Stationary Crushers Market Size, Trends and Insights By Type (Jaw Crushers, Cone Crushers, Symons Cone Crushers, Hydraulic Cone Crushers, Gyratory Cone Crushers, Impact Crushers, Horizontal Shaft Impact, Vertical Shaft Impact, Gyratory Crushers, Roll Crushers), By Capacity (Less than 100 TPH, 100-300 TPH, Above 300 TPH), By Application (Mining, Construction, Aggregate Processing, Recycling, Other Applications), By Power Source (Electric, Diesel, Hybrid), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | Asia Pacific |

Major Players

- Metso Outotec Corporation

- Sandvik AB

- Terex Corporation

- Thyssenkrupp AG

- Others

Reports Description

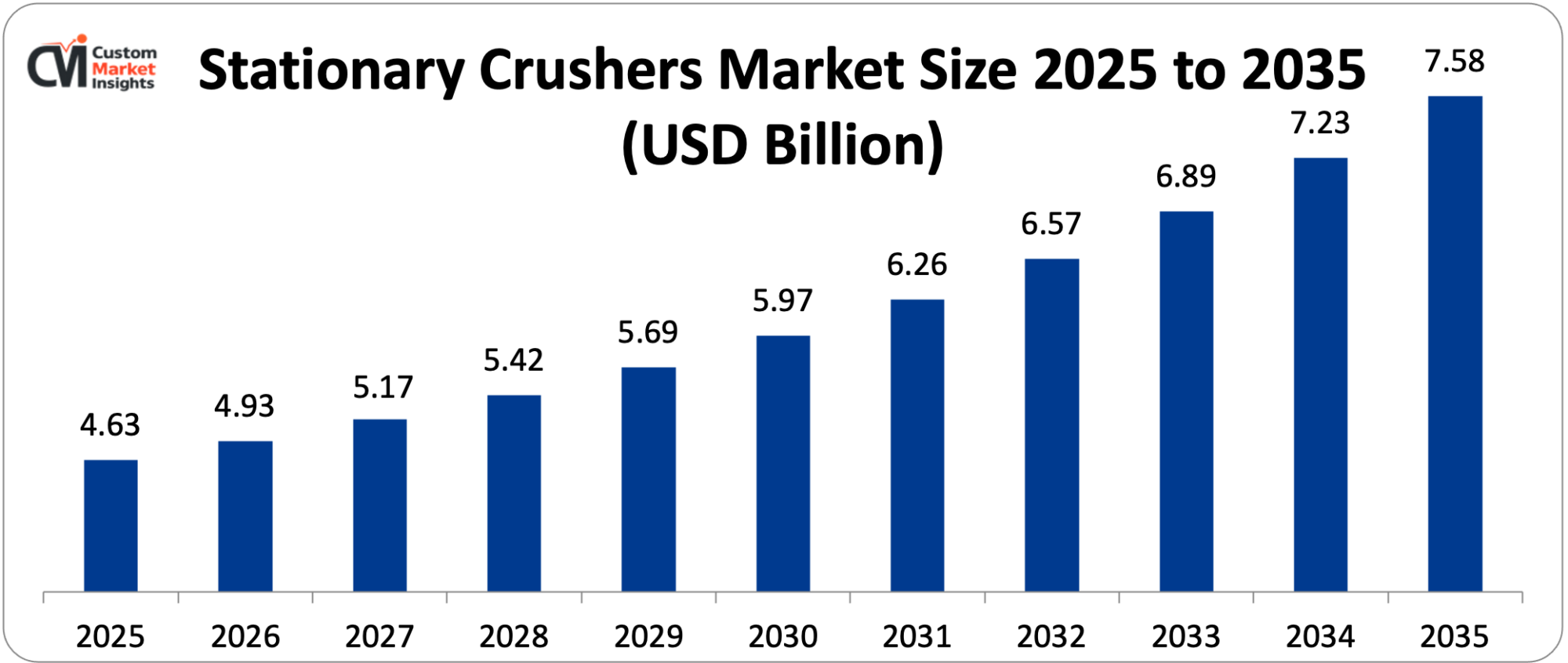

The market size of the global stationary crushers is estimated to be USD 4.63 billion in 2025, and it is estimated that such a market size will rise to USD 4.93 billion in 2026, and to around USD 7.58 billion in 2035, at an annual CAGR of 6.5% between the years 2026 and 2035. The market is growing because of the growing demand of aggregates in the construction and infrastructure development, the growing mining operations around the world, the growing focus on recycling and waste management, and the innovations in technology in automation and energy efficiency.

Market Highlight

- Asia Pacific was the market leader of the stationary crushers with a 58% market share of 2025.

- North America will grow by 5.8% in the period between 2026 and 2035.

- The jaw crushers segment had taken over 35% of the market share in 2025 by type.

- By type, the cone crusher segment will experience the highest CAGR of 7.8% between 2026 and 2035.

- Application-wise, the mining segment will have the largest market share of 42% in 2025, with the recycling segment projected to have the highest CAGR of 9.4% within the period of the projection, 2026-35.

- Capacity The segment of 300 TPH and above took 48% of the market share in 2025.

- In 2024, the overall crushers market had a dominant 60.8% share of the stationary crushers.

