US Hazardous Wastewater Treatment Market Size, Trends and Insights By Source (Hospital, Pharmaceutical, Oil & Gas, Power Generation, Automotive, Food & Beverages), By Treatment Process (Physical, Chemical, Thermal, Biological), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | USA |

| Largest Market: | USA |

Major Players

- Veolia Environnement S.A.

- Xylem Inc.

- Ecolab Inc.

- DuPont Water Solutions

- Others

Reports Description

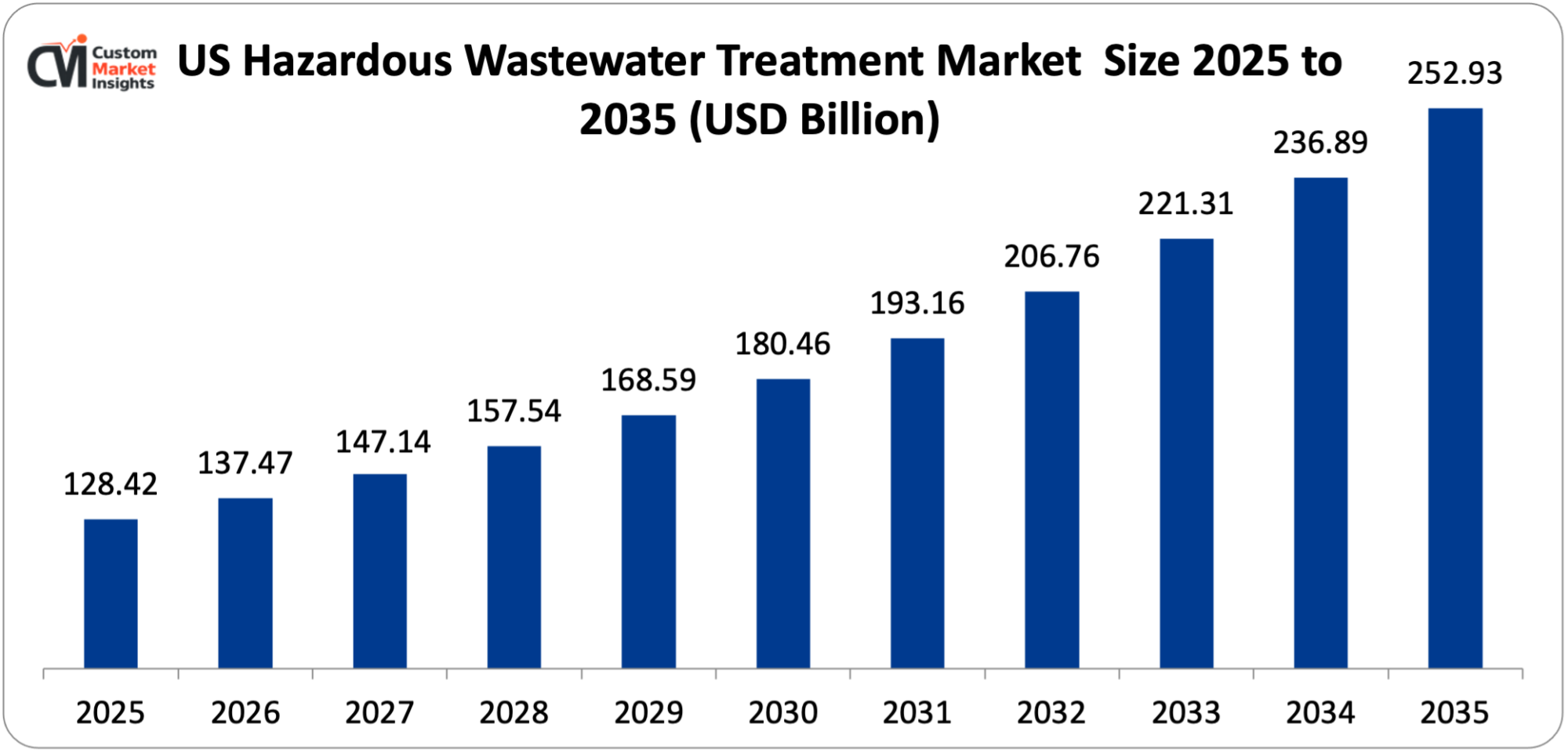

The US Hazardous Wastewater Treatment Market is expected to record a CAGR of 7.04% from 2026 to 2035. In 2026, the market size was USD 137.46 Billion. By 2035, the valuation is anticipated to reach USD 252.93 Billion. The market is growing owing to stringent environmental regulations (EPA), aging infrastructure, and industrial reshoring. Higher adoption of membrane bioreactors (MBR) is another factor driving the market. Plus, prices of materials such as activated carbon (used in hazardous wastewater treatment) did increase by 15-25% in 2024-25, which is driving mergers and consolidation amongst the providers.

Market Highlights

- By source, the oil & gas sector held around 32% of the market share in 2025.

- By source, the pharmaceuticals segment is expected to witness the fastest CAGR of 8.1% between 2026 and 2035.

- Treatment process wise, the highest market share of 35.24% was attributed to the chemical treatment segment in 2025.

- By treatment process, the biological treatment segment is expected to witness the fastest CAGR of 5.46% between 2026 and 2035.

Significant Growth Factors

The hazardous wastewater treatment market presents significant growth opportunities due to several factors:

- Evolution of Enhanced Membrane Technologies

The EPA’s 2024 regulations call for setting stringent limits on polyfluoroalkyl substances (PFAs), which have, in turn, generated demand for advanced filtration. Improved nanofiltration (NF) and reverse osmosis (RO) membranes are imperative for the removal of hazardous chemicals, which conventional treatment is unable to handle. Shifting to membrane bioreactors (MBRs) from traditionally activated sludge systems is one of the ongoing trends. MBRs do combine membrane filtration with biological treatment for producing exceptionally high effluent quality, thereby letting water be used directly in municipal and industrial applications. They are also reported to offer a 90% reduction regarding sludge protection and the need for a smaller footprint, thereby rendering them ideal for congested urban areas. Evolution of membranes does encompass developing ceramic membranes and low-fouling polymeric membranes. The former ones are known for offering superlative chemical and thermal stability, longer lifespan, and resistance to fouling. This allows for treating high-strength, complex industrial wastewater, like in petrochemicals and mining.

