Vegan Baking Ingredients Market Size, Trends and Insights By Product (Flour, Oils, Sweeteners, Flavoring Agents), By Application (Cakes & Pastries, Breads & Rolls, Biscuits & Cookies), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Cargill

- Associated British Foods plc

- Ingredion Incorporated

- Tate & Lyle plc

- Others

Reports Description

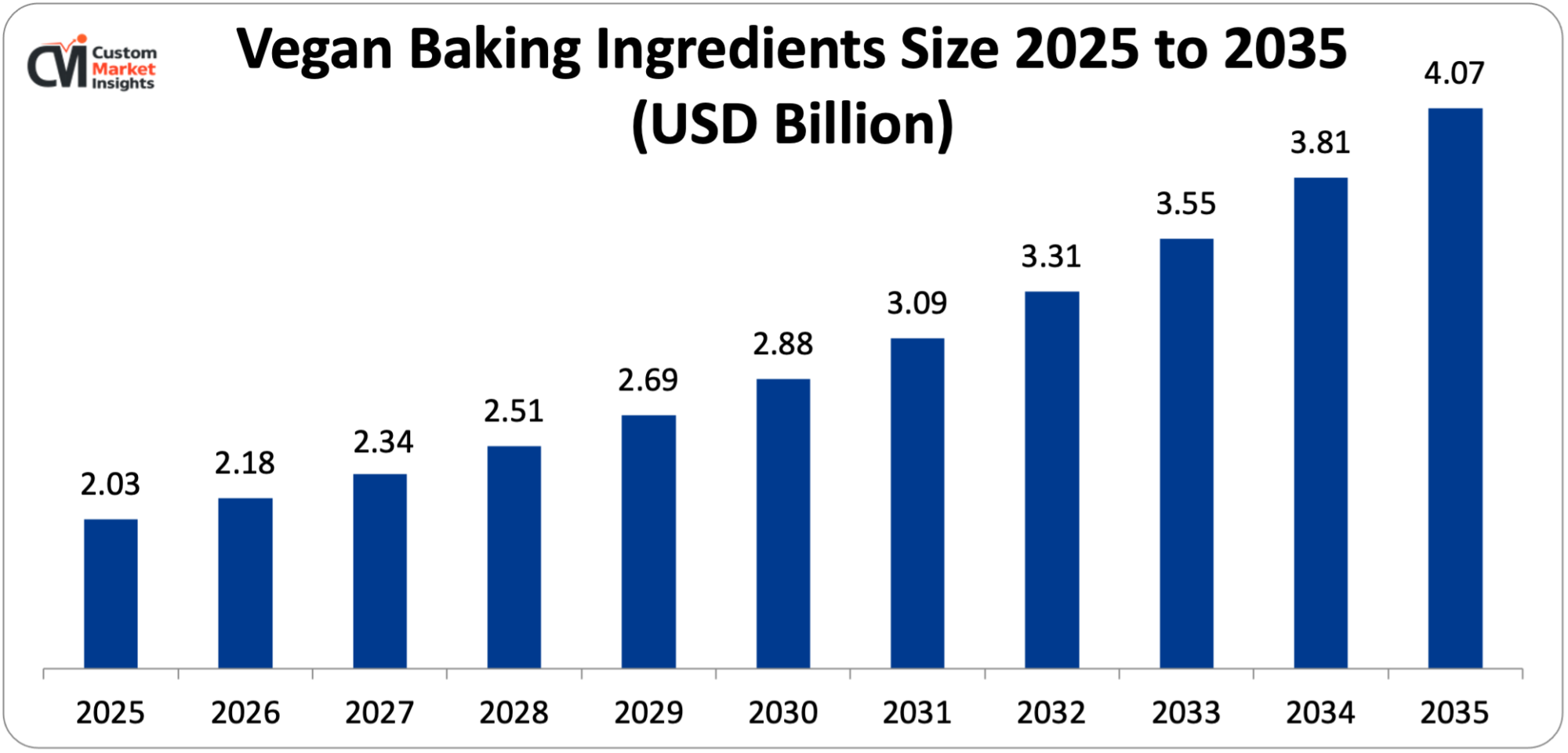

As per the Vegan Baking Ingredients Market analysis conducted by the CMI team, the vegan baking ingredients market is expected to record a CAGR of 7.15% from 2026 to 2035. In 2026, the market size was USD 2.18 Billion. By 2035, the valuation is anticipated to reach USD 4.07 Billion.

