Advanced Wound Closure Market Size, Trends and Insights By Product Type (Sutures, Absorbable Sutures, Non-absorbable Sutures, Surgical Staplers, Manual Staplers, Powered Staplers, Tissue Adhesives, Natural Adhesives, Synthetic Adhesives, Hemostatic Agents, Thrombin-based Agents, Fibrin Sealants, Collagen-based Agents, Others, Mechanical Closure Devices, Others), By Application (Cardiovascular Surgery, Orthopedic Surgery, General Surgery, Cosmetic Surgery, Gynecological Surgery, Neurological Surgery, Ophthalmic Surgery, Other Applications), By End User (Hospitals, Ambulatory Surgical Centers, Clinics, Other End Users), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2026 – 2035

Report Snapshot

| Study Period: | 2026-2035 |

| Fastest Growing Market: | Asia Pacific |

| Largest Market: | North America |

Major Players

- Johnson & Johnson (Ethicon)

- Medtronic plc

- B. Braun Melsungen AG

- Smith & Nephew plc

- Others

Reports Description

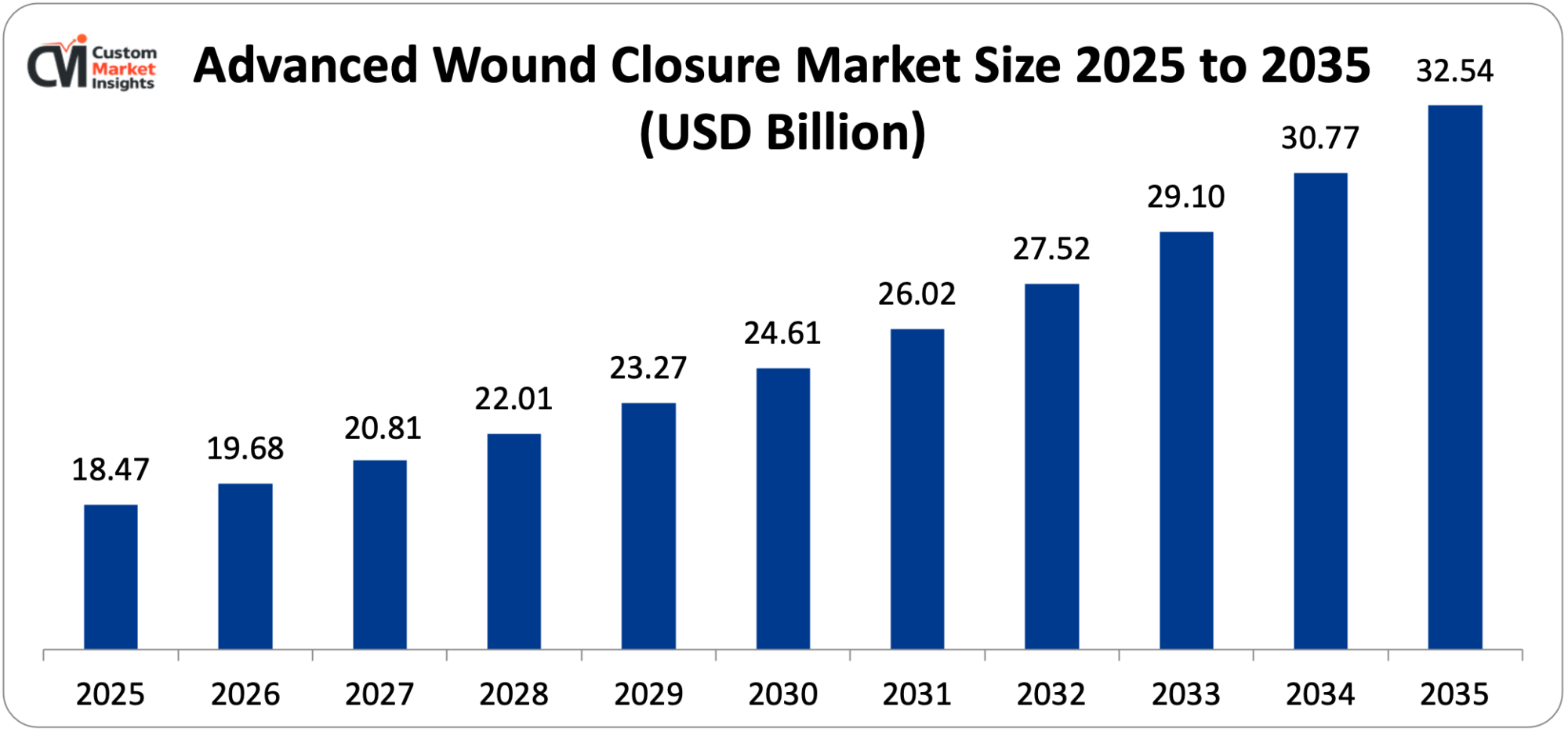

It is estimated that the size of the global advanced wound closure market is USD 18.47 billion in 2025 and the market is expected to grow at a CAGR of 6.9% between 2026 and 2035 and is projected to rise further to USD 19.68 billion in 2026 to about USD 32.54 billion in 2035. The growth in the prevalence of chronic diseases that demand surgical intervention, the increasing number of surgical operations performed around the world, the geriatric population with increased surgical demands, technological advancements in wound closure equipment, and the desire to do surgery using less invasive means all contribute towards the growth of the market.

Market Highlight

- Trends in advanced wound closure markets show that North America controlled the largest market share of 42% by the year 2025.

- Asia Pacific will grow at the highest CAGR of 8.2% in the period from 2026 to 2035.

- By product type, the sutures segment was estimated to have acquired 38% of the market in 2025.

- By product type, the tissue adhesives segment has the highest CAGR of 8.7% between 2026 and 2035.

- Application wise, the cardiovascular surgery segment had the largest share of 28% in the market in 2025, and the cosmetic surgery segment was projected to have the fastest growth in terms of CAGR of 9.3% in the estimated time frame between 2026 and 2035.

- By end user, the hospitals segment was taking 64% of the market share in 2025.

- Wound care products Advanced wound closure products contributed about 73% of the total wound care market in 2024.