Stationary Crushers Market Trends – Significant Growth Factors

The Stationary Crushers Market Trends present significant growth opportunities due to several factors:

- Surging Infrastructure Development and Urbanization Globally: The growing rate of construction works and urbanization in the world is the main driver of the stationary crushers market where huge volumes of aggregates are needed to be produced by the stationary crushing plants in fixed locations. As per the data shown by the world construction analysis during 2025, the construction industry is likely to achieve USD 15.5 trillion in 2030 with emerging economies such as China, India, and Sub-Saharan Africa registering very high investments in the infrastructure that would provide perfect conditions to adopt stationary crushers. The second most utilized resource in the world after water is sand and gravel which is extracted around the world in nearly 50 billion tons every year mainly by urbanization and development of infrastructure. Due to the growth in the size of the cities, there is additional demand on sophisticated crushers to make construction material needed in the construction of roads, buildings, bridges, airports and power plants. Large-scale industrial processes such as quarrying and aggregate production that require the high capacity and efficiency of crushers in a continuous mode are also associated with stationary crushers. These crushers do have benefits in that they are more stable and durable and hence are applicable in heavy-duty operations that demand performance over a long period and a uniform quality output. The Belt and Road Initiative by China is a gigantic infrastructure construction project that improves trade routes and connectivity in Asia, Europe, and Africa, which involves the construction of highways, railways, ports, and airports construction, which require stationary crushers to convert large amounts of raw materials such as limestone, granite, and basalt into aggregates. It is forecasted that China alone will be spending USD 44.7 trillion in its construction industry as a result of the construction industry by the year 2030, which will be an unprecedented demand of crushing equipment. The stationary layout allows the optimization of crushing plants of several stages, control of gradation, and the combination of screening, washing, and conveyor systems that form full complexes of aggregate production. Recent fixed crushing facilities can produce up to 500 tons per hour and some large facilities over 1,000 TPH which is sufficient to process materials quickly enough to meet the construction and infrastructure project timelines and construction material requirements of the fast-growing urban centres.

- Mining Industry Expansion and Mineral Extraction Growth: The growing rate of construction works and urbanization in the world is the main driver of the stationary crushers market where huge volumes of aggregates are needed to be produced by the stationary crushing plants in fixed locations. As per the data shown by the world construction analysis during 2025, the construction industry is likely to achieve USD 15.5 trillion in 2030 with emerging economies such as China, India, and Sub-Saharan Africa registering very high investments in the infrastructure that would provide perfect conditions to adopt stationary crushers. The second most utilized resource in the world after water is sand and gravel which is extracted around the world in nearly 50 billion tons every year, mainly by urbanization and development of infrastructure. Due to the growth in the size of the cities, there is additional demand on sophisticated crushers to make construction material needed in the construction of roads, buildings, bridges, airports and power plants. Large-scale industrial processes such as quarrying and aggregate production that require the high capacity and efficiency of crushers in a continuous mode are also associated with stationary crushers. These crushers do have benefits in that they are more stable and durable and hence are applicable in heavy-duty operations that demand performance over a long period and a uniform quality output. The Belt and Road Initiative by China is a gigantic infrastructure construction project that improves trade routes and connectivity in Asia, Europe, and Africa, which involves the construction of highways, railways, ports, and airports, which require stationary crushers to convert large amounts of raw materials such as limestone, granite, and basalt into aggregates. It is forecasted that China alone will be spending USD 44.7 trillion in its construction industry as a result of the construction industry by the year 2030, which will be an unprecedented demand of crushing equipment. The stationary layout allows the optimization of crushing plants of several stages, control of gradation, and the combination of screening, washing, and conveyor systems that form full complexes of aggregate production. Recent fixed crushing facilities can produce up to 500 tons per hour, and some large facilities over 1,000 TPH which is sufficient to process materials quickly enough to meet the construction and infrastructure project timelines and construction material requirements of the fast-growing urban centres.

What are the Major Advances Changing the Stationary Crushers Market Today

- Automation and AI-Powered Process Optimization: The most radical technological change in the form of the integration of automation systems, artificial intelligence, and IoT sensors into non-portable crushing plants can make the process autonomous, predictive, and real-time optimization, which maximizes productivity with the lowest downtimes. The present day automated stationary crushing systems include load sensing, which automatically alters the settings of crushers according to feed properties, automated gap adjustment that keeps the product at optimum sizes as they wear; centrally controlled systems that can control the whole crush circuit through a few input control centers, and remote monitoring, which allows operators to supervise several plants at centralized points. AI-enabled analytics use the data of many sensors, which are tracking vibration, temperature, power usage, and material movement, and create the pattern, which aids in predicting the upcoming equipment failures before the breakdowns take place, so the proactive maintenance scheduling will eliminate unplanned downtime by 30-40%, according to industry implementations. Digital twin technology produces virtual models of crushing plants that enable operators to experiment with various operating conditions, experiment with process modifications in virtual environments, operationalizing change, and optimize the parameters of the crushers to match particular material properties and production needs. These new systems have helped in enhancing the efficiency of the crushers by 20-25%, which has allowed the system to increase its throughput but consume less energy per ton of the material being processed which directly increases the profitability of the quarrying and mining activities.

- Energy-Efficient and Hybrid Power Systems: The emergence of energy-efficient crushing technology and hybrid power systems has solved the increased worries about the cost of operation and sustainability of the crushing business to the environment. The use of stationary crushers with traditional diesel engines is also being phased out by electric and hybrid versions, which have significant savings in the operational costs and lower environmental impact. Hybrid crushers incorporate the dual-power feature of using diesel engines along with the inclusion of electric motors so that they can run on utility power where such power is present but provide a backup source of diesel when it is needed in locations with untrustworthy electrical supply or during times of peak power demand when the cost of electricity is also at its highest. Government data indicates that hybrid systems will save up to 30% of fuel use relative to diesel-only operations, which will aid in efforts such as the European Green Deal to cut carbon emissions by 55% by 2030. Hybrid crushers segment is expected to record the highest CAGR of 8.5% within the forecast period due to increasing demand for energy-saving solutions that are consistent with the international sustainability objectives. Moreover, hybrid crushers will reduce greenhouse gas emissions by 15-20%, and thus they are essential in sustainable industrial operations as dual power will be available and the performance of the crushers will not be affected by poor electricity supply in the location. Electric stationary crushers do not produce diesel emissions at all in the crushing area, have less noise pollution, and are thus suitable for operations close to populated areas, and have the advantage of lower prices for electric power, especially in most markets than diesel fuel. Highly developed motor designs such as variable frequency drives are more efficient in power use because the speed of the motor is set to match the load demand, and in some cases the regenerative braking mechanism of the motor is used to recapture energy during slower motion.