The market is expanding due to the consumers increasingly preferring products excluding eggs, dairy, and the other ingredients derived from animals owing to ethical concerns pertaining to animal welfare, increased awareness regarding food allergens, and calls for clean label nutrition profiles. In other words, the formulation of breads, cakes, pastries, and cookies with cleaner nutrition profiles has turned out to be one of the structural shifts in the present scenario.

Market Highlights

- Europe dominated the vegan baking ingredients market in 2025 with 33.32% of the overall share.

- The Asia Pacific is expected to witness the fastest CAGR of 10.23% in the vegan baking ingredients market during the forecast period.

- By product, the flour segment dominated the vegan baking ingredients market with 39% of the overall share.

- By product, the flavoring agents segment is expected to witness the fastest CAGR of 7.34% in the vegan baking ingredients market during the forecast period.

- By application, the breads & rolls segment dominated the vegan baking ingredients market with 44.32% of the overall share.

- By application, the biscuits & cookies segment is expected to witness the fastest CAGR of 5.34% in the vegan baking ingredients market during the forecast period

Significant Growth Factors

The Vegan Baking Ingredients Market Trends signify the following:

- Switch to Free-form Preferences: Conventional baking ingredients, particularly dairy, butter, and eggs are associated with saturated fats, lactose, and cholesterol. As such, the modern-day buyers are trying to keep them at bay. Also, vegan formulations are reported to align with wider “free-from” preferences like low-sugar, non-GMO, gluten-free, and lactose-free alternatives. Such convergence results in not only vegans but also wellness-driven consumers, the ones with dietary sensitivities, and flexitarians getting drawn to vegan baking ingredients.

- Environmental Consciousness: Environmental consciousness is another factor shaping the vegan baking ingredients market. Baking falls in the category of high-frequency packaged foods, which means choices of ingredients have a visible impact on the carbon footprints. With raised awareness regarding greenhouse emissions from the industrial farming practices and dairy supply chains, the bakers and consumers alike are preferring plant-based oils, flours, binding agents, and sweeteners. These preferences do translate to adoption in the long run as the buying decision is value-driven instead of being price-driven.

- Incorporation of Technological Advancements with Integration of AI: Modern-day vegan ingredients are able to deliver better moisture retention, structure, and mouthfeel, thereby transcending historical barriers like weak binding or dry texture. These enhancements backed by R&D activities give commercial food manufacturers and home bakers a higher level of confidence for reformulating without compromising with shelf appeal or taste. AI algorithms do analyse the molecular structures for creating plant-based substitutes for eggs, butter, and dairy, thereby improving functionality, taste, and texture. Players such as Climax Foods use “deep plant intelligence” for replicating animal-based ingredients. AI also curtails the trial and error part by 15-25% by facilitating quicker development of baking mixes that are high-protein, gluten-free, and allergen-friendly.

What are the Major Advancements Changing the Vegan Baking Ingredients Market Today?

- Development of Biotechnology-derived Solutions: Biotechnology applications need specialized biotechnology platforms with improved functional specifications that extend support to superlative banking performance while adhering to vegan compliance, thereby rendering premium market segments with varied value propositions. The manufacturers are handsomely investing in the development of precision ingredients in order to address commercial baking applications while extending support to innovation in advanced nutrition optimization and the development of functional foods.

