Metal Tank Market Size, Trends and Insights By End Use Industry (Oil and gas, Industrial, Municipal, Others), By Application (Fuel, Water & Wastewater, Fire Protection, Industrial, Food and Beverage, Paper and Pulp, Others), By Size (Below 5,000 Gallons, 5,000 to 25,000 Gallons, Over 25,000 Gallons), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Report Code: CMI24284

Category: Machinery & Equipment

Report Snapshot

Source: CMI

| Study Period: | 2023-2032 |

| Fastest Growing Market: | Asia-Pacific |

| Largest Market: | Europe |

Major Players

- CST Industries Inc.

- Highland Tank & Manufacturing Company Inc.

- Superior Tank Co. Inc.

- Tanks Direct Ltd.

- Others

Reports Description

As per the current market research conducted by CMI Market Research Team, the global Metal Tank market is expected to record a CAGR of 4.1% from 2023 to 2032. In 2022, the market size is projected to reach a valuation of USD 8.12 billion. By 2032, the valuation is anticipated to reach USD 14.3 billion.

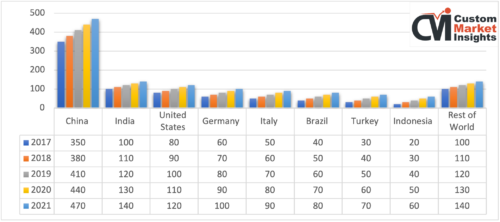

According to CMI Market Research Analysis (Approx)

According to CMI Market Research Analysis (Approx)

The metal tank market encompasses the industry involved in producing, distributing, and selling tanks made of metal for storing and containing various substances. It offers a diverse range of tank sizes, shapes, and materials to meet specific storage requirements across sectors like oil and gas, water treatment, chemicals, and food and beverage.

The market is competitive, with companies competing by introducing innovative designs, advanced materials, and customized solutions. Key trends in the market include a focus on sustainability, compliance with environmental regulations, advancements in tank technology, customization to meet industry needs, and the adoption of digital solutions for remote monitoring and control of tanks.

Metal Tank Market – Significant Growth Factors

The Metal Tank Market presents significant growth opportunities due to several factors:

- Increasing Demand for Sustainable Solutions: Environmental concerns and laws are driving an increase in demand for sustainable storage solutions. Metal tanks are considered environmentally benign because of their longevity, recyclability, and corrosion resistance. This trend provides an opportunity for manufacturers to provide sustainable metal tank options and capitalise on market demand for environmentally friendly storage solutions.

- Technological Advancements in Tank Design: The metal tank industry is witnessing advancements in tank design, materials, and manufacturing processes. This includes innovations in coating technologies, improved insulation, and the integration of IoT (Internet of Things) capabilities for remote monitoring and control. These technological advancements enhance tank performance, increase efficiency, and provide real-time data for optimized operations.

- Growing Adoption of Customized Solutions: Various industries have specific storage requirements, necessitating customized tank solutions. Metal tank manufacturers are focusing on providing tailored products that meet the unique needs of different sectors, such as food and beverage, oil and gas, and water treatment. Offering customized solutions allows companies to cater to niche markets and strengthen customer satisfaction and loyalty.

- Expansion in Emerging Markets: Rapid industrialization and infrastructure development in emerging markets present significant growth opportunities for the metal tank market. These regions experience increased demand for storage solutions in sectors like energy, water treatment, and manufacturing. Companies that can establish a presence and offer reliable and cost-effective metal tank solutions in these markets can benefit from the growing opportunities.

- Emphasis on Safety and Compliance: Strict safety regulations and standards regarding the storage and containment of hazardous substances drive the demand for high-quality metal tanks. Manufacturers that focus on producing tanks that comply with safety standards and provide robust containment solutions have a competitive advantage in the market. Emphasizing safety and compliance helps build trust among customers and enhances market presence.

Metal Tank Market – Mergers and Acquisitions

The Metal Tank Market has seen several mergers and acquisitions in recent years, with companies seeking to expand their market presence and leverage synergies to improve their product offerings and profitability. Some notable examples of mergers and acquisitions in the Metal Tank Market include:

- CST Industries Inc. partnership with Petersen Aluminum Corporation: In 2020, CST Industries, a leading manufacturer of storage tanks, entered into a partnership with Petersen Aluminum Corporation to expand its product offerings and enhance its presence in the metal tank market.