- Bioremediation Advancements

Developing designer microbes using CRISPR-Cas9 has facilitated the degradation of pollutants that were intractable previously. They include persistent organic pollutants (POPs), 1,4-dioxane, and complex hydrocarbons. Integrating nanotechnology comprising nano-sized iron particles (nZVI) does improve bioavailability of pollutants along with microbial metabolic activity, thereby expediting the breakdown of heavy metals and chlorinated solvents. Deploying moving bed biofilm reactors (MBBRs) and membrane bioreactors does provide controlled environments for sizable microbial activity, whereby it could achieve over 90% of the organic matter even if industrial scenarios involve higher loads. Also, switching toward in situ treatments like biostimulation and bioaugmentation does reduce the environmental footprint.

What are the Major Advancements Changing the US Hazardous Wastewater Treatment Market Today?

- Increased Digitalization and Technology Integration

Integration of AI, IoT, ML, and cloud computing is poised to optimize the hazardous wastewater treatment processes. Such technologies do allow for continual monitoring of the quality of water, treatment equipment’s predictive maintenance, and complex systems’ automated control, which help in the reduction of operational costs. IoT-enabled devices and smart sensors enable real-time data collection along with remote diagnostics, whereby they help industries in the detection of anomalies on a prompt note and go for corrective actions with immediate effect. Also, AI-based analytics and digital twins aid in simulating treatment processes and optimizing usage of chemicals, thereby contributing to cost efficiency and environmental compliance.

Blockchain technology is also being adopted for ascertaining data transparency. With industries facing stringent environmental regulations with mounting pressure for reducing their ecological footprints, there is an upsurge in the demand for digital solutions. Environmental bodies and governments are promoting digital initiatives through policy support and funding, wherein the industries are encouraged to opt for smarter treatment systems.

- Demand for Decentralized Wastewater Treatment

Centralized systems are known to require capital investments in infrastructure on an extensive note. On the other hand, decentralized solutions offer cost-effectiveness, flexibility, and scalability for small-scale operations and remote industrial facilities. Such systems do treat wastewater in the vicinity of the source, thereby reducing the requirement for complicated sewage networks and optimizing the costs of transportation.

