Thin-film Electrode Market Size, Trends and Insights By Material (Metal-Based, Gold, Platinum, Silver, Titanium, Other Metals, Boron-Doped Diamond-Based, Carbon-Based, Graphene, Carbon Nanotubes, Glassy Carbon, Polymer-Based, Other Materials), By Manufacturing Facility (Physical Vapor Deposition (PVD), Sputtering, Evaporation, Pulsed Laser Deposition, Chemical Vapor Deposition (CVD), Plasma-Enhanced CVD, Atomic Layer Deposition, Sputtering, Electrochemical Deposition/Electroplating, Other Manufacturing Technology), By End-Use Industry (Healthcare & Biotechnology, Medical Devices, Biosensors, Diagnostic Equipment, Electronics & Semiconductor, Consumer Electronics, IoT Devices, Wearables, Energy & Power, Batteries, Fuel Cells, Solar Cells, Chemical & Petrochemical, Other End-Use Industries), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | North American |

| Largest Market: | Asia Pacific |

Major Players

- BASi Research Products Inc.

- MicruX Technologies

- Merck KGaA

- Flex Medical Solutions Ltd.

- Others

Reports Description

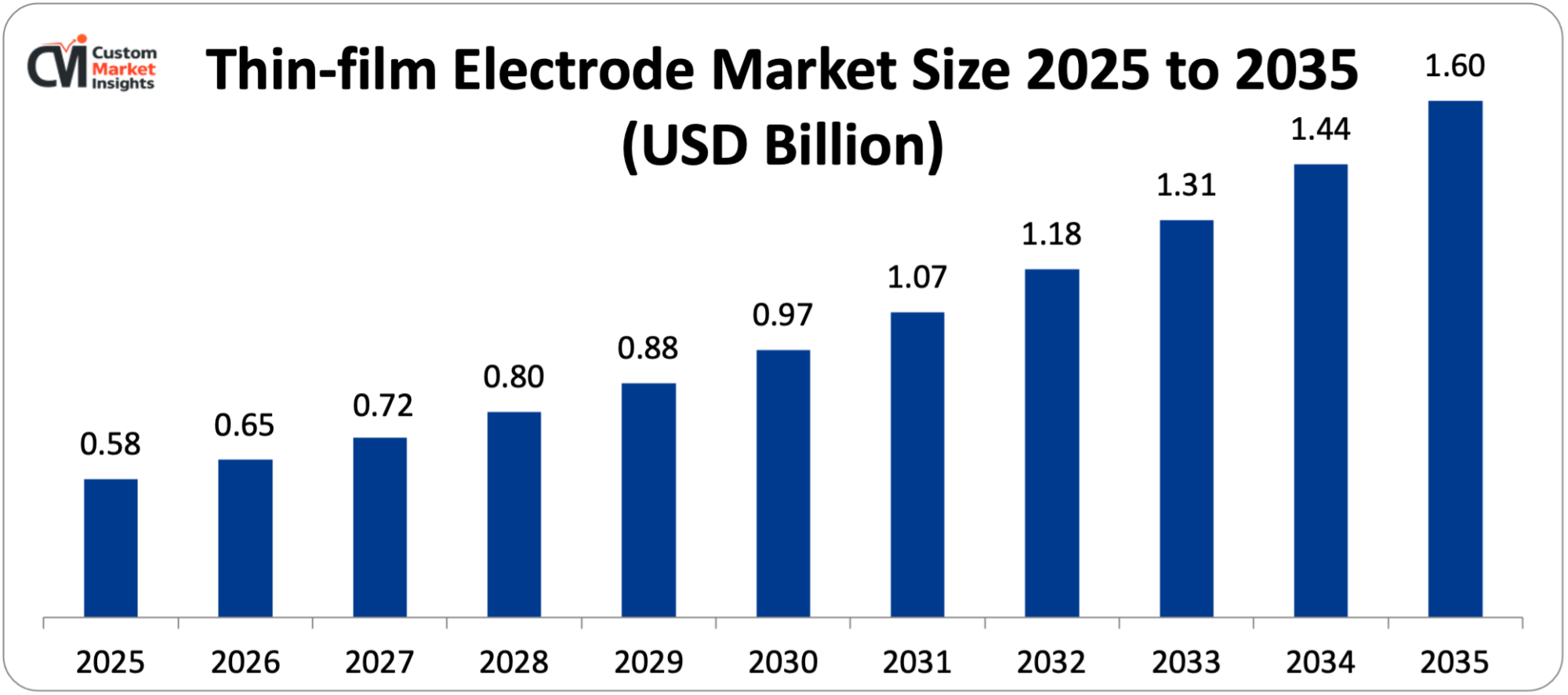

The market size of thin-film electrodes is estimated to be USD 584.6 million in 2025 and it is anticipated to grow by USD 652.7 million in 2026 up to about USD 1,595.3 million by 2035 at 11.8% CAGR per 2026-2035. The market growth is determined by increasing demand for miniaturized electronic products, increasing use of wearable and flexible products, increased focus on renewable energy and energy storage technology and development of deposition technology that is more precise.