- Highland Tank & Manufacturing Company Inc. acquires Mid Atlantic Tank: In 2019, Highland Tank, a prominent tank manufacturer, completed the acquisition of Mid Atlantic Tank to strengthen its market position and expand its customer base in the Mid-Atlantic region.

- Assmann Corporation of America partners with Snyder Industrie: In 2018, Assmann Corporation, specializing in polyethylene tanks, established a strategic partnership with Snyder Industries, a manufacturer of plastic tanks and containers. This collaboration aimed to leverage each other’s expertise and broaden their product portfolios.

- Tarsco Bolted Tank, a TF Warren Company, acquires Globaltherm: In 2017, Tarsco Bolted Tank, a division of TF Warren Company, acquired Globaltherm, a leader in the design and manufacturing of storage tank insulation systems. This acquisition enabled Tarsco Bolted Tank to provide comprehensive solutions for insulated storage tanks.

- Permastore Limited and Xerxes Corporation form a strategic alliance: In 2016, Permastore, a renowned manufacturer of glass-fused-to-steel tanks, entered into a strategic alliance with Xerxes Corporation, a subsidiary of ZCL Composites. This partnership aimed to combine Permastore’s expertise in glass-fused-to-steel technology with Xerxes’ fiberglass-reinforced plastic tank solutions, expanding their product offerings and market reach.

These partnerships and acquisitions have helped companies expand their product offerings, improve their market presence, and capitalize on growth opportunities in the Metal Tank Market. The trend is expected to continue as companies seek to gain a competitive edge in the market.

COMPARATIVE ANALYSIS OF THE RELATED MARKET

| Metal Tank Market | ISO Tank Container Market | Outdoor Storage Sheds Market |

| CAGR 4.1% (Approx) | CAGR 5% (Approx) | CAGR 6% (Approx) |

| US$ 14.3 Billion by 2032 | USD 325 Million by 2030 | USD 10.2 Billion by 2030 |

Metal Tank Market – Significant Threats

The Metal Tank Market faces several significant threats that could impact its growth and profitability in the future. Some of these threats include:

- Intense Competition: The metal tank market is highly competitive, with many manufacturers and suppliers vying for market share. This results in pricing pressures and reduced profit margins for companies. To stay ahead of competitors, companies must differentiate themselves through product innovation, quality, and excellent customer service.

- Volatile Raw Material Prices: Metal tanks require materials such as steel and aluminium, which are subject to fluctuations in global commodity markets. Sharp increases in raw material prices can negatively impact manufacturing costs and profit margins for metal tank manufacturers. Effective supply chain management and strategic sourcing are crucial to mitigate risks associated with volatile raw material prices.

- Regulatory Compliance: Metal tank manufacturers must follow tight standards governing the design, production, and installation of tanks, particularly those used to store dangerous substances. Noncompliance can result in fines, penalties, and damage to one’s reputation. Staying updated on evolving regulations and investing in robust quality control and compliance management systems are essential to ensure regulatory compliance.

- Substitution by Alternative Materials: Alternative materials like fiberglass-reinforced plastic (FRP) and polyethylene tanks pose a threat to the metal tank market. These materials provide benefits like corrosion resistance, lightweight construction, and ease of installation. To counteract this threat, metal tank makers must emphasise the distinct advantages of metal tanks, such as their durability, strength, and long-term reliability in a variety of applications.

Report Scope

| Feature of the Report | Details |

| Market Size in 2023 | USD 8.8 Billion |

| Projected Market Size in 2032 | USD 14.3 Billion |

| Market Size in 2022 | USD 8.12 Billion |

| CAGR Growth Rate | 4.1% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By End Use Industry, Application, Size and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Category-Wise Insights

By End Use Industry:

- Oil and gas: The oil and gas industry relies on metal tanks for the storage and transportation of various products, including crude oil, petroleum products, and natural gas. In the metal tank market, the trends in the oil and gas sector include increasing demand for large-capacity storage tanks, advancements in tank technology for enhanced safety and efficiency, and the integration of digital monitoring systems for real-time data analysis and remote operations.

- Industrial: The metal tank market serves various industries for storage and containment purposes. Key end-use industrial sectors include manufacturing, oil and gas, chemicals, water treatment, and food and beverage. Trends in the metal tank market include increased demand for sustainable solutions, customization to industry needs, technological advancements, and compliance with stringent regulations for safety and environmental protection.