Significant Growth Factors

The Advanced Wound Closure Market Trends present significant growth opportunities due to several factors:

- Escalating Global Surgical Volume and Aging Population Demographics: The growing amount of surgical operations in the world is the major reason behind the modernized wound closure market, and healthcare systems currently execute hundreds of millions of surgical operations every year that require a dependable and efficient wound closure measure. Global healthcare statistics show that in 2024, it is estimated that 312 million major surgical operations are carried out every year around the world, and this figure is likely to reach 385 million major surgical operations in 2030, with the growing population aging and access to surgical care becoming more available in developing countries. The World Health Organization also estimates that there are 5 billion individuals who do not access safe, affordable surgical care when it is required, which is an enormous potential for the market growth due to the development of healthcare infrastructure all over the world. Statistical data demonstrates that those above 65 years have been experiencing surgeries 3-4 times more than younger age groups and the world geriatric population (65+ years) is expected to be 1.5 billion in 2050, compared to 761 million in 2021, which results in an unprecedented volume of surgical operations and corresponding wound closure products. Cardiovascular diseases, with 523 million cases annually and 18.6 million cardiac deaths, have been on the list of diseases requiring millions of cardiac surgeries in the form of coronary artery bypass grafting, valve replacement and sturdy vascular repair requiring special sutures and hemostatic agents. According to the reports by the American College of Surgeons, about 28 million inpatient surgical operations and 48 million outpatient operations are carried out in the United States alone every year, and all of them need the proper wound closure methods. Orthopedic surgeries such as joint replacements, fracture repairs and spinal surgeries had over 54 million surgeries worldwide in 2023 with 2.5 million knee replacement and hip replacement surgeries alone in developed countries annually. This is due to the growing focus on patient outcomes such as cosmetic outcomes, infection prevention and recovery and the increase in modern surgical practices focusing on the adoption of high-technology wound closure devices that enhance a reduction in the amount of scarring, decrease the time of the procedure and reduce the risks involved. Antimicrobial coated advanced sutures lower the occurrence of surgical site infections by 30-40% relative to standard sutures, and surgical site infections impact 2-5% of all inpatient surgical consumers and cost the healthcare system USD 3-10 billion per year in the United States alone. The change in the minimally invasive procedures that increased by 23% in 2019-2024 necessitates a wound closure solution that involves small incisions, such as absorbable sutures, tissue tapes, and the sophisticated staplers used in laparoscopic and robotic-assisted surgeries.

- Rising Prevalence of Chronic Diseases and Trauma Incidents: The rise in the market has significantly increased as the chronic disease burden in the globe demands surgical treatment with diseases such as diabetes, cardiovascular disease, cancer and obesity affecting billions of persons requiring surgical procedures throughout the disease progression. The International Diabetes Federation states that diabetes is present in 537 million adults across the world with the figure expected to rise to 643 million by 2030, and diabetic patients are subjected to complications with a surgical procedure that is 2-3 times more frequent than that of non-diabetic groups. In 2023, cancer diagnoses were over 19.3 million all over the world, with surgical oncology as the main type of curative therapy for solid tumors, advanced wound closure techniques were needed to complete a complex tumor resection, reconstructive intervention, and repeat intervention. Trauma and injury are key causes, as the World Health Organization estimates about 5 million deaths due to trauma every year and tens of millions of patients have to undergo emergency surgery due to traumatic injuries such as vehicle accidents, work-related injuries, falls, and traumatic injuries related to violence. Road traffic injuries alone cost 1.35 million deaths every year and 20-50 million non-fatal injuries, and severe trauma patients need several surgical operations such as orthopedic repairs, vascular reconstruction, and soft tissue repair. The world is already dealing with 890 million obese adults and bariatric surgery operations have surpassed 835,000 operations annually around the world with an approximate CAGR of 8%, and this needs special wound closure products that can cope with a higher tissue tension and assist healing under the compromised metabolic conditions that are occurring in the world. Advanced wound closure products segment, bariatric applications is growing at a high rate as it provides better outcomes such as a 45% decrease in wound complications with the use of reinforced sutures and tissue adhesives over traditional wound closure procedures. Gynecological surgery market such as cesarean sections, hysterectomies, and reconstruction markets, are estimated to consist of about 65 million operations every year across the world with cesarean operations being 21% globally and more than 30% in most developed countries. Although fewer in absolute numbers, military and conflict related injuries are becoming the source of innovation in high hemostatic agent and rapid wound closure technologies with most combat fatalities being caused by hemorrhage, leading to the development of high end hemostatic products, which have since been widely applied in the civilian context.

What are the Major Advances Changing the Advanced Wound Closure Market Today

- Smart Sutures and Biosensor-Integrated Wound Closure Devices: The most radical technological breakthrough is the development of biosensors, microelectronics, and diagnostic options into wound-closure products that will provide real-time wound care, infection warning, and healing evaluation whose integration is completely transforming the paradigms of post-operative care. New smart sutures have miniaturized sensors that will detect temperature, PH, oxygen and biochemical indicators of infection or inflammation and are able to send data wirelessly to health care professionals to allow them to intervene before complications can occur and be noticed. A body of research that has been discovered in top-tier medical journals indicates that smart sutures are able to detect surgical site infections 2-3 days before clinical observation, potentially preventing 40-50% of complications connected to infections due to the application of antibiotics in time or wound revision. The Advanced biosensor sutures are made of conductive polymer threads, which have a sensitivity and specificity of 95% and 92% respectively to detect bacteria-specific biomarkers and detect pathogenic organisms such as methicillin-resistant Staphylococcus aureus (MRSA) and Pseudomonas aeruginosa before infection occurs. Digital health integration makes it possible to continuously monitor high-risk surgical patients, use cloud-based analytics to analyze sensor data of multiple patients at the same time, find trends that may pose a risk of complications and send automatic alerts when intervention limits are surpassed. Smart suture monitoring in a clinical trial involving 2,400 patients in 15 medical facilities showed that this technology led to a 27% lessening of hospital readmission rates and a USD 8,400 per-patient reduction in overall treatment prices due to complication prevention. These novel top-tier systems have helped to enhance the result of the surgical procedure by 30-35%, creating better protocols of recovery with earlier hospitalization, and with the best safety measures, which are provided with remote monitoring.