- High-Capacity Cone Crushers and Advanced Crushing Chambers: Next generation cone crushers with streamlined designs of crushing chambers and increased throughput capacities respond to the needs of the mining and aggregate industries to achieve increased productivity and improved quality of products. The most rapid growth of 7.8% CAGR is in the cone crushers between 2026 and 2035 associated with increasing demand for high-quality aggregates in infrastructure work with the Global Cement and Concrete Association indicating that the global concrete production surpassed 4.4 billion cubic meters in 2022, making cone crushers adopt high precision crushing. Contemporary cone crushers also feature advanced technology such as hydraulic adjustment systems, which allow rapid change of gaps without deactivation of equipment, multi-action crushing chambers which combine crushing with grinding action to achieve better particle shapes, high pivot point designs which give crushers more stroke which allows better throughput and automated release systems for tramp iron to prevent crashing of uncrushable particles. The latest examples of this line of innovation can be found in the release of three next-generation Nordberg HPe Series cone crushers (HP600e, HP800e, and HP900e) by Metso in March 2025 to be used in the mining and aggregates industry and the announcement of the QH443E tracked cone crusher by Sandvik in April 2025 to operate with sustainability and productivity in mind in heavy-duty tasks. Such fine cone crushers have been demonstrated to have reduction ratios of 6:1 or more in tertiary use with cubical products and few fines that make high specification aggregates in asphalt and concrete manufacture. The precision crushing allows several grades of products to be produced using the same machines by adjusting the gap, creating flexibility when using the machines by the aggregate producers that are facing different market needs.

- Recycling-Optimized Crushing Technologies: The increasing focus on the use of recycling and sustainable material management of construction and demolition waste has stimulated the creation of crushing technologies with a specific focus on the crushing of recycled material. Environmental segment is the one that is predicted to record the highest CAGR of 9.4% in the period of 2025-2033 due to the growing interest in waste recycling and sustainable processes, where, according to the Environmental Protection Agency, the construction and demolition waste recycling rates have already hit 30% of the global levels in 2022, which promotes the need to have crushers in waste processing. The development of the modern crushing systems has been to be able to process and separate the material and reuse it in another form with the development of the asphalt stations being able to produce a mix that has up to 70% of recycled materials. Recycling-optimized stationary crushers are designed as follows: contamination detection devices to identify and reject unsuitable materials, material separation devices to segregate concrete, asphalt, wood, and metals, overband magnets and eddy current separators to remove ferrous and non-ferrous metals, and wash systems to remove contaminants to create clean aggregates to specifications to use in new construction. The capability to yield high quality, recycled aggregates out of construction wastes decreases the extraction of virgin aggregates, conserves natural resources and removes large volumes of waste materials from landfills, which is part of the circular economy concept that is becoming mandatory by government policy and corporate sustainability pledges.

Category Wise Insights

By Type

Why Jaw Crushers Lead the Market?

The largest segment in 2025 is the jaw crushers that will have about 35% of the market share. This domination can be attributed to the popularity that jaw crushers enjoy in the primary crushing operations within the mining and construction industries wherein their strong design and reliability coupled with affordable price and quality have rendered them the tool of choice when it comes to the primary reduction of material. The U.S. Geological Survey notes that the world produced 1.8 billion metric tons of crushed stone in 2022 with jaw crushers being the most popular method of reducing this starting material. Jaw crushers are categorized into two types one fixed and another that is movable and compresses material in between the jaw plates using immense force, which in effect breaks down big lumps of boulders and rock pieces into smaller and manageable sizes to be subjected to other processing steps. These crushers process feed materials from soft limestone through to very hard granite and basalt with capacities from small 50 TPH at the contractor’s end to huge 1,000+ TPH plants to serve large quarries.

The jaw crushers have a number of reasons as to why they are popular based on the fact that they have simple and robust construction with fewer moving parts which reduces the level of maintenance needed; they can handle several types of materials, such as sticky, abrasive and high moisture content feeds in addition to having high reduction ratios that give high reduction in a single pass and lower capital cost per unit of capacity when compared to gyratory crushers. Also, the International Labour Organization notes that jaw crushers need less frequent maintenance in contrast with other models, which lowers the costs of operations up to 20%, which validates their role on the market. The recent jaw crushers have some technological additions such as the hydraulic adjustment system to change gaps quickly, the automatic lubrication system to minimize the maintenance, and the wearable materials to ensure the life of components and less frequent replacement.

Cone crushers are the quickest expanding categories with a projected CAGR of 7.8% between 2026 and 2035 owing to the increased demand of superior aggregates in infrastructural courses of action. The cone crushers are noted to perform well in secondary and tertiary crushing processes whereby the precision of shaping particles, as well as the uniformity of the product grades, is a major priority. Cones Crusher Industries will experience high industry adoption with an anticipated 5.1% CAGR in the cone crusher market which is projected to reach USD 1.95 billion in 2025 and then USD 2.51 billion by 2030. Cone crushers make use of a gyrating spindle, which rotates eccentrically within a non-portable outer crushing chamber, which forms compression forces that reduce materials to increasingly smaller sizes as it rotates. Higher cubicity of products in advanced cone crushers over jaw and impact crushers results in aggregate production with low elongated or flaky products that are needed in high performance concrete and asphalt construction.

By Application

Why Mining Dominates Stationary Crusher Applications?