- Municipal: In the metal tank market, the term “municipal” refers to the use of metal tanks in applications related to local government or public services. This includes storage and containment of water for municipal water supply, wastewater treatment, stormwater management, and other infrastructure projects. The trend in the municipal sector involves the adoption of advanced metal tanks for efficient and sustainable water management and infrastructure development.

- Others: By end use, the metal tank market serves various industries such as water treatment, chemicals, food and beverage, and more. Key trends in the market include a growing emphasis on sustainability, technological advancements in tank design, increasing demand for customized solutions, and compliance with stringent regulations regarding the storage and containment of hazardous substances.

By Application

- Fuel: Fuel storage is an important application area within the metal tank market, with tanks built to securely store and contain a variety of fuels such as petrol, diesel and aviation fuel. A greater emphasis on safety regulations, enhanced monitoring systems, and the use of environmentally friendly technology to reduce emissions and maintain compliance with regulatory standards are notable trends in this sector.

- Water & Wastewater: The water and wastewater segment of the metal tank market involves the use of metal tanks for storing and containing water and wastewater in different industries and municipal systems. Key trends in this area encompass an increasing demand for sustainable water management solutions, the adoption of advanced treatment technologies, and a strong focus on meeting stringent water quality regulations.

- Fire Protection: Fire protection, another application in the metal tank market, entails the use of metal tanks to store water or fire suppression agents for firefighting purposes. Market trends include the implementation of advanced fire protection systems, a rise in fire safety regulations, demand for customized tank solutions, and the integration of digital technologies for remote monitoring and control.

- Industrial: The industrial use of metal tanks in the market pertains to their storage and containment applications in various sectors, such as oil and gas, chemicals, water treatment, and manufacturing. Noteworthy trends within this category include an increasing emphasis on sustainability practices, technological advancements to enhance efficiency, customized solutions tailored to industry-specific requirements, and strict compliance with regulations for storing hazardous substances.

- Food and Beverage: The food and beverage industry extensively relies on metal tanks for the storage and processing of ingredients, additives, and finished products. Key trends in this segment involve the demand for food-grade metal tanks, customization to meet specific industry needs, and the integration of advanced technologies to improve hygiene and operational efficiency.

- Paper and Pulp: In the metal tank market, tanks are also utilized in the paper and pulp industry for storing chemicals, water, and various fluids used in the manufacturing process. Notable trends in this sector include the demand for corrosion-resistant tanks, customized solutions for different chemicals, and tanks designed to meet specific industry standards and regulations.

- Others: The “others” category in the metal tank market encompasses applications outside specific sectors such as oil and gas, water treatment, or chemical storage. This includes diverse industries like agriculture, pharmaceuticals, and construction. Trends in this segment revolve around customized tank solutions, an increasing focus on sustainability practices, and technological advancements tailored to meet specific industry requirements.

By Size:

- Below 5,000 Gallons: Metal tanks in the category of fewer than 5,000 gallons refer to tanks with a capacity below 5,000 gallons. In this segment, the metal tank market is witnessing trends like growing demand from residential and small-scale commercial applications, a focus on compact and space-efficient designs, and the integration of advanced technologies for improved performance and easy installation.

- 5,000 to 25,000 Gallons: Metal tanks ranging from 5,000 to 25,000 gallons are commonly used for medium-sized storage needs in various industries. The trends in this segment include an increasing demand for customized solutions, an emphasis on durability and resistance to corrosion, and the adoption of advanced coating technologies for better performance and longer lifespan.

- Over 25,000 Gallons: For tanks exceeding 25,000 gallons, they fall into the category of large-sized tanks in the metal tank market. The trend in this segment shows a rising demand from industries like oil and gas, water treatment, and chemical storage. These large tanks offer ample storage capacity and cater to the requirements of industries with higher storage needs.

Metal Tank Market – Regional Analysis

The Metal Tank Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: There is a movement towards sustainable practises in North America, which is increasing demand for eco-friendly metal tanks that are recyclable and have a low environmental impact. The application of sophisticated coating technologies for metal tanks is increasing in North America, improving corrosion resistance, longevity, and overall performance. The rise of the oil and gas industry in North America is driving the metal tank market, creating a demand for storage solutions to handle increased production and distribution activities.