- Expanding Plant-based Food Industry: Vegan baking ingredients do cater to the requirements of formulations for the plant-based meat alternatives, specialty vegan products, and dairy-free desserts that call for advanced texturing, binding, and fat replacement capacities. The plant-based food manufacturers do need specialized vegan ingredients that deliver improved protein content, superlative functionality, and better processing stability under the challenging manufacturing conditions. The food companies are recognizing competitive advantages on the part of advanced vegan ingredient integration for market differentiation and product innovation, thereby making way for specialized formulations for the emerging categories of plant-based food.

Category Wise Insights

By Product

- Why is Flour Dominating the Vegan Baking Ingredients Market?

Flour is leading the vegan baking ingredients market (around 39% of the market share). This is credited to the manufacturers and bakers increasingly adopting options such as oat-based creamers, coconut milk powder, and aquafaba for matching the texture and taste of traditional recipes without cholesterol or allergens. Also, innovation in flavors has turned out to be one of the key differentiators in the form of cocoa-based blends, vanilla bean infusions, fruit essences, and fermentation-driven cheesy or buttery notes, especially in indulgent and sweet bakery categories.

By Application

- Why are breads & rolls dominating the vegan baking ingredients market?

Breads & rolls are contributing 44.32% of the market share application-wise. This is due to the increased demand on their part with consumers increasingly preferring cholesterol-free, plant-based diets with reduced allergens, thereby compeling bakeries to replace conventional eggs, dairy, and butter-based ingredients. The growth is increasingly driven by vegan lifestyle choices’ higher penetration amongst Gen Z and millennials. It has also been reported that functional substitutes like aquafaba, coconut milk powder, dairy-free emulsifiers, and pea proteins add to softness, retention of moisture, and stability of dough, wherein the manufacturers can match the texture of traditional breads & rolls without the involvement of animal derivatives.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 2.18 Billion |

| Projected Market Size in 2035 | USD 4.07 Billion |

| Market Size in 2025 | USD 2.03 Billion |

| CAGR Growth Rate | 7.15% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product, Application and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is Europe’s Vegan Baking Ingredients Market Size?