The mining applications will be the largest segment with an estimated 42% in 2025. This leadership indicates the core activity in the mineral extraction operations where run-of-mine ore has to be crushed into sizes that can be fed to grinding mills, flotation circuits and other downstream processing devices. In mining operations, the enormous volumes of material are continuously crushed in the stationary crushing plants over the lifetime of the mine, with large operations crushing 50,000 to 200,000 tons per day. The leadership of the mining industry is motivated by the continuous growth of mineral mining across the world and an ever-growing demand for metals and other minerals such as copper, iron ore, gold, lithium, and rare earths which are fundamental to the contemporary technologies and improvement of infrastructure. Mining process normally utilizes several crushing steps in sequence with primary crushers (usually jaw or gyratory) crushing blast to 150-200mm, secondary (typically cone crushers) crushing to 50mm or smaller and tertiary crushers producing final sizing to be fed into grinding circuits.

Automation and digitalization are the new normal in the mining industry as companies undergo transformation. The modern mine crush facilities feature systems of optimization of the crushers that run a continuous check on throughput and perform automatic adjustment, fleet control systems that coordinate the hauling equipment to supply the feed to the crushers and predictive maintenance systems that schedule the interventions based on the equipment condition and not on a timely basis. The mining market is estimated at USD 1.96 trillion in 2024 and estimated at USD 2.06 trillion in 2025 that has a growth of 4.6% CAGR and a growth of 5.8% CAGR to 2029, giving the crushing equipment a solid demand to support its expansion.

The strongest growth is observed in recycling applications that should experience a CAGR of 9.4% between 2026 and 2035 due to the growing interest in the management of construction waste, the principles of the circular economy, and the sustainable use of materials. The material that is recycled through stationary recycling crushing plants is construction and demolition debris such as concrete, asphalt, brick, and mixed waste material, which are crushed into recycled aggregates that can be used in the road base, backfill, and in some instances, new concrete creation. EPA reports that the recycling rates of construction and demolition waste hit 30% worldwide in 2022, and several of the developed nations have rates of 70-80% and higher due to the compulsory recycling policies. Contemporary recycling based crushing facilities can attain multi-material recovery with in-built separation apparatus that produces grade-clean products at the correct conformity, which promotes the enhanced utilization of recycled materials in infrastructure endeavours due to sustainability targets and conservation of virgin aggregate demand requirements.

By Capacity

Why Above 300 TPH Systems Dominate the Market?

The largest category is systems above 300 TPH that take up some 48% of the market share in 2025. This superiority is an indication of the magnitude of contemporary mining and cumulative activities that involve a large-scale production apparatus to produce at a cost-effective rate. Large quarries and mines have crushing plants with a capacity of 500 TPH up to more than 1,500 TPH, and the largest plants in the world have capacities in excess of 2,000 TPH in primary crushing. Large stationary crushing facilities also offer economies of scale, lowering per-ton costs of processing due to constant large volume operation, efficient use of labor and support equipment, and the most efficient use of maintenance schedules to maximize productive operating time. These massive plants often include massive gyratory or enormous jaw primary crushers which supply a series of parallel secondary and tertiary crushers to form bendable production systems that are capable of making numerous product grades at once.

The 300 TPH above is motivated by the mega-projects in the infrastructure development that need huge aggregate volumes, large-scale mining operations where the importance of throughput is key to economic viability, and a complex of several quarries to feed a concrete batching plant, asphalt plant, and other large-volume users. The high-capacity systems of the present day have been completely automated with central control rooms controlling complete crushing and screening circuits, automated quality control systems sampling and testing products on a continuous basis and sophisticated scheduling systems that optimize production in accordance with customer demand and shipping schedules.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 4.93 billion |

| Projected Market Size in 2035 | USD 7.58 billion |

| Market Size in 2025 | USD 4.63 billion |

| CAGR Growth Rate | 6.5% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Type, Capacity, Application, Power Source and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Stationary Crushers Market – Regional Analysis

How Big is the Asia Pacific Market Size?