Market Highlight

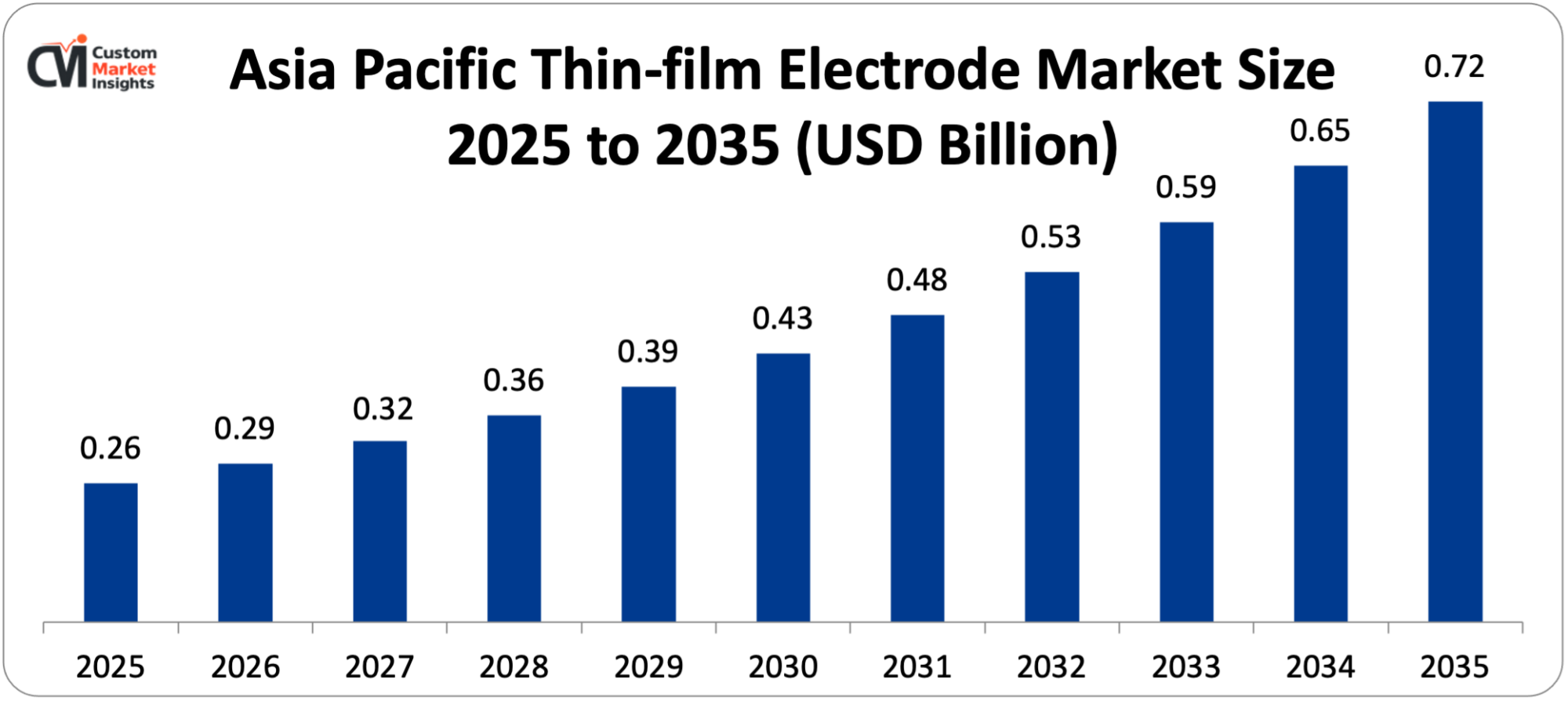

- Asia Pacific Asia-Pacific dominated the market that reached a 45% market share in 2025 in the thin-film electrode market.

- North America is projected to grow at a robust CAGR of 10.2% in the period of 2026 to 2035.

- By material, the section of the thin-film electrodes that is based on overlays of metal in 2025 had won over 52% of the market share.

- At the facility level, the physical vapor deposition segment is leading with a share of 58% in 2025 and the sputtering segment is expected to have the best CAGR of 12.4 in the period of 2026 to 2035.

- By end-use industry, the electronics and semiconductor segment is the one that would contribute the largest market share of 46% in 2025, and the healthcare and biotechnology segment is set to grow at a CAGR of 13.2% across the prognosticated period of 2026 to 2035.

- By application, the energy storage segment has been growing at a rapid rate of 12.7% CAGR due to the use of solid-state batteries.

Thin-film Electrode Market Trends – Significant Growth Factors

The Thin-film Electrode Market Trends present significant growth opportunities due to several factors:

- Explosive Growth of IoT and Wearable Device Ecosystem: The main force behind the thin-film electrode market is the growing number of Internet of Things devices and wearable technologies being developed all over the world, which generate an unprecedented demand for miniaturized high-performance power sources, as well as sensing electrodes. Industry analysis in 2025 suggests that in 2025 global connected IoT devices may be 30.91 billion and with forecasts of over 40 billion live endpoints by 2025, continued demand will be found in the creation of compact, solderable, and long-life power solutions where typical coin cell technology has failed but where thin-film solid-state battery technology thrives. The wearable biosensors industry alone is forecasted to reach USD 72.579 billion in 2025 and USD 167.81 billion by 2034 and increasing at a rate of CAGR 9.76%, with more than half of all healthcare practitioners favoring real-time patient data via wearable biosensor devices. It was found that the wearable technology market will have been USD 86.92 billion in the year 2025, and it will be USD 330.81 billion by the year 2035, with the CAGR reinforcing at 14.3% in the years 2026-2035. The proliferation of connected devices such as smartwatches, fitness trackers, medical implants, smart contact lenses and invisible wearables demands small power sources that are light and can sustain their performance over a long operational duration. With vacuum deposition methods like physical vapor deposition, thin-film electrodes allow binder-free architectures, offering better energy density, better cycling stability and lower internal resistance in contrast to the more traditional slurry-based electrodes. The consumption pattern implies that the market has now transitioned beyond the science project stage and into the high-volume industrial demand with global consumption of high-purity sputtering targets increasing to 48200 metric tons in 2024 as the level of upstream intelligence manufacturing activity in support of thin-film electrode manufacturing activity. The medical implant applications segment, which is highly dependent on thin-film technology in the manufacture of implants, is estimated to hit USD 0.97 billion in 2030, with medical battery applications having over 60.5% market share dominance in the advanced market segment. There is a specific and urgent need for batteries that operate with high current pulses, and thin-film types of batteries have shown discharge rates of 12.5 C and can be used in the transmission of data amongst related devices.

