Fighter Jet Engine Market Size, Trends and Insights By Type (Jet Engines, Turbine Engines, Ramjet Engines, Scramjet Engines), By Application (Fighter Aircraft, Transport Aircraft, Helicopters, Bombers, Reconnaissance Aircraft, Tanker Aircraft, Unmanned Aerial Vehicles), By Component (Compressor, Combustor, Turbine, Afterburner, Exhaust Nozzle), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Report Snapshot

| Study Period: | 2023-2032 |

| Fastest Growing Market: | Asia-Pacific |

| Largest Market: | Europe |

Major Players

- Pratt & Whitney (United Technologies Corporation)

- General Electric Aviation (General Electric Company)

- Rolls-Royce Holdings PLC

- Safran Aircraft Engines

- Others

Reports Description

As per the current market research conducted by CMI Team, the global Fighter Jet Engine market is expected to record a CAGR of 5.7% from 2023 to 2032. In 2022, the market size is projected to reach a valuation of USD 11.3 billion. By 2032, the valuation is anticipated to reach USD 16.5 billion.

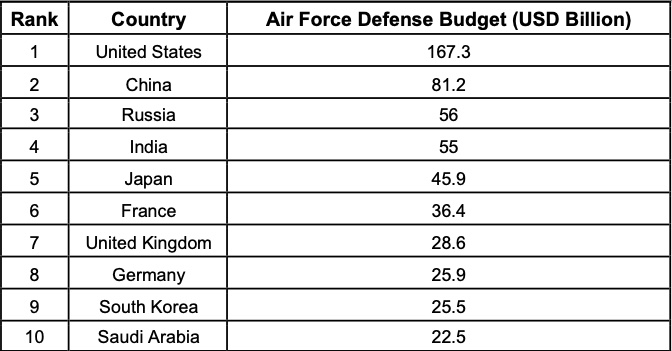

Top 10 Countries With The Highest Air Force Defence Budget In 2021

Source: Stockholm International Peace Research Institute (SIPRI)

The Fighter Jet Engine market refers to the industry involved in designing, developing, manufacturing, and selling engines specifically for fighter aircraft. It includes military and commercial entities that supply and service these engines for defence organizations worldwide.

This market is highly specialized and advanced, influenced by geopolitical factors and defence budgets. It requires extensive research and collaboration with governments and defence contractors. Key trends driving the market include technological advancements for better fuel efficiency, power-to-weight ratios, and durability.

There is also a shift towards electric propulsion systems to reduce emissions and improve efficiency, driven by sustainability concerns.

Fighter Jet Engine Market – Significant Growth Factors

The Fighter Jet Engine market presents significant growth opportunities due to several factors:

- Increasing Defence Expenditure: The rise in defence budgets across various countries presents a significant market driver, as governments allocate funds to modernize and expand their air force capabilities. This creates opportunities for engine manufacturers to meet the growing demand for advanced Fighter Jet Engines.

- Technological Advancements: Ongoing advancements in engine technologies, such as improved fuel efficiency, higher power output, and enhanced durability, drive market growth. Engine manufacturers can capitalize on these advancements by developing innovative solutions that meet the evolving performance requirements of fighter aircraft.

- Geopolitical Tensions and Security Concerns: Heightened geopolitical tensions and security concerns around the world drive the demand for Fighter Jet Engines. Countries strive to maintain air superiority and strengthen their defence capabilities, creating opportunities for engine manufacturers to supply engines for new aircraft procurement programs.

- Fleet Modernization and Upgrades: The need to replace aging fighter jet fleets and upgrade existing aircraft with advanced engines presents a significant market driver. Engine manufacturers can seize the opportunity by offering retrofit solutions and collaborating with defence organizations to enhance the performance and lifespan of fighter aircraft.

- Emerging Markets: Emerging economies, particularly in regions like Asia-Pacific and the Middle East, are witnessing rapid growth in their defence sectors. This opens up new market opportunities for engine manufacturers as these countries invest in advanced fighter aircraft and seek reliable engine suppliers to support their defence modernization efforts.