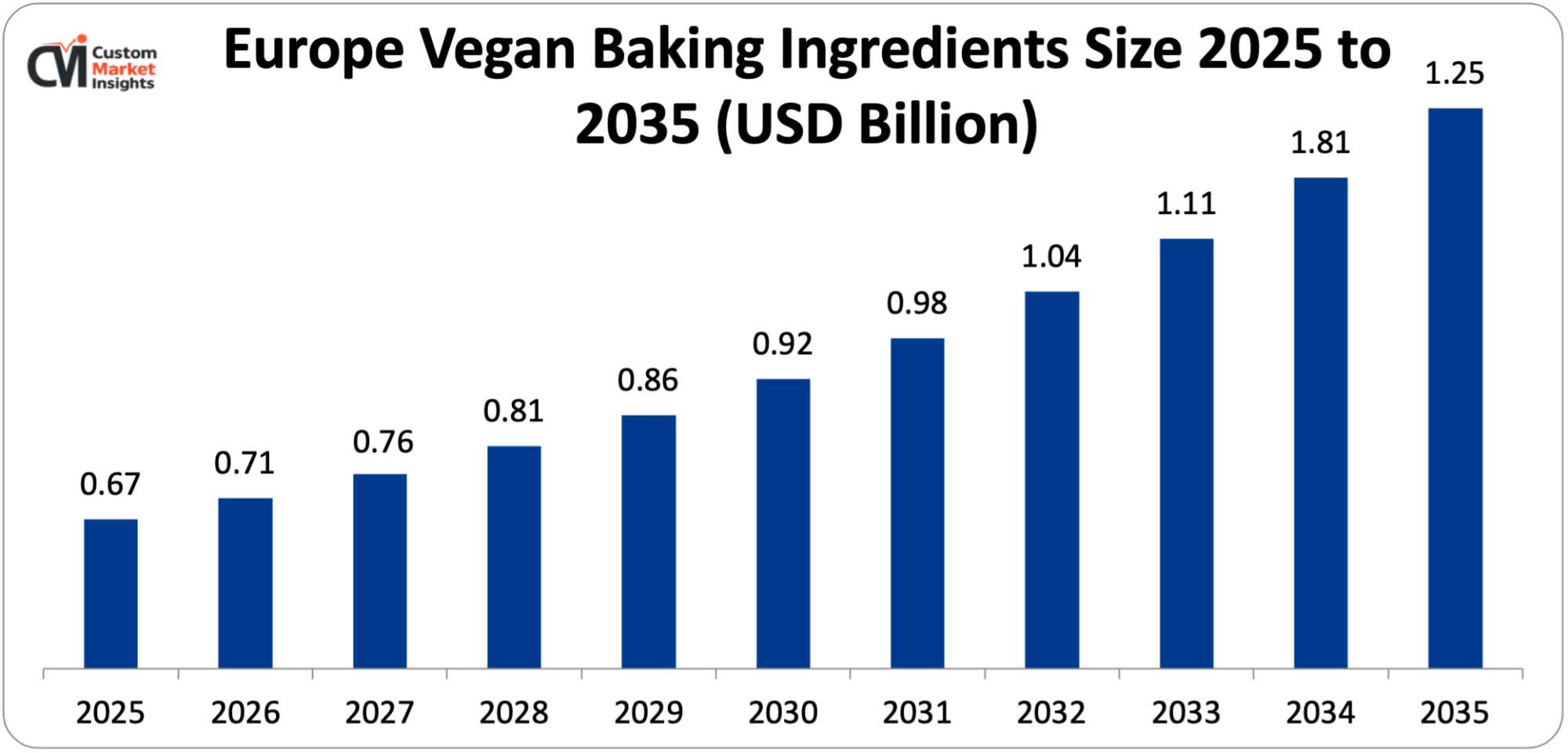

Europe’s vegan baking ingredients market was worth USD 669.9 Million in 2025 and is expected to reach USD 1.25 Billion by 2035 at a CAGR of 6.47% between 2025 and 2035.

Why did Europe Dominate the Vegan Baking Ingredients Market in 2025?

Europe is witnessing a strong demand for vegan baking ingredients as a greater number of consumers are shifting to dairy-free, plant-based, and egg-free meals, which are further driven by calls for environmentally friendly, health, and animal welfare. Also, Europe has housed dessert and baking culture for a long time, which involves extensive usage of cakes, breads, pastries, and the other baked goods. They are now being replaced by vegan-friendly substitutes.

What is the Size of the U.K. Vegan Baking Services Market?

The market size of the U.K. vegan baking services was USD 0.36 Billion in 2025 and is expected to reach USD 0.66 Billion in 2035, witnessing a CAGR of 6.34% between 2026 and 2035.

U.K. Vegan Baking Ingredients Market Trends

The U.K. is witnessing robust demand for vegan baking ingredients, which is a reflection of a paradigm shift. In other words, the U.K.’s bakery industry is witnessing shift toward plant-based diets along with environmental, health-conscious, and environmentally friendly eating. It has been observed that mainstream households and flexitarians are also going for plant-based alternatives when baking, especially with the desire for clean label foodstuff. The innovations include gluten-free vegan flours, aquafaba for meringues, and plant-based butter substitutes.

Why is Asia Pacific Experiencing the Fastest Growth in the Vegan Baking Ingredients Market?

The Asia Pacific is expected to witness the fastest CAGR for vegan baking ingredients during the forecast period. This is due to a shift in dietary behavior toward lactose-free, plant-based, and allergen-reduced gulping patterns, especially amongst the urban youth. Also, rising awareness regarding cholesterol-controlled diets, dairy sensitivity, and impacts of sustainability is compeling commercial bakeries and households to use soy, coconut, pulse-based alternatives, and oats in place of milk solids, butter, and egg emulsifiers. Economies like India, Indonesia, Australia, Thailand, and China are witnessing an upsurge in the discovery of vegan recipes via social platforms. On the other hand, retail availability of stabilizers, dairy-free mixes, and creamers is on the rise herein.