- Performance Breakthroughs and Manufacturing Scale-Up: The market has been increasing at a very high pace as a result of radical performance and industrialization of the thin-film electrode manufacturing capability. Innovations encompass the realisation of record-breaking energy densities with TDK Corporation showing the realisation of materials delivering 1,000 Wh/L volumetric energy density in 2024, commercial products such as the Gen4 solid-state battery by Blue Solutions achieving 900 Wh/L volumetric density and 450 Wh/kg gravimetric density, micro-storage with Ensurge shipping 11-layer cell designs with 200 Wh/L density in January 2025, and research advances with Chinese scientists reporting these data substantiate the fact that binder-free deposition is better in terms of energy retention than conventional porous electrodes. Meanwhile, the cycle life durability is also getting better and a prototype by Harvard/Adden Energy can have 6,000 cycles and maintain 80% capacity in early 2024. Both high density and exceedingly long service life make thin-film electrodes the ultimate choice to use in the next generation of power usage. Industrial scaling has now become the greatest trend that determines the direction of the market, and there has been a fierce move by the manufacturers to go beyond the prototype stages to achieve high volume throughput. Ensure Micropower has a firm goal of 150000 units of solid-state microbatteries by Q4 2025, and Enovix is adding up to 4 production line layouts in Fab 2 of Malaysia, which is expected to reach 9.5-10 million units annually when fully loaded. The maturing infrastructure supply chain is confirmed by Global infrastructure commitments. Blue Solutions has confirmed a colossal increase in May 2024 to 25 GWh/annum production capacity at its Alsace gigafactory, which is capable of serving around 250,000 vehicles annually. Applications in medical technology are high-value growth opportunities, and Ilika has triggered a manufacturing milestone in August 2025 with Cirtec Medical, which will become their partner over 10 years, where they have a 300 microAh capacity Stereax M300 microbattery, specifically designed to operate in long-term implantation. Smart cameras are on the rise and NTU smart contact lens batteries are capable of producing 45 microamperes of current and 201 microwatts of the greatest power output that is needed to produce continuous and non-invasive health monitoring.

What are the Major Advances Changing the Thin-film Electrode Market Today

- Solid-State Battery Technology and Binder-Free Architecture: The most significant technological innovation is the creation of solid-state thin-film battery, which allow previously inaccessible power densities at microscopic dimensions on the scale of factors. Thin-film electrodes are also processed by vacuum deposition methods such as physical vapor deposition, chemical vapor deposition and sputtering to form very fine layers of active material on foil, in contrast to traditional versions using foil and a slurry of active material, binders, and conductive additives applied on the foil. This binder-free design gets rid of dormant components, drives volumetric power density to the utmost, allows stable electrode-electrolyte interfaces vital in solid-state ionic conduction, and permits microfabrication so that it can be combined with semiconductor technologies. Solid-state designs avoid liquid electrolyte flammability factors and allow operating over a wider range of temperatures between -40°C and +85°C than can be achieved with liquid electrolytes and can allow ultrathin profiles of micrometers instead of millimeters. Real-world applications present feasible benefits, and products have passed more than 1,000 charge-discharge cycles without structural damage and capacity loss that typical miniature batteries cannot sustain.

- Advanced Deposition Technologies and Multilayer Stacking: The new technology of vacuum deposition has transformed the process of thin-film electrode preparation. The market is composed of 58% of physical vapor deposition (PVD). It employs the process of sputtering where energetic ions are directed to a target to remove atoms that are attached to a substrate, and evaporation where materials are heated in the absence of a vacuum until they become vapor and condense into thin layers. New PVD devices can test numerous targets simultaneously to form complicated multilayer designs. They also possess in-situ monitoring enabling the thickness to be within one nanometer and can be run as high-speed roll-to-roll processes of flexible substrates. Another option can be obtained with chemical vapor deposition (CVD). It employs gas reactions on precursor gases to construct conformal coats on shapes of complexity, and this is particularly helpful with 3-D microstructures. Multilayer stacking designs boost the density of the energy and the size is kept small. Ensure is switching to a 43-layer design with 11 layers in the design demonstrating that increasing layers in the design can increase capacity without significantly increasing the device size. These manufacturing advances enable thin-film electrodes optimized for diverse applications from implantable medical devices requiring biocompatibility to harsh-environment industrial sensors demanding extended operating temperature ranges The development of sophisticated vacuum deposition technologies has transformed the production of thin-film electrode materials, making it possible to control the composition, the thickness and the interface properties of electrode materials on an atomic level. The physical vapor deposition has the highest market share at 58% with the processes that are used such as sputtering whereby the energetic ions bombard target materials and these atoms are ejected onto substrates, as well as evaporation whereby the materials are vaporized under vacuum and condensed as thin films. PVD systems today employ multiple-target designs that allow complex multilayer structures, on-site monitoring at the molecular level to ensure tight thickness control of the process to less than single nanometers and roll-to-roll processing of flexible substrates. Alternative methods are offered by chemical vapor deposition by reaction of precursor gases to make conformal coatings around topographical features of complex surfaces, especially useful to three-dimensional microstructures. A sophisticated CVD technique, atomic layer deposition, is deposited in one atomic layer with greater uniformity than ever before. Multilayer stacking designs achieve the highest possible energy density in smaller volumes, and the development of Ensurge in 11-layer to planned 43-layer designs shows the ability of each additional stack layer to add capacity without correspondingly raising area. These new manufacturing capabilities allow thin-film electrodes to be optimized for various different applications such as implantable medical devices which need the electrode to be biocompatible, and industrial sensors with very high operating temperatures that need to be industrial.

- Medical Implant and Bioelectronic Applications: The inclusion of thin-film electrodes in implantable medical devices and bioelectronic interfaces is a high-value application segment that is currently growing at a rapid pace due to the need for a thin-film technology to achieve unique performance capabilities. Pacemakers, neurostimulators, cochlear implants, and drug delivery pumps are some of the examples of implantable medical devices that need power sources that can work without failure over the years or decades in the human body. The thin-film solid-state batteries offer hermetically sealed designs that do not leak electrolytes, biocompatible materials that can be used in contact with the tissues, small footprints that can be implanted in anatomically tight spaces, and consistent discharge properties that provide predictable stability of their devices. The Stereax M300 microbattery represents an example of implantable power systems that are specialised, with the capacity to deliver 300 microAh in a package with a direct interface to implantable electronics. Smart contact lens applications are taking miniaturization to its limits, as thin-film batteries are producing enough power (45 microamperes, 201 microwatts) to power up built-in sensors and wireless communication without being felt or noticed in terms of thickness or weight. The market analysis shows that the implantable devices dominate the market share of 60.5% of the entire medical battery in the country and the financial projections suggest that this segment will grow to USD 0.97 billion in 2030. Next-generation bioelectronic medicine such as neural interfaces to record brain activity, electroceuticals to deliver therapeutic effects of specified electrical stimulation, and closed-loop systems with sensing and actuation to manage a disease autonomously is also facilitated by thin-film electrodes.

