

- 6.1 Global Strategic Portfolio Management Market overview: By Deployment Mode

- Chapter 7. Global Strategic Portfolio Management Market – Organization Size Analysis

- 7.1 Global Strategic Portfolio Management Market overview: By Organization Size

- 7.1.1 Global Strategic Portfolio Management Market share, By Organization Size, 2025 and 2035

- 7.2 Small and Medium Enterprises (SMEs)

- 7.2.1 Global Strategic Portfolio Management Market by Small and Medium Enterprises (SMEs), 2026 – 2035 (USD Billion)

- 7.3 Large Enterprises

- 7.3.1 Global Strategic Portfolio Management Market by Large Enterprises, 2026 – 2035 (USD Billion)

- 7.1 Global Strategic Portfolio Management Market overview: By Organization Size

- Chapter 8. Global Strategic Portfolio Management Market – Application Analysis

- 8.1 Global Strategic Portfolio Management Market overview: By Application

- 8.1.1 Global Strategic Portfolio Management Market share, By Application, 2025 and 2035

- 8.2 Project Portfolio Management (PPM)

- 8.2.1 Global Strategic Portfolio Management Market by Project Portfolio Management (PPM), 2026 – 2035 (USD Billion)

- 8.3 Product Portfolio Management

- 8.3.1 Global Strategic Portfolio Management Market by Product Portfolio Management, 2026 – 2035 (USD Billion)

- 8.4 IT Portfolio Management

- 8.4.1 Global Strategic Portfolio Management Market by IT Portfolio Management, 2026 – 2035 (USD Billion)

- 8.5 Resource Management

- 8.5.1 Global Strategic Portfolio Management Market by Resource Management, 2026 – 2035 (USD Billion)

- 8.6 Financial Portfolio Management

- 8.6.1 Global Strategic Portfolio Management Market by Financial Portfolio Management, 2026 – 2035 (USD Billion)

- 8.7 Other Applications

- 8.7.1 Global Strategic Portfolio Management Market by Other Applications, 2026 – 2035 (USD Billion)

- 8.1 Global Strategic Portfolio Management Market overview: By Application

- Chapter 9. Global Strategic Portfolio Management Market – End-User Industry Analysis

- 9.1 Global Strategic Portfolio Management Market overview: By End-User Industry

- 9.1.1 Global Strategic Portfolio Management Market share, By End-User Industry, 2025 and 2035

- 9.2 Information Technology

- 9.2.1 Global Strategic Portfolio Management Market by Information Technology, 2026 – 2035 (USD Billion)

- 9.3 Banking and Financial Services

- 9.3.1 Global Strategic Portfolio Management Market by Banking and Financial Services, 2026 – 2035 (USD Billion)

- 9.4 Healthcare

- 9.4.1 Global Strategic Portfolio Management Market by Healthcare, 2026 – 2035 (USD Billion)

- 9.5 Manufacturing

- 9.5.1 Global Strategic Portfolio Management Market by Manufacturing, 2026 – 2035 (USD Billion)

- 9.6 Retail

- 9.6.1 Global Strategic Portfolio Management Market by Retail, 2026 – 2035 (USD Billion)

- 9.7 Telecommunications

- 9.7.1 Global Strategic Portfolio Management Market by Telecommunications, 2026 – 2035 (USD Billion)

- 9.8 Government and Public Sector

- 9.8.1 Global Strategic Portfolio Management Market by Government and Public Sector, 2026 – 2035 (USD Billion)

- 9.9 Other Industries

- 9.9.1 Global Strategic Portfolio Management Market by Other Industries, 2026 – 2035 (USD Billion)

- 9.1 Global Strategic Portfolio Management Market overview: By End-User Industry

- Chapter 10. Strategic Portfolio Management Market – Regional Analysis

- 10.1 Global Strategic Portfolio Management Market Regional Overview

- 10.2 Global Strategic Portfolio Management Market Share, by Region, 2025 & 2035 (USD Billion)

- 10.3. North America

- 10.3.1 North America Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.3.1.1 North America Strategic Portfolio Management Market, by Country, 2026 – 2035 (USD Billion)

- 10.3.1 North America Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.4 North America Strategic Portfolio Management Market, by Component, 2026 – 2035

- 10.4.1 North America Strategic Portfolio Management Market, by Component, 2026 – 2035 (USD Billion)

- 10.5 North America Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035

- 10.5.1 North America Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.6 North America Strategic Portfolio Management Market, by Organization Size, 2026 – 2035

- 10.6.1 North America Strategic Portfolio Management Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.7 North America Strategic Portfolio Management Market, by Application, 2026 – 2035

- 10.7.1 North America Strategic Portfolio Management Market, by Application, 2026 – 2035 (USD Billion)

- 10.8 North America Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035

- 10.8.1 North America Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.9. Europe

- 10.9.1 Europe Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.9.1.1 Europe Strategic Portfolio Management Market, by Country, 2026 – 2035 (USD Billion)

- 10.9.1 Europe Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.10 Europe Strategic Portfolio Management Market, by Component, 2026 – 2035