- Bioresorbable Polymer Technologies and Drug-Eluting Wound Closure Products: Advances in bioresorbable polymers with controlled degradation rates and drug-eluting properties offer solutions to the important issues in wound closure such as foreign body reactions, the requirement of suture removal and the prevention of infections. Non-absorbable sutures are traditional concepts, and their removal involves procedures that cause patients discomfort, use healthcare resources and create compliance issues, especially in children and geriatric patients, as around 15-20% of patients do not come back to the suture removal appointment. Recent developments in bioresorbable sutures have resulted in the manufacture of modern sutures based on advanced copolymers such as poly(lactic-co-glycolic acid) (PLGA), polydioxanone, and polyglyconate that have predictable suture absorption rates of 7 days in rapid-absorbing formulations and 180 days in slow-absorbing applications, eliminating the need to remove such sutures, with sufficient tensile strength to be used in the critical stages of the healing process. The statistical data provided by the analysis of 50,000 plus surgeries proves that absorbable sutures help to decrease the overall costs of treatment by USD 250-400 per patient due to the absence of removal visits and the increase in patient satisfaction by 35% in comparison to non-absorbable versions. Drug-eluting wound closure products introduce antimicrobial agents, anti-inflammatory agents, or growth factors into polymer matrices, which deliver lasting local delivery increasing its healing and preventing infections. The use of triclosan-impregnated sutures in a variety of surgical specialties has shown 30-35% facility in reducing the occurrence of surgical site infections, and meta-analysis of 34 randomized controlled trials on 17,000+ patients showed a significant reduction in infection risk without the development of antimicrobial resistance. In new generation drug-eluting stents, the infection rates (3-5%) are reduced to less than 1.5 which is expected to prevent not only 45,000-75,000 cases per year of surgical site infections in the United States alone but also worldwide. The next generation of tissue adhesives using bacteriophage treatment with 89% efficacy against antibiotic-resistant bacteria in laboratory tests are the new frontier with major commercial opportunities. It is assumed that the bioresorbable polymer segment will experience a CAGR of 7.8% in the forecast period due to the increasing popularity of the surgeon to the materials that do not retain foreign bodies and make the post-operative treatment less challenging.

- Robotic Surgery-Compatible Wound Closure Systems and Automated Suturing Technologies: The advent of robotic-assisted surgery systems and automated suturing systems solves the technical issues of minimally invasive surgeries and contributes to the achievement of increased accuracy, consistency, and efficiency in wound management. Robotic surgical robots, most notably those in the da Vinci Surgical System with more than 7,500 systems installed worldwide with 2+ million procedures in 2014, operation robots need specialized wound closure tools designed to be manipulated by robots such as articulating needle drivers, automated knot-tying systems, and suture that can be manipulated by robots because of its properties. Among the robotics surgery markets, the global market size now surpasses USD 8.9 billion in 2024 and has grown with a 14.3% CAGR with wound closure being a key element of all robotic surgery operations, leading to the emergence of special products that demand premium prices (40-60%) over those offered by conventional methods. Suturing machines remove the knot-tying process, cutting the length of the operation by 15-25%, and offering an even level of tension in wound edges, which is especially important in laparoscopic suturing in which the manual knot-tying process is very challenging. The 5800 laparoscopic studies show that automated suturing devices would save the operation time by 18 minutes per case on average, which amounts to USD 2.8 million savings per year in high volume surgery centers due to optimisation of the operating room and the number of cases per year. The next generation of robots include computer-vision and artificial intelligence that is used to examine the tissue properties in real time and automatically modulate suture tension, suture spacing, and depth to achieve maximum wound repair quality with minimum tissue damage. AI-enhanced suturing Multi-center trials with 1,200+ robotic-assisted operations indicate that AI-enhanced wound surgery is 34% less likely to cause wound complications than manual suture, and has better cosmetic outcomes based on objective scar assessment scales. When incorporated into surgical navigation systems, robotic suture placement has been found to be precise in anatomically challenging areas (such as cardiovascular anastomoses) with a 40% decrease in anastomotic leaks compared to standard procedures. Wound closure automation market should also increase to USD 2.4 billion by 2030 due to the growing use of robotic surgery in all surgical specialties and proven advantages such as shortened surgery duration, better consistency, and increased patient outcomes.

- Advanced Hemostatic Agents and Bioactive Tissue Sealants: The rising sophistication of the surgical practice and the rise of anticoagulation therapy have contributed to the introduction of sophisticated technologies in the form of hemostatic devices used in bringing about hemostasis quickly whilst enhancing tissue healing and avoiding complications. Recent hemostatic agents involve the use of mechanisms such as mechanical pressure, procoagulant activation and tissue sealing with advanced formulations using fibrin, thrombin, gelatin, collagen and synthetic polymers to form a strong hemostatic matrix. The hemostatic agents market in the global market grew to USD 4.3 billion in 2024 which comprises 23% of the advanced wound closure market and is boosted by growing surgical complexity, geriatric populations with comorbidities, and rising prevalence of anticoagulant therapy (6-8% of surgical patients). Topical thrombin-based products attain hemostasis within 60-90 seconds in 94% of their uses, a much faster time than the traditional technique which takes 3-5 minutes of constant pressure, and the time savings is especially important in cardiac surgery, trauma and liver resections where persistent bleeding raises the risk of mortality. High-end fibrin sealants offer tissue approximation strength similar to sutures and leak both air and fluid creating their own value specifically in pulmonary surgery, where air leakage occurs in 28-60% and increases hospital stay by an average of 3.8 days. The result of clinical evidence involving 8,400+ thoracic surgery patients shows that fibrin sealant usage both decreases the length of stay by 1.7 days and the length of air leakage by 42%, and this results in savings of USD 4,200-6,800 per patient. Bioactive tissue sealants that include growth factors, antimicrobial agents and extracellular matrix components do not only achieve hemostasis but actively stimulate tissue regeneration with preclinical trials demonstrating that the products are 45-60% faster than conventional products in regard to wound healing. Microporous polysaccharide technology hemorrhagic hemostatic powders and granules for achieving hemostasis in actively bleeding tissues are said to be effective in 91% of clinical trials of 2,600+ surgical patients with difficult-to-manage hemorrhage control including on anticoagulation therapy.

Category Wise Insights

By Product Type

Why Sutures Lead the Market?

The largest segment is in 2025 sutures which has about 38% of the market share. This hegemony attests to the universal nature of sutures in operation in virtually all specialties of surgery, the fact that it has been used throughout millennia in wound closure, its relative cost effectiveness in comparison with other technologies and the ongoing development of new materials and designs that improve its performance properties. More than 400 million units of suture are produced each year with the average number of cases per year being 50,000-150,000 sutures per hospital, depending on the surgical volume and mix. Sutures are thread-like products that can be used to approximate wound edges or ligate blood vessels and have a wide variety of choices such as monofilament and multifilament, different absorption profiles (rapid (7-14 days) to permanent), and a wide range of material choices such as natural (silk, catgut) or synthetic (polyglacolytic acid, polypropylene, nylon) depending on tissue type and healing needs.

The popularity of the suture market is enabled by some of its main opportunities such as the ability to use it in virtually any type of tissue and surgical procedure, the use of a fine wound edge that allows achieving the best healing and cosmetic results, the use of a different tension customized to suit the specifics of the tissue, and the familiarity with the technical art of the suture market developed during long-term training. Moreover, the health economics research shows that sutures offer an affordable wound closure with the price/procedure of USD 15-150 based on material and size which is significantly lower than other technologies such as surgical staplers (USD 200-800) or tissue adhesives (USD 100-400), which support their role in the market despite premium prices because of superior formulations. The contemporary sutures have technological improvements such as antimicrobial laminates that decrease the infection rate to 30-40, specialized needle system that minimizes tissue injury, and well-engineered absorption kinetics to match tissue healing periods.