- Flexible and Wearable Electronics Integration: Due to the development of flexible thin-film electrodes on polymer substrates, conformable electronic systems that can flex (and reflex) can be made, and they can be embedded directly into textiles and accessories. Elastic substrate materials such as polyethylene terephthalate (PET), polyimide and elastomers can be used to deposit functional thin-film layers and be mechanically flexible enough to be used in wearables. Flexible electronics electronic skin patches that track vital signs, smart fabrics that place sensors all over clothing, and conformal battery packs that are pieces that wrap around devices or the bodies of a person are all powered by thin-film electrodes on flexible substrates. The future of stretchable thin-film electrodes is in development, and materials engineering has been used to provide electrodes that can maintain electrically active behavior when subjected to tensile strain to tensile elongation of 30%. These flexible systems have dedicated architectures such as serpentine metal interconnects that are unfolded under strain, island-bridge architectures in which rigid building blocks connect through stretchable interconnections, and materials that are intrinsically stretchable with electrical properties preserved during deformation. The Wearable applications are creating an innovation in the charging interface, as some systems based on thin-film integration include wireless charging features, which would remove connectors that are incompatible with waterproof and airtight wearable housings.

Category Wise Insights

By Material

Why Metal-Based Electrodes Lead the Market?

The biggest part, which is around 52% of the total market share, will be in 2025 metal-based thin-film electrodes. This is due to the fact that metals are better in terms of conducting electricity, stability, and mechanical integrity which makes them the best when it comes to high-performance electrochemical systems in a wide application. The gold, platinum, silver and titanium are the most commonly used metals in the fabrication of the electrodes of thin films due to their high electron transfer ability which is vital in electrochemical reactions, corrosion resistance to work in harsh chemical environment, biocompatibility to be used in medical and biosensor fabrication and ease of production using well-developed sputtering and evaporation methods. Gold electrodes are the most chemically inert and electrochemically stable and therefore most useful in biosensor applications, platinum provides the best catalytic performance needed in fuel cell and electrochemical sensor applications, silver has the highest electrical conductivity of all the metals and is less expensive than gold or platinum, and titanium has biocompatibility and corrosion resistance that are useful in medical implants.

Metal thin-film electrodes offer good signal quality and low impedance that is important in sensitive measurements in healthcare diagnostics and environmental monitoring. The deposition methods that have long been developed to produce metallic thin films allow reproducible large-scale production, and sputtering methods have demonstrated the ability to produce thicknesses in the range of single nanometers and have good adhesion to a wide variety of substrate materials. In multilayer devices, metal electrodes are used as underplates in the intricate structures, which can conduct conduction channels of active substances to external circuits. Metal thin films are used in battery applications as current collectors, lithium metal as a solid-state anode and protective layers against degradation. The adaptability of metallic thin-film electrodes in a variety of applications such as biosensors that detect the presence of particular biomolecules, microelectronics that offer interconnects and contact pads, storage devices that utilize the property of an active battery component, and electrochemical reactors that allow regulated chemical reactions all maintain leadership on the market.

Thin-film carbon-based electrodes represent an emerging area that is subject to strong growth due to combinations of several attractive characteristics such as large electrochemical potential ranges, low background currents leading to high signal-to-noise, chemical inertness, and possibly low costs versus precious metals. Graphene thin films are particularly good conductors, strong and have a great surface area per unit mass, allowing them to be utilized in supercapacitor electrodes and sensing platforms. Carbon nanotube electrodes possess controlled nanostructured surfaces with superior electrochemical characteristics in biosensing. Glassy carbon electrodes provide a well-defined electrochemical behavior, therefore, they can be used as a reference in basic electrochemistry studies.

By Manufacturing Facility

Why Physical Vapor Deposition Dominates Manufacturing?

The biggest manufacturing segment is the physical vapor deposition, which has an estimated 58% of the market share in 2025. This dominance indicates that PVD is more controlled, precise and of higher quality film than any other deposition technique with the process providing the ability to create thin uniform, dense and high adhesion coating needed to operate the electrode in a thin-film application. PVD is a series of related processes such as sputtering in which target materials are blasted with high energy ions to cause the ejection of atoms into substrates, evaporation in which the target materials are heated to vaporization temperatures in vacuum chambers, and the pulsed laser deposition in which target materials are ablated by high-energy laser pulses that form plasma plumes that settle as films onto lower temperature substrates. These processes are run under controlled vacuum conditions which limit the contamination of the atmosphere and give films of high quality, strict control of composition, and repeatable characteristics.

Accuracy of PVD processes is vital in the manufacturing of thin-film electrodes in biosensors where the thickness difference of the film affects device sensitivity, microelectronics where uniform film coating is important in maintaining uniform device behavior, and electrochemical devices where voids in the film create localized degradation accelerating devices. Current PVD systems have enhanced features such as in-situ film thickness control with quartz crystal microbalances or optical interferometry, automated substrate handling in high-throughput mode, multi-target mode to deposit a variety of films without interruptions in the vacuum, and substrate heating or cooling to control film microstructure and stress. Roll-to-roll PVD systems have allowed the continuous processing of flexible substrates that are necessary in high-volume fabrication of flexible electronics and wearable devices.

A subgroup of PVD, sputtering, is the fastest growing, with a forecasted CAGR of 12.4% from 2026 to 2035. The magnetron sputtering conditions involve the application of magnetic fields that confine the electrons around target surfaces which strongly enhance ionization and deposition and lower the heating of the substrates. This allows coating temperature sensitive materials such as polymers used in flexible electronics. In reactive sputtering the reactive gases are introduced in the deposition process allowing the formation of films of compounds with controlled stoichiometry such as metal oxides, nitrides, and carbides. High-power impulse magnetron sputtering (HiPIMS) employs the use of pulsed power which forms highly ionized plasmas that generate extremely dense and smooth films with high quality.