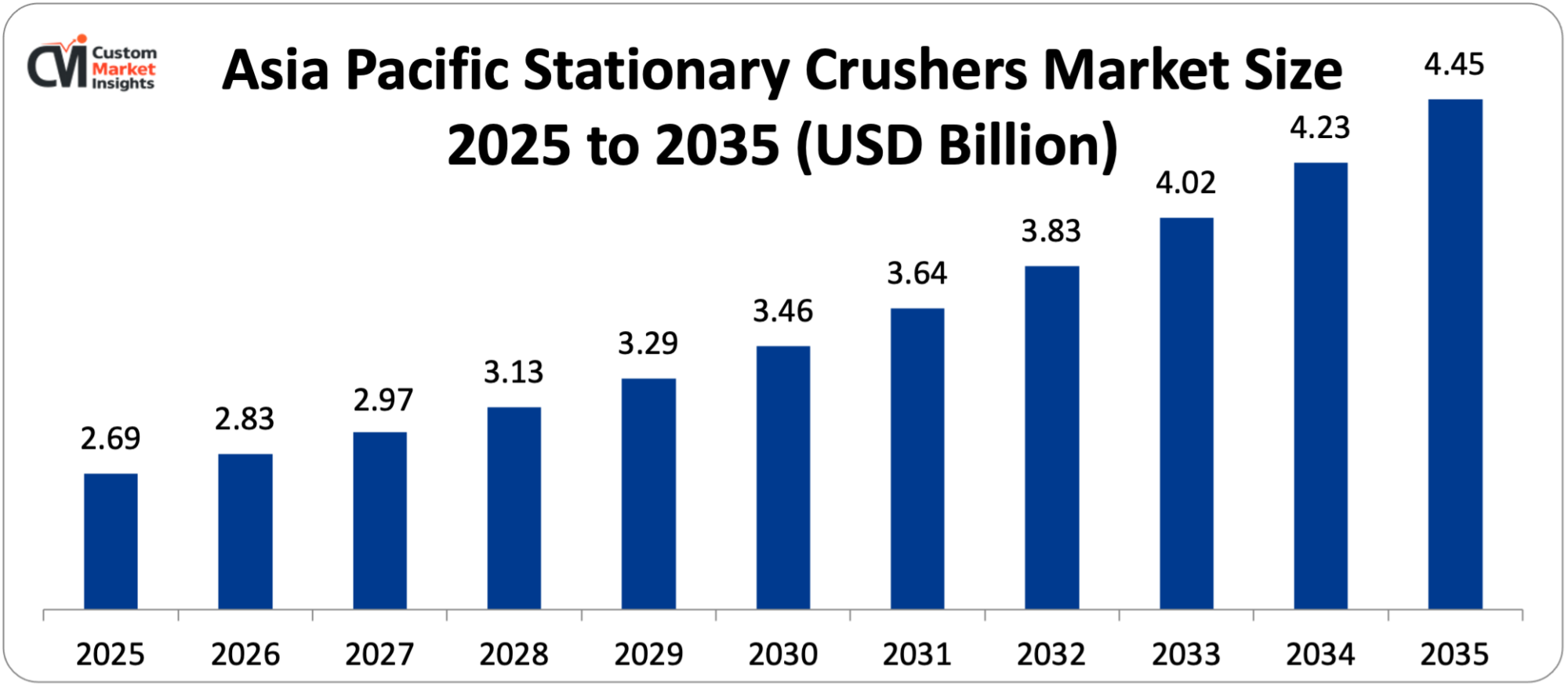

The Asia Pacific stationary crushers market size is estimated at USD 2.69 billion in 2025 and is projected to reach approximately USD 4.45 billion by 2035, with a 6.8% CAGR from 2026 to 2035.

Why did Asia Pacific Dominate the Market in 2025?

Asia Pacific can play a key role in the world with an estimated market share of about 58% in 2025, due to the various factors influencing such practices as rapid urbanization and the development of infrastructure in the region, the massive growth of the construction industry especially in China and India, a vast amount of mining activities such as coal, iron ore, and industrial minerals, as well as government investments in the infrastructure creation programs that drive the market. The area enjoys massive construction sectors that are expanding in the fast-growing urbanization nations with the never-ending technological improvements in the technologies of crushers that improve efficiency and productivity. China has controlled the market with an overwhelming share because it was the largest construction and infrastructural market in the world, and the Belt and Road Initiative resulted in an overwhelming demand of aggregates. The increasing infrastructure development of India such as highway construction, urban metro systems, and smart city development generates high demand for crushers. The Asia-Pacific region is said to be dominating the market even in the forecast period as it is characterized by continuing urbanization, increasing disposable incomes to invest in infrastructure and the government policies that promote industrialization.

China Market Trends

The mass construction activity with an expected USD 44.7 trillion investment by 2030, leading role in world production of coal and industrial minerals, government infrastructure projects such as the Belt and Road generation of enormous aggregate demand, and the production capacity of local crushers make China have the biggest stationary crusher market in the world. The coal mining sector alone in China needs lots of crushing capacity and the government has put tough safety checks in place in 2024 and is shutting down small scale mines and investing in large scale mechanized production with advanced crushing facilities.

Why is North America Experiencing Steady Growth?

North America has been at a steady growth with an expected CAGR of 5.8% in 2026 2035, which is an indicator of a mature but stable construction and mining industry, replacement and modernization of old crushing machinery, rising adoptions of advanced automation and efficiency technology, and increased focus on recycling that generates new demand of crushers. The United States has high aggregate production of more than 1.8 billion tons every year of crushed stone, sand, and gravel, which promotes massive construction work and demands constant capacity of crushers.

What is the Size of the U.S. Market?

In the U.S., the market size of the stationary crushers is estimated at USD 725 million in the year 2025 and is anticipated to grow at an accelerating rate of 5.8% between the years 2026 and 2035.

U.S. Market Trends

The US market constitutes a huge share of the world demand due to the massive aggregate production that underpins the construction industry, mining activities comprising metallic and industrial minerals, increasing construction and demolition waste recycling, and technological advancement in the automation and efficiency of crushers. Sustainable aggregate demand is through infrastructure investment such as the Bipartisan Infrastructure Law that offers USD 1.2 trillion to roads, bridges and transportation projects. Equipment replacement rates are also high because the operators are replacing their old fleets of crushers with new and modern ones that are efficient.

Why is Europe Focusing on Sustainability and Efficiency?

The European market is large, which is implied by the high level of construction and mining industries, a high concentration on environmental rules leading to recycling, the interest in energy efficiency and emission decrease, and an aggregate production industry. Europe holds a major market share across the world with stringent regulations that dictate the adoption of hybrid and electric crushers, the full establishment of recycling facilities that process construction waste, and the adoption of high levels of automation that enhance productivity and safety.

Germany Market Trends

Germany boasts great market share owing to a well-developed construction market, huge mass production serving the concrete and asphalt market, and high environmental standards that encourage environmental sustainability and production quality in the manufacture of crushers. The German operators focus on high-efficiency and low-emission crushing solutions, which provoked the use of the latest technologies.

Why is the Middle East & Africa Region Experiencing Growth?

The LAMEA region is characterized by increasing market growth due to infrastructure development of countries that are members of the Gulf Cooperation Council, mining growth in African countries with mineral resources, increasing urbanization, which is generating a market of construction materials, and state-led economic diversification projects. Some of the middle Eastern nations such as Saudi Arabia and UAE are spending heavily on mega-projects that need high crushing capacities.

Top Players in the Market and Their Offerings

- Metso Outotec Corporation

- Sandvik AB

- Terex Corporation

- Thyssenkrupp AG

- FLSmidth & Co. A/S

- Komatsu Ltd.

- Hitachi Construction Machinery Co. Ltd.

- McCloskey International

- Eagle Crusher Company Inc.

- Shanghai Shibang Machinery Co. Ltd.

- Others

Market News- Key Developments

The market has undergone significant developments as industry participants seek to expand capabilities and enhance product portfolios.