- Collaborations and Partnerships: Collaborations between engine manufacturers, defence contractors, and governments play a crucial role in the Fighter Jet Engine market. Strategic partnerships can leverage expertise, resources, and technology sharing, leading to joint research and development efforts and expanded market opportunities.

Fighter Jet Engine Market – Mergers and Acquisitions

The Fighter Jet Engine market has seen several mergers and acquisitions in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability. Some notable examples of mergers and acquisitions in the Fighter Jet Engine market include:

- General Electric and Safran: In 2019, General Electric and Safran joined forces to establish a joint venture called CFM International, focusing on commercial aircraft engines. This collaboration aimed to strengthen their position as leading engine suppliers for various aircraft, including fighter jets.

- Pratt & Whitney and Turkish Aerospace Industries: In 2019, Pratt & Whitney signed an agreement with Turkish Aerospace Industries (TAI) to explore collaboration in developing Fighter Jet Engines. The partnership aimed to enhance Turkey’s defence capabilities and advance engine technologies.

- Boeing and Safran: In 2018, Boeing and Safran formed a joint venture called CFM International to develop engines for aircraft. This partnership aimed to combine their expertise and resources to improve engine performance and fuel efficiency.

- Rolls-Royce and Rostec: In 2019, Rolls-Royce and Rostec State Corporation formed a strategic partnership to develop engines for the Russian Chinese CR929 aircraft. This collaboration aimed to meet the increasing demand for advanced engines in the commercial aviation sector.

- Pratt & Whitney and TAI: In 2019, Pratt & Whitney and TAI joined forces to explore opportunities for collaborative development in Fighter Jet Engines. The partnership aimed to combine Pratt & Whitney’s engine expertise with TAI’s defence capabilities, fostering innovation and supporting Turkey’s aerospace industry.

- United Engine Corporation (UEC) and China-Russia Commercial Aircraft International Corporation (CRAIC): In 2019, UEC, a subsidiary of Rostec, and CRAIC signed a cooperation agreement to develop an engine for the jointly produced CR929 wide-body aircraft. This partnership aimed to enhance the technological capabilities of both countries and strengthen their position in the global aerospace market.

These mergers and acquisitions have helped companies expand their product offerings, improve their market presence, and capitalize on growth opportunities in the Fighter Jet Engine market. The trend is expected to continue as companies seek to gain a competitive edge in the market.

COMPARATIVE ANALYSIS OF THE RELATED MARKET

| Fighter Jet Engine market | Military Training Aircraft Market | Military Transport Aircraft Market |

| CAGR 5.7% (Approx) | CAGR 3.28% (Approx) | CAGR 4.8% (Approx) |

| US$ 16.5 billion by 2032 | USD 7.4 Billion by 2030 | USD 45.4 Billion by 2030 |

Fighter Jet Engine Market – Significant Threats

The Fighter Jet Engine market faces several significant threats that could impact its growth and profitability in the future. Some of these threats include:

- Increasing Competitiveness: The Fighter Jet Engine market is highly competitive, with numerous global players vying for contracts and market share. Intense competition poses a threat to existing companies, as they need to continually innovate, invest in research and development, and offer competitive pricing to stay ahead in the market.

- Technological Advances by Competitors: Rapid advancements in engine technologies by competitors can pose a threat to established players in the market. If a competitor introduces a breakthrough engine design or technology, it could disrupt the market dynamics and potentially capture a significant share of contracts and customers.

- Budgetary Constraints: Reductions in defence budgets of various countries can impact the Fighter Jet Engine market. When defence spending is curtailed, it may lead to delays or cancellations of aircraft procurement programs, which directly affects the demand for Fighter Jet Engines.

