Europe Love Hotels Market Size, Trends and Insights By Type (Themed, Basic), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Europe |

| Largest Market: | Europe |

Major Players

- Fusion Hotel

- Montmartre Mon Amour

- Witchery by the Castle

- Komorowski Luxury Guest Rooms

- Others

Reports Description

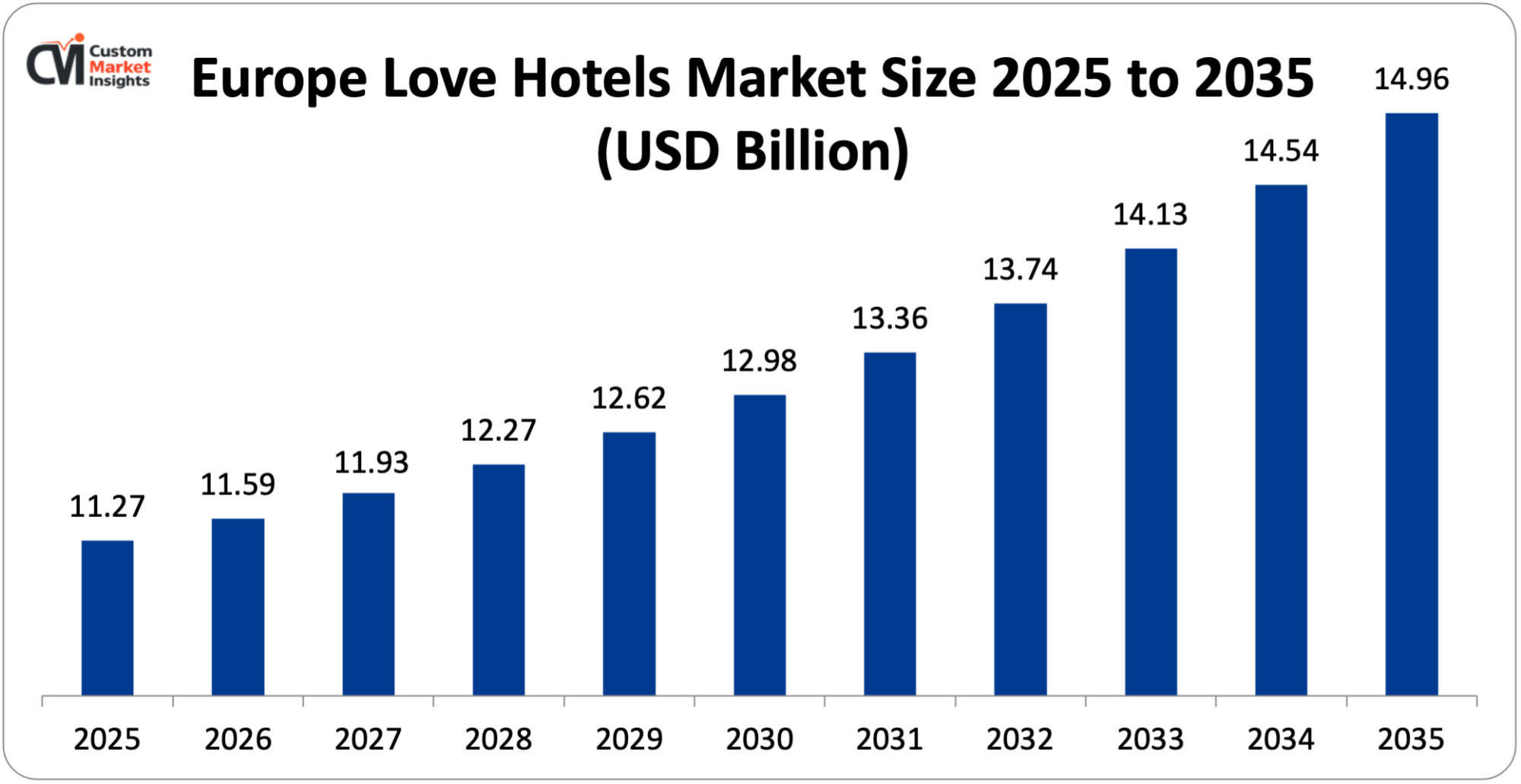

The Europe Love Hotels Market is expected to record a CAGR of 2.87% from 2026 to 2035. In 2026, the market size was USD 11.59 Billion. By 2035, the valuation is anticipated to reach USD 14.96 Billion. The market is expanding due to a growing focus on experiential and sustainable tourism.