- In March 2025: Sandvik Mobile Crushing and Screening launched the QH443E a tracked cone crusher that focuses on sustainability and productivity in heavy duty operations as an example of how the industry is shifting to electric power. (Source: Sandvik)

- In March 2025: Metso introduced three new generation Nordberg HPe Series cone crushers HP600e, HP800e and HP900e, to be used in mining and aggregates. They are highly automated and more efficient demonstrating the latest achievement in the field of crushers. (Source: Metso)

These strategic activities have allowed companies to strengthen market positions, expand product offerings, enhance technological capabilities, and capitalize on growth opportunities within the expanding market.

The Stationary Crushers Market is segmented as follows:

By Type

- Jaw Crushers

- Cone Crushers

- Symons Cone Crushers

- Hydraulic Cone Crushers

- Gyratory Cone Crushers

- Impact Crushers

- Horizontal Shaft Impact

- Vertical Shaft Impact

- Gyratory Crushers

- Roll Crushers

By Capacity

- Less than 100 TPH

- 100-300 TPH

- Above 300 TPH

By Application

- Mining

- Construction

- Aggregate Processing

- Recycling

- Other Applications

By Power Source

- Electric

- Diesel

- Hybrid

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Stationary Crushers Market, (2026 – 2034) (USD Billion)

- 2.2 Global Stationary Crushers Market: snapshot

- Chapter 3. Global Stationary Crushers Market – Industry Analysis

- 3.1 Stationary Crushers Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Surging Infrastructure Development and Urbanization Globally

- 3.2.2 Mining Industry Expansion and Mineral Extraction Growth

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Type

- 3.7.2 Market attractiveness analysis By Capacity

- 3.7.3 Market attractiveness analysis By Application

- 3.7.4 Market attractiveness analysis By Power Source

- Chapter 4. Global Stationary Crushers Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Stationary Crushers Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Stationary Crushers Market – Type Analysis

- 5.1 Global Stationary Crushers Market overview: By Type

- 5.1.1 Global Stationary Crushers Market share, By Type, 2025 and 2034

- 5.2 Jaw Crushers

- 5.2.1 Global Stationary Crushers Market by Jaw Crushers, 2026 – 2034 (USD Billion)

- 5.3 Cone Crushers

- 5.3.1 Global Stationary Crushers Market by Cone Crushers, 2026 – 2034 (USD Billion)

- 5.4 Symons Cone Crushers

- 5.4.1 Global Stationary Crushers Market by Symons Cone Crushers, 2026 – 2034 (USD Billion)

- 5.5 Hydraulic Cone Crushers

- 5.5.1 Global Stationary Crushers Market by Hydraulic Cone Crushers, 2026 – 2034 (USD Billion)

- 5.6 Gyratory Cone Crushers

- 5.6.1 Global Stationary Crushers Market by Gyratory Cone Crushers, 2026 – 2034 (USD Billion)

- 5.7 Impact Crushers

- 5.7.1 Global Stationary Crushers Market by Impact Crushers, 2026 – 2034 (USD Billion)

- 5.8 Horizontal Shaft Impact

- 5.8.1 Global Stationary Crushers Market by Horizontal Shaft Impact, 2026 – 2034 (USD Billion)

- 5.9 Vertical Shaft Impact

- 5.9.1 Global Stationary Crushers Market by Vertical Shaft Impact, 2026 – 2034 (USD Billion)

- 5.10 Gyratory Crushers

- 5.10.1 Global Stationary Crushers Market by Gyratory Crushers, 2026 – 2034 (USD Billion)

- 5.11 Roll Crushers

- 5.11.1 Global Stationary Crushers Market by Roll Crushers, 2026 – 2034 (USD Billion)

- 5.1 Global Stationary Crushers Market overview: By Type

- Chapter 6. Global Stationary Crushers Market – Capacity Analysis

- 6.1 Global Stationary Crushers Market overview: By Capacity

- 6.1.1 Global Stationary Crushers Market share, By Capacity, 2025 and 2034

- 6.2 Less than 100 TPH

- 6.2.1 Global Stationary Crushers Market by Less than 100 TPH, 2026 – 2034 (USD Billion)

- 6.3 100-300 TPH

- 6.3.1 Global Stationary Crushers Market by 100-300 TPH, 2026 – 2034 (USD Billion)

- 6.4 Above 300 TPH

- 6.4.1 Global Stationary Crushers Market by Above 300 TPH, 2026 – 2034 (USD Billion)

- 6.1 Global Stationary Crushers Market overview: By Capacity

- Chapter 7. Global Stationary Crushers Market – Application Analysis

- 7.1 Global Stationary Crushers Market overview: By Application

- 7.1.1 Global Stationary Crushers Market share, By Application, 2025 and 2034

- 7.2 Mining

- 7.2.1 Global Stationary Crushers Market by Mining, 2026 – 2034 (USD Billion)

- 7.3 Construction

- 7.3.1 Global Stationary Crushers Market by Construction, 2026 – 2034 (USD Billion)

- 7.4 Aggregate Processing

- 7.4.1 Global Stationary Crushers Market by Aggregate Processing, 2026 – 2034 (USD Billion)

- 7.5 Recycling

- 7.5.1 Global Stationary Crushers Market by Recycling, 2026 – 2034 (USD Billion)

- 7.6 Other Applications

- 7.6.1 Global Stationary Crushers Market by Other Applications, 2026 – 2034 (USD Billion)

- 7.1 Global Stationary Crushers Market overview: By Application

- Chapter 8. Global Stationary Crushers Market – Power Source Analysis

- 8.1 Global Stationary Crushers Market overview: By Power Source

- 8.1.1 Global Stationary Crushers Market share, By Power Source, 2025 and 2034

- 8.2 Electric

- 8.2.1 Global Stationary Crushers Market by Electric, 2026 – 2034 (USD Billion)

- 8.3 Diesel

- 8.3.1 Global Stationary Crushers Market by Diesel, 2026 – 2034 (USD Billion)

- 8.4 Hybrid

- 8.4.1 Global Stationary Crushers Market by Hybrid, 2026 – 2034 (USD Billion)