- Geopolitical Instability: Political and geopolitical tensions can disrupt the market by affecting international trade agreements and collaborations. Trade disputes, sanctions, or changes in diplomatic relations between countries can impact the flow of technology, components, and partnerships, creating uncertainties and challenges for the Fighter Jet Engine market.

Report Scope

| Feature of the Report | Details |

| Market Size in 2023 | USD 11.90 Billion |

| Projected Market Size in 2032 | USD 16.5 Billion |

| Market Size in 2022 | USD 11.3 Billion |

| CAGR Growth Rate | 5.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Application, Component and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Category-Wise Insights

By Type:

- Jet Engines: Jet engines are powerful propulsion systems that generate thrust by expelling fast-moving exhaust gases. In the Fighter Jet Engine market, key trends include improving fuel efficiency, achieving higher power-to-weight ratios, using advanced materials, exploring electric propulsion options, and prioritizing sustainability to reduce emissions and minimize environmental impact.

- Turbine Engines: These are a form of combustion engine that converts fluid energy into mechanical energy. Trends in the Fighter Jet Engine market centre on improving turbine engine technology, such as boosting fuel efficiency, raising power-to-weight ratios, and adding long-lasting and high-performance materials.

- Ramjet Engines: These engines are air-breathing propulsion systems that rely on high-speed airflow for operation. In the Fighter Jet Engine market, the trend revolves around enhancing speed and manoeuvrability, driving the exploration of ramjet engine technology. Advancements in materials, aerodynamics, and fuel efficiency are pursued to optimize the performance of ramjet engines in fighter aircraft.

- Scramjet Engines: Scramjet engines are specialized air-breathing engines designed to propel high-speed vehicles by compressing incoming air before combustion. They eliminate the need for carrying onboard oxidizers. In the Fighter Jet Engine market, there is a growing interest in exploring and developing scramjet engine technology to achieve even higher speeds and enhance performance in hypersonic flight.

By Application:

- Fighter Aircraft: Fighter aircraft are agile military planes designed for air combat. In the Fighter Jet Engine market, trends include advancements in engine performance and efficiency, integration of stealth technology, improved manoeuvrability, and a focus on multi-role capabilities for versatile missions.

- Transport Aircraft: Transport aircraft are used for carrying passengers or cargo. In the Fighter Jet Engine market, trends focus on enhancing fuel efficiency, increasing payload capacity, extending range and endurance, and adopting technologies for quieter and more eco-friendly operations.

- Helicopters: Choppers are vertical take-off and landing aircraft. Trends in the Fighter Jet Engine industry include improvements in engine power and dependability, decreased maintenance requirements, greater fuel efficiency, and the integration of new technology for improved performance, manoeuvrability, and safety.

- Bombers: Bombers are long-range aircraft for strategic bombing missions. In the Fighter Jet Engine market, trends involve developing engines with higher power and range, improved fuel efficiency, stealth capabilities, and the ability to carry various munitions for versatile strike capabilities.

- Reconnaissance Aircraft: Reconnaissance aircraft are used for intelligence gathering and surveillance. In the Fighter Jet Engine market, trends focus on developing engines with extended endurance, enhanced sensors and data processing capabilities, improved fuel efficiency, and reduced radar signature for covert operations.

- Tanker Aircraft: Tanker aircraft provide aerial refuelling capabilities to extend the range and endurance of other aircraft. In the Fighter Jet Engine market, trends include developing engines with higher thrust and fuel efficiency, improved aerial refuelling systems, and advanced technologies for safe and efficient fuel transfer operations.

- Unmanned Aerial Vehicles (UAVs): UAVs, or drones, are remotely piloted or autonomous aircraft. In the Fighter Jet Engine market, trends involve developing lightweight engines with long endurance, improved power-to-weight ratios, advanced control systems, and integration of artificial intelligence for autonomous operations and mission versatility.

By Component:

- Compressor: The compressor is a component in a Fighter Jet Engine that pressurizes and compresses incoming air before entering the combustion chamber. In the market, trends include the development of more efficient and lightweight compressors, often utilizing advanced materials and aerodynamic designs to improve engine performance and fuel efficiency.