China’s Vegan Bakery Ingredients Market Trends

China’s vegan baking ingredients market is expanding due to increased demand for high class, specialized plant-based derivatives in the baking vertical. Flour (inclusive of gluten-free options such as coconut and oat) stays the largest segment. There is a notable rise in demand for plant-based dairy alternatives (plant-based creamers and oat milk) and egg replacements (aquafaba and fava bean protein). An exclusive feature of the Chinese market is the demand for products compliant with “Buddhist vegan” standards. They exclude animal products and pungent vegetables.

Where does North America stand with respect to Vegan Baking Ingredients Market?

The vegan baking ingredients market in North America is expected to witness a decent CAGR during the forecast period due to evolving preferences of consumers toward sustainability, health, and unhealthy dietary choices, especially amongst the youth. With a larger number of people in Canada and the U.S. adopting vegan diets, the demand for plant-based baking components increases. These components are reported to replicate eggs, dairy, and the other traditional baking ingredients without compromising texture or taste.

U.S. Vegan Baking Ingredients Market Trends

The U.S. vegan baking ingredients market is witnessing strong growth, basically driven by growing demand for allergen-free, plant-based, and clean label products. The key dynamics include the popularity of specialized flours (coconut, almond), flaxseed, and aquafaba. Also, the U.S. market is shifting toward sustainable, natural sweeteners (date sugar, monk fruit). The consumers are seen moving toward coconut sugar and maple syrup, apart from plant-based fats. Also, fermented ingredients such as sourdough are used for improving digestibility, flavour, and shelf life.

Where is the Middle East & Africa regarding Adoption of Vegan Baking Ingredients?

Though MEA is conventionally dominated by various animal-based products, this region is seeing noteworthy momentum, especially in South Africa, Saudi Arabia, and the UAE, basically supported by an increased availability of plant-based alternatives to conventional baking ingredients such as butter, eggs, and dairy. Research states that the vegan population has grown by 27% since the year 2023 in the Middle East alone. In South Africa, 10-12% of the population is identified as flexitarian, vegetarian, or vegan.

Brazil Vegan Baking Ingredients Trends

In Brazil, oat milk and coconut milk are amongst the leading choices regarding the creation of creamy textures in desserts, with soy, cashew-based, and peanut-based alternatives being popular with respect to cheese substitutes and dairy-free baking. Plus, usage of native ingredients such as passion fruit, açaí, mango, and cupuaçu is increasing, thereby adding both – functional value and flavour to the baked goods.

Top Players in the Vegan Baking Ingredients Market and Their Offerings

- Cargill

- Associated British Foods plc

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Tate & Lyle plc

- IFF Inc.

- Bakels Group

- Dawn Food Products Inc.

- Kerry Group

- Corbion N.V.

- Koninklijke DSM N.V.

- Others

Key Developments

Vegan baking ingredients market has experienced considerable changes in the last few years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- Puratos holds around 10% of the market share due to an emphasis on functional performance optimization, industrial applications, and technical support across various food manufacturing and commercial baking sectors.

These strategic measures have enabled the companies to reinforce their competitive positions, increase the product line, boost their technological competencies and also seize growth opportunities in the fast growing rise hailing services market.

