US Ethylene Carbonate Market Size, Trends and Insights By Form (Solid, Liquid), By Application (Lubricants, Surface Coatings, Lithium Battery Electrolyte, Plasticizers), By End-use (Automotive, Industrial, Oil & Gas, Medical), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | USA |

| Largest Market: | USA |

Major Players

- BASF SE

- Empower Materials Inc.

- Alchem

- Alfa Aesar

- Others

Reports Description

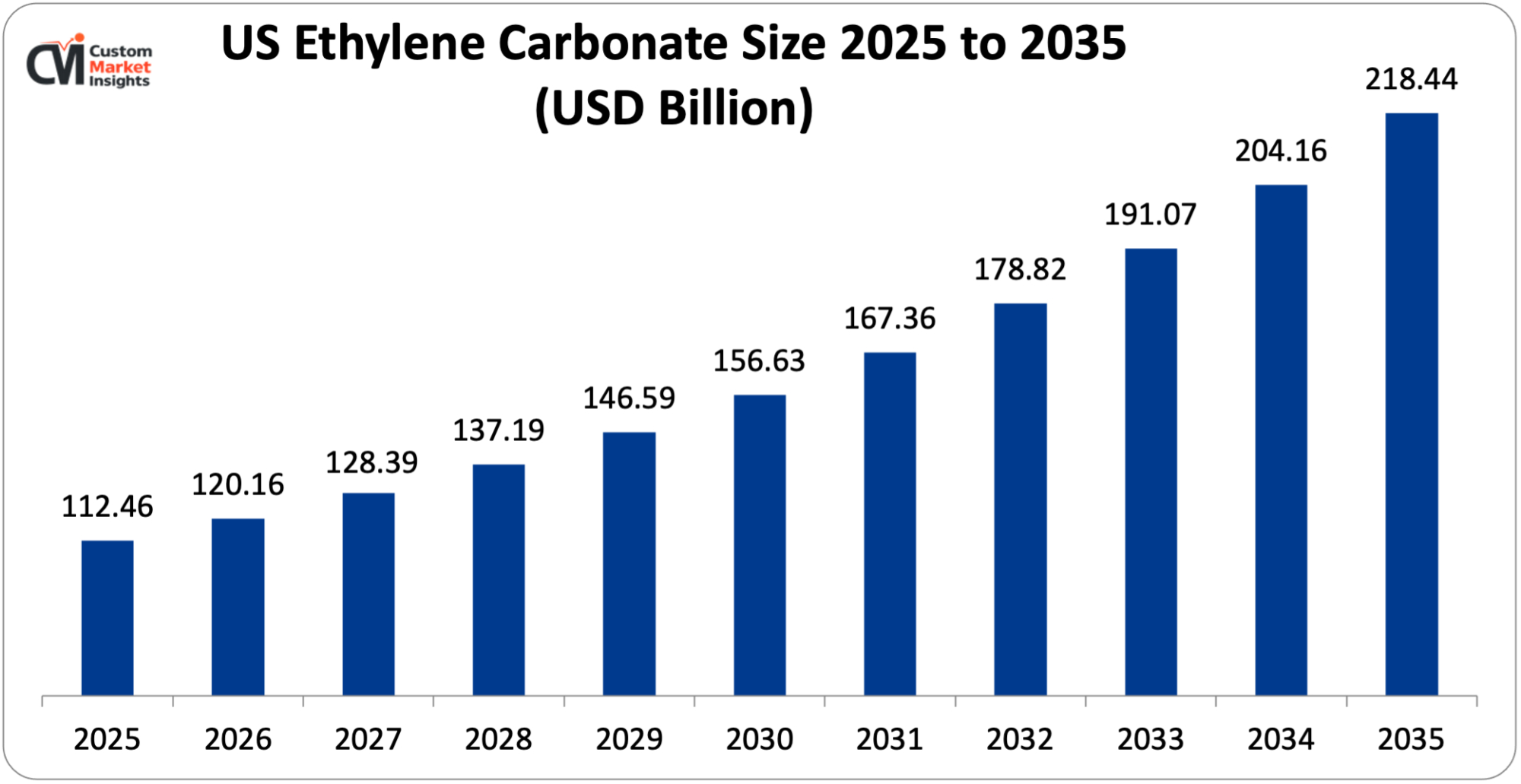

The US Ethylene Carbonate Treatment Market is expected to record a CAGR of 6.85% from 2026 to 2035. In 2026, the market size was USD 120.16 Million. By 2035, the valuation is anticipated to reach USD 218.14 Million.