By End-Use Industry

Why Electronics & Semiconductor Dominates Applications?

The largest end-use segment is electronics and semiconductor, which will occupy some 46% of the market share in 2025. This leadership role is based on wide application of precision thin-film electrodes in microelectronic equipment, sensors and integrated circuit systems where size and performance constraints compel their use. Thin-film electrodes have important applications that allow miniaturization, high performance, and energy-efficient electronic devices to be developed such as transistors in which thin-film gate electrodes can be used to control switching behavior, integrated circuits in which multilayer thin-film interconnect scheme can be used to create an integrated circuit, and microelectromechanical systems (MEMS) in which thin-film electrodes can be used as a sensing and actuation element. These electrodes are important to give the necessary electrical paths that are necessary in transmitting of signals and movement of charges in semiconductor devices where uniformity, stability, and conductivity are paramount performance indicators.

Thin-film electrode has been increased due to increasing demands of compact and versatile electronic devices such as smartphones, wearable devices, IoT sensors, and smart home systems. The world of connected IoT devices that are projected to reach 30.91 billion devices by 2025 presents the greatest demand for microscale sources of power and sensor electrodes that will enable such a connected network of systems. The consumer electronics industry is characterized by a high volume, with smartphones alone selling off billions of units per year, each having a high density of thin-film electrode structures in their batteries, display, touch sensors and wireless charging coils. The market development of wearable technology from USD 86.92 billion in 2025 to the forecast USD 330.81 billion in 2035 gives the sustained growth momentum to the thin-film electrodes that allow compact, flexible and long-lasting wearable systems.

The swiftest growth is in the field of healthcare and biotechnology applications with a projected CAGR between 2026 and 2035 of 13.2%, due to increased application of thin-film electrodes in medical diagnostics, implantable devices, and wearable health monitors. Thin-film based biosensors allow point-of-care diagnostics of blood, saliva or other biofluid-specific biomarkers with high sensitivity and selectivity. The market of wearable biosensors estimated to be USD 72.579 billion in 2025 and projected to increase to USD 167.81 billion in 2034 provides a high demand for the thin-film electrode technologies. The medical implants such as pacemakers, neurostimulators, and drug delivery systems need thin-film solid-state batteries that can ensure stable power solutions during the lifetimes of the devices, which are in years or decades. Medical batteries will be USD 0.97 billion by 2030 with the implantable devices taking up 60.5% of the market share. Minimization of thin-film electrodes to microscopic size with Smart contact lenses, neural interfaces and bioelectronic medicine applications drives thin-film electrode miniaturization to its extremes with microscopic dimensions and biocompatibility being essential specifications.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 652.7 million |

| Projected Market Size in 2035 | USD 1,595.3 million |

| Market Size in 2025 | USD 584.6 million |

| CAGR Growth Rate | 11.8% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Material, Manufacturing Facility, End-Use Industry and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Thin-film Electrode Market – Regional Analysis

How Big is the Asia Pacific Market Size?

The Asia Pacific thin-film electrode market size is estimated at USD 263 million in 2025 and is projected to reach approximately USD 717 million by 2035, with a 10.6% CAGR from 2026 to 2035.

Why did Asia Pacific Dominate the Market in 2025?

The most notable actor in the global market is Asia Pacific, as it will control around 45% of the market in the year 2025, due to a well-developed manufacturing ecosystem, high rates of industrialization, and the growth of the electronics and healthcare industries in the Asia Pacific region. Major manufacturers of semiconductors, sensors and electronic materials are based in the area, especially in China, Japan, South Korea and Taiwan which are key centers of thin-film deposition and microfabrication technology. The rising investment in advanced research in material nanotechnology as well as precision manufacturing makes the region stronger in terms of the ability to produce high-quality thin-film electrodes that can be used in various applications. China has a July 2024 policy of medical equipment upgrades, which hastens the purchase of new technologies such as thin-film systems in county-level hospitals, and the country experienced a 29% increase in capital inflow to diagnostic innovation in 2024.

China Market Trends

China has the rapidly growing market as a result of government investment in self-sufficiency in semiconductor manufacturing, mass production of electronics for the global consumer markets, an electric vehicle industry growing fast that needs a high level of battery technologies, and the creation of local thin-film deposition equipments, which makes it less dependent on foreign technology. The development of the Internet of Things ecosystem in China motivates the need for miniaturized power and sensor electrodes, and the location of the country as a world manufacturing superpower guarantees the continuation of the consumption of thin-film electrodes.

Why is North America Experiencing Strong Growth?

North America is in good growth with a predicted CAGR of 10.2% between the years 2026 and 2035 due to the vigorous medical device development, excellent semiconductor research and development, and the early utilization of wearable health technologies. The strengths of the region are the concentration of the leading medical device companies in the development of implantable and wearable devices, the large investment of venture capital in battery and biosensor startups, advanced university research programs in the development of new thin-film materials and applications, and the regulatory environment in the FDA that allows the development of new medical technologies. Specialized medical battery segment which is expected to attain USD 0.97 billion in 2030 has a focused demand among the North American healthcare systems.

What is the Size of the U.S. Market?

The market size of U.S. thin-film electrodes is estimated at USD 187 million in 2025, and the market size will be close to USD 428 million in 2035, with a robust CAGR of 9.8% between 2026 and 2035.

U.S. Market Trends

The US market is a major share of the global market due to its dominance in medical technology innovation, high semiconductor fabrication capacity, high defense and aerospace government expenditures in support of specialized electronics applications, and entrepreneurial ecosystem in support of thin-film battery and sensor startups. The fact that Ensure Micropower has been able to engage 120 commercial opportunities by August 2025 is an indication that downstream OEMs are aggressively pursuing thin-film components in an attempt to differentiate the next-generation products.

Why is Europe Focusing on Sustainable Energy Applications?