The fastest growing product line is the tissue adhesives with a projected CAGR of 8.7% from 2026 to 2035 due to the benefits of the quick application of the product, which has saved 3-5 minutes per surgery, a good aesthetic appearance with scarring being 40% less than that of sutures in use, the removal of foreign body sensation and removal process, and the ability to use it in pediatric patients where 63% of children experienced needle phobia. The market of tissue adhesives is also projected to reach USD 2.1 billion in 2025 and up to USD 4.3 billion in 2033, which indicates high adoption of tissue adhesives, especially in emergency rooms, pediatric surgery, and cosmetic operations. The results of clinical trials on 12,000+ patients make it clear that tissue adhesives can deliver the same wound healing results as sutures in low tension repairs and have a better patient satisfaction rating and save an average of 35 minutes in the overall procedure.

By Application

Why Cardiovascular Surgery Dominates Advanced Wound Closure Applications?

The greatest category is cardiovascular surgery applications with around 28% of the total market share in 2025. This leadership is a technical complexity of cardiac and vascular surgeries that demand the special wound closure products, the high value of cardiovascular surgery that warrants the high cost of the premium products, and the critical nature of the reliability of the closure whereby failure leads to life-threatening complications. Cardiovascular surgery includes about 2.2 million operations each year in the developed nations such as coronary artery bypass grafting (395,000 surgeries per year in the US), valve replacement (293,000 surgeries), vascular repair, and structural heart surgery. The advanced sutures used in these procedures include cardiovascular specific sutures which offer smooth surface characteristics, which avoid thrombus formation, specific suture sizing, which allows anastomosis of fragile vessels 1-3 mm in diameter, and high knot security in pulsatile blood flow conditions which result in fatal hemorrhage in case of suture failure.

The leadership of the cardiovascular segment is motivated by the aging population where cardiovascular disease cases are rising, more cardiovascular procedures are being performed with minimally invasive surgical procedures that demand vascular access site closure devices, and higher prices with cardiovascular-specific sutures that are priced 200-400% higher than general-purpose products. Cardiovascular surgery uses the highest volume of wound closure products per case, and complex operations use 15-30 specialized sutures as opposed to 3-8 sutures in the more general surgery operations. The use of modern cardiac surgery is widespread in the use of the highest levels of hemostatic agents, whereby 87% of the cardiac operations involve the use of topical hemostats that decrease the number of bleeding complications and lessen the number of transfusions that require hemostatic adjuncts in 25-50% of cardiac surgery patients.

The cosmetic surgery applications are registering the highest growth with a forecast of 9.3% between 2026 and 2035 because of the rising volumes of cosmetic procedures in the world, rising aesthetic awareness among the demographics, the growth of minimally invasive aesthetic procedures, and higher prices of the products that offer a high level of cosmetic results. Cosmetic surgery American Society of Plastic Surgeons states that the 2023 cosmetic surgeries in the United States total 18.2 million, and the cosmetic surgery market is USD 64.7 billion with an 8.9% CAGR. The minimization of scars is an important cosmetic procedure and patients are prepared to pay a high price for the high-end wound closure procedures such as tissue adhesives, absorbable subcuticular sutures and specialized skin closure tapes that deliver the best aesthetics. Research indicates that new wound closure methods used in cosmetic surgery would decrease visible scarring by 45-60% as compared to traditional modalities and this would have a direct impact on patient satisfaction and the reputation of the surgeon in the competitive cosmetic surgery market.

By End User

Why Hospitals Dominate the Market?

The biggest end-user segment is the hospitals that will take about 64% of the market share in 2025. This supremacy displays the position of hospitals as key sites of extensive surgical operations, high surgical turnover that uses large amounts of products, facilities that serve entire spectrums of surgical specialties, and centralized purchases that make effective procurement. The number of hospital admissions all over the world reaches above 400 million each year, of which around 78% of the key surgical operations take place in the hospital rather than in the ambulatory surgical facilities or clinics. Big academic medical facilities conduct 15,000-35,000 surgeries a year, with wound closure items spending USD 1.5-4.2 million on the products per year depending on the complexity of the cases and specialty mix.

Hospitals are equipped with a thorough surgical capacity across various specialties, each with its own demand for a wound closure product that is specialized to meet tissue type, healing needs and the surgical process. The purchasing decisions made by the hospital focus on the reliability of the products and the overall support of the supplier as well as the standardization of the surgical departments so that there are economies of scale. Group purchasing organizations on behalf of hospital networks also enter into volume-based contracts that offer a 15-30% cost savings over individual hospital buying and still allow access to the best product innovations. The hospital market segment has the advantage of immediate product availability for the needs of emergency patients, complicated case referrals with complex case closure products, and academic teaching missions that compel the use of new technologies due to research and training opportunities.

The ambulatory surgical centers are the highest growth segment, with a projected CAGR of 7.8% between 2026 and 2035 due to the focus of the healthcare system on cost control, the preference of the patients for outpatient surgeries, the increased scope of procedures that can be conducted in an outpatient facility, and the expertise of the ASC in high-volume surgeries that maximize product standardization. One country, the U.S., has over 6,100+ ambulatory surgical centers, which conduct 28+ million procedures in the year, and the ASC market of the world is under 6.2% CAGR of migration of the procedures out of the hospital environment into the lower-cost area.

Report Scope

| Feature of the Report | Details |

| Market Size in 2026 | USD 19.68 billion |

| Projected Market Size in 2035 | USD 32.54 billion |

| Market Size in 2025 | USD 18.47 billion |

| CAGR Growth Rate | 6.9% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Key Segment | By Product Type, Application, End User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

Regional Analysis

How Big is the North America Market Size?