- 10.10.1 Europe Strategic Portfolio Management Market, by Component, 2026 – 2035 (USD Billion)

- 10.11 Europe Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035

- 10.11.1 Europe Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.12 Europe Strategic Portfolio Management Market, by Organization Size, 2026 – 2035

- 10.12.1 Europe Strategic Portfolio Management Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.13 Europe Strategic Portfolio Management Market, by Application, 2026 – 2035

- 10.13.1 Europe Strategic Portfolio Management Market, by Application, 2026 – 2035 (USD Billion)

- 10.14 Europe Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035

- 10.14.1 Europe Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.15. Asia Pacific

- 10.15.1 Asia Pacific Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.15.1.1 Asia Pacific Strategic Portfolio Management Market, by Country, 2026 – 2035 (USD Billion)

- 10.15.1 Asia Pacific Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.16 Asia Pacific Strategic Portfolio Management Market, by Component, 2026 – 2035

- 10.16.1 Asia Pacific Strategic Portfolio Management Market, by Component, 2026 – 2035 (USD Billion)

- 10.17 Asia Pacific Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035

- 10.17.1 Asia Pacific Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.18 Asia Pacific Strategic Portfolio Management Market, by Organization Size, 2026 – 2035

- 10.18.1 Asia Pacific Strategic Portfolio Management Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.19 Asia Pacific Strategic Portfolio Management Market, by Application, 2026 – 2035

- 10.19.1 Asia Pacific Strategic Portfolio Management Market, by Application, 2026 – 2035 (USD Billion)

- 10.20 Asia Pacific Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035

- 10.20.1 Asia Pacific Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.21. Latin America

- 10.21.1 Latin America Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.21.1.1 Latin America Strategic Portfolio Management Market, by Country, 2026 – 2035 (USD Billion)

- 10.21.1 Latin America Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.22 Latin America Strategic Portfolio Management Market, by Component, 2026 – 2035

- 10.22.1 Latin America Strategic Portfolio Management Market, by Component, 2026 – 2035 (USD Billion)

- 10.23 Latin America Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035

- 10.23.1 Latin America Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.24 Latin America Strategic Portfolio Management Market, by Organization Size, 2026 – 2035

- 10.24.1 Latin America Strategic Portfolio Management Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.25 Latin America Strategic Portfolio Management Market, by Application, 2026 – 2035

- 10.25.1 Latin America Strategic Portfolio Management Market, by Application, 2026 – 2035 (USD Billion)

- 10.26 Latin America Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035

- 10.26.1 Latin America Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035 (USD Billion)

- 10.27. The Middle-East and Africa

- 10.27.1 The Middle-East and Africa Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.27.1.1 The Middle-East and Africa Strategic Portfolio Management Market, by Country, 2026 – 2035 (USD Billion)

- 10.27.1 The Middle-East and Africa Strategic Portfolio Management Market, 2026 – 2035 (USD Billion)

- 10.28 The Middle-East and Africa Strategic Portfolio Management Market, by Component, 2026 – 2035

- 10.28.1 The Middle-East and Africa Strategic Portfolio Management Market, by Component, 2026 – 2035 (USD Billion)

- 10.29 The Middle-East and Africa Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035

- 10.29.1 The Middle-East and Africa Strategic Portfolio Management Market, by Deployment Mode, 2026 – 2035 (USD Billion)

- 10.30 The Middle-East and Africa Strategic Portfolio Management Market, by Organization Size, 2026 – 2035

- 10.30.1 The Middle-East and Africa Strategic Portfolio Management Market, by Organization Size, 2026 – 2035 (USD Billion)

- 10.31 The Middle-East and Africa Strategic Portfolio Management Market, by Application, 2026 – 2035

- 10.31.1 The Middle-East and Africa Strategic Portfolio Management Market, by Application, 2026 – 2035 (USD Billion)

- 10.32 The Middle-East and Africa Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035

- 10.32.1 The Middle-East and Africa Strategic Portfolio Management Market, by End-User Industry, 2026 – 2035 (USD Billion)

- Chapter 11. Company Profiles

- 11.1 Planview Inc.

- 11.1.1 Overview

- 11.1.2 Financials

- 11.1.3 Product Portfolio

- 11.1.4 Business Strategy

- 11.1.5 Recent Developments

- 11.2 Clarity (Broadcom Inc.)

- 11.2.1 Overview

- 11.2.2 Financials

- 11.2.3 Product Portfolio

- 11.2.4 Business Strategy

- 11.2.5 Recent Developments

- 11.3 ServiceNow Inc.

- 11.3.1 Overview

- 11.3.2 Financials

- 11.3.3 Product Portfolio

- 11.3.4 Business Strategy

- 11.3.5 Recent Developments

- 11.4 Anaplan Inc.