The travelers all across Europe are increasingly asking for private, personalized and themed lodging options offering something beyond ordinary stays. Such trends coupled with the influence of quick payment methods and online booking are redefining Europe’s love hotel market and also extending support to its evolution.

Market Highlights

- By type, the basic form of love hotels held around 91% of the market share in 2025 and is expected to witness the fastest CAGR of 4.25% during the forecast period.

- Country-wise, Spain dominated the Europe love hotels market in 2025 with 30.12% of the overall share and is expected to witness the fastest CAGR of 3.76% during the forecast period.

Significant Growth Factors

The Europe love hotels market presents significant growth opportunities due to several factors:

- Rising Demand for Themed Luxury

Innovations like virtual reality gaming suites, unique themed rooms, romantic art deco-inspired accommodations, and wellness retreats are addressing different fantasies. Plus, they are drawing attention from the consumers asking for experimental lodging as well. Europe’s short-stay market is on a rapid expansion spree through day-use offerings and short-term rentals especially driven by an increase in the volume of city events and international tourists. As the fact that cultural stigma around “love hotels” is higher in Europe in comparison with East Asia cannot be ruled out, the majority of operators in this region do pose themselves as day-use rooms, design hotels, or boutique motels rather than love hotels. Short-term rental platforms, local boutique groups, and increased application of online booking services are contributing to the expansion of love hotels in Europe.

- Evolution of Targeted Couple-Centric Packages

Love hotels in Europe are working toward partnering with various travel agencies to offer specialized packages including amenities such as saunas, private spas, and intimate, romantic settings. Also, online booking services are being adopted with specialized platforms, which allow for simpler access to private, short-stay, and discrete accommodations. The year 2021 marked movement in the direction of contactless and digital services. With increased utilization of technology-assisted alternatives such as voice control, smartphone check-in, and biometrics, conventional customer-facing services are witnessing a makeover.

What are the Major Advancements Changing the Europe Love Hotels Market Today?

- Automation and Digitalization coupled with Integration of Technology (IoT)

Research states that almost 60% of the hotels based in Europe, in 2025, either used or planned to use AI for enhancing guest experience. Moreover, automated, contactless, and robot-assisted services for check-out and check-in are common. Integrating IoT does provide an improved convenience, thereby letting guests exercise control over room settings such as temperature, lighting, and entertainment through smartphones. Tech platforms and online booking through them are contributing to the further growth of the market. Also, notable investments in new properties followed by conversions by the major chains worldwide are acting as revenue generators.

- Demand for Experiential Bleisure

The young business travelers are seen fusing workdays with quality time, thereby paving the way for multi-night itineraries that help in reshaping seasonal assumptions and fortifying the rate optimization opportunities all across Europe. Spain recorded 94 million arrivals in 2024 alone, which translates to the support extended to longer stays that address the European love hotels market. The properties are also responding by blending workspace offerings with the wellness offerings, wherein they are delivering personalized packages boosting the ancillary expenditures. This strategy has been observed to improve revenue incurred per available room as the volatility pertaining to occupancy narrows.

Category Wise Insights

By Type

Why Does the Basic Type of Love Hotel Dominate the Europe Love Hotels Market?