- Europe: In Europe, there is a strong emphasis on energy efficiency, driving the demand for metal tanks with insulation capabilities to reduce heat loss and optimize energy consumption. Due to outstanding corrosion resistance, cleanliness features, and appropriateness for holding a wide range of liquids, including food and beverages, stainless steel tanks are becoming increasingly popular in Europe. The rising water treatment industry is driving the metal tank market in Europe, creating a demand for tanks to store and treat water for a variety of uses, including municipal and industrial.

- Asia-Pacific: The Asia-Pacific region is experiencing rapid industrialization and urbanization, driving the demand for metal tanks in sectors such as manufacturing, construction, and infrastructure development. With increasing awareness about water conservation, there is a growing trend in Asia-Pacific towards rainwater harvesting systems, boosting the demand for metal tanks used for rainwater collection and storage. Asia-Pacific is witnessing advancements in manufacturing techniques and materials used in metal tank production, leading to improved tank designs, higher durability, and increased adoption of innovative solutions.

- LAMEA: The LAMEA region is witnessing significant infrastructure development, including the construction of power plants, water treatment facilities, and transportation networks, driving the demand for metal tanks for storage and containment purposes. LAMEA has rich oil and gas reserves, and the market for metal tanks is influenced by the expansion of exploration, production, and refining activities in the region. The metal tank market in LAMEA is characterized by a demand for customized solutions that can accommodate specific requirements, such as extreme weather conditions, unique storage needs, or compliance with local regulations.

Competitive Landscape – Metal Tank Market

The Metal Tank Market is highly competitive, with a large number of manufacturers and retailers operating globally. Some of the key players in the market include:

- CST Industries Inc.

- Highland Tank & Manufacturing Company Inc.

- Superior Tank Co. Inc.

- Tanks Direct Ltd.

- Assmann Corporation of America

- Tarsco Bolted Tank (a TF Warren Company)

- Permastore Limited

- GSC Tanks

- Norwesco Industries

- Hamilton Tanks LLC

- Others

These companies operate in the market through various strategies such as product innovation, mergers and acquisitions, and partnerships. For example, in 2022, CST Industries, Inc. forged a partnership with Petersen Aluminum Corporation in 2020.

This strategic alliance aimed to broaden CST Industries’ range of products and strengthen its position in the metal tank market. By leveraging the expertise and resources of Petersen Aluminum Corporation, CST Industries aimed to enhance its product offerings and provide customers with innovative and reliable storage tank solutions.

Several new players have entered the metal tank market by adopting innovative approaches and focusing on development. These companies have introduced advanced manufacturing techniques, incorporated cutting-edge materials, and emphasized product customization to meet evolving customer demands.

They have also invested in research and development to enhance tank designs, improve performance, and ensure compliance with industry standards. These new players are gaining recognition for their innovative solutions and are gradually establishing their presence in the competitive metal tank market. Key players in the metal tank market have achieved market domination through various factors.

The Metal Tank Market is segmented as follows:

By End Use Industry

- Oil and gas

- Industrial

- Municipal

- Others

By Application

- Fuel

- Water & Wastewater

- Fire Protection

- Industrial

- Food and Beverage

- Paper and Pulp

- Others

By Size

- Below 5,000 Gallons

- 5,000 to 25,000 Gallons

- Over 25,000 Gallons

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Metal Tank Market, (2024 – 2033) (USD Billion)

- 2.2 Global Metal Tank Market : snapshot

- Chapter 3. Global Metal Tank Market – Industry Analysis

- 3.1 Metal Tank Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Increasing Demand for Sustainable Solutions

- 3.2.2 Technological Advancements in Tank Design

- 3.2.3 Growing Adoption of Customized Solutions

- 3.2.4 Expansion in Emerging Markets

- 3.2.5 Emphasis on Safety and Compliance.