- Turbine: The turbine extracts energy from the high-temperature gases produced in the combustion process to drive the compressor and other engine components. In the market, trends include advancements in turbine design, materials, and cooling techniques to increase efficiency, power output, and durability, enabling higher performance and longer engine life.

- Combustor: The combustor is where fuel is mixed with compressed air and ignited, generating high-temperature and high-pressure gases for propulsion. In the Fighter Jet Engine market, trends focus on improving combustion efficiency, reducing emissions, and exploring alternative fuel options to meet stringent environmental regulations and enhance operational capabilities.

- Afterburner: The afterburner is an additional combustion chamber located downstream of the turbine, injecting additional fuel to increase thrust during high-speed operations. In the Fighter Jet Engine market, trends involve optimizing afterburner efficiency and fuel consumption to enhance aircraft acceleration, top speed, and manoeuvrability, while considering the associated increased fuel consumption and exhaust emissions.

- Exhaust Nozzle: The exhaust nozzle directs the flow of hot gases leaving the engine, contributing to thrust, and controlling exhaust characteristics. In the market, trends focus on variable geometry exhaust nozzles, which optimize performance across a wide range of flight conditions, including enhancing manoeuvrability, and stealth capabilities, and reducing infrared signatures. Efforts are also directed towards reducing noise and improving fuel efficiency through nozzle design.

Fighter Jet Engine Market – Regional Analysis

The Fighter Jet Engine market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: The North American market focuses on developing Fighter Jet Engines with improved stealth capabilities to maintain air superiority and counter emerging threats. They also invest in research and development to achieve supersonic and hypersonic speeds for enhanced operational capabilities. Pratt & Whitney, a subsidiary of Raytheon Technologies Corporation, is a leading player known for advanced engine technologies and a strong market presence.

- Europe: Europe emphasizes sustainable aviation by developing Fighter Jet Engines with reduced emissions and improved fuel efficiency to comply with environmental regulations. Collaboration among European countries and various manufacturers and research organizations drives the development of cutting-edge engine technologies. Rolls-Royce Holdings plc, based in the UK, is a major player with high-performance engines and longstanding partnerships with defence organizations.

- Asia-Pacific: The Asia-Pacific region experiences increasing defence budgets, leading to a demand for advanced Fighter Jet Engines to modernize air forces and enhance national security. Countries like China and India focus on indigenous development to reduce reliance on foreign suppliers and strengthen their aerospace industries. Aero Engine Corporation of China (AECC) is a prominent player responsible for developing and manufacturing engines for various military aircraft programs.

- LAMEA: The LAMEA (Latin America, Middle East, and Africa) countries prioritize acquiring advanced Fighter Jet Engines to address regional security challenges and protect their airspace. Military modernization programs in the Middle East and Africa contribute to the increased demand for state-of-the-art Fighter Jet Engines. Israel Aerospace Industries (IAI) is a key player known for its expertise in aerospace technologies and advanced engine production for combat aircraft.

Competitive Landscape – Fighter Jet Engine market

The Fighter Jet Engine market is highly competitive, with a large number of manufacturers and retailers operating globally. Some of the key players in the market include:

- Pratt & Whitney (United Technologies Corporation)

- General Electric Aviation (General Electric Company)

- Rolls-Royce Holdings PLC

- Safran Aircraft Engines

- Eurojet Turbo GmbH

- Klimov Design Bureau (United Engine Corporation)

- Honeywell Aerospace

- MTU Aero Engines AG

- Snecma (Safran Group)

- Ishikawajima-Harima Heavy Industries Co. Ltd. (IHI Corporation)

- Others

These companies operate in the market through various strategies such as product innovation, mergers and acquisitions, and partnerships. For example, In 2022, General Electric (GE) and Safran announced a partnership to develop and produce the engine for a new military aircraft program.