Decentralized treatment systems for sectors such as pharmaceuticals, food & beverages, and chemicals that are known for generating site-specific and high-strength effluents allow for customized solutions that assure environmental stability and regulatory compliance. Also, the industries placed in water-stressed regions are visibly adopting on-site treatment for recycling and reusing water, thereby aligning with goals pertaining to corporate sustainability.

- Impact of AI US Hazardous Wastewater Treatment Market

AI optimizes various energy-intensive processes such as aeration. The AI-powered aeration systems are capable of cutting energy consumption by 30 to 50% by analyzing pollutant levels and flow rates in real-time. AI models do analyze the variability of raw water for optimizing chemical and coagulant dosing, thereby cutting down on overheads. AI is also being used for modelling and predicting the behavior and removing the efficiency of PFAS (forever chemicals) and microplastics. ML is improving the ability to detect such contaminants in the complicated analytical datasets, thereby enhancing the identification of contaminants. AI techniques are also used for predicting the adsorption capacity of heavy metals (such as Ni, Cd, Cu, and Pb), thereby curtailing the requirement of extensive trial-and-error techniques.

Category Wise Insights

By Source

Why Does the Oil & Gas Sector Dominate the US Hazardous Wastewater Treatment Market?

The oil & gas sector leads the US hazardous wastewater treatment market. It held around 32% of the market share in 2025. This is credited to the huge volumes of oily effluents and wastewater generated across downstream and upstream operations. Also, matured oil fields are raising the water-to-oil ratios, thereby driving the demand on a significant note. Stringent discharge limits for salinity of hydrocarbons do reinforce continual investment in treatment. Coastal and offshore operations are further strengthening the dominance of this segment.

By Treatment Process

How Does the Chemical Treatment Sector Dominate the US Hazardous Wastewater Treatment Market?

The chemical treatment sector led (35.24%) the US hazardous wastewater treatment market in 2025 and the scenario is expected to persist during the forecast period. This is owing to the ability of chemical treatment to effectively handle non-biodegradable, toxic, and variable industrial effluents. The industries depend on chemical processes for controlling pH, reducing toxicity, and removing heavy metals so as to address the discharge norms. This method is broadly used across the pharmaceuticals, oil & gas, and metal processing sectors. Its regulatory reliability and flexibility are also contributing to its dominance. The commercial waste treatment (CWT) facilities relying on chemical processes are capable of handling large volumes of waste.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 137.46 Billion |

| Projected Market Size in 2035 | USD 252.93 Billion |

| Market Size in 2025 | USD 128.42 Billion |

| CAGR Growth Rate | 7.04% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Source, Treatment Process and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Top Players in the US Hazardous Wastewater Treatment Market and Their Offerings

- Veolia Environnement S.A.

- Xylem Inc.

- Ecolab Inc.

- DuPont Water Solutions

- 3M Company

- Pentair plc

- Aquatech International LLC

- Solenis LLC

- Kemira Oyj

- Calgon Carbon Corporation

- Others

Key Developments

The US Hazardous Wastewater Market has experienced considerable changes in the last two years as the market players are trying to diversify their technological aspects and develop product portfolios using strategic approaches.

- In October 2023, Solenis announced that it had completed the acquisition of CedarChem LLC. The main objective is to align with the former’s direct GTM strategy for providing customers with enhanced wastewater and chemical treatment products and service offerings.

- In March 2023, Aquatech International entered into a partnership with Fluid Technology Solutions, Inc. in order to develop various next-gen solutions for advanced separation, improved brine concentration, and reuse of water.

- In January 2023, Xylem Inc. inked an agreement to acquire Evoqua as a part of an all-stock deal with an enterprise value of close to USD 7.5 Bn. The business is poised to be exclusively positioned for creating and delivering a comprehensive spectrum of cutting-edge solutions by banking on the former’s leading position herein.