The market is growing due to increased application of ethylene carbonate in portable electronics, electric vehicles, and storage of renewable energy. The other application areas include adhesives, coatings, plastics, and pharmaceuticals.

Ethylene carbonate is used in the form of a solvent as well as its intermediate in the pharmaceutical industry and also as a component in polymer systems that are used for packaging. This compound is also preferred owing to its lower toxicity.

Market Highlights

- By form, the solid form of ethylene carbonate held around 54% of the market share in 2025.

- By form, the liquid form of ethylene carbonate is expected to witness the fastest CAGR of 7.1% between 2026 and 2035.

- Application wise, the highest market share of 35.24% was attributed to the lubricants segment in 2025.

- By application, the lithium battery electrolyte segment is expected to witness the fastest CAGR of 8.46% between 2026 and 2035.

- By end-use, the automotive sector dominated the US ethylene carbonate market with 45.16% in 2025.

- By end-use, the oil & gas sector is expected to witness the fastest CAGR of 7.85% during the forecast period.

Significant Growth Factors

The US ethylene carbonate market presents significant growth opportunities due to several factors:

- Rising Demand from Lubricant and Lithium-Ion Battery Electrolyte Applications

The rising demand for ethylene carbonate from lubricant and lithium-ion battery electrolyte applications all across the US implies that ethylene carbonate is amongst the crucial solvents for lithium-ion battery electrolytes, wherein they do offer lower volatility and a higher dielectric constant, which does improve battery stability and enhance ion conduction. Ethylene carbonate is looked upon as one of the best intermediates regarding creation of high-performance greases and lubricants as it makes way for exceptional thermal stability, compatibility with additives, and low-temperature fluidity. The growth of the market is thus driven by aerospace, automotive, and industrial machinery verticals, apart from growing preference for environmentally friendly and synthetic lubricants. The biodegradability has also made it a viable solution.

- Evolution of Lithium-Sulfur Batteries

The lithium-sulfur batteries are poised to create innumerable opportunities for the US ethylene carbonate market as ethylene carbonate is one of the key components regarding the development of next-generation energy storage technologies. Such batteries are highly looked upon for several applications, basically owing to their potential for lighter designs, higher energy density, and lower costs of production in comparison with conventional lithium-ion batteries. Usage of sulfur is also emphasized. It is an inexpensive element available in abundance for large-scale applications such as drones, electric vehicles, and renewable energy storage systems. Research efforts and commercialization regarding Li-S batteries are in progress with the market witnessing an upsurge in demand for high class electrolytes.

What are the Major Advancements Changing the US Ethylene Carbonate Market Today?

- Rising Demand for EV Battery Manufacturing at the Local Level

The US is witnessing major investments in large-scale, domestic carbonate solvent facilities on its Gulf Coast with the objective of localizing the battery supply chain for EVs. The manufacturers are thus emphasizing on improving the energy density, safety, and lifespan of batteries. Also, sterner environmental regulations and decarbonisation goals are catalyzing innovation regarding the way ethylene carbonate is used. The industry players are also going for greener methods like utilization of renewable feedstock coupled with capturing carbon dioxide (CO2) for being used as raw material. Developing advanced separation and distillation technologies is important in order to achieve the ultra-high purity needed for the next-generation batteries. Also, R&D activities are being conducted for using ethylene carbonate as a precursor or component in the next-gen solid-state battery electrolytes. Moreover, novel US tariffs regarding imported ethylene carbonate are triggering a strategic shift in the direction of domestic sourcing, thereby compeling the procurement teams to prioritize the local suppliers.

- Technological Advancements coupled with Integration of AI

Technological advancements that encompass AI-driven advanced manufacturing and predictive analytics are expediting the US ethylene carbonate market. They are thus enhancing the manufacturing efficiency, purity, and yield for meeting the higher battery-grade standards. AI helps in optimization of supply chains and lessens usage of energy, whereas the IoT sensors improve quality and safety in lithium-ion battery and automotive applications. AI-driven process controls do manufacture high-purity ethylene carbonate, which is vital to cater to the demand from automotive components and lithium-ion battery electrolytes. Integrating AI also bolsters efficiency of production, thereby extending direct support to the high-volume requirements of the EV sector, which is one of the major factors fueling the demand for ethylene carbonate.