This collaboration aims to leverage GE’s expertise in engine technology and Safran’s capabilities in aircraft design to deliver a highly advanced and efficient engine solution for the program, enhancing its performance and operational capabilities.

The market is also witnessing the entry of several new players, such as Aero Engine Corporation of China (AECC) and Hindustan Aeronautics Limited (HAL) have adopted innovation and development to enter the Fighter Jet Engine market.

AECC has made significant strides in developing advanced engines for military aircraft programs, leveraging indigenous capabilities to reduce reliance on foreign suppliers.

HAL, based in India, has also ventured into the Fighter Jet Engine market with its indigenous development programs. Key players dominating the market include Rolls-Royce Holdings plc, Pratt & Whitney (a subsidiary of Raytheon Technologies Corporation), and General Electric.

These companies have established themselves as leaders through their extensive experience, strong market presence, and cutting-edge engine technologies. They have secured long-term contracts with defense organizations, maintained strategic partnerships, and consistently delivered high-performance engines that meet the demanding requirements of modern fighter jets.

The Fighter Jet Engine Market is segmented as follows:

By Type

- Jet Engines

- Turbine Engines

- Ramjet Engines

- Scramjet Engines

By Application

- Fighter Aircraft

- Transport Aircraft

- Helicopters

- Bombers

- Reconnaissance Aircraft

- Tanker Aircraft

- Unmanned Aerial Vehicles

By Component

- Compressor

- Combustor

- Turbine

- Afterburner

- Exhaust Nozzle

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Fighter Jet Engine Market, (2024 – 2033) (USD Billion)

- 2.2 Global Fighter Jet Engine Market : snapshot

- Chapter 3. Global Fighter Jet Engine Market – Industry Analysis

- 3.1 Fighter Jet Engine Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Increasing Defence Expenditure

- 3.2.2 Technological Advancements

- 3.2.3 Geopolitical Tensions and Security Concerns

- 3.2.4 Fleet Modernization and Upgrades

- 3.2.5 Emerging Markets

- 3.2.6 Collaborations and Partnerships.

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porters Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Type

- 3.7.2 Market attractiveness analysis By Application

- 3.7.3 Market attractiveness analysis By Component

- Chapter 4. Global Fighter Jet Engine Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Fighter Jet Engine Market: company market share, 2022

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Fighter Jet Engine Market – Type Analysis

- 5.1 Global Fighter Jet Engine Market overview: By Type

- 5.1.1 Global Fighter Jet Engine Market share, By Type, 2022 and – 2033

- 5.2 Jet Engines

- 5.2.1 Global Fighter Jet Engine Market by Jet Engines, 2024 – 2033 (USD Billion)

- 5.3 Turbine Engines

- 5.3.1 Global Fighter Jet Engine Market by Turbine Engines, 2024 – 2033 (USD Billion)

- 5.4 Ramjet Engines

- 5.4.1 Global Fighter Jet Engine Market by Ramjet Engines, 2024 – 2033 (USD Billion)

- 5.5 Scramjet Engines

- 5.5.1 Global Fighter Jet Engine Market by Scramjet Engines, 2024 – 2033 (USD Billion)

- 5.1 Global Fighter Jet Engine Market overview: By Type

- Chapter 6. Global Fighter Jet Engine Market – Application Analysis

- 6.1 Global Fighter Jet Engine Market overview: By Application

- 6.1.1 Global Fighter Jet Engine Market share, By Application, 2022 and – 2033

- 6.2 Fighter Aircraft

- 6.2.1 Global Fighter Jet Engine Market by Fighter Aircraft, 2024 – 2033 (USD Billion)

- 6.3 Transport Aircraft

- 6.3.1 Global Fighter Jet Engine Market by Transport Aircraft, 2024 – 2033 (USD Billion)

- 6.4 Helicopters

- 6.4.1 Global Fighter Jet Engine Market by Helicopters, 2024 – 2033 (USD Billion)