The US Hazardous Wastewater Treatment Market is segmented as follows:

By Source

- Hospital

- Pharmaceutical

- Oil & Gas

- Power Generation

- Automotive

- Food & Beverages

By Treatment Process

- Physical

- Chemical

- Thermal

- Biological

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 US Hazardous Wastewater Treatment Market, (2026 – 2035) (USD Billion)

- 2.2 US Hazardous Wastewater Treatment Market: snapshot

- Chapter 3. US Hazardous Wastewater Treatment Market – Industry Analysis

- 3.1 US Hazardous Wastewater Treatment Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Evolution of Enhanced Membrane Technologies

- 3.2.2 Bioremediation Advancements

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Source

- 3.7.2 Market attractiveness analysis By Treatment Process

- Chapter 4. US Hazardous Wastewater Treatment Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 US Hazardous Wastewater Treatment Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. US Hazardous Wastewater Treatment Market – Source Analysis

- 5.1 US Hazardous Wastewater Treatment Market overview: By Source

- 5.1.1 US Hazardous Wastewater Treatment Market share, By Source, 2025 and 2035

- 5.2 Hospital

- 5.2.1 US Hazardous Wastewater Treatment Market by Hospital, 2026 – 2035 (USD Billion)

- 5.3 Pharmaceutical

- 5.3.1 US Hazardous Wastewater Treatment Market by Pharmaceutical, 2026 – 2035 (USD Billion)

- 5.4 Oil & Gas

- 5.4.1 US Hazardous Wastewater Treatment Market by Oil & Gas, 2026 – 2035 (USD Billion)

- 5.5 Power Generation

- 5.5.1 US Hazardous Wastewater Treatment Market by Power Generation, 2026 – 2035 (USD Billion)

- 5.6 Automotive

- 5.6.1 US Hazardous Wastewater Treatment Market by Automotive, 2026 – 2035 (USD Billion)

- 5.7 Food & Beverages

- 5.7.1 US Hazardous Wastewater Treatment Market by Food & Beverages, 2026 – 2035 (USD Billion)

- 5.1 US Hazardous Wastewater Treatment Market overview: By Source

- Chapter 6. US Hazardous Wastewater Treatment Market – Treatment Process Analysis

- 6.1 US Hazardous Wastewater Treatment Market overview: By Treatment Process

- 6.1.1 US Hazardous Wastewater Treatment Market share, By Treatment Process , 2025 and 2035

- 6.2 Physical

- 6.2.1 US Hazardous Wastewater Treatment Market by Physical, 2026 – 2035 (USD Billion)

- 6.3 Chemical

- 6.3.1 US Hazardous Wastewater Treatment Market by Chemical, 2026 – 2035 (USD Billion)

- 6.4 Thermal

- 6.4.1 US Hazardous Wastewater Treatment Market by Thermal, 2026 – 2035 (USD Billion)

- 6.5 Biological

- 6.5.1 US Hazardous Wastewater Treatment Market by Biological, 2026 – 2035 (USD Billion)

- 6.1 US Hazardous Wastewater Treatment Market overview: By Treatment Process

- Chapter 7. US Hazardous Wastewater Treatment Market – Regional Analysis

- 7.1 US Hazardous Wastewater Treatment Market Regional Overview

- 7.2 US Hazardous Wastewater Treatment Market Share, by Region, 2025 & 2035 (USD Billion)

- Chapter 8. Company Profiles

- 8.1 Veolia Environnement S.A.

- 8.1.1 Overview

- 8.1.2 Financials

- 8.1.3 Product Portfolio

- 8.1.4 Business Strategy

- 8.1.5 Recent Developments

- 8.2 Xylem Inc.

- 8.2.1 Overview

- 8.2.2 Financials

- 8.2.3 Product Portfolio

- 8.2.4 Business Strategy

- 8.2.5 Recent Developments

- 8.3 Ecolab Inc.