- 11.4.1 Overview

- 11.4.2 Financials

- 11.4.3 Product Portfolio

- 11.4.4 Business Strategy

- 11.4.5 Recent Developments

- 11.5 Atlassian Corporation

- 11.5.1 Overview

- 11.5.2 Financials

- 11.5.3 Product Portfolio

- 11.5.4 Business Strategy

- 11.5.5 Recent Developments

- 11.6 Microsoft Corporation (Project Online)

- 11.6.1 Overview

- 11.6.2 Financials

- 11.6.3 Product Portfolio

- 11.6.4 Business Strategy

- 11.6.5 Recent Developments

- 11.7 Oracle Corporation (Primavera)

- 11.7.1 Overview

- 11.7.2 Financials

- 11.7.3 Product Portfolio

- 11.7.4 Business Strategy

- 11.7.5 Recent Developments

- 11.8 Planisware

- 11.8.1 Overview

- 11.8.2 Financials

- 11.8.3 Product Portfolio

- 11.8.4 Business Strategy

- 11.8.5 Recent Developments

- 11.9 Workfront (Adobe Inc.)

- 11.9.1 Overview

- 11.9.2 Financials

- 11.9.3 Product Portfolio

- 11.9.4 Business Strategy

- 11.9.5 Recent Developments

- 11.10 Changepoint (Daptiv)

- 11.10.1 Overview

- 11.10.2 Financials

- 11.10.3 Product Portfolio

- 11.10.4 Business Strategy

- 11.10.5 Recent Developments

- 11.11 Celoxis

- 11.11.1 Overview

- 11.11.2 Financials

- 11.11.3 Product Portfolio

- 11.11.4 Business Strategy

- 11.11.5 Recent Developments

- 11.12 Sciforma

- 11.12.1 Overview

- 11.12.2 Financials

- 11.12.3 Product Portfolio

- 11.12.4 Business Strategy

- 11.12.5 Recent Developments

- 11.13 Others.

- 11.13.1 Overview

- 11.13.2 Financials

- 11.13.3 Product Portfolio

- 11.13.4 Business Strategy

- 11.13.5 Recent Developments

- 11.1 Planview Inc.

List Of Figures

Figures No 1 to 47

List Of Tables

Tables No 1 to 127

Prominent Player

- Planview Inc.

- Clarity (Broadcom Inc.)

- ServiceNow Inc.

- Anaplan Inc.

- Atlassian Corporation

- Microsoft Corporation (Project Online)

- Oracle Corporation (Primavera)

- Planisware

- Workfront (Adobe Inc.)

- Changepoint (Daptiv)

- Celoxis

- Sciforma

- Others

FAQs

The key players in the market are Planview, Inc., Clarity (Broadcom Inc.), ServiceNow Inc., Anaplan Inc., Atlassian Corporation, Microsoft Corporation (Project Online), Oracle Corporation (Primavera), Planisware, Workfront (Adobe Inc.), Changepoint (Daptiv), Celoxis, Sciforma, Others.

According to current market analysis, it is expected that the market will hit the USD 16.34 billion mark by 2035 with a healthy growth rate of 9.7% over the period 2026 to 2035 as the complexity of the continually increasing digital transformation demands coordinated portfolio management, integration of AI and machine learning enabling predictive analytics and automated optimization, adoption of agile and hybrid methodology necessitating platforms that support the multipolar project approaches, more frequent portfolio intelligence in place of periodic reporting cycles, and increased executive awareness of portfolio management as a critical capability.

Based on current analysis, the market is projected to reach approximately USD 16.34 billion by 2035, witnessing robust growth driven by continued digital transformation complexity requiring coordinated portfolio management, AI and machine learning integration enabling predictive analytics and automated optimization, agile and hybrid methodology adoption requiring platforms supporting diverse project approaches, real-time portfolio intelligence replacing periodic reporting cycles, integrated resource capacity planning optimizing scarce skilled personnel across competing initiatives, and growing executive recognition that portfolio management is critical for strategy execution with 76% of C-suite leaders considering it essential capability, at a CAGR of 9.7% from 2026 to 2035.

North America will have the largest market share of revenue, about 42% of the worldwide market share because of the high level of project management maturity with institutionalized PMO practice and professional standards, concentration of the world largest number of fortune 500 and fortune 1000 companies with complex multi-billion-dollar strategic portfolios, leadership in technology with Silicon Valley and major tech hubs spearheading platform development, more than 600,000 PMP-certified professionals who can offer talent pool to complex portfolio management, a huge investment in digital transformation with fortune.

Asia-Pacific Region has the highest growth with a forecasted CAGR of 12.3% by 2026 to 2035 due to rapid economic growth which has provided increasing levels of corporate sectors managing growing project portfolios, due to accelerated digital transformation with rising numbers of enterprises and governments investing heavily in technology modernization, with a massive technology sector and digital government initiatives, and growing adoption of professional project management practices as regional organizations are maturing to no longer use ad-hoc approaches to project management but rather systematic portfolio management strategies.

Global Strategic Portfolio Management Market is also projected to grow significantly as the acceleration of digital transformation is expected to see enterprises investing USD 1.3 trillion in strategic initiatives per year, 73% of organizations managing 20-100 simultaneous strategic initiatives creating more complexity than ever, low project success rates are being driven by poor execution on projects with only 35% executing projects on time and on budget, opportunity to create better portfolio value is being offered at 18-25% through intelligent prioritization and resource allocation, and 85% of executive teams spending less than.