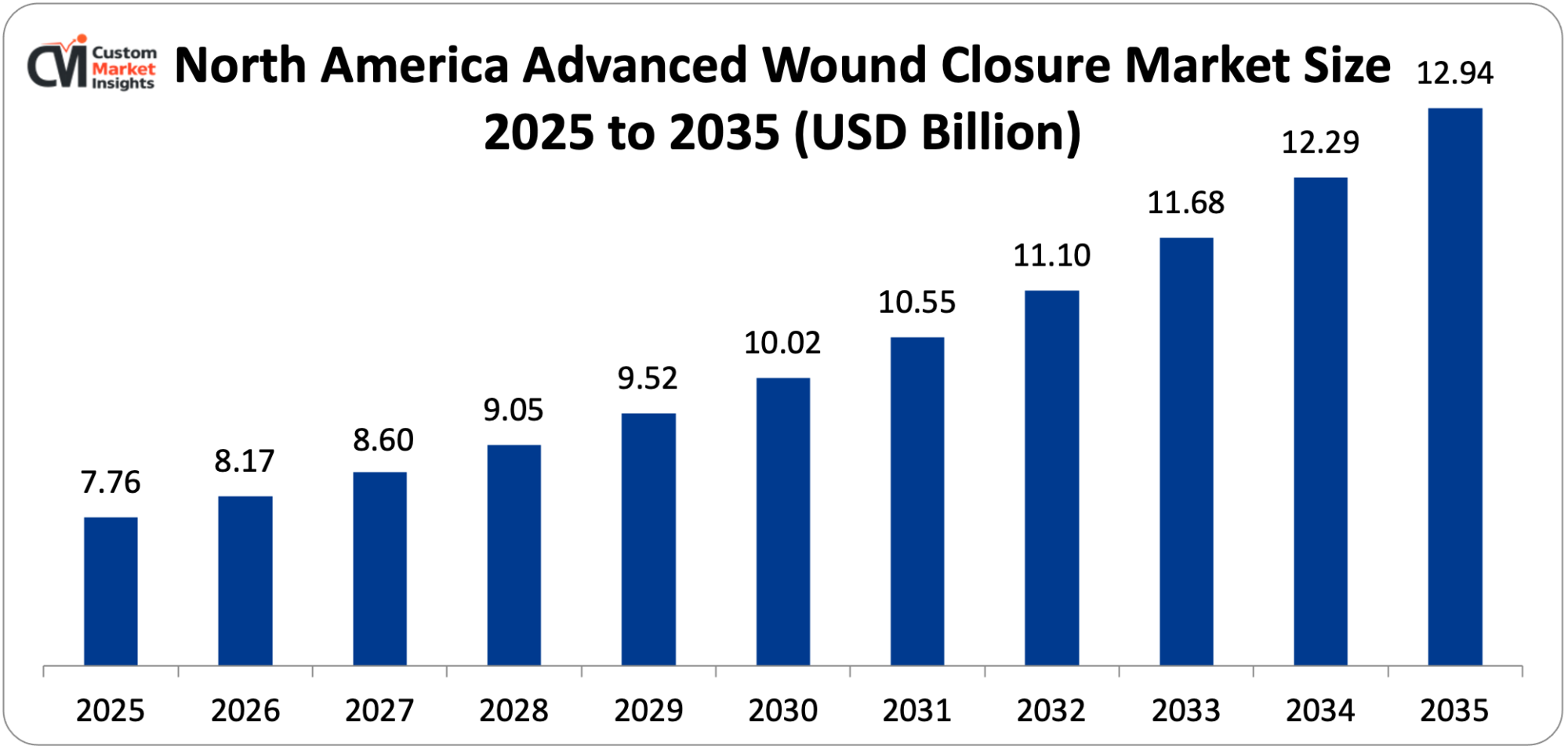

The North America advanced wound closure market size is estimated at USD 7.76 billion in 2025 and is projected to reach approximately USD 12.94 billion by 2035, with a 6.7% CAGR from 2026 to 2035.

Why did North America Dominate the Market in 2025?

North America has been the strongest player in the whole world with a market share of about 42% in 2025 due to the presence of sophisticated healthcare infrastructure with advanced surgical facilities, a large surgical procedure volume with the United States performing more surgical procedures annually, high health insurance enrollment that allows access to the best wound closure technology and concentration of major manufacturers of medical devices including Johnson & Johnson, Medtronic, and Baxter which are headquartered in the region. The area has the advantage of highly developed system of reimbursements that promote implementation of new technologies, well-developed infrastructure of clinical research that prove effectiveness of new products, and readiness of healthcare providers to implement high-end solutions that can provide better results. The US controls the market in the region with 82% share because of the highest per-capita spending on healthcare of USD 12,555 a year, well-developed surgical specialization, and the speed with which it is embracing technological advancements.

U.S. Market Trends

The US market is the largest national market in the world in terms of highest volumes of surgery in the world with Medicare statistics revealing that 15+ million inpatient surgeries are taking place in the US with hospitals aggressively adopting robotic surgery systems, an extensive insurance base with 92% of the population having health insurance and the most advanced medical research base, which is leading to innovation. The US aging population of 17% over 65 years-old and predicted 21% by the year 2030 generates the sustained demand in surgery with Medicare beneficiaries aging 4.2 times faster than younger generations. The US market is characterized by premium product adoption with tissue adhesives having a 28% market share in the US as compared to 18% in the world implying their willingness to embrace high cost technology with enhanced outcomes and patient satisfaction.

Why is Asia Pacific Experiencing the Fastest Growth?

Asia Pacific has the highest growth with the projected CAGR of 8.2% between 2026 and 2035 and that is because of the fast-growing healthcare infrastructure in the developing countries, the development of the middle-income population with access to more healthcare services, governmental programs aimed at the improvement of the availability of surgical services, and the increase in the utilization of international quality standards in healthcare facilities. The surgical volume is estimated at 120 million surgical procedures in the region every year, and the number of surgical procedures increases at a rate of 9-11% per year in states such as India, Indonesia, and Vietnam due to the increase in access to healthcare.

China Market Trends

China is a rapidly expanding market due to healthcare reforms to cover 95% of the population by insurance, extensive hospital building with 36,000 plus hospitals conducting 65+ million surgical procedures per year, increasing medical tourism as international patients increasingly seek cheaper surgical treatment, and China’s domestic capabilities to manufacture medical devices. The high population of China at the age above 60 will reach 264 million in 2024 to 400 million in 2035, the aging population has resulted in growth in surgical demand of over 8% per year.

India Market Trends

India is a high-growth market with a population of 1.4 billion generating huge volumes of patients, is still experiencing expansion of its private hospital sector, the medical tourism industry is conducting 700,000+ procedures on international patients per year, and the government is undertaking various initiatives such as Ayushman Bharat, which covers health coverage for 500 million citizens. India is conducting 15 million or more surgery operations each year, with a 12% CAGR as access to healthcare is extended to the underprivileged groups.

Why is Europe Focusing on Innovation and Quality?

The European market is large and developed, with a high level of healthcare systems with universal coverage, a high focus on evidence-based medicine influencing the implementation of clinically proven technologies, strict medical device regulations that guarantee product safety and effectiveness, and strong public health systems that focus on cost-effectiveness, in addition to clinical outcomes. Europe carries out 85+ million surgical operations every year in varying healthcare structures between centralized national health service and multipayer insurance based care structures.