- 8.1 Global Stationary Crushers Market overview: By Power Source

- Chapter 9. Stationary Crushers Market – Regional Analysis

- 9.1 Global Stationary Crushers Market Regional Overview

- 9.2 Global Stationary Crushers Market Share, by Region, 2025 & 2034 (USD Billion)

- 9.3. North America

- 9.3.1 North America Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.3.1.1 North America Stationary Crushers Market, by Country, 2026 – 2034 (USD Billion)

- 9.3.1 North America Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.4 North America Stationary Crushers Market, by Type, 2026 – 2034

- 9.4.1 North America Stationary Crushers Market, by Type, 2026 – 2034 (USD Billion)

- 9.5 North America Stationary Crushers Market, by Capacity, 2026 – 2034

- 9.5.1 North America Stationary Crushers Market, by Capacity, 2026 – 2034 (USD Billion)

- 9.6 North America Stationary Crushers Market, by Application, 2026 – 2034

- 9.6.1 North America Stationary Crushers Market, by Application, 2026 – 2034 (USD Billion)

- 9.7 North America Stationary Crushers Market, by Power Source, 2026 – 2034

- 9.7.1 North America Stationary Crushers Market, by Power Source, 2026 – 2034 (USD Billion)

- 9.8. Europe

- 9.8.1 Europe Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.8.1.1 Europe Stationary Crushers Market, by Country, 2026 – 2034 (USD Billion)

- 9.8.1 Europe Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.9 Europe Stationary Crushers Market, by Type, 2026 – 2034

- 9.9.1 Europe Stationary Crushers Market, by Type, 2026 – 2034 (USD Billion)

- 9.10 Europe Stationary Crushers Market, by Capacity, 2026 – 2034

- 9.10.1 Europe Stationary Crushers Market, by Capacity, 2026 – 2034 (USD Billion)

- 9.11 Europe Stationary Crushers Market, by Application, 2026 – 2034

- 9.11.1 Europe Stationary Crushers Market, by Application, 2026 – 2034 (USD Billion)

- 9.12 Europe Stationary Crushers Market, by Power Source, 2026 – 2034

- 9.12.1 Europe Stationary Crushers Market, by Power Source, 2026 – 2034 (USD Billion)

- 9.13. Asia Pacific

- 9.13.1 Asia Pacific Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.13.1.1 Asia Pacific Stationary Crushers Market, by Country, 2026 – 2034 (USD Billion)

- 9.13.1 Asia Pacific Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.14 Asia Pacific Stationary Crushers Market, by Type, 2026 – 2034

- 9.14.1 Asia Pacific Stationary Crushers Market, by Type, 2026 – 2034 (USD Billion)

- 9.15 Asia Pacific Stationary Crushers Market, by Capacity, 2026 – 2034

- 9.15.1 Asia Pacific Stationary Crushers Market, by Capacity, 2026 – 2034 (USD Billion)

- 9.16 Asia Pacific Stationary Crushers Market, by Application, 2026 – 2034

- 9.16.1 Asia Pacific Stationary Crushers Market, by Application, 2026 – 2034 (USD Billion)

- 9.17 Asia Pacific Stationary Crushers Market, by Power Source, 2026 – 2034

- 9.17.1 Asia Pacific Stationary Crushers Market, by Power Source, 2026 – 2034 (USD Billion)

- 9.18. Latin America

- 9.18.1 Latin America Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.18.1.1 Latin America Stationary Crushers Market, by Country, 2026 – 2034 (USD Billion)

- 9.18.1 Latin America Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.19 Latin America Stationary Crushers Market, by Type, 2026 – 2034

- 9.19.1 Latin America Stationary Crushers Market, by Type, 2026 – 2034 (USD Billion)

- 9.20 Latin America Stationary Crushers Market, by Capacity, 2026 – 2034

- 9.20.1 Latin America Stationary Crushers Market, by Capacity, 2026 – 2034 (USD Billion)

- 9.21 Latin America Stationary Crushers Market, by Application, 2026 – 2034

- 9.21.1 Latin America Stationary Crushers Market, by Application, 2026 – 2034 (USD Billion)

- 9.22 Latin America Stationary Crushers Market, by Power Source, 2026 – 2034

- 9.22.1 Latin America Stationary Crushers Market, by Power Source, 2026 – 2034 (USD Billion)

- 9.23. The Middle-East and Africa

- 9.23.1 The Middle-East and Africa Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.23.1.1 The Middle-East and Africa Stationary Crushers Market, by Country, 2026 – 2034 (USD Billion)

- 9.23.1 The Middle-East and Africa Stationary Crushers Market, 2026 – 2034 (USD Billion)

- 9.24 The Middle-East and Africa Stationary Crushers Market, by Type, 2026 – 2034

- 9.24.1 The Middle-East and Africa Stationary Crushers Market, by Type, 2026 – 2034 (USD Billion)

- 9.25 The Middle-East and Africa Stationary Crushers Market, by Capacity, 2026 – 2034

- 9.25.1 The Middle-East and Africa Stationary Crushers Market, by Capacity, 2026 – 2034 (USD Billion)

- 9.26 The Middle-East and Africa Stationary Crushers Market, by Application, 2026 – 2034

- 9.26.1 The Middle-East and Africa Stationary Crushers Market, by Application, 2026 – 2034 (USD Billion)

- 9.27 The Middle-East and Africa Stationary Crushers Market, by Power Source, 2026 – 2034

- 9.27.1 The Middle-East and Africa Stationary Crushers Market, by Power Source, 2026 – 2034 (USD Billion)

- Chapter 10. Company Profiles

- 10.1 Metso Outotec Corporation

- 10.1.1 Overview

- 10.1.2 Financials

- 10.1.3 Product Portfolio

- 10.1.4 Business Strategy

- 10.1.5 Recent Developments

- 10.2 Sandvik AB

- 10.2.1 Overview

- 10.2.2 Financials

- 10.2.3 Product Portfolio

- 10.2.4 Business Strategy

- 10.2.5 Recent Developments

- 10.3 Terex Corporation

- 10.3.1 Overview

- 10.3.2 Financials

- 10.3.3 Product Portfolio

- 10.3.4 Business Strategy

- 10.3.5 Recent Developments

- 10.4 Thyssenkrupp AG

- 10.4.1 Overview

- 10.4.2 Financials

- 10.4.3 Product Portfolio

- 10.4.4 Business Strategy

- 10.4.5 Recent Developments

- 10.5 FLSmidth & Co. A/S

- 10.5.1 Overview

- 10.5.2 Financials

- 10.5.3 Product Portfolio

- 10.5.4 Business Strategy

- 10.5.5 Recent Developments

- 10.6 Komatsu Ltd.