The European market is large, with developed research abilities, a high focus on renewable energy and green concerns, and a developed medical equipment business. Europe has considerable market share all over the world with Germany, UK and France accounting for substantial users. This is shown by the enormous scale of the expansion planned by Blue Solutions that aimed at the 25 GWh/year production capacity of its Alsace gigafactory, which would supply battery power to about 250,000 vehicles annually, with European confidence in the solid-state industrialization of battery technology based on thin-film electrode technology.

Germany Market Trends

Germany is home to a large market owing to the well-developed automotive market that has adopted electric cars, the high level of research in the field of chemistry and materials science, and accurate manufacturing as well as the focus on producing high quality products. German firms are undertaking the development of thin-film solid-state battery technology to be used in automobiles that require safety and energy density to be very demanding.

Why is the Middle East & Africa Region Developing Capabilities?

The LAMEA region demonstrates the developing trends in the markets where some countries are increasing the level of adoption due to the growth of the electronics manufacturing sector, increasing the level of healthcare infrastructure investment, and the emergence of the renewable energy projects. The market share is currently small, but the enhanced industrial potential and increased use of technologies contribute to the gradual rise of the market share.

Top Players in the Market and Their Offerings

- BASi Research Products Inc.

- MicruX Technologies

- Merck KGaA

- Flex Medical Solutions Ltd.

- PalmSens

- MSE Supplies LLC

- Metrohm DropSens

- First Solar Inc.

- Hanergy Thin Film Power Group Ltd.

- Applied Materials Inc.

- Others

Market News- Key Developments

The market has undergone significant developments as industry participants seek to expand capabilities and enhance product portfolios.

- In June 2025: Linxens and FlexMedical Solutions partnered to develop and deliver ready-to-use functionalized electrodes designed for next-generation biosensor applications, combining Linxens’ expertise in miniaturized connectivity solutions with FlexMedical Solutions’ advanced thin-film electrode technologies for medical diagnostics. (Source: Linxens)

- In March 2025: MicruX announced the expansion of its screen-printed dual electrode (D2PE) lineup, now offered in gold alongside high-performance carbon versions, with advanced design and fabrication on flexible, high-resistivity PET substrates providing enhanced durability and exceptional performance. (Source: MicruX Technologies)

These strategic activities have allowed companies to strengthen market positions, expand product offerings, and capitalize on growth opportunities within the expanding market.

The Thin-film Electrode Market is segmented as follows:

By Material

- Metal-Based

- Gold

- Platinum

- Silver

- Titanium

- Other Metals

- Boron-Doped Diamond-Based

- Carbon-Based

- Graphene

- Carbon Nanotubes

- Glassy Carbon

- Polymer-Based

- Other Materials

By Manufacturing Facility

- Physical Vapor Deposition (PVD)

- Sputtering

- Evaporation

- Pulsed Laser Deposition

- Chemical Vapor Deposition (CVD)

- Plasma-Enhanced CVD

- Atomic Layer Deposition

- Sputtering

- Electrochemical Deposition/Electroplating

- Other Manufacturing Technology

By End-Use Industry

- Healthcare & Biotechnology

- Medical Devices

- Biosensors

- Diagnostic Equipment

- Electronics & Semiconductor

- Consumer Electronics

- IoT Devices

- Wearables

- Energy & Power

- Batteries

- Fuel Cells

- Solar Cells

- Chemical & Petrochemical

- Other End-Use Industries

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Thin-film Electrode Market, (2026 – 2035) (USD Million)

- 2.2 Global Thin-film Electrode Market: snapshot

- Chapter 3. Global Thin-film Electrode Market – Industry Analysis

- 3.1 Thin-film Electrode Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Explosive Growth of IoT and Wearable Device Ecosystem

- 3.2.2 Performance Breakthroughs and Manufacturing Scale-Up

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Material

- 3.7.2 Market attractiveness analysis By Manufacturing Facility

- 3.7.3 Market attractiveness analysis By End-Use Industry

- Chapter 4. Global Thin-film Electrode Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Thin-film Electrode Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Thin-film Electrode Market – Material Analysis

- 5.1 Global Thin-film Electrode Market overview: By Material

- 5.1.1 Global Thin-film Electrode Market share, By Material, 2025 and 2035

- 5.2 Metal-Based

- 5.2.1 Global Thin-film Electrode Market by Metal-Based, 2026 – 2035 (USD Million)

- 5.3 Gold

- 5.3.1 Global Thin-film Electrode Market by Gold, 2026 – 2035 (USD Million)

- 5.4 Platinum

- 5.4.1 Global Thin-film Electrode Market by Platinum, 2026 – 2035 (USD Million)

- 5.5 Silver

- 5.5.1 Global Thin-film Electrode Market by Silver, 2026 – 2035 (USD Million)

- 5.6 Titanium

- 5.6.1 Global Thin-film Electrode Market by Titanium, 2026 – 2035 (USD Million)

- 5.7 Other Metals

- 5.7.1 Global Thin-film Electrode Market by Other Metals, 2026 – 2035 (USD Million)

- 5.8 Boron-Doped Diamond-Based

- 5.8.1 Global Thin-film Electrode Market by Boron-Doped Diamond-Based, 2026 – 2035 (USD Million)

- 5.9 Carbon-Based

- 5.9.1 Global Thin-film Electrode Market by Carbon-Based, 2026 – 2035 (USD Million)

- 5.10 Graphene

- 5.10.1 Global Thin-film Electrode Market by Graphene, 2026 – 2035 (USD Million)

- 5.11 Carbon Nanotubes

- 5.11.1 Global Thin-film Electrode Market by Carbon Nanotubes, 2026 – 2035 (USD Million)

- 5.12 Glassy Carbon

- 5.12.1 Global Thin-film Electrode Market by Glassy Carbon, 2026 – 2035 (USD Million)

- 5.13 Polymer-Based

- 5.13.1 Global Thin-film Electrode Market by Polymer-Based, 2026 – 2035 (USD Million)

- 5.14 Other Materials

- 5.14.1 Global Thin-film Electrode Market by Other Materials, 2026 – 2035 (USD Million)