Germany Market Trends

Germany has the largest market in Europe (17+ million surgical operations per year), a developed medical technology industry, universal health insurance (access to high quality products), and a great focus on specialisation in surgery. The spending of USD 545 billion a year by German healthcare contributes to the implementation of new technologies in wound closure, and the usage of tissue adhesives is 35 times more than the European average.

Top Players in the Market and Their Offerings

- Johnson & Johnson (Ethicon)

- Medtronic plc

- B. Braun Melsungen AG

- Smith & Nephew plc

- 3M Company

- Baxter International Inc.

- Integra LifeSciences Holdings Corporation

- Teleflex Incorporated

- Conmed Corporation

- Arthrex Inc.

- Stryker Corporation

- Becton Dickinson and Company

- Others

Key Developments

- In July 2024: Johnson & Johnson’s Ethicon division announced the launch of the ECHELON 3000 Powered Stapler with Gripping Surface Technology, representing next-generation surgical stapling with enhanced tissue compression and reduced firing force requirements for improved outcomes in thoracic and colorectal procedures.

- In November 2025: Medtronic received FDA approval for the Signia Stapling System with Tri-Staple Technology, featuring differentiated compression providing 30% greater compression at the anvil and 40% at the staple tips, addressing varied tissue thickness in single firing for improved anastomotic integrity.

The Advanced Wound Closure Market is segmented as follows:

By Product Type

- Sutures

- Absorbable Sutures

- Non-absorbable Sutures

- Surgical Staplers

- Manual Staplers

- Powered Staplers

- Tissue Adhesives

- Natural Adhesives

- Synthetic Adhesives

- Hemostatic Agents

- Thrombin-based Agents

- Fibrin Sealants

- Collagen-based Agents

- Others

- Mechanical Closure Devices

- Others

By Application

- Cardiovascular Surgery

- Orthopedic Surgery

- General Surgery

- Cosmetic Surgery

- Gynecological Surgery

- Neurological Surgery

- Ophthalmic Surgery

- Other Applications

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Other End Users

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Contents

- Chapter 1. Preface

- 1.1 Report Description and Scope

- 1.2 Research scope

- 1.3 Research methodology

- 1.3.1 Market Research Type

- 1.3.2 Market research methodology

- Chapter 2. Executive Summary

- 2.1 Global Advanced Wound Closure Market, (2026 – 2035) (USD Billion)

- 2.2 Global Advanced Wound Closure Market: snapshot

- Chapter 3. Global Advanced Wound Closure Market – Industry Analysis

- 3.1 Advanced Wound Closure Market: Market Dynamics

- 3.2 Market Drivers

- 3.2.1 Escalating Global Surgical Volume and Aging Population Demographics

- 3.2.2 Rising Prevalence of Chronic Diseases and Trauma Incidents

- 3.3 Market Restraints

- 3.4 Market Opportunities

- 3.5 Market Challenges

- 3.6 Porter’s Five Forces Analysis

- 3.7 Market Attractiveness Analysis

- 3.7.1 Market attractiveness analysis By Product Type

- 3.7.2 Market attractiveness analysis By Application

- 3.7.3 Market attractiveness analysis By End User

- Chapter 4. Global Advanced Wound Closure Market- Competitive Landscape

- 4.1 Company market share analysis

- 4.1.1 Global Advanced Wound Closure Market: company market share, 2025

- 4.2 Strategic development

- 4.2.1 Acquisitions & mergers

- 4.2.2 New Product launches

- 4.2.3 Agreements, partnerships, collaborations, and joint ventures

- 4.2.4 Research and development and Regional expansion

- 4.3 Price trend analysis

- 4.1 Company market share analysis

- Chapter 5. Global Advanced Wound Closure Market – Product Type Analysis

- 5.1 Global Advanced Wound Closure Market overview: By Product Type

- 5.1.1 Global Advanced Wound Closure Market share, By Product Type, 2025 and 2035

- 5.2 Sutures

- 5.2.1 Global Advanced Wound Closure Market by Sutures, 2026 – 2035 (USD Billion)

- 5.3 Absorbable Sutures

- 5.3.1 Global Advanced Wound Closure Market by Absorbable Sutures, 2026 – 2035 (USD Billion)

- 5.4 Non-absorbable Sutures

- 5.4.1 Global Advanced Wound Closure Market by Non-absorbable Sutures, 2026 – 2035 (USD Billion)

- 5.5 Surgical Staplers

- 5.5.1 Global Advanced Wound Closure Market by Surgical Staplers, 2026 – 2035 (USD Billion)

- 5.6 Manual Staplers

- 5.6.1 Global Advanced Wound Closure Market by Manual Staplers, 2026 – 2035 (USD Billion)

- 5.7 Powered Staplers

- 5.7.1 Global Advanced Wound Closure Market by Powered Staplers, 2026 – 2035 (USD Billion)

- 5.8 Tissue Adhesives

- 5.8.1 Global Advanced Wound Closure Market by Tissue Adhesives, 2026 – 2035 (USD Billion)

- 5.9 Natural Adhesives

- 5.9.1 Global Advanced Wound Closure Market by Natural Adhesives, 2026 – 2035 (USD Billion)

- 5.10 Synthetic Adhesives

- 5.10.1 Global Advanced Wound Closure Market by Synthetic Adhesives, 2026 – 2035 (USD Billion)

- 5.11 Hemostatic Agents

- 5.11.1 Global Advanced Wound Closure Market by Hemostatic Agents, 2026 – 2035 (USD Billion)

- 5.12 Thrombin-based Agents

- 5.12.1 Global Advanced Wound Closure Market by Thrombin-based Agents, 2026 – 2035 (USD Billion)

- 5.13 Fibrin Sealants

- 5.13.1 Global Advanced Wound Closure Market by Fibrin Sealants, 2026 – 2035 (USD Billion)

- 5.14 Collagen-based Agents

- 5.14.1 Global Advanced Wound Closure Market by Collagen-based Agents, 2026 – 2035 (USD Billion)

- 5.15 Mechanical Closure Devices

- 5.15.1 Global Advanced Wound Closure Market by Mechanical Closure Devices, 2026 – 2035 (USD Billion)

- 5.16 Others

- 5.16.1 Global Advanced Wound Closure Market by Others, 2026 – 2035 (USD Billion)

- 5.1 Global Advanced Wound Closure Market overview: By Product Type

- Chapter 6. Global Advanced Wound Closure Market – Application Analysis

- 6.1 Global Advanced Wound Closure Market overview: By Application

- 6.1.1 Global Advanced Wound Closure Market share, By Application, 2025 and 2035

- 6.2 Cardiovascular Surgery

- 6.2.1 Global Advanced Wound Closure Market by Cardiovascular Surgery, 2026 – 2035 (USD Billion)