The basic type of love hotel is dominating the European love hotels market (over 90% of the market share). This is credited to the fact that the basic love hotels are no-frills, simple rooms that are meant for short stays and the desired privacy. Such hotels have been designed to include the basic facilities such as a clean bathroom, bed, essential toiletries, and TV units. These properties do compete based on ease of booking, price, and location, which is especially in the vicinity of city centers or transport hubs. There is also an upsurge in demand for low-cost basic hotels and lodging, as budget-oriented pairs/couples vie for affordable options.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 11.59 Billion |

| Projected Market Size in 2035 | USD 14.96 Billion |

| Market Size in 2025 | USD 11.27 Billion |

| CAGR Growth Rate | 2.87% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Type and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | Europe |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is Spain’s Love Hotels Market Size?

Spain’s love hotels market was worth USD 3.41 Billion in 2025 and is expected to reach USD 6.61 Billion by 2035 at a CAGR of 3.42% between 2025 and 2035.

Spain Love Hotels Market Trends

Spain is witnessing a visible demand for immersive, themed experiences and privacy. Though basic hotels dominate as of now, romantic, themed, and experiential options are amongst the fastest growing ones, which, in turn, address short-stay, modern preferences. Spain is, in fact, emerging as a European hub for such a niche. The consumers are looking out for personalized, exclusive, and fantastical themes providing escape from the monotonous rut. Discrete, quick booking systems with digital check-in are vital to the business model. The higher demand revolves around the major tourist destinations such as Barcelona, Madrid, and the Balearic Islands.

Top Players in the Europe Love Hotels Market and Their Offerings –

- Fusion Hotel

- Montmartre Mon Amour

- Witchery by the Castle

- Komorowski Luxury Guest Rooms

- Trezzeni Palace Hotel

- Tigotan Lovers & Friends

- Canaves Oia Suites

- Hotel Maria Cristina

- Palazzo Belvedere

- Relais Bourgondisch Cruyce

- Hotel Da Baixa

- Hotel Moresco

- Only YOU Boutique Hotel

- Elysium Hotel

- Others

Key Developments

The European love hotels market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In June 2025, ActivumSG announced that it had completed the acquisition of Fairmont La Hacienda Costa del Sol for EUR 170 Million, whereas Landfair and Evientro agreed upon buying Vienna Marriott for more than EUR 100 Million, whereby it did demonstrate a craving for prime assets.

- In May 2025, Marriott inked an agreement with Verkehrsbuero Hospitality for five Austrian hotels, which totaled more than 1,100 rooms across 3 flags, thereby strengthening its mid-scale footprint across Europe.

The Europe Love Hotels Market is segmented as follows:

By Type

- Themed

- Basic

Regional Coverage:

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Europe Love Hotels Market, (2026 – 2035) (USD Billion)

- 2.2 Europe Love Hotels Market: snapshot

- Chapter 3. Europe Love Hotels Market – Industry Analysis

- 3.1 Europe Love Hotels Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Rising Demand for Themed Luxury

- 3.2.2 Evolution of Targeted Couple-Centric Packages

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Type

- Chapter 4. Europe Love Hotels Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Europe Love Hotels Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Europe Love Hotels Market – Type Analysis

- 5.1 Europe Love Hotels Market overview: By Type

- 5.1.1 Europe Love Hotels Market share, By Type, 2025 and 2035

- 5.2 Themed

- 5.2.1 Europe Love Hotels Market by Themed, 2026 – 2035 (USD Billion)

- 5.3 Basic

- 5.3.1 Europe Love Hotels Market by Basic, 2026 – 2035 (USD Billion)

- 5.1 Europe Love Hotels Market overview: By Type

- Chapter 6. Europe Love Hotels Market – Regional Analysis

- 6.1 Europe Love Hotels Market Regional Overview

- 6.2 Europe Love Hotels Market Share, by Region, 2025 & 2035 (USD Billion)

- 6.3. Europe

- 6.3.1 Europe Europe Love Hotels Market, 2026 – 2035 (USD Billion)

- 6.3.1.1 Europe Europe Love Hotels Market, by Country, 2026 – 2035 (USD Billion)

- 6.3.1 Europe Europe Love Hotels Market, 2026 – 2035 (USD Billion)

- 6.4 Europe Europe Love Hotels Market, by Type, 2026 – 2035

- 6.4.1 Europe Europe Love Hotels Market, by Type, 2026 – 2035 (USD Billion)