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porters Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By End Use Industry

- 3.7.2 Market attractiveness analysis By Application

- 3.7.3 Market attractiveness analysis By Size

- Chapter 4. Global Metal Tank Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Metal Tank Market: company market share, 2022

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, cullaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Metal Tank Market – End Use Industry Analysis

- 5.1 Global Metal Tank Market overview: By End Use Industry

- 5.1.1 Global Metal Tank Market share, By End Use Industry, 2022 and – 2033

- 5.2 Oil and gas

- 5.2.1 Global Metal Tank Market by Oil and gas, 2024 – 2033 (USD Billion)

- 5.3 Industrial

- 5.3.1 Global Metal Tank Market by Industrial, 2024 – 2033 (USD Billion)

- 5.4 Municipal

- 5.4.1 Global Metal Tank Market by Municipal , 2024 – 2033 (USD Billion)

- 5.5 Others

- 5.5.1 Global Metal Tank Market by Others, 2024 – 2033 (USD Billion)

- 5.1 Global Metal Tank Market overview: By End Use Industry

- Chapter 6. Global Metal Tank Market – Application Analysis

- 6.1 Global Metal Tank Market overview: By Application

- 6.1.1 Global Metal Tank Market share, By Application, 2022 and – 2033

- 6.2 Fuel

- 6.2.1 Global Metal Tank Market by Fuel, 2024 – 2033 (USD Billion)

- 6.3 Water & Wastewater

- 6.3.1 Global Metal Tank Market by Water & Wastewater, 2024 – 2033 (USD Billion)

- 6.4 Fire Protection

- 6.4.1 Global Metal Tank Market by Fire Protection, 2024 – 2033 (USD Billion)

- 6.5 Industrial

- 6.5.1 Global Metal Tank Market by Industrial, 2024 – 2033 (USD Billion)

- 6.6 Food and Beverage

- 6.6.1 Global Metal Tank Market by Food and Beverage, 2024 – 2033 (USD Billion)

- 6.7 Paper and Pulp

- 6.7.1 Global Metal Tank Market by Paper and Pulp, 2024 – 2033 (USD Billion)

- 6.8 Others

- 6.8.1 Global Metal Tank Market by Others, 2024 – 2033 (USD Billion)

- 6.1 Global Metal Tank Market overview: By Application

- Chapter 7. Global Metal Tank Market – Size Analysis

- 7.1 Global Metal Tank Market overview: By Size

- 7.1.1 Global Metal Tank Market share, By Size, 2022 and – 2033

- 7.2 Below 5,000 Gallons

- 7.2.1 Global Metal Tank Market by Below 5,000 Gallons , 2024 – 2033 (USD Billion)

- 7.3 5,000 to 25,000 Gallons

- 7.3.1 Global Metal Tank Market by 5,000 to 25,000 Gallons, 2024 – 2033 (USD Billion)

- 7.4 Over 25,000 Gallons

- 7.4.1 Global Metal Tank Market by Over 25,000 Gallons, 2024 – 2033 (USD Billion)

- 7.1 Global Metal Tank Market overview: By Size

- Chapter 8. Metal Tank Market – Regional Analysis

- 8.1 Global Metal Tank Market Regional Overview

- 8.2 Global Metal Tank Market Share, by Region, 2022 & – 2033 (USD Billion)

- 8.3. North America

- 8.3.1 North America Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.3.1.1 North America Metal Tank Market, by Country, 2024 – 2033 (USD Billion)

- 8.3.1 North America Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.4 North America Metal Tank Market, by End Use Industry, 2024 – 2033

- 8.4.1 North America Metal Tank Market, by End Use Industry, 2024 – 2033 (USD Billion)

- 8.5 North America Metal Tank Market, by Application, 2024 – 2033

- 8.5.1 North America Metal Tank Market, by Application, 2024 – 2033 (USD Billion)

- 8.6 North America Metal Tank Market, by Size, 2024 – 2033

- 8.6.1 North America Metal Tank Market, by Size, 2024 – 2033 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.7.1.1 Europe Metal Tank Market, by Country, 2024 – 2033 (USD Billion)

- 8.7.1 Europe Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.8 Europe Metal Tank Market, by End Use Industry, 2024 – 2033

- 8.8.1 Europe Metal Tank Market, by End Use Industry, 2024 – 2033 (USD Billion)

- 8.9 Europe Metal Tank Market, by Application, 2024 – 2033

- 8.9.1 Europe Metal Tank Market, by Application, 2024 – 2033 (USD Billion)

- 8.10 Europe Metal Tank Market, by Size, 2024 – 2033

- 8.10.1 Europe Metal Tank Market, by Size, 2024 – 2033 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.11.1.1 Asia Pacific Metal Tank Market, by Country, 2024 – 2033 (USD Billion)

- 8.11.1 Asia Pacific Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.12 Asia Pacific Metal Tank Market, by End Use Industry, 2024 – 2033