- 6.3 Orthopedic Surgery

- 6.3.1 Global Advanced Wound Closure Market by Orthopedic Surgery, 2026 – 2035 (USD Billion)

- 6.4 General Surgery

- 6.4.1 Global Advanced Wound Closure Market by General Surgery, 2026 – 2035 (USD Billion)

- 6.5 Cosmetic Surgery

- 6.5.1 Global Advanced Wound Closure Market by Cosmetic Surgery, 2026 – 2035 (USD Billion)

- 6.6 Gynecological Surgery

- 6.6.1 Global Advanced Wound Closure Market by Gynecological Surgery, 2026 – 2035 (USD Billion)

- 6.7 Neurological Surgery

- 6.7.1 Global Advanced Wound Closure Market by Neurological Surgery, 2026 – 2035 (USD Billion)

- 6.8 Ophthalmic Surgery

- 6.8.1 Global Advanced Wound Closure Market by Ophthalmic Surgery, 2026 – 2035 (USD Billion)

- 6.9 Other Applications

- 6.9.1 Global Advanced Wound Closure Market by Other Applications, 2026 – 2035 (USD Billion)

- 6.1 Global Advanced Wound Closure Market overview: By Application

- Chapter 7. Global Advanced Wound Closure Market – End User Analysis

- 7.1 Global Advanced Wound Closure Market overview: By End User

- 7.1.1 Global Advanced Wound Closure Market share, By End User, 2025 and 2035

- 7.2 Hospitals

- 7.2.1 Global Advanced Wound Closure Market by Hospitals, 2026 – 2035 (USD Billion)

- 7.3 Ambulatory Surgical Centers

- 7.3.1 Global Advanced Wound Closure Market by Ambulatory Surgical Centers, 2026 – 2035 (USD Billion)

- 7.4 Clinics

- 7.4.1 Global Advanced Wound Closure Market by Clinics, 2026 – 2035 (USD Billion)

- 7.5 Other End Users

- 7.5.1 Global Advanced Wound Closure Market by Other End Users, 2026 – 2035 (USD Billion)

- 7.1 Global Advanced Wound Closure Market overview: By End User

- Chapter 8. Advanced Wound Closure Market – Regional Analysis

- 8.1 Global Advanced Wound Closure Market Regional Overview

- 8.2 Global Advanced Wound Closure Market Share, by Region, 2025 & 2035 (USD Billion)

- 8.3. North America

- 8.3.1 North America Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.3.1.1 North America Advanced Wound Closure Market, by Country, 2026 – 2035 (USD Billion)

- 8.3.1 North America Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.4 North America Advanced Wound Closure Market, by Product Type, 2026 – 2035

- 8.4.1 North America Advanced Wound Closure Market, by Product Type, 2026 – 2035 (USD Billion)

- 8.5 North America Advanced Wound Closure Market, by Application, 2026 – 2035

- 8.5.1 North America Advanced Wound Closure Market, by Application, 2026 – 2035 (USD Billion)

- 8.6 North America Advanced Wound Closure Market, by End User, 2026 – 2035

- 8.6.1 North America Advanced Wound Closure Market, by End User, 2026 – 2035 (USD Billion)

- 8.7. Europe

- 8.7.1 Europe Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.7.1.1 Europe Advanced Wound Closure Market, by Country, 2026 – 2035 (USD Billion)

- 8.7.1 Europe Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.8 Europe Advanced Wound Closure Market, by Product Type, 2026 – 2035

- 8.8.1 Europe Advanced Wound Closure Market, by Product Type, 2026 – 2035 (USD Billion)

- 8.9 Europe Advanced Wound Closure Market, by Application, 2026 – 2035

- 8.9.1 Europe Advanced Wound Closure Market, by Application, 2026 – 2035 (USD Billion)

- 8.10 Europe Advanced Wound Closure Market, by End User, 2026 – 2035

- 8.10.1 Europe Advanced Wound Closure Market, by End User, 2026 – 2035 (USD Billion)

- 8.11. Asia Pacific

- 8.11.1 Asia Pacific Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.11.1.1 Asia Pacific Advanced Wound Closure Market, by Country, 2026 – 2035 (USD Billion)

- 8.11.1 Asia Pacific Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.12 Asia Pacific Advanced Wound Closure Market, by Product Type, 2026 – 2035

- 8.12.1 Asia Pacific Advanced Wound Closure Market, by Product Type, 2026 – 2035 (USD Billion)

- 8.13 Asia Pacific Advanced Wound Closure Market, by Application, 2026 – 2035

- 8.13.1 Asia Pacific Advanced Wound Closure Market, by Application, 2026 – 2035 (USD Billion)

- 8.14 Asia Pacific Advanced Wound Closure Market, by End User, 2026 – 2035

- 8.14.1 Asia Pacific Advanced Wound Closure Market, by End User, 2026 – 2035 (USD Billion)

- 8.15. Latin America

- 8.15.1 Latin America Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.15.1.1 Latin America Advanced Wound Closure Market, by Country, 2026 – 2035 (USD Billion)

- 8.15.1 Latin America Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.16 Latin America Advanced Wound Closure Market, by Product Type, 2026 – 2035

- 8.16.1 Latin America Advanced Wound Closure Market, by Product Type, 2026 – 2035 (USD Billion)

- 8.17 Latin America Advanced Wound Closure Market, by Application, 2026 – 2035

- 8.17.1 Latin America Advanced Wound Closure Market, by Application, 2026 – 2035 (USD Billion)

- 8.18 Latin America Advanced Wound Closure Market, by End User, 2026 – 2035

- 8.18.1 Latin America Advanced Wound Closure Market, by End User, 2026 – 2035 (USD Billion)

- 8.19. The Middle-East and Africa

- 8.19.1 The Middle-East and Africa Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.19.1.1 The Middle-East and Africa Advanced Wound Closure Market, by Country, 2026 – 2035 (USD Billion)

- 8.19.1 The Middle-East and Africa Advanced Wound Closure Market, 2026 – 2035 (USD Billion)

- 8.20 The Middle-East and Africa Advanced Wound Closure Market, by Product Type, 2026 – 2035

- 8.20.1 The Middle-East and Africa Advanced Wound Closure Market, by Product Type, 2026 – 2035 (USD Billion)

- 8.21 The Middle-East and Africa Advanced Wound Closure Market, by Application, 2026 – 2035

- 8.21.1 The Middle-East and Africa Advanced Wound Closure Market, by Application, 2026 – 2035 (USD Billion)

- 8.22 The Middle-East and Africa Advanced Wound Closure Market, by End User, 2026 – 2035

- 8.22.1 The Middle-East and Africa Advanced Wound Closure Market, by End User, 2026 – 2035 (USD Billion)

- Chapter 9. Company Profiles

- 9.1 Johnson & Johnson (Ethicon)