- 6.5 Bombers

- 6.5.1 Global Fighter Jet Engine Market by Bombers, 2024 – 2033 (USD Billion)

- 6.6 Reconnaissance Aircraft

- 6.6.1 Global Fighter Jet Engine Market by Reconnaissance Aircraft , 2024 – 2033 (USD Billion)

- 6.7 Tanker Aircraft

- 6.7.1 Global Fighter Jet Engine Market by Tanker Aircraft, 2024 – 2033 (USD Billion)

- 6.8 Unmanned Aerial Vehicles

- 6.8.1 Global Fighter Jet Engine Market by Unmanned Aerial Vehicles, 2024 – 2033 (USD Billion)

- 6.1 Global Fighter Jet Engine Market overview: By Application

- Chapter 7. Global Fighter Jet Engine Market – Component Analysis

- 7.1 Global Fighter Jet Engine Market overview: By Component

- 7.1.1 Global Fighter Jet Engine Market share, By Component, 2022 and – 2033

- 7.2 Compressor

- 7.2.1 Global Fighter Jet Engine Market by Compressor, 2024 – 2033 (USD Billion)

- 7.3 Combustor

- 7.3.1 Global Fighter Jet Engine Market by Combustor, 2024 – 2033 (USD Billion)

- 7.4 Turbine

- 7.4.1 Global Fighter Jet Engine Market by Turbine, 2024 – 2033 (USD Billion)

- 7.5 Afterburner

- 7.5.1 Global Fighter Jet Engine Market by Afterburner, 2024 – 2033 (USD Billion)

- 7.6 Exhaust Nozzle

- 7.6.1 Global Fighter Jet Engine Market by Exhaust Nozzle, 2024 – 2033 (USD Billion)

- 7.1 Global Fighter Jet Engine Market overview: By Component

- Chapter 8. Fighter Jet Engine’s Market – Regional Analysis

- 8.1 Global Fighter Jet Engine’s Market Regional Overview

- 8.2 Global Fighter Jet Engine’s Market Share, by Region, 2022 & – 2033 (USD Billion)

- 8.3. North America

- 8.3.1 North America Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.3.1.1 North America Fighter Jet Engine’s Market, by Country, 2024 – 2033 (USD Billion)

- 8.3.1 North America Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.4 North America Fighter Jet Engine’s Market, by Type, 2024 – 2033

- 8.4.1 North America Fighter Jet Engine’s Market, by Type, 2024 – 2033 (USD Billion)

- 8.5 North America Fighter Jet Engine’s Market, by Application, 2024 – 2033

- 8.5.1 North America Fighter Jet Engine’s Market, by Application, 2024 – 2033 (USD Billion)

- 8.6 North America Fighter Jet Engine’s Market, by Component, 2024 – 2033

- 8.6.1 North America Fighter Jet Engine’s Market, by Component, 2024 – 2033 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.7.1.1 Europe Fighter Jet Engine’s Market, by Country, 2024 – 2033 (USD Billion)

- 8.7.1 Europe Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.8 Europe Fighter Jet Engine’s Market, by Type, 2024 – 2033

- 8.8.1 Europe Fighter Jet Engine’s Market, by Type, 2024 – 2033 (USD Billion)

- 8.9 Europe Fighter Jet Engine’s Market, by Application, 2024 – 2033

- 8.9.1 Europe Fighter Jet Engine’s Market, by Application, 2024 – 2033 (USD Billion)

- 8.10 Europe Fighter Jet Engine’s Market, by Component, 2024 – 2033

- 8.10.1 Europe Fighter Jet Engine’s Market, by Component, 2024 – 2033 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.11.1.1 Asia Pacific Fighter Jet Engine’s Market, by Country, 2024 – 2033 (USD Billion)

- 8.11.1 Asia Pacific Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.12 Asia Pacific Fighter Jet Engine’s Market, by Type, 2024 – 2033