- 10.6.1 Overview

- 10.6.2 Financials

- 10.6.3 Product Portfolio

- 10.6.4 Business Strategy

- 10.6.5 Recent Developments

- 10.7 Hitachi Construction Machinery Co. Ltd.

- 10.7.1 Overview

- 10.7.2 Financials

- 10.7.3 Product Portfolio

- 10.7.4 Business Strategy

- 10.7.5 Recent Developments

- 10.8 McCloskey International

- 10.8.1 Overview

- 10.8.2 Financials

- 10.8.3 Product Portfolio

- 10.8.4 Business Strategy

- 10.8.5 Recent Developments

- 10.9 Eagle Crusher Company Inc.

- 10.9.1 Overview

- 10.9.2 Financials

- 10.9.3 Product Portfolio

- 10.9.4 Business Strategy

- 10.9.5 Recent Developments

- 10.10 Shanghai Shibang Machinery Co. Ltd.

- 10.10.1 Overview

- 10.10.2 Financials

- 10.10.3 Product Portfolio

- 10.10.4 Business Strategy

- 10.10.5 Recent Developments

- 10.11 Others.

- 10.11.1 Overview

- 10.11.2 Financials

- 10.11.3 Product Portfolio

- 10.11.4 Business Strategy

- 10.11.5 Recent Developments

- 10.1 Metso Outotec Corporation

List Of Figures

Figures No 1 to 39

List Of Tables

Tables No 1 to 102

Prominent Player

- Metso Outotec Corporation

- Sandvik AB

- Terex Corporation

- Thyssenkrupp AG

- FLSmidth & Co. A/S

- Komatsu Ltd.

- Hitachi Construction Machinery Co. Ltd.

- McCloskey International

- Eagle Crusher Company Inc.

- Shanghai Shibang Machinery Co. Ltd.

- Others

FAQs

The key players in the market are Metso Outotec Corporation, Sandvik AB, Terex Corporation, Thyssenkrupp AG, FLSmidth & Co. A/S, Komatsu Ltd., Hitachi Construction Machinery Co. Ltd., McCloskey International, Eagle Crusher Company Inc., Shanghai Shibang Machinery Co. Ltd., Others.

The government regulations also have a substantial impact on the market by influencing infrastructure investment with provision of transportation, bridges, and road projects that contribute to aggregate demand, mineral extraction and processing policies, environmental regulations, which lead to emission standards, noise control, and dust management, recycling requirements which contribute to processing of construction waste, safety regulations that require use of modern equipment with operator protection system, and automated controls. Policy environments such as the Belt and Road in China, the U.S. Infrastructure Investment and Jobs Act, and the European Green Deal promote the development of the chromises market and, at the same time, help push the industry towards more sustainable and efficient technologies.

Fixed crushing plants are capital investments of high magnitude and are obtained at highly diverse prices depending on the type, capacity and design. Jaw crushers are available in small sizes (USD 50,000) to large primary crushers (USD 500,000+) and cone crushers (USD 200,000 to USD 1 million+) to features to size and are available in single stage or multi-stage complete crushing plants (USD 2-10 million). Nonetheless, there are a number of reasons to support these investments such as, long operation lives of 15-30 years with correct maintenance, economies of scale that manufactures aggregates at USD 3-8 per ton which is significantly lower than what is charged to customers, ability to finance this over time as they are used and a very high volume of production. Markets in used and refurbished equipment offer lower entry point prices to smaller operators and leasing options have substitutes to direct purchase.

According to the current analysis, the market is estimated to grow to about USD 7.58 billion in 2035, with a strong growth rate of 6.5% in the market between 2026 and 2035, which is due to the presence of infrastructure megaprojects worldwide, expansion of mining activities to support energy transition minerals, development of recycling infrastructure, automation and integration of AI to enhance productivity, the adoption of energy-efficient hybrid systems, and high-capacity crushing systems that will facilitate economical large-scale operations.

Asia Pacific will continue to enjoy the most revenue share, with an estimated 58% share of the global market share, mainly because of the world largest construction and infrastructure markets in the region, the dominance of China with USD 44.7 trillion of projected construction investment through 2030, the rapid growth of infrastructure development in India, the high volume of mining activity, the low-cost manufacturing capabilities, and ongoing urbanization that will have the effect of ensuring a sustained aggregate demand in many decades.

Asia-Pacific region retains the dominant market share of 58% and vigorous growth trend due to the high urbanization and construction of infrastructure in China and India, enormous construction industry with the Belt and Road Initiative by China creating unprecedented aggregate demand, the vast range of mining operations of various types of minerals, government infrastructure investment programs and large-scale projects necessitating large capacities of stationary crushing plants.

The Global Stationary Crushers Market is forecasted to witness impressive growth in the light of the booming infrastructure development where construction industry is estimated to go up to USD 15.5 trillion by 2030, the 50 billion tons of sand and gravel extracted annually as the second most utilized resource after water, the mining develop and grow to 19.3 billion metric tons in 2022 with production and mining contributing 6-8% of global GDP, the projected USD 44.7 trillion infrastructure development in China by 2030, the concentration.