- 8.12.1 Asia Pacific Metal Tank Market, by End Use Industry, 2024 – 2033 (USD Billion)

- 8.13 Asia Pacific Metal Tank Market, by Application, 2024 – 2033

- 8.13.1 Asia Pacific Metal Tank Market, by Application, 2024 – 2033 (USD Billion)

- 8.14 Asia Pacific Metal Tank Market, by Size, 2024 – 2033

- 8.14.1 Asia Pacific Metal Tank Market, by Size, 2024 – 2033 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.15.1.1 Latin America Metal Tank Market, by Country, 2024 – 2033 (USD Billion)

- 8.15.1 Latin America Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.16 Latin America Metal Tank Market, by End Use Industry, 2024 – 2033

- 8.16.1 Latin America Metal Tank Market, by End Use Industry, 2024 – 2033 (USD Billion)

- 8.17 Latin America Metal Tank Market, by Application, 2024 – 2033

- 8.17.1 Latin America Metal Tank Market, by Application, 2024 – 2033 (USD Billion)

- 8.18 Latin America Metal Tank Market, by Size, 2024 – 2033

- 8.18.1 Latin America Metal Tank Market, by Size, 2024 – 2033 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Metal Tank Market, by Country, 2024 – 2033 (USD Billion)

- 8.19.1 The Middle-East and Africa Metal Tank Market, 2024 – 2033 (USD Billion)

- 8.20 The Middle-East and Africa Metal Tank Market, by End Use Industry, 2024 – 2033

- 8.20.1 The Middle-East and Africa Metal Tank Market, by End Use Industry, 2024 – 2033 (USD Billion)

- 8.21 The Middle-East and Africa Metal Tank Market, by Application, 2024 – 2033

- 8.21.1 The Middle-East and Africa Metal Tank Market, by Application, 2024 – 2033 (USD Billion)

- 8.22 The Middle-East and Africa Metal Tank Market, by Size, 2024 – 2033

- 8.22.1 The Middle-East and Africa Metal Tank Market, by Size, 2024 – 2033 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 CST Industries Inc.

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 Highland Tank & Manufacturing Company Inc.

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 Superior Tank Co. Inc.

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 Tanks Direct Ltd.

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 Assmann Corporation of America

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 Tarsco Bolted Tank a TF Warren Company

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Permastore Limited

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 GSC Tanks

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 Norwesco Industries

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 Hamilton Tanks LLC

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 Others.

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.1 CST Industries Inc.

List Of Figures

Figures No 1 to 30

List Of Tables

Tables No 1 to 77

Report Methodology

In order to get the most precise estimates and forecasts possible, Custom Market Insights applies a detailed and adaptive research methodology centered on reducing deviations. For segregating and assessing quantitative aspects of the market, the company uses a combination of top-down and bottom-up approaches. Furthermore, data triangulation, which examines the market from three different aspects, is a recurring theme in all of our research reports. The following are critical components of the methodology used in all of our studies:

Preliminary Data Mining

On a broad scale, raw market information is retrieved and compiled. Data is constantly screened to make sure that only substantiated and verified sources are taken into account. Furthermore, data is mined from a plethora of reports in our archive and also a number of reputed & reliable paid databases. To gain a detailed understanding of the business, it is necessary to know the entire product life cycle and to facilitate this, we gather data from different suppliers, distributors, and buyers.

Surveys, technological conferences, and trade magazines are used to identify technical issues and trends. Technical data is also gathered from the standpoint of intellectual property, with a focus on freedom of movement and white space. The dynamics of the industry in terms of drivers, restraints, and valuation trends are also gathered. As a result, the content created contains a diverse range of original data, which is then cross-validated and verified with published sources.

Statistical Model

Simulation models are used to generate our business estimates and forecasts. For each study, a one-of-a-kind model is created. Data gathered for market dynamics, the digital landscape, development services, and valuation patterns are fed into the prototype and analyzed concurrently. These factors are compared, and their effect over the projected timeline is quantified using correlation, regression, and statistical modeling. Market forecasting is accomplished through the use of a combination of economic techniques, technical analysis, industry experience, and domain knowledge.

Short-term forecasting is typically done with econometric models, while long-term forecasting is done with technological market models. These are based on a synthesis of the technological environment, legal frameworks, economic outlook, and business regulations. Bottom-up market evaluation is favored, with crucial regional markets reviewed as distinct entities and data integration to acquire worldwide estimates. This is essential for gaining a thorough knowledge of the industry and ensuring that errors are kept to a minimum.