- 8.12.1 Asia Pacific Fighter Jet Engine’s Market, by Type, 2024 – 2033 (USD Billion)

- 8.13 Asia Pacific Fighter Jet Engine’s Market, by Application, 2024 – 2033

- 8.13.1 Asia Pacific Fighter Jet Engine’s Market, by Application, 2024 – 2033 (USD Billion)

- 8.14 Asia Pacific Fighter Jet Engine’s Market, by Component, 2024 – 2033

- 8.14.1 Asia Pacific Fighter Jet Engine’s Market, by Component, 2024 – 2033 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.15.1.1 Latin America Fighter Jet Engine’s Market, by Country, 2024 – 2033 (USD Billion)

- 8.15.1 Latin America Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.16 Latin America Fighter Jet Engine’s Market, by Type, 2024 – 2033

- 8.16.1 Latin America Fighter Jet Engine’s Market, by Type, 2024 – 2033 (USD Billion)

- 8.17 Latin America Fighter Jet Engine’s Market, by Application, 2024 – 2033

- 8.17.1 Latin America Fighter Jet Engine’s Market, by Application, 2024 – 2033 (USD Billion)

- 8.18 Latin America Fighter Jet Engine’s Market, by Component, 2024 – 2033

- 8.18.1 Latin America Fighter Jet Engine’s Market, by Component, 2024 – 2033 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Fighter Jet Engine’s Market, by Country, 2024 – 2033 (USD Billion)

- 8.19.1 The Middle-East and Africa Fighter Jet Engine’s Market, 2024 – 2033 (USD Billion)

- 8.20 The Middle-East and Africa Fighter Jet Engine’s Market, by Type, 2024 – 2033

- 8.20.1 The Middle-East and Africa Fighter Jet Engine’s Market, by Type, 2024 – 2033 (USD Billion)

- 8.21 The Middle-East and Africa Fighter Jet Engine’s Market, by Application, 2024 – 2033

- 8.21.1 The Middle-East and Africa Fighter Jet Engine’s Market, by Application, 2024 – 2033 (USD Billion)

- 8.22 The Middle-East and Africa Fighter Jet Engine’s Market, by Component, 2024 – 2033

- 8.22.1 The Middle-East and Africa Fighter Jet Engine’s Market, by Component, 2024 – 2033 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 Pratt & Whitney (United Technologies Corporation)

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 General Electric Aviation (General Electric Company)

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 Rolls-Royce Holdings PLC

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 Safran Aircraft Engines

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 Eurojet Turbo GmbH

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 Klimov Design Bureau (United Engine Corporation)

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Honeywell Aerospace

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 MTU Aero Engines AG

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 Snecma (Safran Group)

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 Ishikawajima-Harima Heavy Industries Co. Ltd. (IHI Corporation)

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 Others.

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.1 Pratt & Whitney (United Technologies Corporation)

List Of Figures

Figures No 1 to 32

List Of Tables

Tables No 1 to 77

Report Methodology

In order to get the most precise estimates and forecasts possible, Custom Market Insights applies a detailed and adaptive research methodology centered on reducing deviations. For segregating and assessing quantitative aspects of the market, the company uses a combination of top-down and bottom-up approaches. Furthermore, data triangulation, which examines the market from three different aspects, is a recurring theme in all of our research reports. The following are critical components of the methodology used in all of our studies:

Preliminary Data Mining

On a broad scale, raw market information is retrieved and compiled. Data is constantly screened to make sure that only substantiated and verified sources are taken into account. Furthermore, data is mined from a plethora of reports in our archive and also a number of reputed & reliable paid databases. To gain a detailed understanding of the business, it is necessary to know the entire product life cycle and to facilitate this, we gather data from different suppliers, distributors, and buyers.

Surveys, technological conferences, and trade magazines are used to identify technical issues and trends. Technical data is also gathered from the standpoint of intellectual property, with a focus on freedom of movement and white space. The dynamics of the industry in terms of drivers, restraints, and valuation trends are also gathered. As a result, the content created contains a diverse range of original data, which is then cross-validated and verified with published sources.