The Vegan Baking Ingredients Market is segmented as follows:

By Product

- Flour

- Oils

- Sweeteners

- Flavoring Agents

By Application

- Cakes & Pastries

- Breads & Rolls

- Biscuits & Cookies

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Vegan Baking Ingredients Market, (2026 – 2035) (USD Billion)

- 2.2 Global Vegan Baking Ingredients Market: snapshot

- Chapter 3. Global Vegan Baking Ingredients Market – Industry Analysis

- 3.1 Vegan Baking Ingredients Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Switch to Free-form Preferences

- 3.2.2 Environmental Consciousness

- 3.2.3 Incorporation of Technological Advancements with Integration of AI

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product

- 3.7.2 Market attractiveness analysis By Application

- Chapter 4. Global Vegan Baking Ingredients Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Vegan Baking Ingredients Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Vegan Baking Ingredients Market – Product Analysis

- 5.1 Global Vegan Baking Ingredients Market overview: By Product

- 5.1.1 Global Vegan Baking Ingredients Market share, By Product, 2025 and 2035

- 5.2 Flour

- 5.2.1 Global Vegan Baking Ingredients Market by Flour, 2026 – 2035 (USD Billion)

- 5.3 Oils

- 5.3.1 Global Vegan Baking Ingredients Market by Oils, 2026 – 2035 (USD Billion)

- 5.4 Sweeteners

- 5.4.1 Global Vegan Baking Ingredients Market by Sweeteners, 2026 – 2035 (USD Billion)

- 5.5 Flavoring Agents

- 5.5.1 Global Vegan Baking Ingredients Market by Flavoring Agents, 2026 – 2035 (USD Billion)

- 5.1 Global Vegan Baking Ingredients Market overview: By Product

- Chapter 6. Global Vegan Baking Ingredients Market – Application Analysis

- 6.1 Global Vegan Baking Ingredients Market overview: By Application

- 6.1.1 Global Vegan Baking Ingredients Market share, By Application , 2025 and 2035

- 6.2 Cakes & Pastries

- 6.2.1 Global Vegan Baking Ingredients Market by Cakes & Pastries, 2026 – 2035 (USD Billion)

- 6.3 Breads & Rolls

- 6.3.1 Global Vegan Baking Ingredients Market by Breads & Rolls, 2026 – 2035 (USD Billion)

- 6.4 Biscuits & Cookies

- 6.4.1 Global Vegan Baking Ingredients Market by Biscuits & Cookies, 2026 – 2035 (USD Billion)

- 6.1 Global Vegan Baking Ingredients Market overview: By Application

- Chapter 7. Vegan Baking Ingredients Market – Regional Analysis

- 7.1 Global Vegan Baking Ingredients Market Regional Overview

- 7.2 Global Vegan Baking Ingredients Market Share, by Region, 2025 & 2035 (USD Billion)

- 7.3. North America

- 7.3.1 North America Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.3.1.1 North America Vegan Baking Ingredients Market, by Country, 2026 – 2035 (USD Billion)

- 7.3.1 North America Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.4 North America Vegan Baking Ingredients Market, by Product, 2026 – 2035

- 7.4.1 North America Vegan Baking Ingredients Market, by Product, 2026 – 2035 (USD Billion)

- 7.5 North America Vegan Baking Ingredients Market, by Application, 2026 – 2035

- 7.5.1 North America Vegan Baking Ingredients Market, by Application, 2026 – 2035 (USD Billion)

- 7.6. Europe

- 7.6.1 Europe Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.6.1.1 Europe Vegan Baking Ingredients Market, by Country, 2026 – 2035 (USD Billion)

- 7.6.1 Europe Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.7 Europe Vegan Baking Ingredients Market, by Product, 2026 – 2035

- 7.7.1 Europe Vegan Baking Ingredients Market, by Product, 2026 – 2035 (USD Billion)

- 7.8 Europe Vegan Baking Ingredients Market, by Application, 2026 – 2035

- 7.8.1 Europe Vegan Baking Ingredients Market, by Application, 2026 – 2035 (USD Billion)

- 7.9. Asia Pacific

- 7.9.1 Asia Pacific Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.9.1.1 Asia Pacific Vegan Baking Ingredients Market, by Country, 2026 – 2035 (USD Billion)

- 7.9.1 Asia Pacific Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.10 Asia Pacific Vegan Baking Ingredients Market, by Product, 2026 – 2035