Category Wise Insights

By Form

Why Does the Solid Form of Ethylene Carbonate Dominate the US Ethylene Carbonate Market?

The solid form of ethylene carbonate dominates the market as it is known for its longer life span followed by its ability to withstand higher temperatures without witnessing any of the chemical alterations. Solid ethylene carbonate is broadly used for several end-use industries such as automotive, industrial, and medical (apart from chemical). It does act as one of the additives regarding the production of pharmaceuticals, soldering fluxes, and cosmetics. Coming to the oil & gas vertical, ethylene carbonate serves as a solvent for reducing viscosity during high-pressure or high-temperature operations, particularly when the other fluids prove to be ineffective owing to lower viscosity.

By Application

How Does the Lubricants Sector Dominate the US Ethylene Carbonate Market?

The lubricants sector dominates the US ethylene carbonate market by application owing to lubricants being used extensively across various verticals such as automotive, industrial, oil & gas, and likewise. Ethylene carbonate is used in the form of a co-solvent or additive during the formulation of lubricants for improving their characteristics and ultimately performance. It improves film formation and lubricity, thereby reducing wear and friction between the moving parts. Ethylene carbonate, by creating a protective layer on the metal surfaces, aids in preventing metal-metal contact, thereby reducing the risk of component failure and surface damage.

By End-use

Why does the Automotive Sector lead the US Ethylene Carbonate Market?

The automotive sector leads the US ethylene carbonate market owing to increased usage of ethylene carbonate in the automotive vertical, especially in the production of components like spark plugs, ignition cable sets, and battery terminals. This is basically attributed to ethylene carbonate’s higher dielectric strength, which improves safety and renders protection against electric shock in the automotive applications. The increased demand for EVs coupled with substantial advancements in this sector is also fueling the growth of the market.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 120.16 Million |

| Projected Market Size in 2035 | USD 218.14 Million |

| Market Size in 2025 | USD 112. 46 Million |

| CAGR Growth Rate | 6.85% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Form, Application, End-use and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Top Players in the US Ethylene Carbonate Market and Their Offerings

- Huntsman International LLC

- BASF SE

- Mitsubishi Chemical Group Corporation

- Empower Materials Inc.

- Alchem

- Alfa Aesar

- Others

Key Developments

The US ethylene carbonate market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In August 2022, Indorama Ventures Public Company Limited (IVL), under its Vision 2030, entered into partnership with Capchem Technology USA Inc. with the objective of establishing a newfangled lithium-ion battery solvents plant on the US Gulf Coast.

The US Ethylene Carbonate Market is segmented as follows:

By Form

- Solid

- Liquid

By Application

- Lubricants

- Surface Coatings

- Lithium Battery Electrolyte

- Plasticizers

By End-use

- Automotive

- Industrial

- Oil & Gas

- Medical

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 US Ethylene Carbonate Market, (2026 – 2035) (USD Billion)

- 2.2 US Ethylene Carbonate Market: snapshot

- Chapter 3. US Ethylene Carbonate Market – Industry Analysis

- 3.1 US Ethylene Carbonate Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Rising Demand from Lubricant and Lithium-Ion Battery Electrolyte Applications

- 3.2.2 Evolution of Lithium-Sulfur Batteries

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Form

- 3.7.2 Market attractiveness analysis By Application

- 3.7.3 Market attractiveness analysis By End-use

- Chapter 4. US Ethylene Carbonate Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 US Ethylene Carbonate Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. US Ethylene Carbonate Market – Form Analysis

- 5.1 US Ethylene Carbonate Market overview: By Form

- 5.1.1 US Ethylene Carbonate Market share, By Form, 2025 and 2035

- 5.2 Solid

- 5.2.1 US Ethylene Carbonate Market by Solid, 2026 – 2035 (USD Billion)

- 5.3 Liquid

- 5.3.1 US Ethylene Carbonate Market by Liquid, 2026 – 2035 (USD Billion)