- Chapter 7. Company Profiles

- 7.1 Fusion Hotel

- 7.1.1 Overview

- 7.1.2 Financials

- 7.1.3 Product Portfolio

- 7.1.4 Business Strategy

- 7.1.5 Recent Developments

- 7.2 Montmartre Mon Amour

- 7.3 Witchery by the Castle

- 7.4 Komorowski Luxury Guest Rooms

- 7.5 Trezzeni Palace Hotel

- 7.6 Tigotan Lovers & Friends

- 7.7 Canaves Oia Suites

- 7.8 Hotel Maria Cristina

- 7.9 Palazzo Belvedere

- 7.10 Relais Bourgondisch Cruyce

- 7.11 Hotel Da Baixa

- 7.12 Hotel Moresco

- 7.13 Only YOU Boutique Hotel

- 7.14 Elysium Hotel

- 7.15 Others.

- 7.1 Fusion Hotel

List Of Figures

Figures No 1 to 10

List Of Tables

Tables No 1 to 3

Prominent Player

- Fusion Hotel

- Montmartre Mon Amour

- Witchery by the Castle

- Komorowski Luxury Guest Rooms

- Trezzeni Palace Hotel

- Tigotan Lovers & Friends

- Canaves Oia Suites

- Hotel Maria Cristina

- Palazzo Belvedere

- Relais Bourgondisch Cruyce

- Hotel Da Baixa

- Hotel Moresco

- Only YOU Boutique Hotel

- Elysium Hotel

- Others

FAQs

The key players in the market are Fusion Hotel, Montmartre Mon Amour, Witchery by the Castle, Komorowski Luxury Guest Rooms, Trezzeni Palace Hotel, Tigotan Lovers & Friends, Canaves Oia Suites, Hotel Maria Cristina, Palazzo Belvedere, Relais Bourgondisch Cruyce, Hotel Da Baixa, Hotel Moresco, Only YOU Boutique Hotel, Elysium Hotel, Others.

As the explicit love hotels are found to be restricted by the zoning laws, the operators based in Europe are repositioning themselves as boutique motels/hourly-stay hotels for complying with regulations at the local level while addressing analogous demand for privacy. Though there is no specified “love hotel” regulation at EU level, such establishments ought to follow stern fire, safety, and health regulations – just like regular hotels (for instance – Construction Products Directive).the EU

Europe’s love hotels are seen competing directly on the basis of price, thereby paving the way for short-term/hourly rates for intimate, private spaces. This, in turn, does provide a low-cost, high-value option in comparison with traditional hotels, particularly for urban, young, and budget-conscious travelers. Increased online booking, which does offer anonymity and flexible, fast, and discounted rates, is visibly raising adoption of love hotels.

The Europe love hotels market is expected to reach USD 4.96 Billion by 2035, growing at a CAGR of 2.87% from 2026 to 2035. The increased short-stay, on-demand models let hotels offer “rest” periods (typically 2-3 hours) or day use, which helps in raising the revenue and addressing those in need of short-term accommodation on an immediate basis.

Spain is anticipated to dominate the market during the forecast period as it has emerged as one of the top travel destinations. Higher influx of tourists (~111 million air travelers recorded in 2025 alone) translates into higher demand for various kinds of accommodation inclusive of boutiques and themed hotels for shorter stays. Also, increased utilization of online booking apps (OTAs), which do offer day- or hourly use bookings, has enabled private, simpler access to such establishments.

With urban living spaces turning out to be smaller with the continuation of multi-generational housing, the couples are asking for discrete, private, and judgment-free spaces for romantic, short-term escapes. The market is thus switching to love rooms with regular suites or hotels getting rebranded with saunas, Jacuzzis, private spas, and romantic themes, which is basically targeting the couples who are seeking to move away from the monotony of life. Also, urban, younger, and affluent demographics are giving priority to Instagram-friendly, experiential, and themed lodging over functional, standard hotel rooms.