- 7.10.1 Asia Pacific Vegan Baking Ingredients Market, by Product, 2026 – 2035 (USD Billion)

- 7.11 Asia Pacific Vegan Baking Ingredients Market, by Application, 2026 – 2035

- 7.11.1 Asia Pacific Vegan Baking Ingredients Market, by Application, 2026 – 2035 (USD Billion)

- 7.12. Latin America

- 7.12.1 Latin America Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.12.1.1 Latin America Vegan Baking Ingredients Market, by Country, 2026 – 2035 (USD Billion)

- 7.12.1 Latin America Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.13 Latin America Vegan Baking Ingredients Market, by Product, 2026 – 2035

- 7.13.1 Latin America Vegan Baking Ingredients Market, by Product, 2026 – 2035 (USD Billion)

- 7.14 Latin America Vegan Baking Ingredients Market, by Application, 2026 – 2035

- 7.14.1 Latin America Vegan Baking Ingredients Market, by Application, 2026 – 2035 (USD Billion)

- 7.15. The Middle-East and Africa

- 7.15.1 The Middle-East and Africa Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.15.1.1 The Middle-East and Africa Vegan Baking Ingredients Market, by Country, 2026 – 2035 (USD Billion)

- 7.15.1 The Middle-East and Africa Vegan Baking Ingredients Market, 2026 – 2035 (USD Billion)

- 7.16 The Middle-East and Africa Vegan Baking Ingredients Market, by Product, 2026 – 2035

- 7.16.1 The Middle-East and Africa Vegan Baking Ingredients Market, by Product, 2026 – 2035 (USD Billion)

- 7.17 The Middle-East and Africa Vegan Baking Ingredients Market, by Application, 2026 – 2035

- 7.17.1 The Middle-East and Africa Vegan Baking Ingredients Market, by Application, 2026 – 2035 (USD Billion)

- Chapter 8. Company Profiles

- 8.1 Cargill

- 8.1.1 Overview

- 8.1.2 Financials

- 8.1.3 Product Portfolio

- 8.1.4 Business Strategy

- 8.1.5 Recent Developments

- 8.2 Associated British Foods plc

- 8.2.1 Overview

- 8.2.2 Financials

- 8.2.3 Product Portfolio

- 8.2.4 Business Strategy

- 8.2.5 Recent Developments

- 8.3 Ingredion Incorporated

- 8.3.1 Overview

- 8.3.2 Financials

- 8.3.3 Product Portfolio

- 8.3.4 Business Strategy

- 8.3.5 Recent Developments

- 8.4 Archer Daniels Midland Company (ADM)

- 8.4.1 Overview

- 8.4.2 Financials

- 8.4.3 Product Portfolio

- 8.4.4 Business Strategy

- 8.4.5 Recent Developments

- 8.5 Tate & Lyle plc

- 8.5.1 Overview

- 8.5.2 Financials

- 8.5.3 Product Portfolio

- 8.5.4 Business Strategy

- 8.5.5 Recent Developments

- 8.6 IFF Inc.

- 8.6.1 Overview

- 8.6.2 Financials

- 8.6.3 Product Portfolio

- 8.6.4 Business Strategy

- 8.6.5 Recent Developments

- 8.7 Bakels Group

- 8.7.1 Overview

- 8.7.2 Financials

- 8.7.3 Product Portfolio

- 8.7.4 Business Strategy

- 8.7.5 Recent Developments

- 8.8 Dawn Food Products Inc.

- 8.8.1 Overview

- 8.8.2 Financials

- 8.8.3 Product Portfolio

- 8.8.4 Business Strategy

- 8.8.5 Recent Developments

- 8.9 Kerry Group

- 8.9.1 Overview

- 8.9.2 Financials

- 8.9.3 Product Portfolio

- 8.9.4 Business Strategy

- 8.9.5 Recent Developments

- 8.10 Corbion N.V.