Statistical Model

Simulation models are used to generate our business estimates and forecasts. For each study, a one-of-a-kind model is created. Data gathered for market dynamics, the digital landscape, development services, and valuation patterns are fed into the prototype and analyzed concurrently. These factors are compared, and their effect over the projected timeline is quantified using correlation, regression, and statistical modeling. Market forecasting is accomplished through the use of a combination of economic techniques, technical analysis, industry experience, and domain knowledge.

Short-term forecasting is typically done with econometric models, while long-term forecasting is done with technological market models. These are based on a synthesis of the technological environment, legal frameworks, economic outlook, and business regulations. Bottom-up market evaluation is favored, with crucial regional markets reviewed as distinct entities and data integration to acquire worldwide estimates. This is essential for gaining a thorough knowledge of the industry and ensuring that errors are kept to a minimum.

Some of the variables taken into account for forecasting are as follows:

• Industry drivers and constraints, as well as their current and projected impact

• The raw material case, as well as supply-versus-price trends

• Current volume and projected volume growth through 2030

We allocate weights to these variables and use weighted average analysis to determine the estimated market growth rate.

Primary Validation

This is the final step in our report’s estimating and forecasting process. Extensive primary interviews are carried out, both in-person and over the phone, to validate our findings and the assumptions that led to them.

Leading companies from across the supply chain, including suppliers, technology companies, subject matter experts, and buyers, use techniques like interviewing to ensure a comprehensive and non-biased overview of the business. These interviews are conducted all over the world, with the help of local staff and translators, to overcome language barriers.

Primary interviews not only aid with data validation, but also offer additional important insight into the industry, existing business scenario, and future projections, thereby improving the quality of our reports.

All of our estimates and forecasts are validated through extensive research work with key industry participants (KIPs), which typically include:

• Market leaders

• Suppliers of raw materials

• Suppliers of raw materials

• Buyers.

The following are the primary research objectives:

• To ensure the accuracy and acceptability of our data.

• Gaining an understanding of the current market and future projections.

Data Collection Matrix

| Perspective | Primary research | Secondary research |

| Supply-side |

|

|

| Demand-side |

|

|

Market Analysis Matrix

| Qualitative analysis | Quantitative analysis |

|

|

Prominent Player

- Pratt & Whitney (United Technologies Corporation)

- General Electric Aviation (General Electric Company)

- Rolls-Royce Holdings PLC

- Safran Aircraft Engines

- Eurojet Turbo GmbH

- Klimov Design Bureau (United Engine Corporation)

- Honeywell Aerospace

- MTU Aero Engines AG

- Snecma (Safran Group)

- Ishikawajima-Harima Heavy Industries Co. Ltd. (IHI Corporation)

- Others

FAQs

“North America” region will lead the Global Fighter Jet Engine Market during the forecast period 2023 to 2032.

The key factors driving the Market are Increasing Defence Expenditure, Technological Advancements, Geopolitical Tensions and Security Concerns, Fleet Modernization and Upgrades, Emerging Markets And Collaborations and Partnerships.

The key players operating in the Fighter Jet Engine Market are Pratt & Whitney (United Technologies Corporation), General Electric Aviation (General Electric Company), Rolls-Royce Holdings PLC, Safran Aircraft Engines, Eurojet Turbo GmbH, Klimov Design Bureau (United Engine Corporation), Honeywell Aerospace, MTU Aero Engines AG, Snecma (Safran Group), Ishikawajima-Harima Heavy Industries Co. Ltd. (IHI Corporation), Others.

The Global Fighter Jet Engine Market is expanding growth with a CAGR of approximately 5.7% during the forecast period (2023 to 2032).

The Global Fighter Jet Engine Market size was valued at USD 11.3 Billion in 2022 and it is projected to reach around USD 16.5 Billion by 2032.