- 8.3.1 Overview

- 8.3.2 Financials

- 8.3.3 Product Portfolio

- 8.3.4 Business Strategy

- 8.3.5 Recent Developments

- 8.4 DuPont Water Solutions

- 8.4.1 Overview

- 8.4.2 Financials

- 8.4.3 Product Portfolio

- 8.4.4 Business Strategy

- 8.4.5 Recent Developments

- 8.5 3M Company

- 8.5.1 Overview

- 8.5.2 Financials

- 8.5.3 Product Portfolio

- 8.5.4 Business Strategy

- 8.5.5 Recent Developments

- 8.6 Pentair plc

- 8.6.1 Overview

- 8.6.2 Financials

- 8.6.3 Product Portfolio

- 8.6.4 Business Strategy

- 8.6.5 Recent Developments

- 8.7 Aquatech International LLC

- 8.7.1 Overview

- 8.7.2 Financials

- 8.7.3 Product Portfolio

- 8.7.4 Business Strategy

- 8.7.5 Recent Developments

- 8.8 Solenis LLC

- 8.8.1 Overview

- 8.8.2 Financials

- 8.8.3 Product Portfolio

- 8.8.4 Business Strategy

- 8.8.5 Recent Developments

- 8.9 Kemira Oyj

- 8.9.1 Overview

- 8.9.2 Financials

- 8.9.3 Product Portfolio

- 8.9.4 Business Strategy

- 8.9.5 Recent Developments

- 8.10 Calgon Carbon Corporation

- 8.10.1 Overview

- 8.10.2 Financials

- 8.10.3 Product Portfolio

- 8.10.4 Business Strategy

- 8.10.5 Recent Developments

- 8.11 Others.

- 8.11.1 Overview

- 8.11.2 Financials

- 8.11.3 Product Portfolio

- 8.11.4 Business Strategy

- 8.11.5 Recent Developments

- 8.1 Veolia Environnement S.A.

List Of Figures

Figures No 1 to 19

List Of Tables

Tables No 1 to 2

Prominent Player

- Veolia Environnement S.A.

- Xylem Inc.

- Ecolab Inc.

- DuPont Water Solutions

- 3M Company

- Pentair plc

- Aquatech International LLC

- Solenis LLC

- Kemira Oyj

- Calgon Carbon Corporation

- Others

FAQs

The key players in the market are Veolia Environnement S.A., Xylem Inc., Ecolab Inc., DuPont Water Solutions, 3M Company, Pentair plc, Aquatech International LLC, Solenis LLC, Kemira Oyj, Calgon Carbon Corporation, Others.

Strict EPA standards under the Resource Conservation and Recovery Act (RCRA) and Clean Water Act (CWA) do necessitate advanced methods of treatment (such as oxidation and membrane filtration) for handling complex pollutants such as heavy metals, PFAS, and organic compounds. The RCRA regulations imply tracking of hazardous waste, right from generation to final disposal, thereby creating a persistent requirement of certified TSDFs (treatment, storage, and disposal facilities). Also, regulations like effluent limitations guidelines (ELGs) do push the market toward advanced technologies inclusive of adopting real-time, AI-driven monitoring as well as IoT for raised compliance and efficiency.

The higher costs involved in treating high-pollutant, complex wastewater do act as a barrier to speedy market expansion. The operational costs for the 150,000 Gallons Per Day (GPD) facility are likely to range between USD 500,000 and USD 1.5 Million every year, thereby hampering adoption by underfunded, smaller, or cost-sensitive firms. Also, raised tariffs on various imported components such as membranes, pumps, and steel have increased manufacturing costs for treatment systems, whereby the suppliers are forced to opt for cheaper designs or pass on the costs to the consumers via higher tariffs.

The US hazardous wastewater treatment market is expected to reach USD 252.93 Billion by 2034, growing at a CAGR of 7.04% from 2026 to 2035. The US EPA has enforced strict regulations (such as the Clean Water Act and PFAS limits) regarding the adoption of compliant, advanced, and pricey treatment technologies. The industry tends to generate a sizable quantity of liquid waste, especially from chemicals, oil & gas, and the manufacturing sector, which is driving the requirement for special treatment.

Evolution of enhanced membrane technologies is basically driving the US hazardous wastewater treatment market. Switching to advanced systems such as forward osmosis and MBRs from traditional methods allows for better treatment of complicated industrial effluents. Also, incorporating IoT sensors allows for monitoring in real-time, wherein the membrane’s performance is optimized and maintenance in high-stakes environments is reduced. Also, the researchers are into the development of genetically modified microorganisms (GMMs) with synthetic consortia for targeting complex contaminants (such as PFAs, PAHs, and PCBs) with higher rates of degradation.