- 8.10.1 Overview

- 8.10.2 Financials

- 8.10.3 Product Portfolio

- 8.10.4 Business Strategy

- 8.10.5 Recent Developments

- 8.11 Koninklijke DSM N.V.

- 8.11.1 Overview

- 8.11.2 Financials

- 8.11.3 Product Portfolio

- 8.11.4 Business Strategy

- 8.11.5 Recent Developments

- 8.12 Others.

- 8.12.1 Overview

- 8.12.2 Financials

- 8.12.3 Product Portfolio

- 8.12.4 Business Strategy

- 8.12.5 Recent Developments

- 8.1 Cargill

List Of Figures

Figures No 1 to 21

List Of Tables

Tables No 1 to 52

Prominent Player

- Cargill

- Associated British Foods plc

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Tate & Lyle plc

- IFF Inc.

- Bakels Group

- Dawn Food Products Inc.

- Kerry Group

- Corbion N.V.

- Koninklijke DSM N.V.

- Others

FAQs

The key players in the market are Cargill, Associated British Foods plc, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Tate & Lyle plc, IFF Inc., Bakels Group, Dawn Food Products Inc., Kerry Group, Corbion N.V., Koninklijke DSM N.V., Others.

Regulations make provisions for legally defining vegan food, which is inclusive of additives, ingredients, processing aids, and enzymes whose origin cannot be traced to animals. This, in turn, does avert fraudulent labelling and ascertains that ingredients like sugar are not processed using animal products (such as bone char). The governments are also enforcing standardized, stringent logos for distinguishing vegan products from the non-vegan counterparts. For instance – In economies like India, a specified logo is needed for vegan foods. Such rules ascertain transparency, thereby letting consumers make proper choices.

Higher prices, generally 100% or even costlier than traditional counterparts owing to small volumes of production and specialized sourcing, are acting as deterrents to the consumers who are price-sensitive. However, demand for ethical, healthier, and allergen-free options is expected to continue to drive the growth of the market. Closure of the price gap is critical as far as switching is concerned, as more than 30% of consumers mention affordability as one of the top factors for raising their consumption of the plant-based products.

According to the present analysis and forecast modeling, the vegan baking ingredients market is projected to reach USD 4.07 Billion by the year 2035 due to the rise in adoption of plant-based diets, increased demand for cruelty-free and sustainable baking solutions, and ongoing trends of vegan lifestyles with regards to different retail, bakery, and foodservice applications.

Europe is anticipated to dominate the market during the forecast period. This is owing to a sizable shift toward vegetarian, vegan, and flexitarian diets driven by ethical, health, and environmental concerns all across the Europe. For instance, in Germany, the number of vegans has increased twofold since the year 2016. Research also states that 75% of the households are inclined toward more vegan options. Also, the fact that Europe has the highest per capita bread consumption can’t be ignored. Moreover, the EU has laid down potential legislation for eliminating cages in animal agriculture by the year 2027

The Asia Pacific is expected to witness the fastest CAGR in this market during the forecast period. This is credited to the fact that the consumers in the Asia Pacific are incorporating vegan diets, thereby resulting in an increased demand for plant-based, egg-free, and dairy-free baking ingredients. Growing urbanization in the emerging economies has also resulted in convenience foods’ higher consumption, which includes bakery products such as pastries, cakes, and bread. Improved retail availability of non-GMO, vegan products and innovations in various plant-based alternatives such as almond and aquafaba are curtailing the barriers to entry for new entrants.

A sizable increase in the number of people preferring vegetarian, vegan, or flexitarian diets is the factor basically driving the vegan baking ingredients market. The end-users, especially Gen Z and millennials are visibly reducing their usage of animal-derived products, whereby they are creating a higher demand for egg- and dairy-free alternatives. The prime innovations are inclusive of functional plant proteins (chickpea, soy, pea) for binding. Also, with vegan products getting mainstreamed in specialty stores, supermarkets, and online platforms, the ingredients have turned out to be more flexible.