- 5.1 Global Thin-film Electrode Market overview: By Material

- Chapter 6. Global Thin-film Electrode Market – Manufacturing Facility Analysis

- 6.1 Global Thin-film Electrode Market overview: By Manufacturing Facility

- 6.1.1 Global Thin-film Electrode Market share, By Manufacturing Facility, 2025 and 2035

- 6.2 Physical Vapor Deposition (PVD)

- 6.2.1 Global Thin-film Electrode Market by Physical Vapor Deposition (PVD), 2026 – 2035 (USD Million)

- 6.3 Sputtering

- 6.3.1 Global Thin-film Electrode Market by Sputtering, 2026 – 2035 (USD Million)

- 6.4 Evaporation

- 6.4.1 Global Thin-film Electrode Market by Evaporation, 2026 – 2035 (USD Million)

- 6.5 Pulsed Laser Deposition

- 6.5.1 Global Thin-film Electrode Market by Pulsed Laser Deposition, 2026 – 2035 (USD Million)

- 6.6 Chemical Vapor Deposition (CVD)

- 6.6.1 Global Thin-film Electrode Market by Chemical Vapor Deposition (CVD), 2026 – 2035 (USD Million)

- 6.7 Plasma-Enhanced CVD

- 6.7.1 Global Thin-film Electrode Market by Plasma-Enhanced CVD, 2026 – 2035 (USD Million)

- 6.8 Atomic Layer Deposition

- 6.8.1 Global Thin-film Electrode Market by Atomic Layer Deposition, 2026 – 2035 (USD Million)

- 6.9 Sputtering

- 6.9.1 Global Thin-film Electrode Market by Sputtering, 2026 – 2035 (USD Million)

- 6.10 Electrochemical Deposition/Electroplating

- 6.10.1 Global Thin-film Electrode Market by Electrochemical Deposition/Electroplating, 2026 – 2035 (USD Million)

- 6.11 Other Manufacturing Technology

- 6.11.1 Global Thin-film Electrode Market by Other Manufacturing Technology, 2026 – 2035 (USD Million)

- 6.1 Global Thin-film Electrode Market overview: By Manufacturing Facility

- Chapter 7. Global Thin-film Electrode Market – End-Use Industry Analysis

- 7.1 Global Thin-film Electrode Market overview: By End-Use Industry

- 7.1.1 Global Thin-film Electrode Market share, By End-Use Industry, 2025 and 2035

- 7.2 Healthcare & Biotechnology

- 7.2.1 Global Thin-film Electrode Market by Healthcare & Biotechnology, 2026 – 2035 (USD Million)

- 7.3 Medical Devices

- 7.3.1 Global Thin-film Electrode Market by Medical Devices, 2026 – 2035 (USD Million)

- 7.4 Biosensors

- 7.4.1 Global Thin-film Electrode Market by Biosensors, 2026 – 2035 (USD Million)

- 7.5 Diagnostic Equipment

- 7.5.1 Global Thin-film Electrode Market by Diagnostic Equipment, 2026 – 2035 (USD Million)

- 7.6 Electronics & Semiconductor

- 7.6.1 Global Thin-film Electrode Market by Electronics & Semiconductor, 2026 – 2035 (USD Million)

- 7.7 Consumer Electronics

- 7.7.1 Global Thin-film Electrode Market by Consumer Electronics, 2026 – 2035 (USD Million)

- 7.8 IoT Devices

- 7.8.1 Global Thin-film Electrode Market by IoT Devices, 2026 – 2035 (USD Million)

- 7.9 Wearables

- 7.9.1 Global Thin-film Electrode Market by Wearables, 2026 – 2035 (USD Million)

- 7.10 Energy & Power

- 7.10.1 Global Thin-film Electrode Market by Energy & Power, 2026 – 2035 (USD Million)

- 7.11 Batteries

- 7.11.1 Global Thin-film Electrode Market by Batteries, 2026 – 2035 (USD Million)

- 7.12 Fuel Cells

- 7.12.1 Global Thin-film Electrode Market by Fuel Cells, 2026 – 2035 (USD Million)

- 7.13 Solar Cells

- 7.13.1 Global Thin-film Electrode Market by Solar Cells, 2026 – 2035 (USD Million)

- 7.14 Chemical & Petrochemical

- 7.14.1 Global Thin-film Electrode Market by Chemical & Petrochemical, 2026 – 2035 (USD Million)

- 7.15 Other End-Use Industries

- 7.15.1 Global Thin-film Electrode Market by Other End-Use Industries, 2026 – 2035 (USD Million)

- 7.1 Global Thin-film Electrode Market overview: By End-Use Industry

- Chapter 8. Thin-film Electrode Market – Regional Analysis

- 8.1 Global Thin-film Electrode Market Regional Overview

- 8.2 Global Thin-film Electrode Market Share, by Region, 2025 & 2035 (USD Million)

- 8.3. North America

- 8.3.1 North America Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.3.1.1 North America Thin-film Electrode Market, by Country, 2026 – 2035 (USD Million)

- 8.3.1 North America Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.4 North America Thin-film Electrode Market, by Material, 2026 – 2035

- 8.4.1 North America Thin-film Electrode Market, by Material, 2026 – 2035 (USD Million)

- 8.5 North America Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035

- 8.5.1 North America Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035 (USD Million)

- 8.6 North America Thin-film Electrode Market, by End-Use Industry, 2026 – 2035

- 8.6.1 North America Thin-film Electrode Market, by End-Use Industry, 2026 – 2035 (USD Million)

- 8.7. Europe

- 8.7.1 Europe Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.7.1.1 Europe Thin-film Electrode Market, by Country, 2026 – 2035 (USD Million)

- 8.7.1 Europe Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.8 Europe Thin-film Electrode Market, by Material, 2026 – 2035

- 8.8.1 Europe Thin-film Electrode Market, by Material, 2026 – 2035 (USD Million)

- 8.9 Europe Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035

- 8.9.1 Europe Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035 (USD Million)