Some of the variables taken into account for forecasting are as follows:

• Industry drivers and constraints, as well as their current and projected impact

• The raw material case, as well as supply-versus-price trends

• Current volume and projected volume growth through 2030

We allocate weights to these variables and use weighted average analysis to determine the estimated market growth rate.

Primary Validation

This is the final step in our report’s estimating and forecasting process. Extensive primary interviews are carried out, both in-person and over the phone, to validate our findings and the assumptions that led to them.

Leading companies from across the supply chain, including suppliers, technology companies, subject matter experts, and buyers, use techniques like interviewing to ensure a comprehensive and non-biased overview of the business. These interviews are conducted all over the world, with the help of local staff and translators, to overcome language barriers.

Primary interviews not only aid with data validation, but also offer additional important insight into the industry, existing business scenario, and future projections, thereby improving the quality of our reports.

All of our estimates and forecasts are validated through extensive research work with key industry participants (KIPs), which typically include:

• Market leaders

• Suppliers of raw materials

• Suppliers of raw materials

• Buyers.

The following are the primary research objectives:

• To ensure the accuracy and acceptability of our data.

• Gaining an understanding of the current market and future projections.

Data Collection Matrix

| Perspective | Primary research | Secondary research |

| Supply-side |

|

|

| Demand-side |

|

|

Market Analysis Matrix

| Qualitative analysis | Quantitative analysis |

|

|

Prominent Player

- CST Industries Inc.

- Highland Tank & Manufacturing Company Inc.

- Superior Tank Co. Inc.

- Tanks Direct Ltd.

- Assmann Corporation of America

- Tarsco Bolted Tank (a TF Warren Company)

- Permastore Limited

- GSC Tanks

- Norwesco Industries

- Hamilton Tanks LLC

- Others

FAQs

“North America” region will lead the Global Metal Tank Market during the forecast period 2023 to 2032.

The key factors driving the Market are Increasing Demand for Sustainable Solutions, Technological Advancements in Tank Design, Growing Adoption of Customized Solutions, Expansion in Emerging Markets And Emphasis on Safety and Compliance.

The key players operating in the Metal Tank Market are CST Industries Inc., Highland Tank & Manufacturing Company Inc., Superior Tank Co. Inc., Tanks Direct Ltd., Assmann Corporation of America, Tarsco Bolted Tank a TF Warren Company, Permastore Limited, GSC Tanks, Norwesco Industries, Hamilton Tanks LLC, Others.

The Global Metal Tank Market is expanding growth with a CAGR of approximately 4.1% during the forecast period (2023 to 2032).

The Global Metal Tank Market size was valued at USD 8.12 Billion in 2022 and it is projected to reach around USD 14.3 Billion by 2032.

PURCHASE OPTIONS

3990

4990

5990

2290

2390

What You Get :

- PDF Report Format.

- Can be accessible by 1 single user.

- Free 25% or 40 hours of customisation.

- Free post-sale service assistance.

- 15% discount on your next purchase.

- Dedicated account Associate .

- Permission to print the report.

- Service guarantee available.

- PDF and Excel Datasheet Formats.

- Can be accessible upto 2 to 5 users.

- Free 35% or 60 hours of customisation.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantee available.

- Personalised market brief by author.

- Permission to print the report.

- Report in your Language.

- PDF, Excel and Power Point.

- Can be accessible by unlimited users.

- Free 40% or 80 hours of customisation.

- Free post-sale service assistance.

- 30% discount on your next purchase.

- Permission to print the report.

- Dedicated account manager.

- Service guarantee available.

- Report in your Language.

- Excel Datasheet Format.

- Customized access as per user request.

- Upgradable to other licenses.

- 15% discount on your next purchase.

- Free 20% or 10 hours of customisation.

- In-Depth Company Profiles.

- SWOT Analysis.

- Identify your Competitors.

- Recent Development Analysis.

- Competitor Pricing Strategies.

- Competitor Marketing Strategies.

- Competitor Positioning and Messaging.

- Competitor Product’s Strengths.

- Free 20% or 10 Hours of Customisation.

- 15% Discount on your Next Purchase.

- Upgradable to other licenses.

- PDF Format.

- Permission to Print the Report.