- 9.1.1 Overview

- 9.1.2 Financials

- 9.1.3 Product Portfolio

- 9.1.4 Business Strategy

- 9.1.5 Recent Developments

- 9.2 Medtronic plc

- 9.2.1 Overview

- 9.2.2 Financials

- 9.2.3 Product Portfolio

- 9.2.4 Business Strategy

- 9.2.5 Recent Developments

- 9.3 B. Braun Melsungen AG

- 9.3.1 Overview

- 9.3.2 Financials

- 9.3.3 Product Portfolio

- 9.3.4 Business Strategy

- 9.3.5 Recent Developments

- 9.4 Smith & Nephew plc

- 9.4.1 Overview

- 9.4.2 Financials

- 9.4.3 Product Portfolio

- 9.4.4 Business Strategy

- 9.4.5 Recent Developments

- 9.5 3M Company

- 9.5.1 Overview

- 9.5.2 Financials

- 9.5.3 Product Portfolio

- 9.5.4 Business Strategy

- 9.5.5 Recent Developments

- 9.6 Baxter International Inc.

- 9.6.1 Overview

- 9.6.2 Financials

- 9.6.3 Product Portfolio

- 9.6.4 Business Strategy

- 9.6.5 Recent Developments

- 9.7 Integra LifeSciences Holdings Corporation

- 9.7.1 Overview

- 9.7.2 Financials

- 9.7.3 Product Portfolio

- 9.7.4 Business Strategy

- 9.7.5 Recent Developments

- 9.8 Teleflex Incorporated

- 9.8.1 Overview

- 9.8.2 Financials

- 9.8.3 Product Portfolio

- 9.8.4 Business Strategy

- 9.8.5 Recent Developments

- 9.9 Conmed Corporation

- 9.9.1 Overview

- 9.9.2 Financials

- 9.9.3 Product Portfolio

- 9.9.4 Business Strategy

- 9.9.5 Recent Developments

- 9.10 Arthrex Inc.

- 9.10.1 Overview

- 9.10.2 Financials

- 9.10.3 Product Portfolio

- 9.10.4 Business Strategy

- 9.10.5 Recent Developments

- 9.11 Stryker Corporation

- 9.11.1 Overview

- 9.11.2 Financials

- 9.11.3 Product Portfolio

- 9.11.4 Business Strategy

- 9.11.5 Recent Developments

- 9.12 Becton Dickinson and Company

- 9.12.1 Overview

- 9.12.2 Financials

- 9.12.3 Product Portfolio

- 9.12.4 Business Strategy

- 9.12.5 Recent Developments

- 9.13 Others.

- 9.13.1 Overview

- 9.13.2 Financials

- 9.13.3 Product Portfolio

- 9.13.4 Business Strategy

- 9.13.5 Recent Developments

- 9.1 Johnson & Johnson (Ethicon)

List Of Figures

Figures No 1 to 43

List Of Tables

Tables No 1 to 77

Prominent Player

- Johnson & Johnson (Ethicon)

- Medtronic plc

- B. Braun Melsungen AG

- Smith & Nephew plc

- 3M Company

- Baxter International Inc.

- Integra LifeSciences Holdings Corporation

- Teleflex Incorporated

- Conmed Corporation

- Arthrex Inc.

- Stryker Corporation

- Becton Dickinson and Company

- Others

FAQs

The key players in the market are Johnson & Johnson (Ethicon), Medtronic plc, B. Braun Melsungen AG, Smith & Nephew plc, 3M Company, Baxter International Inc., Integra LifeSciences Holdings Corporation, Teleflex Incorporated, Conmed Corporation, Arthrex Inc., Stryker Corporation, Becton Dickinson and Company, Others.

The government regulations have a significant impact on the market by affecting the market access through medical device approval procedures such as FDA 510(k) clearance and premarket approval in the United States, CE marking in Europe, and NMPA approval in China establishing the payment rates in procedures and related devices affecting the adoption decisions; compelling the use of infection control standards and driving the adoption of antimicrobial products, and requiring the use of standard procedures and documentation. The actions such as the CMS Surgical Care Improvement Project that decreases the occurrence of surgical site infections by implementing evidence-based practices, WHO Safe Surgery Checklist that has been implemented in 130+ countries, and the European Medical Device Regulation (MDR) that improves safety ratings all influence market dynamics and push the industry toward innovation, quality improvements, and generation of evidence that proves its clinical and economic worth.

There is a wide difference in the prices of advanced wound closure products depending on the sophistication of technologies and the specific application. Basic sutures cost USD 2-15 per unit and specialized cardiovascular sutures cost USD 45-180 per unit, surgical staplers cost USD 200-800 per unit and reloads cost USD 100-300, tissue adhesive costs USD 150-600 per use, and hemostatic agents cost USD 150-600 per procedure. The proven clinical advantages that provide justification for premium pricing are 30-40% infection reduction, 15-25% savings in procedure time worth USD 400-800 in operating room expenses, 27% lower readmission rates worth USD 8,400+ per prevented complication, and 35-45% better cosmetic results. Coverage options such as Medicare and private insurance make a great impact on adoption since advanced technologies that prove cost-effective with regard to complication prevention and better outcomes are reimbursable.

According to the present analysis, the market will grow to about USD 32.54 billion by 2035 with robust growth due to the increase in volume of surgery, ageing population, advancement of technology such as smart sutures and AI-enabled systems, use of bioresorbable plastics, adoption of robotic surgery, which is growing at 14.3% CAGR, and high level of hemostatic devices at a CAGR of 6.9% between 2026 and 2035.

It is likely that North America will hold the largest revenue, with a share of about 42% in the world market, because of the well-developed healthcare facilities, the United States has 48+ million surgical interventions, and 92% of its population possesses insurance coverage, with the highest per capita spending on healthcare of USD 12,555/year, and the concentration of the major medical equipment manufacturers making medical innovations.

Asia-Pacific Region has the quickest growth rate of 8.2 with CAGR having 8.2, which can be attributed to the fast developing healthcare infrastructure, increasing middle class with 85% insurance coverage in China, medical tourism doing 2+ million surgeries on international patients, government healthcare programs and 120+ million surgical procedures in operating countries with 9-11% growth percentage.

It is projected that this will lead to a significant growth in the Global Advanced Wound Closure Market since the number of major procedures completed annually in the world will continue to grow to 312+ million with an increase to 385 million in the next decade, the global population is aging with people 65 years or older undergoing surgery 3-4 times more frequently than younger populations, the prevalence of chronic diseases such as diabetes with 537 million cases and cancer with 19.3+ million cases annually needing surgery, is expected to grow, and more patients are seeking more minimally invasive procedures.