- 8.10 Europe Thin-film Electrode Market, by End-Use Industry, 2026 – 2035

- 8.10.1 Europe Thin-film Electrode Market, by End-Use Industry, 2026 – 2035 (USD Million)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.11.1.1 Asia Pacific Thin-film Electrode Market, by Country, 2026 – 2035 (USD Million)

- 8.11.1 Asia Pacific Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.12 Asia Pacific Thin-film Electrode Market, by Material, 2026 – 2035

- 8.12.1 Asia Pacific Thin-film Electrode Market, by Material, 2026 – 2035 (USD Million)

- 8.13 Asia Pacific Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035

- 8.13.1 Asia Pacific Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035 (USD Million)

- 8.14 Asia Pacific Thin-film Electrode Market, by End-Use Industry, 2026 – 2035

- 8.14.1 Asia Pacific Thin-film Electrode Market, by End-Use Industry, 2026 – 2035 (USD Million)

- 8.15. Latin America

- 8.15.1 Latin America Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.15.1.1 Latin America Thin-film Electrode Market, by Country, 2026 – 2035 (USD Million)

- 8.15.1 Latin America Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.16 Latin America Thin-film Electrode Market, by Material, 2026 – 2035

- 8.16.1 Latin America Thin-film Electrode Market, by Material, 2026 – 2035 (USD Million)

- 8.17 Latin America Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035

- 8.17.1 Latin America Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035 (USD Million)

- 8.18 Latin America Thin-film Electrode Market, by End-Use Industry, 2026 – 2035

- 8.18.1 Latin America Thin-film Electrode Market, by End-Use Industry, 2026 – 2035 (USD Million)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.19.1.1 The Middle-East and Africa Thin-film Electrode Market, by Country, 2026 – 2035 (USD Million)

- 8.19.1 The Middle-East and Africa Thin-film Electrode Market, 2026 – 2035 (USD Million)

- 8.20 The Middle-East and Africa Thin-film Electrode Market, by Material, 2026 – 2035

- 8.20.1 The Middle-East and Africa Thin-film Electrode Market, by Material, 2026 – 2035 (USD Million)

- 8.21 The Middle-East and Africa Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035

- 8.21.1 The Middle-East and Africa Thin-film Electrode Market, by Manufacturing Facility, 2026 – 2035 (USD Million)

- 8.22 The Middle-East and Africa Thin-film Electrode Market, by End-Use Industry, 2026 – 2035

- 8.22.1 The Middle-East and Africa Thin-film Electrode Market, by End-Use Industry, 2026 – 2035 (USD Million)

- Chapter 9. Company Profiles

- 9.1 BASi Research Products Inc.

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 MicruX Technologies

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 Merck KGaA

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 Flex Medical Solutions Ltd.

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 PalmSens

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 MSE Supplies LLC

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Metrohm DropSens

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 First Solar Inc.

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 Hanergy Thin Film Power Group Ltd.

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 Applied Materials Inc.

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 Others.

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.1 BASi Research Products Inc.

List Of Figures

Figures No 1 to 53

List Of Tables

Tables No 1 to 77

Prominent Player

- BASi Research Products Inc.

- MicruX Technologies

- Merck KGaA

- Flex Medical Solutions Ltd.

- PalmSens

- MSE Supplies LLC

- Metrohm DropSens

- First Solar Inc.

- Hanergy Thin Film Power Group Ltd.

- Applied Materials Inc.

- Others

FAQs

The key players in the market are BASi Research Products Inc., MicruX Technologies, Merck KGaA, Flex Medical Solutions Ltd., PalmSens, MSE Supplies LLC, Metrohm DropSens, First Solar Inc., Hanergy Thin Film Power Group Ltd., Applied Materials Inc., Others.

Government regulations play a major notable role in the market with medical device approval (FDA controlled) for implantable power sources and bioelectronic source, government regulations that promote clean energy technologies such as thin-film solar cells, battery technologies such as thermal runaway prevention requirements where solid-state thin-film configurations have inherent safety benefits over liquid electrolyte systems and research funding through government agencies such as DARPA, NIH and others that fund research in thin-film technology as well as the safety standards of the battery industry.

Cost of thin-film electrodes is an obstacle to cost-sensitive applications. The cost of advanced solid-state microbatteries can be USD 2-10 per unit based on capacity and specification and special medical-grade implantable power sources are sold at a premium based on the cost of biocompatibility and regulatory compliance. Nevertheless, various aspects enhance accessibility such as economies of scale due to increased production volumes such as thousands to millions of units as companies such as Enovix forecast annual capacity of 9.5-10 million units, process optimization due to reduced material waste and better yields, competition due to innovation and cost-saving, and proven value proposition through imperfect performance, longer lifetime, and the ability to produce entirely new product categories that would otherwise be impossible with traditional technologies.

According to the existing market analysis, the market is expected to grow at 11.8% between 2026 and 2035 with a market size of about USD 1,595.3 million, with strong growth that will come through the expansion of the IoT ecosystem, the proliferation of wearable technology, solid-state battery commercialization, the use of medical implants, the development of flexible electronics, and the sustained gains in the performance in the area of energy density and cycle life.

Asia Pacific will hold the largest revenue share, with a market share of about 45% of the world market as it has a strong manufacturing ecosystem to serve the global markets in electronics, high rates of industrialization and growth of healthcare systems, industry leaders in semiconductor and sensor production in conjunction with China that is seen to account for a 29% increase in diagnostic innovation investments in 2024 and globally, with Japan, South Korea, and Taiwan as main hubs.

The North American market is in the high growth phase with a projected CAGR of 10.2% during the forecast period due to innovation leadership in the medical devices sphere, venture capital funding, the level of semiconductor research and development, early stage use of wearable health technology, the FDA regulatory environment, which favors innovative medical devices, and the concentration of the companies that develop implantable and wearable systems that will need thin-film sources of power and electrodes.

The Global Thin-film Electrode Market is expected to grow significantly because of the explosive growth of IoT devices with 30.91 billion connected devices in 2025, and a projection of more than 400+ million endpoints. The wearable technology market is projected to grow to USD 86.92 billion in 2025 and is expected to grow to USD 167.81 billion in 2034. The wearable biosensors market is projected to grow to USD 72.579 billion in 2025.