- 5.1 US Ethylene Carbonate Market overview: By Form

- Chapter 6. US Ethylene Carbonate Market – Application Analysis

- 6.1 US Ethylene Carbonate Market overview: By Application

- 6.1.1 US Ethylene Carbonate Market share, By Application, 2025 and 2035

- 6.2 Lubricants

- 6.2.1 US Ethylene Carbonate Market by Lubricants, 2026 – 2035 (USD Billion)

- 6.3 Surface Coatings

- 6.3.1 US Ethylene Carbonate Market by Surface Coatings, 2026 – 2035 (USD Billion)

- 6.4 Lithium Battery Electrolyte

- 6.4.1 US Ethylene Carbonate Market by Lithium Battery Electrolyte, 2026 – 2035 (USD Billion)

- 6.5 Plasticizers

- 6.5.1 US Ethylene Carbonate Market by Plasticizers, 2026 – 2035 (USD Billion)

- 6.1 US Ethylene Carbonate Market overview: By Application

- Chapter 7. US Ethylene Carbonate Market – End-use Analysis

- 7.1 US Ethylene Carbonate Market overview: By End-use

- 7.1.1 US Ethylene Carbonate Market share, By End-use, 2025 and 2035

- 7.2 Automotive

- 7.2.1 US Ethylene Carbonate Market by Automotive, 2026 – 2035 (USD Billion)

- 7.3 Industrial

- 7.3.1 US Ethylene Carbonate Market by Industrial, 2026 – 2035 (USD Billion)

- 7.4 Oil & Gas

- 7.4.1 US Ethylene Carbonate Market by Oil & Gas, 2026 – 2035 (USD Billion)

- 7.5 Medical

- 7.5.1 US Ethylene Carbonate Market by Medical, 2026 – 2035 (USD Billion)

- 7.1 US Ethylene Carbonate Market overview: By End-use

- Chapter 8. US Ethylene Carbonate Market – Regional Analysis

- 8.1 US Ethylene Carbonate Market Regional Overview

- 8.2 US Ethylene Carbonate Market Share, by Region, 2025 & 2035 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 Huntsman International LLC

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 BASF SE

- 9.3 Mitsubishi Chemical Group Corporation

- 9.4 Empower Materials Inc.

- 9.5 Alchem

- 9.6 Alfa Aesar

- 9.7 Others.

- 9.1 Huntsman International LLC

List Of Figures

Figures No 1 to 21

List Of Tables

Tables No 1 to 2

Prominent Player

- Huntsman International LLC

- BASF SE

- Mitsubishi Chemical Group Corporation

- Empower Materials Inc.

- Alchem

- Alfa Aesar

- Others

FAQs

The key players in the market are Huntsman International LLC, BASF SE, Mitsubishi Chemical Group Corporation, Empower Materials Inc., Alchem, Alfa Aesar, Others.

The upsurge in the adoption of EVs in the US, which are driven by emission standards set by the regulatory authorities and government incentives, has visibly increased the requirement for lithium-ion batteries. With ethylene carbonate being one of the critical components in the formulation of electrolytes, such policies do boost demand for high-purity ethylene carbonate on a direct basis.

The increased demand for high-purity ethylene in the lithium-ion batteries is raising the manufacturing costs. Moreover, price fluctuations in carbon dioxide and ethylene oxide (essential raw materials) are bound to create uncertainty in the market. With a surge in the costs of feedstock, manufacturing costs are increasing, whereby profit margins for the US manufacturers are poised to get impacted, thereby raising the costs of the end products.

The US ethylene carbonate market is expected to reach USD 218.14 Million by 2035, growing at a CAGR of 6.85% from 2026 to 2035. Ethylene carbonate, due to its efficacy in offering high solubility and polarity against water, is an ideal solvent for several applications. As one of the polar solvents, it is used for making plastics, lubricants, surface coatings, resins, and likewise.

Ethylene carbonate is amongst the key ingredients in lithium-ion battery electrolytes. As such, the demand for ethylene carbonate is bound to witness exponentiation during the forecast period. Ethylene carbonate facilitates a solid electrolyte interface (SEI) to be formed on graphitic carbons’ surface, thereby helping the graphite anode in the reversal of reactions with lithium ions for numerous cycles. It has also been observed that an electrolytic capacitor offers bigger capacitance as compared to its counterparts.